House prices grew by 3.8% on average in the EU last year and the construction volume increased by 0.8%. These positive figures show that European residential property is now truly on its way to recovery.

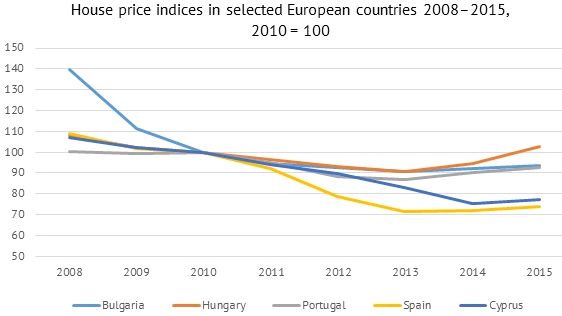

The recovery stage of the property market cycle is the most favourable time to buy a new home as prices have reached their lowest point and are just starting to grow again. This is also beneficial to people who are selling or looking to rent out their home because demand is increasing. For foreign investors, the most promising of them are Bulgaria, Hungary, Spain, Cyprus and Portugal.

-> Property market cycles: how to choose the best moment to buy property

House prices indices in selected European countries 2008 -

2015,

2010 = 100

Bulgaria

Average prices,

EUR sq m

Apartments Houses

After seven years of recession, the Bulgarian property market

has stabilised and finally, prices grew by 4% in Q4 2015

compared to the same period in 2014. The recovery is most

noticeable in Burgas, Plovdiv, Varna and Sofia. At the same

time, house prices in Bulgaria are still among the lowest

in Europe, running at

-> Bulgaria vs. Montenegro: where should you buy a holiday home?

Burgas is one of the most promising real estate markets in Bulgaria

The construction market of Bulgaria also demonstrated

spectacular results after building permit approvals jumped by 13%

in 2015 compared to the previous year. Experts anticipate that

GDP will grow by

Hungary

Average prices,

EUR sq m

Apartments Houses

The property market in Hungary proved itself to be more

resilient than some of its Mediterranean peers following the 2008

crisis and actually did better than Spain between 2009 and 2010.

The local market entered recovery three years ago but this trend

only recently consolidated itself. By Q4 2015, prices for homes had

grown by 10.2%

Lake Balaton is popular with tourists and holiday home buyers

Approvals for construction permits increased by 30% in 2015 and, according to Eurostat forecasts, GDP will continue to grow at a rate of 2.5% up to 2017. The national unemployment rate is set to decline next year to just 5.2% from 6.7% in 2016. The result of this persistent economic growth and rising employment figures will be more demand for property and higher prices.

Spain

Average prices,

EUR sq m

Apartments Houses

Prior to

-> Prices and demand on the up and up for property in Barcelona

The Costa del Sol is one of the strongest local markets in Spain

Data from the construction industry data shows that the time is ripe to buy property after building permit approvals skyrocketed by 50% last year compared to 2014. Nevertheless, Spain's unemployment serves as a constraint to the property market's development but Eurostat experts expect it to finally pass below 20% in 2017. Nevertheless, Spain's GDP growth is expected to chug along at 2.8% in 2016 and 2.5% in 2017, with strong demand from foreign home buyers.

Cyprus

Average prices,

EUR sq m

Apartments Houses

Price growth for residential property in Cyprus is still

struggling to maintain momentum and dipped into negative waters

(–0.2%) in Q4 2015

-> Property in Cyprus: what to know and where to buy in 2016

Larnaca has the most expensive property in Cyprus

Cypriot authorities delivered a small 2% more building permits in 2015 but 6.8% more new homes were commissioned by September of the same year. High unemployment is the main issue for the country's property market as it holds back price growth but it has been falling recently. According to forecasts, it will edge slowly downwards from 15.5% this year to 13.2% by 2017, thus favouring real estate growth.

Portugal

Average prices,

EUR sq m

Apartments Houses

The Portuguese property market is entering the expansion stage

and prices grew by 5% between Q4 2014 and Q4 2015. The most popular

markets with investors are Lisbon and the Algarve, a southern

holiday resort. The average price per square metre for apartments

ranges from €800 to €3,800 and

The revival of the popular Vilamoura resort is a symbol of Portugal's appeal

17% more construction permits were delivered last year compared

to 2014 but commissioned buildings made up just 7% of the

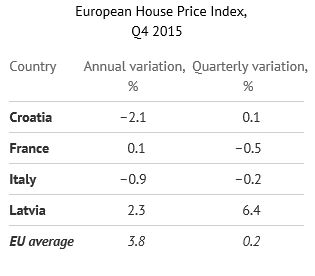

And other European countries?

If the above countries are leaning towards consolidation and

growth, the situation is not as

On the other hand, countries like Italy, Latvia, France and Croatia are still struggling to achieve nationwide growth and property transactions often just benefit a few regions. This means that residential property in these countries is either still too expensive or simply not very popular.

European House Price Index,

Q4 2015

Sources: Eurostat

Our research at Tranio shows that it's better to hold off on buying property in these countries until prices stabilise and begin to show reliable growth. What happens in Greece, an exception among the European property markets, will largely depend on how the government handles the geopolitical situation and economic growth over the next year.

Ivan Chepizhko, Tranio

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.