In any acquisition finance (whether partial or full acquisitions) lenders need to ensure that companies do not provide financial assistance in contravention of the Corporations Act (Cth) 2001 (the Act). Any person (including a lender) involved in the financial assistance may be liable for a penalty of $200,000. If the involvement is dishonest, the person is deemed to have committed an offence and is liable to a penalty of $200,000 or imprisonment for 5 years, or both. Persons involved includes directors of the lenders and other persons of the lender (ie. the lender's officers and advisers).

What is financial assistance?

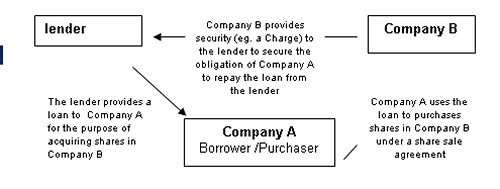

Generally speaking, financial assistance occurs when a target company gives a guarantee, or other security in connection with the financing, of the acquisition of that target company. The Act does not provide much guidance on the type of actions that may constitute financial assistance but in its simplest form, it can be illustrated as follows:

A lender provides a loan to Company A to enable it to acquire shares in Company B and Company B provides security (eg. charge over all the assets and undertakings of Company B) in favour of the lender to secure the obligation of Company A to repay the loan.

Put simply, Company B has financially assisted Company A to acquire shares in itself.

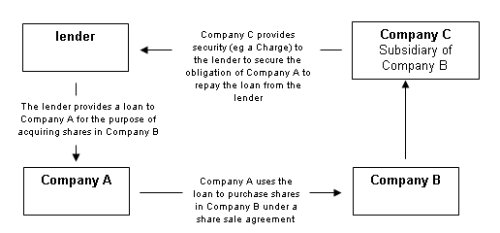

The lender provides a loan to Company A to enable it to acquire shares in Company B and Company C. Company C, a subsidiary of Company B, provides security (eg. charge over all the assets and undertakings of Company C) in favour of the lender to secure the obligation of Company A to repay the loan.

Put simply, Company C has financially assisted Company A to acquire shares in Company B, a holding company of Company C, by granting security for the loan provided by lender to Company A.

What alerts you to financial assistance?

Alarm bells should start ringing if:

- a client asks you to provide a loan to help acquire all or some of the shares in a target company; OR

- a client plans a dividend payment from the target company on, or just after, the completion of the sale.

How do I get rid of this issue?

When approaching a financial assistance issue, ask the following questions.

1. Is the financial assistance exempted?

If the answer is yes, nothing more is required.

Special exemptions may apply for:

- financial institutions

- employee share schemes

- subsidiaries of debenture issues

- a reduction of share capital or a share buy back.

It should be noted that in the usual course of dealings, it is unlikely that these exemptions will apply.

2. Is the provision of financial assistance 'materially prejudice' to the interests of the company, its shareholders or the company's ability to pay its creditors?

Whether a particular transaction involves 'material prejudice' is a question of fact and is a commercial decision for the lender to make based on their own due diligence. If the answer is no, nothing more is required.

If financial assistance 'materially prejudices' the interests of the company, it's shareholders or the company’s ability to pay its creditors (or you are unable to satisfactorily form a view that there is no material prejudice to those parties), shareholder approval must be obtained before the financial assistance is provided.

That is, the giving of the financial assistance must be 'whitewashed' in accordance with the procedure set out in section 260B of the Act.

What is the 'whitewash' procedure?

It is important to identify financial assistance at the early stages of a deal and determine whether it needs to be 'whitewashed'. It will take a minimum of 14 days for an unlisted company (where the shareholders consent to short notice of meeting) and 42 days for a listed company to 'whitewash' the financial assistance. Financial assistance cannot be given until the 'whitewash' is completed.

The Act's 'whitewash' procedure for a company will not be complicated if the financial assistance is dealt with early in a transaction. gadens lawyers can assist you with ensuring your client follows the correct procedures.

Is the transaction invalid if financial assistance occurs?

If a company provides assistance that conflicts with the financial assistance provisions, the conflict will not affect the validity of the any contract or transaction connected with it.

by Anthony Walsh & Paul Armstrong

|

Sydney |

||

|

Paul Armstrong |

t (02) 9931 4759 |

e parmstrong@nsw.gadens.com.au |

|

Anthony Walsh |

t (02) 9931 4948 |

e awalsh@nsw.gadens.com.au |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.