- within Wealth Management topic(s)

- in United States

- in United States

- within Technology, Finance and Banking and Corporate/Commercial Law topic(s)

The Rise of Family Offices in the UAE

The UAE has emerged as a global hub for family offices, with Dubai leading the charge. As interest in family office structures continues to gain traction, Dubai's appeal as a business-friendly jurisdiction with robust infrastructure has fueled rapid growth. Historically, family offices in the UAE were often associated with local families or those from neighboring GCC states. However, in recent years, the UAE has seen a sharp rise in interest from families in Asia, Europe, and Africa.

Several factors contribute to this influx, including the UAE's favorable tax policies, proportionate regulatory frameworks, and strategic geographic location. Families based in Asia, who previously favored Singapore or Hong Kong for their family office setups, are now increasingly considering Dubai arms or even relocating their structures entirely. Similarly, European family offices are increasingly attracted to the UAE's capital-friendly environment and balanced regulatory regime. As a result, the Dubai International Financial Centre (DIFC) has become a top destination for establishing family offices, providing a legal and financial ecosystem tailored to the needs of wealthy families.

Overview of the DIFC Family Office Regime

The DIFC offers one of the most sophisticated frameworks for family offices globally. Established in 2004, the DIFC has evolved into a world-class financial center that appeals to families seeking to establish formal structures for managing their wealth, succession planning, and business continuity.

The Family Arrangements Regulations 2023 brought significant changes to the DIFC family office regime, offering enhanced flexibility and removing certain requirements for Single Family Offices. Notably, Single Family Offices in the DIFC are no longer required to register as Designated Non-Financial Businesses or Professions (DNFBPs). This streamlining has made the DIFC an even more attractive jurisdiction for setting up family offices.

A DIFC Family Office is defined as an entity licensed by the DIFC Registrar to provide services exclusively to a single family, which includes family members, family entities, and businesses. According to the regulations, a family is defined as a group of individuals descended from a common ancestor not exceeding three generations at the time of the office's establishment.

The DIFC family office regime is particularly appealing for those families that seek a formal structure to manage their wealth, investments, and governance while benefiting from the protections offered by the DIFC's robust legal framework.

DIFC Single Family Office Services

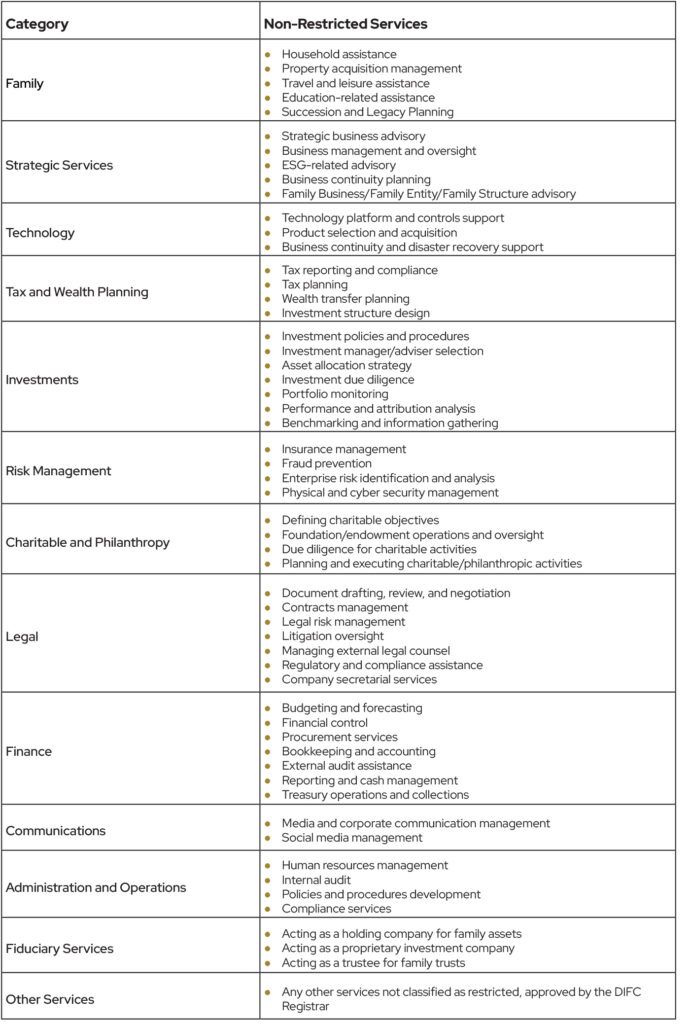

A DIFC Single Family Office can provide a comprehensive range of services designed to manage various aspects of a family's wealth, assets, governance and lifestyle. These services are split into two categories: non-restricted services and restricted services. Non-restricted services are those that are non-financial services and don't typically require any DFSA authorisations. Restricted services, on the other hand, would typically require DFSA approval if they extend beyond a single family.

Below is a full list of the services a DIFC Single Family Office can offer:

Non-restricted Services

DIFC Single Family Office Non-restricted Services

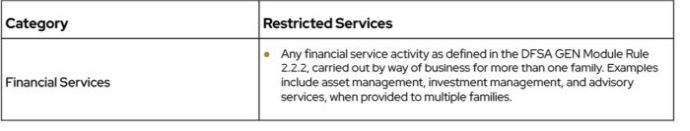

Restricted Services

The restricted services provided by a DIFC Single Family Office usually require DFSA approval if offered to more than one family. These include:

DIFC Single Family Office Restricted Services

The restricted services category covers any financial or regulated service where extending beyond a single-family framework requires specific licensing and oversight by the Dubai Financial Services Authority (DFSA).

DIFC Multi Family Offices

While the DIFC is well-known for its framework supporting Single Family Offices, it also provides a structure for Multi Family Offices. A DIFC Multi Family Office serves more than one family, offering an expanded range of services that may require additional licensing depending on the type of services provided.

Unlike a Single Family Office, which can offer a broad range of non-restricted services to a single family, a Multi Family Office faces more regulatory oversight, particularly if it engages in restricted services that constitute financial activities that are provided to multiple families. To engage in these activities, the Multi Family Office must obtain relevant authorisations from the Dubai Financial Services Authority (DFSA), ensuring compliance with financial regulations.

A Multi Family Office offers advantages for families seeking a consolidated platform for wealth management and governance. These families benefit from shared resources, allowing for better cost efficiency while still enjoying personalized services for asset management, tax planning, and legacy preservation.

The DIFC offers a clear path for setting up a Multi Family Office, but it is important to understand that while non-restricted services can be provided with fewer regulatory hurdles, any services related to investment management, fiduciary roles, or financial advisory across multiple families will require DFSA licensing.

How to Set Up a Family Office in the DIFC

Setting up a DIFC Family Office involves several steps and requires meeting specific regulatory and financial criteria. The DIFC Registrar plays a pivotal role in ensuring that the office meets the required standards, making it a streamlined yet thorough process.

-

Determine the Family Office Type

First, it is crucial to decide whether the family office will be a Single Family Office or a Multi Family Office and the services it will provide. This decision impacts the licensing and regulatory approvals needed.

-

Engage a DIFC Corporate Services Provider & Other Advisors

The next step is to engage a DIFC Corporate Services Provider, such as Cavenwell Group, to assist with the application and documentation process. A Corporate Services Provider acts as a liaison between the family and the DIFC Registrar, ensuring that all paperwork is in order.

Legal and tax advisors familiar with the family and the DIFC regime will provide invaluable insight ensuring the structure is optimised for the family's individual circumstances.

Prepare the Application

The application must include the following information:

- The name of the common ancestor of the Family, and details of the identities of the Family Members to be served by the Family Office.

- A short explanation of the Source of Wealth of the relevant persons served by the Family Office.

- Details of the due diligence conducted to verify the Source of Funds that is funding the Family Office.

- Details of who controls the Family Office.

- Details of the Ultimate Beneficial Owner(s) of the Family Office.

- Details of Family Entities, Family Structures, and Family Businesses to be served by the Family Office.

- Details of any Family Members that are Politically Exposed Persons.

- Details of the Family Office Services to be provided by the Family Office.

- Confirmation that the Family Office Services will be provided in accordance with DIFC regulations.

- Confirmation that the Family meets the Minimum Net Asset Requirement of $50 million USD.

-

Statement by the DIFC Corporate Services Provider

A DIFC Corporate Services Provider, such as Cavenwell, must prepare a statement confirming:

- The individuals listed as Family Members constitute a Family.

- The details of Family Members, Family Entities, Family Structures, and Family Businesses to be served by the Family Office.

- The Family meets the Minimum Net Asset Requirement.

- Appropriate due diligence has been carried out to identify the Ultimate Beneficial Owner(s) and the persons controlling the Family Office.

- Due diligence has been conducted to verify the common ancestor identified in the application.

- Appropriate due diligence has been conducted to verify the Source of Wealth and Source of Funds that will fund the Family Office.

-

Office Space

The family office must identify office space within the DIFC. However, for families with a significant presence in the UAE, it may be possible to waive this requirement by using a DIFC Corporate Services Provider to act as a registered office instead.

-

Minimum Net Asset Requirement

The family must meet the minimum net asset requirement of $50 million USD. This may be held directly by the Family Office, or within other Family Structures.

-

Submit the Application

Once all the documentation is complete, the application is submitted to the DIFC Registrar. The registrar will review the submission, and if all requirements are met, the family office will be granted a license.

-

DFSA Licensing (If Applicable)

For Multi Family Offices or family offices offering restricted services, an additional licensing step with the DFSA will be required.

Do You Need a Family Office in the DIFC?

Not every family requires a formal DIFC Family Office. For some, especially those with simpler asset structures or fewer management and administration needs, structuring tools such as the DIFC Foundation or DIFC Prescribed Companies may be better suited and more aligned with the objectives of the family that drove the initial interest in a family office.

A family office is most beneficial for families with a need for centralised in-house governance, wealth and lifestyle management. These entities can help centralise administration, enhance decision-making, and streamline legacy planning. For larger families, the office may also serve as the primary employment entity or contracting entity for staff such as a chief investment officer, legal administrators, or outsourced service providers.

However, for families looking for a more simplified structure, a DIFC Foundation or Prescribed Company may offer the required governance without the full operational needs of a family office. These structures can hold family assets, ensure confidentiality, and provide effective governance without the need to employ dedicated staff.

Ultimately, whether or not a family requires a DIFC Family Office depends on the complexity of their assets and the family's needs. Ultra High-net-worth families with diverse investments across multiple jurisdictions may benefit from the formal structure a family office provides. Conversely, smaller families or those with less intricate financial needs might find alternative DIFC tools more aligned with their objectives.

What is the Best Location for Establishing a Family Office?

When it comes to establishing a family office, the UAE offers several appealing options, with the Dubai International Financial Centre (DIFC) and the Abu Dhabi Global Market (ADGM) standing out as the most popular choices. Both jurisdictions provide world-class legal and regulatory frameworks, but the decision ultimately depends on the specific needs and priorities of each family.

The DIFC has become a global hub for wealth management, offering a sophisticated financial ecosystem with access to a broad range of services and professionals. Its common law-based legal system, access to international financial markets, and a strong network of professional service providers make it a top choice for many families.

ADGM, on the other hand, also provides a common law framework and an attractive regulatory environment for families, particularly those based in Abu Dhabi. Families considering ADGM benefit from strong legal protections, access to international financial markets, and proximity to some of the region's largest sovereign wealth funds.

Beyond DIFC and ADGM, other options such as the Dubai Multi Commodities Centre (DMCC) and Dubai World Trade Centre (DWTC) may appeal to smaller families or those that do not meet the higher net asset requirements of DIFC or ADGM. These free zones provide flexibility and a less formal structure but may lack the same level of governance and service support as DIFC or ADGM.

The decision between DIFC and ADGM often depends on where the family is based, the nature of their assets, whether they need access to certain types of professional services and ultimately, personal preference.

The Costs and Timelines for Setting Up a DIFC Family Office

Setting up a family office in the DIFC comes with specific costs and timelines that families need to consider. The costs can be broken down into several key areas:

- Application Fees: The licensing fee for a DIFC Family Office is $5,000 for the application itself, with an additional $12,000 required for the license. These fees are payable to the DIFC Registrar at the time of application.

- Professional Service Fees: Engaging a DIFC Corporate Services Provider is essential for the application process. Fees for these services vary depending on the provider but are typically required for handling the administrative and compliance requirements of the setup.

- Office Space Costs: Families will need to rent office space within the DIFC, unless they qualify for a waiver allowing the use of a Corporate Services Provider's office as a registered address. Office space costs depend on the size and location of the premises.

- Legal and Tax Advisory Fees: Legal and tax advice is often required to ensure that the family office complies with all DIFC regulations and is optimised for and compliant with local and international tax laws. The cost of these services can vary based on the complexity of the family's asset structure and the number of jurisdictions involved.

Timelines for a DIFC Family Office

The timeline for setting up a family office in the DIFC is usually around two to six months, depending on the complexity of the family's structure and the speed with which all documentation is prepared and submitted. The DIFC Registrar reviews applications thoroughly, and any incomplete or incorrect submissions can lead to delays. For Multi Family Offices, additional time may be required to secure DFSA licenses for restricted services, which adds to the overall timeline.

Conclusion

Establishing a family office in the Dubai International Financial Centre (DIFC) offers families a robust legal framework and access to world-class financial services. With the ability to structure either a Single or Multi Family Office, the DIFC caters to the varied needs of high-net-worth families looking to manage their wealth, ensure business continuity, and implement governance structures. The DIFC's balanced regulatory regime, favorable tax policies, and access to skilled professionals make it an ideal location for family offices. However, families must carefully consider the setup process, including the required documentation, application fees, and potential licensing requirements, especially if they plan to offer restricted services.

By working with a DIFC Corporate Services Provider and consulting with legal and tax advisors, families can navigate the setup process smoothly and ensure they establish a structure that meets their specific needs.

FAQs About DIFC Family Offices

What are the costs for setting up a DIFC Family Office?

The main costs include $5,000 for the application fee and $12,000 for the license. Additional costs include office space, professional services fees for a DIFC Corporate Services Provider, and legal and tax advisory fees.

Do I need a Multi Family Office or Single Family Office?

This depends on whether the family office will serve only one family or multiple families. A Single Family Office is suited for families that want to focus solely on managing their own wealth and assets. A Multi Family Office, which requires additional licensing from the DFSA, allows the office to serve multiple families.

Can a family office provide asset management services?

Yes, a DIFC Family Office can provide asset management and other financial services without DFSA authorisation, as long as these services are provided exclusively to a single family. If such services are provided to more than one family, DFSA authorisation for the relevant financial services will be required.

Can a DIFC Family Office act as Trustee?

Yes, a DIFC Family Office may act as Trustee for one or more family trusts for the same family. Other entities, such as DIFC Foundations, can also be used as Private Trustee Vehicles, but they can only act as Trustees for trusts from the same family.

Can I change my family office structure after it's been set up?

Yes, family offices in the DIFC can apply to change their structure from a Single Family Office to a Multi Family Office, or vice versa, as long as they comply with the relevant regulations and meet all licensing requirements.

How long does it take to set up a family office in the DIFC?

On average, the setup process takes between two to six months. This timeline depends on how quickly the family can prepare the required documentation and whether DFSA licensing is required for restricted services.

Do I need to have family office staff employed full-time?

It depends on the complexity of the family's needs. In some cases, families may employ staff such as a Chief Investment Officer, legal administrators, or accountants. However, some functions can be outsourced, and in such cases, a formal family office entity may still be required to contract these services.

Is the DIFC family office structure suitable for international families?

Yes, the DIFC is a global financial hub and is particularly attractive to international families due to its common law-based legal system, robust regulatory framework, and favorable tax environment. It's ideal for families with cross-border investments and complex asset structures.

Are there alternative jurisdictions to the DIFC for family offices in the UAE?

Yes, other options include the Abu Dhabi Global Market (ADGM), Dubai Multi Commodities Centre (DMCC), and Dubai World Trade Centre (DWTC). Each jurisdiction offers unique benefits depending on the family's needs, but the DIFC remains the most popular choice for high-net-worth families.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.