- within Tax topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

- with readers working within the Accounting & Consultancy, Technology and Retail & Leisure industries

- within Tax topic(s)

- with Finance and Tax Executives

- in United States

- with readers working within the Accounting & Consultancy and Retail & Leisure industries

INTRODUCTION

On 2nd October 2024, the Deduction of Tax at Source (Withholding) Regulations 2024 (the Regulations), issued by Nigeria's Minister of Finance and Coordinating Minister of the Economy, Olawale Edun, were published in the official gazette. The Regulations took effect from 1st January 2025.

The Regulations aim to complement existing statutory provisions and supersede all prior rules governing deductions at source, excluding Pay-AsYou-Earn (PAYE) taxes. They establish comprehensive rules for the deduction of tax from payments made to taxable persons under the following tax statutes: Capital Gains Tax Act (CGTA); Companies Income Tax Act (CITA); Petroleum Profits Tax Act (PPTA); and Personal Income Tax Act (PITA).

The relevant key provisions of the Regulations are highlighted below.

Exemption of Small Companies from WHT Compliance Obligations

Small companies, defined as those with an annual gross turnover of ₦25,000,000 or less, are exempt from the obligation to deduct withholding tax (WHT) if the following conditions are satisfied:

- The supplier possesses a valid Tax Identification Number (TIN).

- The value of the transaction does not exceed ₦2,000,000 within the relevant calendar month.

This exemption is intended to alleviate the compliance burden for small companies. However, they are required to monitor their transactions to ensure continuous adherence to these conditions. Failure to meet these conditions obligates small companies to comply with the WHT deduction requirements stipulated in the Regulations.

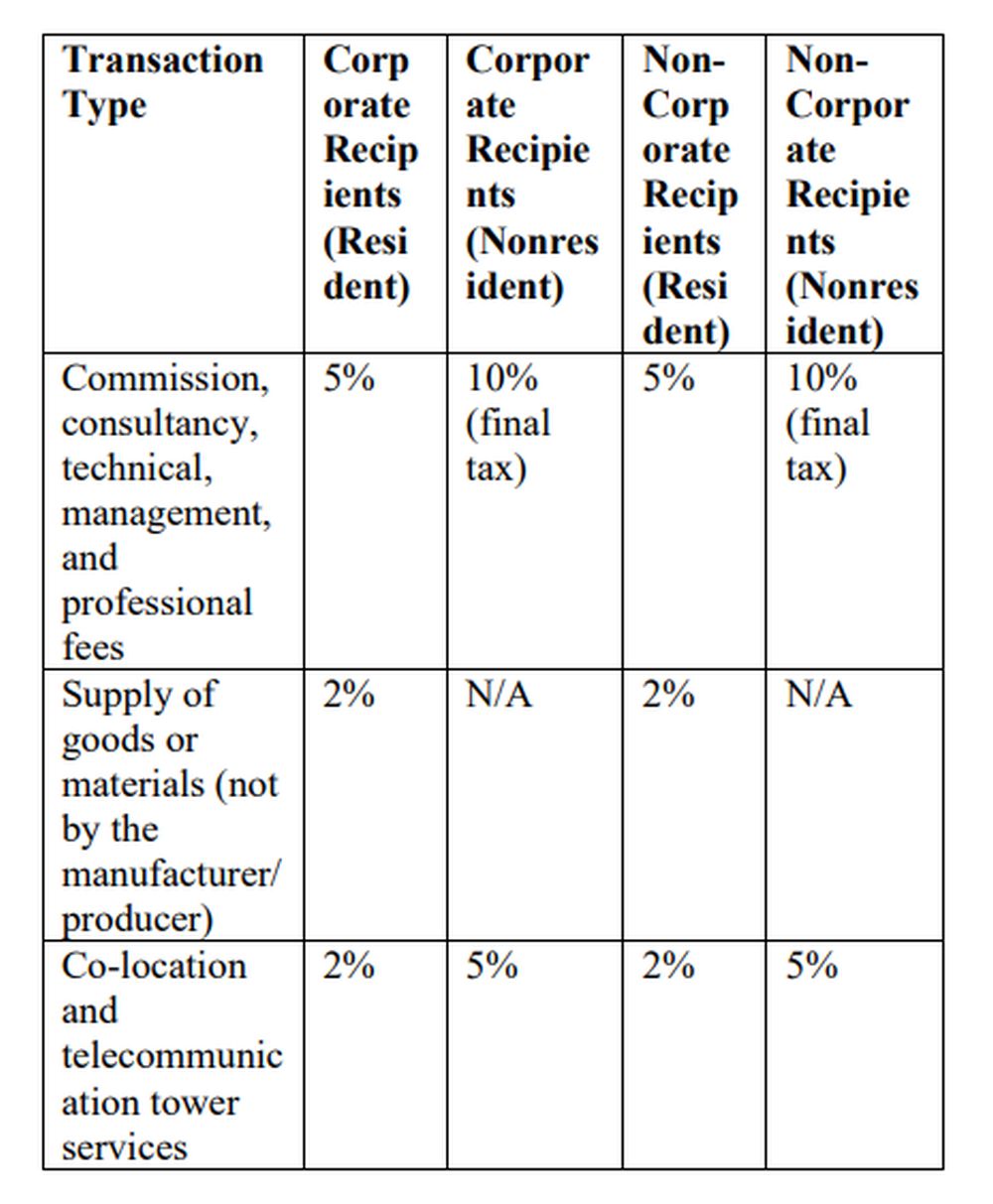

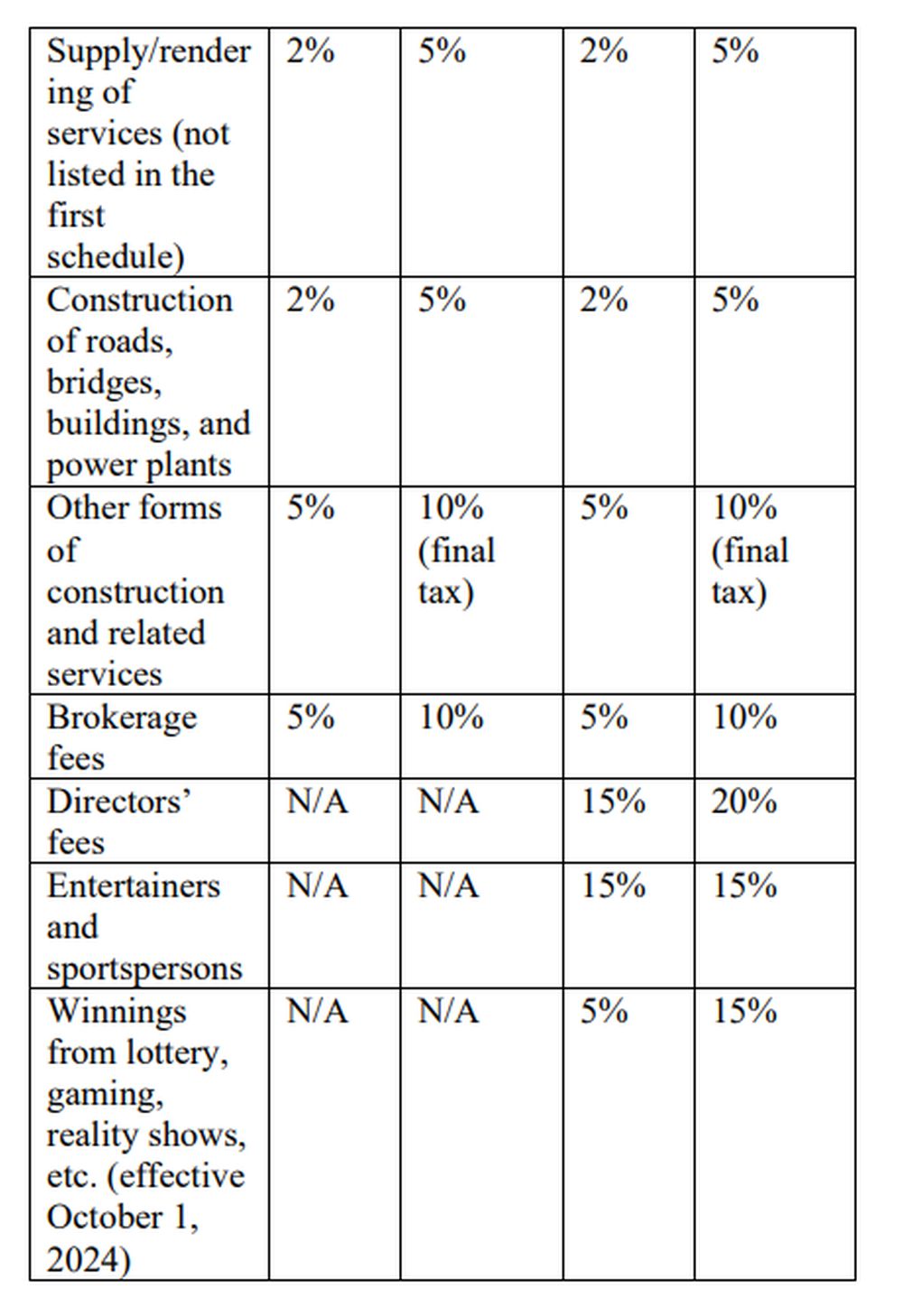

Revised WHT Rates

While the Regulations reduce WHT rates for certain categories of payments (as shown in the table below), the rate for commission, consultancy, technical, management, and professional fees remains unchanged at 10% for non-resident companies.

WHT as an Advance Tax

The Regulations clarify that WHT is not a separate tax and should not be included in a supplier's contract price through a tax gross-up.1 In effect, WHT should not impose an additional cost on the person making the deduction. Instead, it is to be deducted from the transaction cost, as it serves as either an advance payment of income tax or a final tax for the supplier. Nonetheless, Nigerian courts have upheld and enforced gross-up provisions stipulated in contracts.2

Clarity on Time for Deduction at Source

The Regulations have distinguished the timing of WHT deduction obligation on transactions with third-party and related-party suppliers. For transactions with third-party suppliers, WHT is deducted when the payment is made or when the amount due is settled—whichever occurs first. This represents a shift from previous practices where the obligation to deduct WHT was due when the expense was recognised, regardless of when payment was made.

For related-party transactions, the obligation to deduct WHT arises at the earlier of (i) the time of payment or (ii) when the liability to pay is recognised i.e., WHT must be deducted when the payment is made or when the liability is accrued/recognised, whichever occurs first. For example: if a foreign company provides technical services to its Nigerian subsidiary, with a monthly service fee of N5,000,000 with a due date in the contract, the liability is recognised on the date contained in the agreement. The subsidiary must then deduct WHT at the earlier of the payment date or the date contained in the agreement.

Clarity on Time for Remittance of WHT

The remittance deadline for amounts withheld remains unchanged: WHT must be remitted to the Federal Inland Revenue Service (FIRS) by the 21st day following the month in which the tax was withheld. Additionally, the Regulations require the submission of a return, using the prescribed filing template, which must include the following information about the supplier:

- Name, address, and Tax Identification Number (TIN) or Registered Company (RC) number.

- Transaction details, including the gross amount paid, tax deducted, and transaction month.

- National Identification Number (NIN) or RC number (if the TIN is unavailable)

- Issuance of Receipt to Supplier after Remittance of WHT

Obligation on Customer to Issue Receipt of Tax Deducted

The Regulations provide that the customer should issue a receipt of tax deducted to the supplier. The Regulations do not however provide a timeline within which the receipt must be issued. The supplier may present this receipt to the relevant tax authority as evidence of WHT deducted as tax credit, regardless of whether the WHT was remitted by the customer or not. Where a customer issues receipts for deducted but unremitted WHT, the customer will be liable to the WHT as their tax liability, together with interest and penalty in line with the law.

Double withholding tax rate for Suppliers without TIN

The Regulations have introduced a double WHT rate to be applied where the supplier has no TIN. This implies that non-resident companies with no TIN shall also be liable to have WHT withheld on their transaction fees at rates twice the applicable WHT rates provided in the first schedule of the Regulations. This provision is only applicable in cases of rendering of services or any eligible transaction involving non-passive income3.

Exemptions

The Regulations specify 12 categories of transactions exempted from withholding tax (WHT) deductions, aligning closely with existing laws and regulations. Key exemptions include:

- Goods manufactured or materials produced by the supplier. This provision is expected to address ambiguities regarding what constitutes a sale or supply in the ordinary course of business.

- Imported goods where the transaction does not establish a taxable presence in Nigeria for the foreign supplier.

- Over-the-counter transactions, such as noncontractual arrangements paid instantly in cash or via electronic means.

- Supplies of specific petroleum products, including Liquefied Petroleum Gas, Compressed Natural Gas, Premium Motor Spirit (PMS), Automotive Gas Oil (AGO), Low Pour Fuel Oil, Dual Purpose Kerosene, and Jet-A1 fuel.

- Winnings from games of chance or reality shows exclusively designed to promote entrepreneurship, academics, technological, or scientific innovation.

It is important to note that exemptions from WHT deduction at the source should not be interpreted as exemptions from the relevant income tax unless explicitly provided by applicable legislation.

Penalties for noncompliance

The Regulations stipulate the following penalties for noncompliance with the WHT deduction obligation:

- If an individual fails to deduct WHT on a taxable transaction but has remitted the full contract amount to the supplier, an administrative penalty along with a one-time annual interest charge will be imposed.

- If an individual deducts the applicable WHT but fails to remit it to the relevant tax authority, the penalties will include an administrative penalty, annual interest as prescribed by applicable legislation, and the unpaid WHT amount.

CONCLUSION

The Deduction of Tax at Source (Withholding) Regulations 2024 introduce key reforms to enhance clarity, compliance, and efficiency within Nigeria's tax system. By resolving ambiguities, adjusting rates, and implementing updated compliance measures, the Regulations establish a more structured framework for withholding tax obligations. While exemptions and reliefs for small companies aim to reduce administrative burdens, taxpayers must ensure strict adherence to the new requirements, which took effect on 1st January 2025.

Footnotes

1. Gross-up provision ensures that the recipient of a payment receives the full amount owed, regardless of the taxes the payer must withhold. This typically leads to the payer bearing the tax burden thus, increasing the overall cost of the transaction.

2. See Total v Akinpelu (2004) 17NWLR (Pt. 903) CA where the Court of Appeal held that the Personal Income Tax Act's provisions could not frustrate the contractual agreement between the parties that the lessee should pay the 10% withholding tax on behalf of the lessor.

3. Non-passive income, also known as active income, refers to earnings that are generated through active involvement in a trade or business.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.