- within Tax topic(s)

- with readers working within the Aerospace & Defence and Utilities industries

- within Tax and Strategy topic(s)

In alignment with the UAE's National Digital Transformation Strategy, the Ministry of Finance has issued amendments to Articles 59 and 60 of the Executive Regulations of Federal Decree-Law No. 8 of 2017 on Value Added Tax, through Cabinet Decision No. 100 of 2025. These revisions shall be effective from 29th September 2025 and introduce significant changes to invoicing obligations, particularly in preparation for the phased implementation of mandatory e-invoicing.

Summary of Key Amendments

- Discontinuation of Simplified Tax Invoices: Taxable persons must now issue full tax invoices for all supplies, including those below AED 10,000 to VAT registered recipients and sales to non-VAT registered recipients. The same shall be applicable to self-invoices required to be issued pursuant to Public Clarification issued on Concerned Services - Accounting for Output Tax, issuing Tax invoices, and Input Tax recovery. Our update in said regard can be accessed here.

- Mandatory Invoicing for Zero-Rated Supplies: Supplies subject to zero-rated VAT must also be supported by full tax invoices, ensuring traceability and audit compliance.

- Withdrawal of FTA Waivers: Previously granted exemptions by the Federal Tax Authority (FTA) to businesses for not issung tax invoices or credit notes or with lesser details have been rescinded. All taxable transactions must now be supported by electronic invoice or credit note.

- Tax invoice and Tax Credit Note maintained by electronic means: Businesses capable of storing records electronically, while ensuring authenticity of origin and integrity of content, will also be required to comply with e-invoicing obligations.

Our Comments

These revisions introduce critical changes to invoicing

obligations and signal the formal rollout of mandatory e-invoicing

across the UAE. Early compliance will be essential to avoid

administrative penalties and ensure uninterrupted operations.

We advise all VAT-registered entities to:

- Review and update invoicing systems to ensure compatibility with the e-invoicing framework.

- Train finance and compliance teams on the updated regulatory requirements.

- Coordinate with ERP and accounting software providers to enable seamless e-invoice generation and submission.

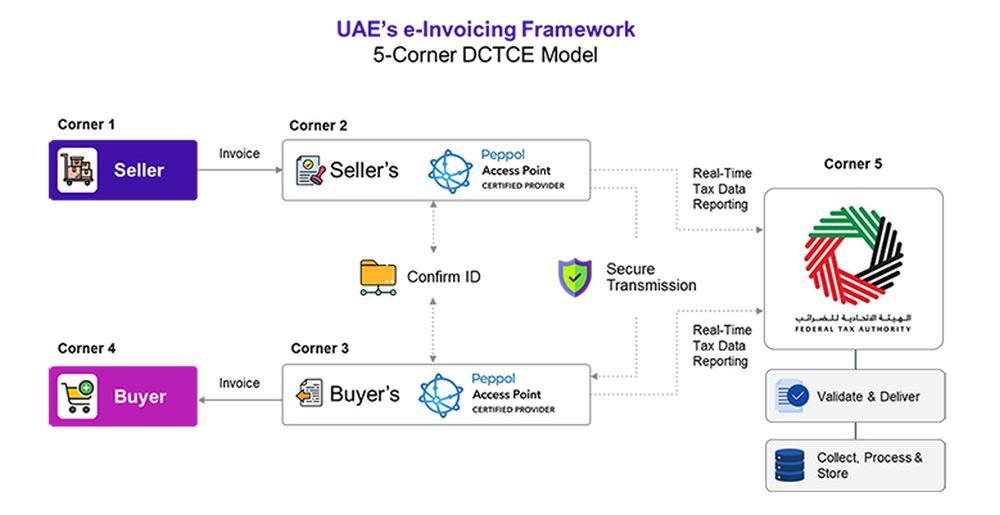

Under the Federal Tax Authority's (FTA) 5-Corner Decentralized Continuous Transaction Control and Exchange (DCTCE) Model, Pan-European Public Procurement On-Line (PEPPOL) plays a pivotal role in enabling standardized and cross-border exchange of electronic invoices and related documents as demonstrated below.

How we can help

At Nexdigm, we are fully prepared to assist businesses in navigating the UAE's mandatory e-invoicing framework. As part of our commitment to seamless compliance, we have synergised with PEPPOL-accredited service providers and will be able to help you through the e-invoicing journey.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.