The Government's Budget for 2014/2015 was presented in Parliament on Wednesday, 28 May 2014 by the Rt. Hon. Perry G. Christie, MP, Prime Minister and Minister of Finance. The national fiscal year runs 01 July to 30 June and it is tradition that the last Wednesday of May is Budget Day.

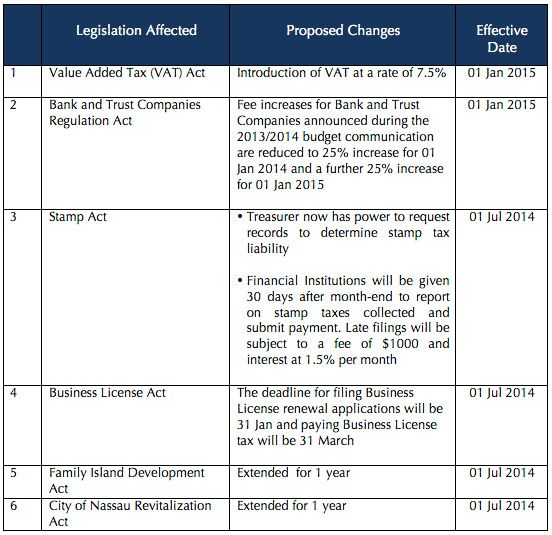

Fiscal measures relevant to businesses, at a glance:

VAT notes:

- To be introduced 01 January 2015.

- Single VAT rate to be generally applied except for exports to be zero rated.

- Few exemptions, Ministry of Finance to release a list in short order.

- VAT-inclusive pricing of goods (meaning the consumer see one price) is proposed instead of VAT-exclusive pricing.

- Deferred payments mechanisms being considered for businesses that qualify for fiscal incentives on imports with a view to providing control over the timing of recognizing certain VAT liabilities.

- For small businesses, while providing vigilance against

fraudulent claims, it is proposed that there be –

- simplified cash basis accounting procedures;

- simplified procedures for tax credits against bad debts; and

- streamlined VAT refund process.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.