- in United States

- within Law Practice Management, Wealth Management and Insurance topic(s)

Federal and state election authorities have increased campaign contribution limits for the 2023–2024 election cycles in the United States. In the upcoming cycle, voters will elect US senators in 33 states and US representatives in all 435 districts. Voters will also elect governors in 14 states (including Kentucky, Lousiana, and Mississippi in 2023), and countless other state and local officials across the country.

Increases in Federal Contribution Limits

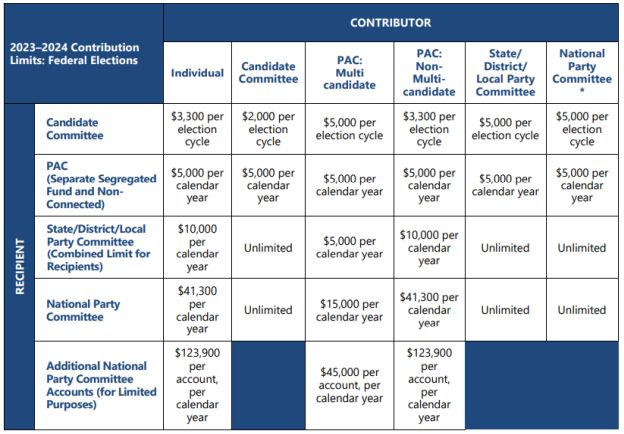

The Federal Election Commission (FEC) is authorized to adjust certain federal contribution limits for inflation each odd-numbered year. The FEC recently announced updated contribution limits for 2023- 2024. Most notably, the FEC increased the limit for individuals to give to candidate committees from $2,900 to $3,300 per election. It also increased the limit for individuals to give to national party committees from $36,500 to $41,300 per calendar year. However, limits on individual contributions to political action committees (PACs) remain unchanged at $5,000 per calendar year. Similarly, the limit on most PAC contributions to candiate committees also remains at $5,000 per election. (See Table A for a summary of the limits for the most common types of contributions.)

Federal contribution limits apply to campaign contributions to candidates for federal office and to the federal election accounts of political parties and PACs.

Increases in State Contribution Limits

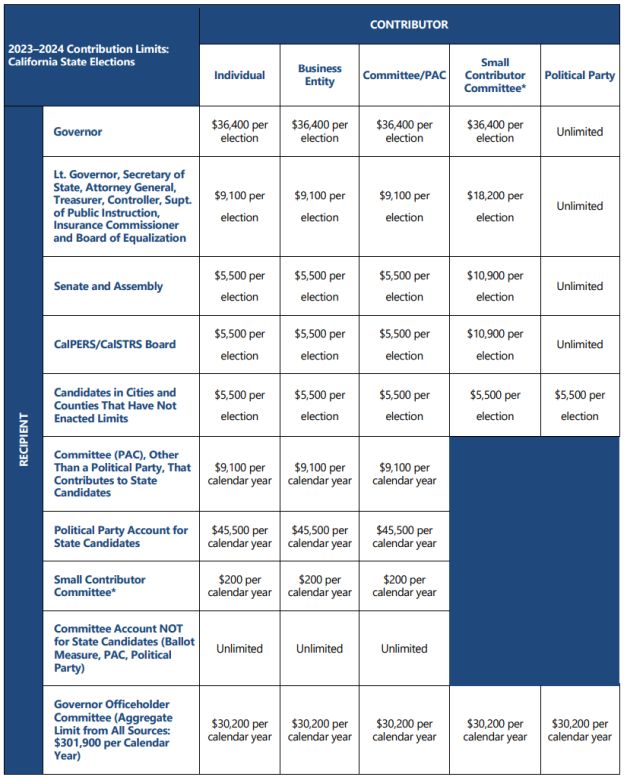

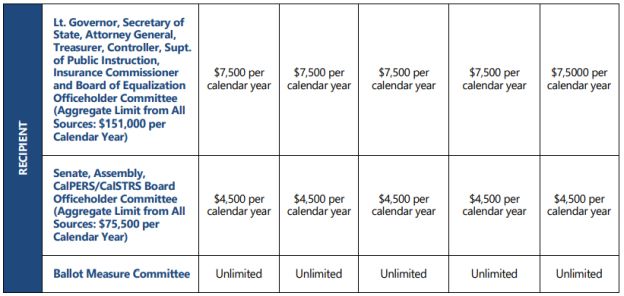

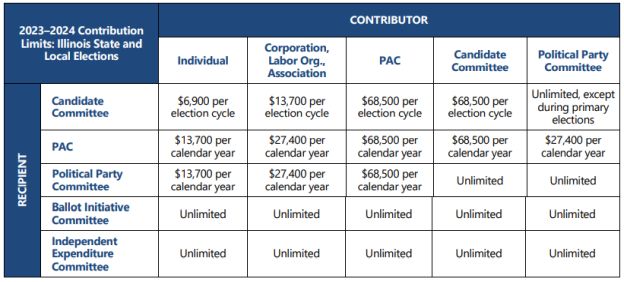

Most states have enacted their own limits on campaign contributions to candidates for state and local office and to political parties and PACs for use in state and local elections. Like the FEC, many of those states adjust their contribution limits periodically.

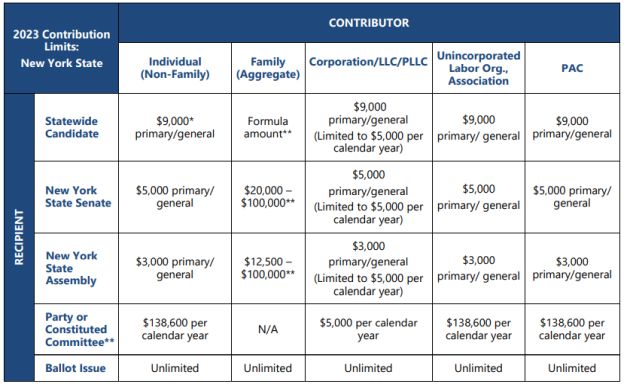

For example, in California, Illinois, and New York, election authorities recently announced updated contribution limits for the current election cycles. (See Tables B, C, and D for summaries of these states' current limits.) These limits will apply to many state and local elections in these states, though some local elections may have further limitations. California, for instance, requires state campaign contribution limits to apply by default to city and county candidates when the city or county has not enacted its own contribution restrictions on such candidates.

One key change from prior years is a recent amendment in New York for non-family primary contribution limits for statewide offices (governor, lieutenant governor, attorney general, and comptroller). During the 2021-2022 election cycle, the non-family primary contribution limit for statewide offices varied by party affilation (Democratic, Republican, Conservative, and Working Families), ranging from $7,500 to $22,600. This limit was determined by calculating the total number of enrolled voters in the candidate's party in the state—excluding inactive voters—multipled by $0.005. However, due to a recent amendment, the non-family primary contribution limit for the current cycle makes no such party distinction, setting the individual contribution limit at $9,000. See N.Y. Elec. Law § 14-114. This also will be the first election cycle where New York State implements a public financing option for campaigns; relevant limits may be affected for candidates using this option.

When Limits No Longer Apply

While more states have enacted broad campaign finance limits, there are many circumstances in which those limits do not apply.

Illinois is a prime example. In 2012, Illinois enacted campaign finance limits applicable to all state and local elections. But the state quickly amended the law to remove the limits if (a) a candidate, alone or with his or her immediate family, contributes or loans more than $100,000 or $250,000, depending on the race, to his or her campaign ("self-funding"), or (b) an independent expenditure committee, commonly called a "super PAC," makes independent expenditures of more than that amount.

Consequently, Illinois' limits have not applied in some of the most competitive and well-funded races. In the 2022 election, contribution limits were removed in the gubernatorial election and the statewide attorney general, secretary of state, and lieutenant govenor races, as well as in 23 state representative races (including one uncontested election) and five state senate elections (including two uncontested elections). The top legislative leaders of both parties lifted the caps in their respective races, even though only Emanuel "Chris" Welch, the Speaker of the House, and Dan McConchie, the Minority Leader of the Senate, faced challengers.

Additionally, California's limits include exceptions with respect to recall elections that were implicated in 2021, as Governor Gavin Newsom faced a recall election in which voters decided to to retain the governor. First, the limits include a general rule that covered candidates and officeholders may not contribute more than $4,900 to another candidate or committee controlled by another candidate or officeholder. However, this limit does not apply if the receiving committee is controlled by an officeholder to oppose the recall election of his or her office. Second, state law effectively treats a recall election as both a ballot measure and a candidate election, as the recall effort includes a question as to whether the officeholder shall be recalled and a question as to who will replace the officeholder if he or she is recalled. Because of this, an officeholder subject to recall may create a separate committee to oppose the recall election and accept unlimited contributions to that committee. Despite the lifting of the contribution caps for the officeholder, the other candidates running to replace the officeholder in the second portion of the recall election remain subject to the contribution limits because they are "seeking elective state office." See Cal. Code Regs. tit. 2 § 18531.5.

Other Limits May Apply

Donors should keep in mind that other limits or regulations may apply beyond the generally applicable campaign finance limits described here. Government contractors and others soliciting business from government agencies, as well as registered lobbyists and participants in regulated industries, are often subject to additional limitations, which might preclude even small donations.

These additional limitations comprise a patchwork of federal, state, and local pay-to-play and government ethics rules. Donors should be aware of any applicable limits before making campaign contributions.

Pay-to-play rules in particular have been the subject of significant recent developments. California and New Jersey, which each already had such restrictions in place, have recently enacted substantive changes to their pay-to-play laws. Elsewhere, New York State continues its efforts to implement pay-to-play rules after previous unsucessful attempts in the 2017-2018, 2019-2020, and 2021-2022 legislative sessions. On April 6, 2023, Senator Zellnor Myrie introduced S6247, which aims to "reduce the appearance of or actual improper influence of the State contracting process and increase its fairness by banning campagin contributions from a company seeking State contracts to office-holders with authority over procuring entities during a restricted contribution period." See S6247, § 14-131. S6247 was recently passed by the Senate and is pending in the Assembly.

Table A

* National Party Committee: These limits apply to the national party committee's accounts for (1) the presidential nominating convention; (2) election recounts, contests and other legal proceedings; and (3) national party headquarters buildings. A party's national committee, Senate campaign committee, and House campaign committee are considered separate national party committees with separate limits. Additionally, a national party committee and its Senate campaign committee may contribute up to $57,800 combined per campaign to each Senate candidate.

Table B

Small Contributor Committee: Any committee that meets all of the following criteria: 1) has been in existence for at least six months, 2) receives contributions from 100 or more persons, 3) has not received more than $200 per calendar year from a single person and 4) makes contributions to five or more candidates. See Cal. Gov't Code § 85203.

Note: A state candidate or state officeholder (or city or county candidate or officeholder subject to the state restrictions) may not contribute more than $5,500 to another state candidate or to a committee controlled by another state candidate or state office holder. This limit applies to the aggregate total of contributions made from the candidate's or officeholder's personal funds and from committees controlled by that candidate. There are some exclusions to this limit, however. It does not apply to contributions to a) a committee controlled by a candidate to oppose the recall election of his or her office, b) another candidate's legal defense fund or c) a committee backing a ballot measure controlled by another candidate. See Cal. Code Regs. tit. 2 § 18535.

Officeholders subject to recall may create a separate committee to oppose the recall election and accept unlimited contributions to that committee. However, because candidates running to replace the officeholder in the second portion of a recall election are "seeking elective state office," the other candidates remain subject to the contribution limits. See id. § 18531.5.

Table C

Table D

* Candidates running jointly for the offices of govenor and lieutenant governor in a general or special election are considered to be one candidate for contribution limit purposes. See NYS Election Law §14-114 (7).

**Family limits in each election are calculated through formulas based on the total number of registered voters in a party or in the district (depending on whether it is a primary or general election). For example, for statewide primary elections, the family limit is equal to the total number of enrolled voters in the candidate's party in the state, excluding voters in inactive status, multiplied by $0.025. For statewide general elections, the family limit is equal to the total number of registered voters in the state, excluding voters in inactive status, multiplied by $0.025. Where ranges have been established, they are listed above.

***Limits on contributions to a party or constituted committee do not apply to "housekeeping" expenses.

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2023. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.