About the author Doron Bergman is a financial expert witness. As a financial expert witness Doron has a professional experience as an expert witness both by the sides and as an appointed expert witness to the Israeli court in varies professional financial issues .Those professional Opinions Includes the following major subjects: accounting issues, derivation of economic Damages, bank – client relationship, forensic accounting, internal audit, Liquidation of business claims against director, evaluation of financial services economic prices, municipal taxes and levies and financial topics addressing to unique Commercial law.

Doron is a CPA (us) with an active license, holding an MBA in finance and accounting from the Hebrew University, BA in economic and business administration from Haifa University and is certified mediator to the Israeli court. Doron has 25 years of financial and management experience including varies professional activity services as Litigation support, valuation and fairness opinion task, due- diligence work and Forensic accounting. Mr. Bergman expert opinions has mentioned several times in legal Israeli website "Takdin ".

This article is based on Mr. Bergman professional hand writing intended to be published during 2012. The Professional hand writing is a critic's oriented perspective view focuses on Major Professional Factor the FINANCIAL EXPERT WITNESS has to consider in a daily basis on court.

THE RIGHTS OF THIS HAND- WRITING DRAFT BELONGS TO DORON BERGMAN .IT IS FORBIDEN TO TRANSFER OR & TO PUBLUSH IT OR PART OF THIS DRAFT.

Article brief

In order to enable an appropriate reply on material lacunas are found in the way litigators commonly handle an Appointed financial expert witness interrogation in court, an alternative comprehensive attitude will be presented in this article .Although this reply directs specifically to give a professional response for lacunas regarding interrogation of appointed financial expert witness, the fundamental developed guidelines are valid as well to a common financial expert witness. The crystallization of those professional guidelines based on article discussed break stones as follows:

- The majors located weaknesses regarding Financial Expert Witness interrogation attitude commonly handled by Litigators in court.

- Analytic examination of power position array between the litigator as interrogator and an Appointed Financial Expert Witness as an interrogated, in court.

- Developing an alternative attitude handling the interrogation based on the above points.

- Crystallization of a comprehensive method handling a focused interrogation on court. In order not being satisfied only on theoretical guidelines, and be able to give a practical useful Tool for Litigators, a substantial portion of this paper will focus on Examination of real court Cases presented as example illustrating the recommended guidelines and offered crystallize Method.

The Article

The legal system has a mysterious glory inspired film directors to create great T.V Movies, presenting the attorney's life in court. .As a TV spectator it has been always fascinating me how Criminal litigators of both sides juggling in court during an interrogation of a witness like a super Magicians who pull a white rabbit from their hats during their performance .The significant ability to dig the missing portion of the Puzzle in a case, to reflect a hidden fact or an Invalid assumption of both sides enable the litigators sometimes to locate a turning point during Witnesses Testimony While interrogate them. Criminal litigators on those cases use a special integration skill to locate and expose the most Critic point. This can be defined as a turning point (TP). This requested goal required from a litigator adopting "out of Boxes" attitude thinking likes an investigator or to assist with a professional who has it.

As a financial expert witness I hear my self asking occasionally the repeated and, some may say, controversial questions: Where have all those litigators vanished? Why the common interrogation looks like an: unsophisticated routines litigator's Attempts to Manipulate and some said to conceive the witnesses? does this Kind of interrogation reflects the Real situation in court, and the movies scenarios are only a fantasy in order to magnate the profession?

As to my personal opinion – I am not sure that this kind of professional litigator behavior is a must. yes, indeed it's sometimes stimulating to choose this kind of strategy – it's seems to be both easier and effective, but my Intention is to show in the First Section of this Article that when its comes to a testimony of a skilled Appointed Financial Expert Witness (AFEW) This behavior is Similar to "hitting your head repeatedly on bricks Wall with the Illogical expectation of "Breaking the Wall", Therefore it is both Painful and ineffective .In this paper I will offer and expended inspired attitude to handle the testimony of an expert witness based on Professional behavior and Creativity that can derives better interrogation comprehensive method of the AFEW.

The following example might reflects chain negatives impacts caused by wrong professional AFEW treatment and unfortunate Decision was taken by court:

"In handled lawsuit between two partners of a cleaning raw material marketing company was required to evaluate The Company in order to compensate the retired partner who forced actually to leave the company four years ago due personal and business dispute between the partners. The judge appointed for the evaluation work a Financial Expert Witness. considering the fact that the partner actually quitted his activity in the company due 30.6.2005 and filling a claim to get his company share value then, but the Case was discussed in court finely in 2009, it was necessary to determine the relevant examined evaluation date. The judge ask the Expert Witness in 2009 to perform a company evaluation to dual relevant dates: the agreed date that the retired partner stopped His activity in the company namely: 30.6.2005 and to the present date namely 30/6/2009.the expert witness evaluations have been presented to the court based on the following professional Assumption and ascertainment As follows:

- the evaluation was done based on the DCF method. (Discounted cash- flow method)

- The AFEW examine all needed documents and transaction between

30.6.2005 till the present checking if any Illegal or Incorrect

activities were done in order deceiving the retired partner –

the AFEW did not find any supportive evidence or traces of

it.

Based on those points the expert witness made the following evaluations: - The company value due 30.6.2005- the partner retired date in actual, was evaluated at an amount of $ 1,000,000.

- The company value due 30.6.2009 was evaluated at an amount of $ 200,000. (Due massive activity hardness).

The expert witness added that the company depreciation value was derived from a lost of significant commercial contracts supplying services to immense government and municipal bodies, a sharp decrease of services prices Due entering of competitors As result of a government Reorganization Regulation in the cleaning raw material Supply Services Market. The AFEW recommended the court adopting the Updated evaluation of $ 200,000 due 30/6/2009 as the relevant evaluation, determining the money amount the retired partner has to receive from his partner. (By him out) the court decision: The judge decided adversely to the AFEW recommendation to adopt the evaluation due 30.6.2006 of $1,000,000 as a relevant evaluation, determining the required money amount. The left Partner has to pass to his partner for his company share. (The retired partner)

The practical court decision Implications: the left partner offered in return to the retired partner buying his company share (%50) at $500,000 based on the evaluation due 30/6/2005 ("by him out"). The retired partner refused and they entered to an ugly dispute. This environment harmed the ability to direct the company. Three months Later the company was got bankrupt and was dissolved leaving a list of depressed harmed creditors including employees. The two partners did not get any money in this process from the company which was Operated Since 1990 namely: 19 years. A layman who hears this story may wonder why? What was going wrong?

This article will attend to those questions later in purpose to clarify the factors which enable this process Happens and in what way a wise AFEW interrogation could maybe prevent those hard implications. A litigator decision choosing the right way to handle an interrogation or cross examination of a witness has to be matched the profile of the witness. It is a common agreed perception that litigators (rights) Privilege to summons a witness for an interrogation or A cross examination is most intensity tool, a legal System enables litigators use in major west countries legal systems.

The based inequality power position between the litigator and a common witness during an Interrogation or a cross examination phase has a huge impact on the Testimony results. This inequality power positions is derived from major three litigator's advantages regarding this process as follows:

1 .Domestic advantage – derived due the fact the testimony took place at the litigators' playground.

This is a strange unfamiliar and even intimidating Environment for a common witness.

2. Legal knowledge advantage- derived due the fact that a testimony, is by definition a material portion Of a legal process and therefore the litigator legal knowledge enable him a significant advantage on a Common witness.

3. Built in nature advantage- derived due the nature of array power positions during an Interrogation or Cross examination, considering the fact the witness has to reply on the litigators' questions. When it Comes to a skilled Expert witness testimony, no mater if he is an appointed by court or not, it is a whole Different game. The first two advantages mentioned before are actually ineffective advantages Regarding this situation.

A Skilled expert witness sees the court as his playground no less than the litigator, therefore he does not have to feel intimidating rather motivated from the professional Opportunity he has to clarify his Opinion. As to the Legal knowledge advantage, a skilled expert witness knows how to bypass those legal Issues in his opinion, no matter what kind of legal education he has. The basic rule is that an AFEW was not appointed to give

an Opinion as a legal expert, wherefore any deviation from his mission as defined by the court will weaken his Opinion.

As to the built in advantage, the material required question is therefore: what is the best way the litigator has to choose in order maximizing this built in advantage?

A factors analytic examination that will done in the next sections will show that in order to realized Litigators' built in advantage on a skilled AFEW; his interrogation has to focus on core professional Topics derived the AFEWO itself.

This acknowledgment may seem to be a surprising argument and therefore might causes immediate Litigator's objections, therefore I am wiling to take a challenge proving it in the next sections. In order responding this issue, it is crucial to get a full comprehension on the unique complicity and in some level vague position of the appointed Expert witness in General and the appointed financial expert Witness specifically in court. This position comprehension requires clarification on core legal Initiatives appointing an expert witness, on the first place.

The major legal systems in the free world found out that in some professional issues that are not Part of The legal professional knowledge, the judge may need a professional assistance when he sits on the Bench and performs his duty as interior of facts. A professional Assistance is required to the court in Cases the Professional knowledge required as a tool to execute interior of facts. There are three main Known Alternative solutions applied in the modern legal systems for this need: 1. using lay judges – as members of Trial bench panel. 2. Appointing a professional arbitrator – it is often use in commercial Disputes. 3. Appointing an expert witness in purpose to issue a professional opinion, aimed to assist the Judge in Interior facts phase. The first two alternatives do not Block an appointment of an expert witness In addition. The core different between those alternatives as relate to an appointed expert Witness Solution has been derived due an embodiment legal authority position of those alternatives inversely to Lack of Legal AEW Authority. An expert opinion is a written suppositional (attestation) testimony Sometimes is used as a substitute to a Verbal testimony, and in other cases they both executed. In a suppositional testimony witness testify on conclusion as compare to a regular witness testifies on fact, therefore a suppositional Testimony is usually Rejected against a reliable regular testimony. The major factors that distinguish any suppositional Testimonies from an appointed expert witness testimony are: 1. The AFEW projected objectivity assumption Court perception 2. The AFEW integrity level 3. The Professional and mental AFEW abilities. The lack of any legal AEW authority emphasizes the claim that the AFEWO validity based on those Principles pillars solely, therefore the AEW has no logical justification to jeopardize it .this point is well Known To court.

The derived required conclusion is therefore, that the litigator apparently has to direct his interrogation on Core Opinion issues. The existed common interrogation strategy focus on the AFEW integrity or Professional skills in order to undermine his credibility, is commonly inefficient and even commonly risky Tools, when it's based on false claim exposure claims.

Sometimes, the litigator use all his creativity to manipulate the AFEW, and ready to spend a lot of effort And time for it, instead concentrating on professional work and directs his creativity in this material Field.

Litigators how ready to make this switch will find that they might start going ahead on a solid stable basis instead of a shaky one. There is only a one" tiny" problem: the litigator may feel inferior to the expert in this field and generally This Feeling is realistic. It will be

conservable assuming that the AEW has, by definition an absolute Advantage on the litigator when it's come to professional knowledge.

This advantage can be Cured or even might change direction due a professional assistance was given to Litigator's .an alternative way is to avoid confrontation with this inferiority and to be satisfied with the common Interrogation way and its unsatisfied results.

What is the practical way implementing this perception specifically while an AFEW testifies?

The Expert financial opinion has been composed from four basic components that have to be ascertainment separately and integrally as a whole based on a quality professional criterions (factors) aimed to present a Coherent Valid professional opinion.

The components are as follows:

- The legal basis

- The information basis

- The professional model Opinion basis

- The technical basis - implementation those three components in order to build a comprehensive Coherent Professional validity opinion.

In order to illustrate an alternative expended attitude offered to handle the AFEW's testimony. Lets get back to the district court case presented before. Here is a brief case remainder:

1. A raw material supply company evaluations that were executed by AFEW due 30.6.2005 and due 30.6.2009 determined the following values:

- A value of $ 1,000,000 due 30.6.2005.

- A value of $ 200,000 due 30.6.2009.

2. Both evaluations were made according the DCF method on 30th of august 2009.

3. The evaluation company depreciation value for the updated date was caused due a lost of main supply raw Material Services contracts.

4 . the AFEW ascertainment did not found any invalidates actions had been done deliberately by the left Partner or Any body else, in order to deceive the retired partner.

5. The judge decided to adopt the company evaluation due 30.6.2005 valued at a sum of $1,000,000 as an appropriate retired partner company share value.

6. three months later the company got bankrupt and left a list of depressed creditors.

Case analysis

This case reflects material chain professional decisions fallacies made by the involved participants in the legal Process, ignited By the AFEW as follows:

The AFEW- THE AFEW chose the DCF model for Company evaluation .the DCF model Implementation Through capitalization of projected operating company cash Flows for the present. The high company Evaluation Due 30.6.2005 could be make sense if this evaluation has being been executed in 2005, due to An Unknown forecasted cash flow at this date, but in this Case the evaluation was actually executed at 30th Of august 2009, while the cash Flow until the end of this date year, already known and this cash flow Did Not support in any way the Predicted cash flow, the AFEW based his 30.6.2005 evaluation. Ignoring the actual company cash flows from 2005 to 2009 is a basic professional failure that caused an Illogical Evaluation and significantly contribute to a material fallacy court decision.

The judge-as regard to the judge and without considering the professional AFEW significant mistake, his owner Received two values for the company evaluation: 1,000,000 due 30.6.2005 and$ 200,000 due 30.6.2009. The AFEW claimed as part of his

opinion that according to his examination he did not Found any fact That Might point on any illegal Action was done in order to deceive the retired partner, Including shifting Assets by the other partner or somebody else from the company to another form of Business, therefore the assumption that the latest evaluation due 30.6.2009 reflects the company value to the present is an Economic Conservative assumption. The court decision ignoring AFEW recommendation to adopt the evaluation due 30.6.2009 and Alternatively Adopting the evaluation of $ 1,000,000 due 30.6.2005 in order to evaluate the retired partner Company share ,is like splitting an artificial inflated asset that does not exist. This perspective view can be holding on a "Reasonable man examination".

The retired partner's litigator-Now lets examine who the retired partner litigator had to interrogate the AFEW In purpose to pursue the court to take the right decision. Generally as a principle rule: when you are trying to pursue a layman in a professional Financial Issue – you have to do your best to Simplify your case and applying his common sense.

therefore; it could be Different if the retired Partners litigator would has succeeded to reflect during the AFEW Interrogation, the Illogical Economy implemented treatment by Adopting 30.6.2005 evaluation done on the 30th of august 2009. This Point Reflection could abolish this Evaluation basis or at least canceled its relevancy.

This might Be achieved by AFEW interrogation on the Following core issues:

- The economic practical meaning of an asset evaluation as a company.

- The evaluation transparence principle of an asset like company, meaning: the value of the company Has to Be Identical to both sides else there is a chance to realize arbitrage profits.

- The reflection of economical projected impact by choosing the high evaluation. The existed partner litigator- as to the existed partner litigator, although the final impact of court decision did not eventually improve the retired partner Economic wealth, it will be unrealistic expecting from him To discover this kind of professional and mental maturity by choosing to undermine the court adopted Evaluation.

Choosing this kind of interrogation attitude by the litigators in this case might significantly Change court decision.

The previous case contains a hidden core factor distinguishing the financial experty from others Expertise as Discussed before, the AEW independency activity has been derived due a legal defined dichotomy Between judicial cognizance scope versus personal knowledge scope, as well as the permitted limited scope interpretation of judicial cognizance used in court.

The Major professional fields the court used experts opinion can be characterized as technicality professional fields like: engineering, medicine, graphology and accounting. The common public Perception recognizes the Technical complexity of those expertises. This perception lowers the public wish expressing an opinion About those issues and enable keeping clear Scope dichotomy between a layman and A professional in Those fields. This public perception breaks through the court and making material Contribution to the clear dichotomy between professional opinions given by a professional expert inversely to a layman idea. The court recognizing between a professional and unprofessional idea enable an AFEW professional Independence in his mission.

It is a whole different situation in the financial field which deals with common daily issues like: buying Selling, producing and so on. Those common daily issues have been exposed to the public on a daily basis. The nearness of those topics to the public, but not less important, the Professional character solutions in Those financial issues, focus on economic principle orientation thinking implementation adversely to massive technical method orientation of other expertise, gives an artificial feeling that every layman has the basic professional tools to issue professional solutions .this Perception breaks through to court And causes Borders blurring between" A judicial cognizance and a personal knowledge. The above Phenomenon has dual characters implication both on the litigators and the AFEW as follows: It might be a catch for the AFEW, but on the other hand it might be also an opportunity to an open minded litigator How is able to simplifies the derived case professional issues to the court, and reflecting his points. The Nearness of the financial character issues to daily life and the basis principle that the professional Financial solution has usually to stand on a reasonable man examination namely: common sense, enable to an open minded litigator directing his interrogation reflecting the common sense of his case to Court as shown in the case that was analyzed previous sections. On the other hand The AFEW has to deal with blurring borders catch was reflected by the following sample:

While testifying on a company evaluation regarding a financial opinion I issued, I have been questioned By the judge:" did you observe all the company transactions invoices as part of your evaluation as has to be Done in an audit work ".the judge question contains a pre assumption with three Basic fallacies Acknowledgments reflecting a mismatch of professional terms and failures to comprehend The mission given To the AFEW as pointed below:

The observation of all the transaction invoices is not part of an audit professional scope.

1. The company evaluation scope attestation is not similar and much limited, to an audit professional Work scope.

2. An observation of all the transacted invoices are not included in an evaluation professional procedures As demonstrated in those three points the judge intervention could be a material disruption factor for An AFEW testimony. In order to overcome this obstacle, the AFEW has to base his opinion on clarified basic professional terms and fundamental opinion scope procedures.

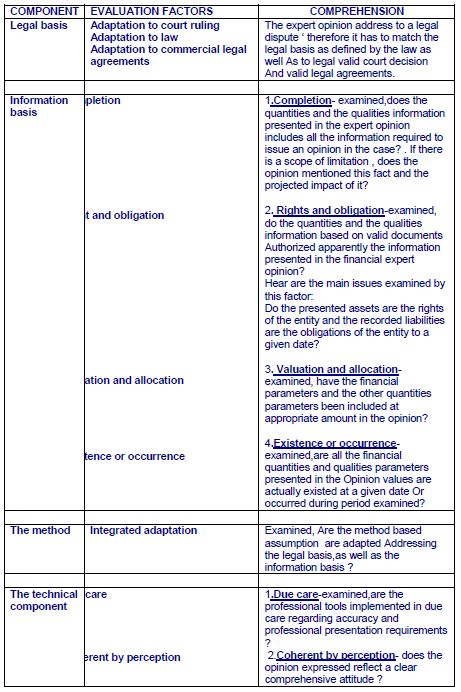

On page 5, four main financial expert opinion components were presented .a validity evaluation of those Break stones separately can be achieved by ascertainment of factors evaluation for each component separately and examining the opinion validity through implementation of comprehensive evaluation factors. In Appendix A of the article an opinion component factors evaluation table will be presented. A brief component evaluation factor review is presented in the next section The evaluation factors are as follows:

- Legal basis factors evaluation - adaptation to valid court decision, law and legal commercial agreements.

- Information basis factors evaluation - the qualities and quantities information validity has to be examines Based on four Ascertains: completeness, rights and obligation, valuation and allocation, excistance or Occurrence.

- Method basis factor evaluation -Integrated adaptation factor - adapted to legal basis and information basis Integrally.

- Technical basis factors evaluation- the work has to be done in "due care" and be coherent by perception.

- Comprehensive opinion factors evaluation- reasonable man examination factor and" by product implications factor."

In order to give an applied focused interrogation guidelines it is recommended for litigators to direct the AFEW interrogation in general commonly to the following basis in this importance order:

- Information basis

- Method basis

- Comprehensive method

- Technical method

- Legal basis

In practice usually the common Interrogation or cross examination of the AFEW is focused on two last And list important components, maybe due lack of professional knowledge. This situation Reflects a Waste of opportunities for litigators.

The previous case example presented, focused on: method basis and the comprehensive basis. The next article section presents a summarized case examination in purpose to reflect:

- The significance of evaluation information factor regarding AFEW testimony.

- The material contribution locating indirect implication hidden in the financial opinion , and the ability to Derive the right conclusion from them, as regard to the inquiry of facts was executed by court.

SUMMERIZED CASE EXAMPLE

THE FACTS:

1. In municipal law suit alleged against a commercial real state properties owner, a city claimed the owner on $ 1,000,000 for unpaid municipality taxes and others municipal levies of two Main properties owned to the Respondent.

2. The claimed debt apparently accumulated during 12-15 years as alleging by the plaintiff.

A. The respondent reply brief contained the following arguments: A. The city use to double charging for municipal taxes and other municipal charges, namely The city used to charge both the tenant and the owner as property holders for the same period.

B. The city used to charge the owner for a period the asset was leased to a tenant that was Regis rated In city records as an authorized property holder.

3.The plaintiff answering brief to the respondent brief contained the following arguments:

- As to the double charging allegation- the city denied the respondent claim.

- as to the debtor identity allegation- the city claimed that due incorrect registration execution by the lessee and The owner the switching holder registration was prevented, therefore they had to Keep charging the owner as property holder

4.An intermediate court determination was ruled as follows:

- regarding the respondent double charging claim – the court appointed me as a financial Expert witness to issue an opinion on this issue.

- Regarding the second respondent claim- the court rejected the respondent claim and Accepted the Plaintiff argument claiming that the municipality forced to charge the owner instead charging the tenant Due switching registration procedures material fallacies.

FUNDAMENTAL REMARKS

1. Legal basis – the administrative law determines the legal fundamental municipality authority to charge for current municipal taxes on properties holders located in city region.

The basic rule relating the municipal taxes determine the following principle:

- The main municipal current taxes levy on real estate properties located in the city region. The taxes Are levying on the current Regisrated property holder possessing the property. The practical interpretation of this rule can be summarized as follows: in a case of property leased – the regisrated Tenant is the recognized property holder; therefore he has to be charged on the current municipal taxes. In a vacant property the owner is recognized as the authorized holder and in general he has to be Charged and pay them.

2. Basis unit charged – the two main commercial properties have been divided and leased to many subs various era spaces Physical Units. for every sub unit the city had to manage an account regarding this account the city has to charge the unit holder due his current property possession.

EXPERT OPINION MISSION CLARIFICATION

Apparently the mission I got may seem to an unprofessional as maybe long but a simple mission, requiring some time and technical effort observing the properties account for the examined years, In order to give an affirmation that no doubles charging was found in the city records .without underestimating the technicality effort and the time that has to be spent on this technicality complexity, the hardness of this "Modest" opinion required scope, are much brooder including some levels of hardness as will be discussed:

The core complexity of the examined case is derived due the information basis.

This complexity composes from three factors as follows:

- The magnate empirical information size.

- The complexity computed financial data base.

- The necessity to base the examination on one information source solely.

Let's clarify this complexity by detail:

Empirical data size:

- The two main properties were divided to 35 physical sub units with separate accounts manage In city hall for 12-15 years in average .the quantity interpretation of this fact is: an empirical data base of 420-525 periodically examined accounts.

- Every physical unit account contain in average the following dates: six charges for current municipal taxes, six charges for water consuming, and approximately at least 5 others financial dates of payments and other charges.

- Based on the above points the empirical data base size composes from approximately more than 6000 Data's .this financial data based on computed core empirical data's as: unit space, unit space fees and other empirical parameters as deductions additions and changes in allocations on physic account Unit space derive a magnate information basis Imperial computed data base.

- The amount of data's factors participated in computed financial data derives the complexity of this level.

- The necessity to base the examination on one information source.

- in administration law suit like this when the plaintiff is a regulated public body and the respondent Is a private property owner or a small commercial body with limited access to the Complete Relevant Data Base. THE respondent limited access to complete data base adversely to the municipality ability to present A complete set of recording concentrating all commercial backing on the properties and, not less Important the basic fundamental court assumption that the city hall records are with high Validity degree apparently enabling the AFEW to base his examination solely on Those Records. The validity court perception regarding the municipality accounting records is derived from high internal Control requirements this system has to apply as a public regulated body This court perception actually enables recognition of the municipality records as "a con record" Namely: reliable evidence by definition. This composed complexity strength the need to examine Information basis by implementation of Information factor evaluations.

INFORMATION BASIS

In order to ascertain the double charging issue the city transferred for my examination:

- a full bonded copy of properties physical units accounts.

- Company files specifying the basic parameters apparently Support the accounts.

- Supported recording documents.

INTERMIDIATE OPINION MAIN FINDING

1. A cross –check of copy bonded books transferred me, comparably to internal municipality data base and other legal documents found the following findings:

- At least several physical account were not included in the bounded copy of the city books transferred me

- Lacks of continuance periodic reporting were found for several physical unit accounts.

2. An examination of transferred copy bounded books performed based on empirical and municipality Data Base, regarding the Regisrated unit holder for the relevant period, in order to explain the accounts Charges found:

- An inconsistency between city records accounts as presented in the bounded books and the City data base regarding those units, expressed as follows: in significant number of physical Periodic unit Account the municipality charged the owner for current municipal taxes (the respondent), although According the city own data base, the tenant was the registrar holder, therefore he had to be charged Instead of the owner.

3. A copy bounded unit accounts review found in some periodic physical unit account an apparently planted debt water fee historical balances for years before without a source .although the nominal Amounts were Modest, those nominal balances accumulated high periodic interests and index fee, therefore the updated balances are quite material .the reflection of this finding in the city records was as follows: in several Physical unit account for 2006 were found water fee debt balance titled water Fee balance for 2004. This balance apparently was accumulated on 2004 or before. An examination of periodic account for 2004 and Periods before, did not support the water fee debt balance including in the 2006 physic unit account.

COMPREHANSION OF INTERMEDIATE OPINION FINDING AND THEIR IMPLECATION ON THE REQUIRED COURT ISSUE.

As a remainder -the court appoint me to examine the respondent claiming on double charging municipal taxes. First I have to acknowledge clearly that none of the intermediate findings enable affirming municipal double Charging existence.

Now! After this deceleration I have to make several materials reservations relating this deceleration as follows:

- Finding no.1 proves with no doubt that the transferred bounded municipal books were not complete. They did not contained all the composed properties accounts as claimed by the city .never the less In the accounts Transferred, I found that in several physical unit account few periodic reports were missing although according the city hall own records the respondent was charged during those Periods. (Those charges had to be reported on the missing periodic reports). The above reservation emphasizes the information incompleteness transferred by the city. As I claimed before information incompetence preventing the possibility to affirm an existence or nonexistence of double charging due the real possibility that those missing accounts contain double charges and even respondent payments. It is crucial to recognize that theoretically those accounts there might contain a credit balances that could even change significantly the owner debt as claimed by the city hall.

- Finding no.2& 3 direct to real risk of significant internal control weaknesses that questioned materially the validity of city records in general and obviously the city records regarding the owner properties.

The mains Fallacies are:

1 .As to finding no.2- the apparently possibility to charge the owner, a tenant or any body else in city hall books inversely to the fundamental data base files regarding those properties demonstrate a material Internal control weakness questionable substantially the validly of city hall records in general and Those account properties specifically.

2. As to finding no.3-the apparently possibility to implant a debt balance in periodic unit account have The following fallacies implications:

- It is apparently reflects material internal control weaknesses that seriously questioning the city hall Validity records in general and specifically the records regarding owner properties.

- This apparently finding causes inflation of the claimed debt. (this point is out of the Opinion required scope.) In order to summarize the intermediate opinion implication as relate to the original required issue, it will be Appropriate to mention two basic implication:

1. Information basis incompleteness

2. Major internal control weaknesses seriously questioning the city financial records validity. This weakness can be analyzed through the last three evaluation information basis as mentioned in Page 9 for this article. In order to clarify the actual meaning of the internal control discovered weaknesses we have to recognize that this examination was done based on court perception about the validity of city hall records due internal control requirements applied on the municipal .the intermediate opinion found a whole different reality.

I am not a legal expert – but I pertain to believe, reflecting those implications to court might Change court Case perception.

The analytic work was presented hear demonstrate the importance of choosing the right questions Issues require a professional comprehension in order to locate and reflect them in court. Sometimes the litigator has an opportunity to locate indirect implication that does not expressed Directly as part of expert opinion due opinion scope limitation .Those implication might be significance to The litigator case and not required professional knowledge just open minded. this case contains This opportunity as will be analyzed in the next section:

This derived argument base on the rejected respondent claim about the municipal charges that has to levy on tenants as a regisrated holder but actually full on the owner. As a reminder the city hall claimed that Due to owner and tenements fallacies occur during the switching registration process she was prevented to switch the regisrated holder identity and therefore she kept charging the owner.

It will be interesting to examine this argument as regard to the intermediate opinion finding:

A. As a basis fact I have to mention that the city hall law suit was composed from accumulated all physical unit Account debt balances appeared in copy bounded transferred books - this suitability was checked and found accurate.

B. As proved in finding no .2 -in several physical unit accounts the city hall charged the owner although the regulated holders in city hall records were the tenants.

C. A comparison of Regis rated tenants regarding POINT B and the holders' identity as claimed in respondent rejected argument – found a definite identity tenant match between the two respectively the same periodic accounts.

D. Finding no.2 respectively to points A &B above points on four derived concussions:

- The respondent claim those charges had to full on the tenants as regisrated owner was right.

- The city hall claim as regard to their own records was incorrect

- The court decision regarding the rejection of the second respondent argument was a fallacy.

- The city hall charges levied on the owner in those cases instead of on the tenant were unjust and caused to inflated claim debt.

The unsolved left issue is: did the city hall charge the tenants in those cases in addition the charges the city halls charge the owner of the properties. In order to examine this it's required to get a complete sate of city hall books regarding those properties – the way to accomplish goal is out of this paper scope.

As an AFEW I was prevented to engage this derived conclusion due scope court limitation. exposure of this derived conclusion through a wise interrogation could assist the respondent Litigator to request an AFEW opinion scope expanding in order examines entire respondent claims. In this Professional paper I try to expand the litigator perspective to ASEW interrogation in order to better Achieve litigators' goals. This expanded prospection is not aimed to replace litigator professional Existed tools other than expanding his professional" tools box". I am definitely aware that implementation of this attitude requires the litigator comprehension on financial an ed hock professional assistance and to dedicate time for it – I believe that in order to exhaust his ability to give good solutions for his client case – it will be meaningful.

APPENDIX A: COMPONENT EVALUAUON FACTOS TABLE

Components valuation factors Table

BIBLIOGRAPHY

- ABOUT THE EVIDENCE" BY Y.KIMCHY ISRARL.

- MAJOR LEGAL SYSTEMS IN THE WORLD TODAY" THIRD EDITION BY RENE DAVID A JONE E.C .BRIERLY 1985.

- THE ENGLISH LEGAL SYSTEM-EIGHT EDITIONS BY A.K.R KIRALFY LLM, PHD.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.