80 insurance CEOs in 37 countries were interviewed for PwC's 18th Annual Global CEO Survey A marketplace without boundaries? Responding to disruption ( www.pwc.com/ceosurvey)

91% of insurance CEOs see over-regulation as a threat to their growth prospects over the next 12 months, more than any other industry.

Insurance CEOs – more than CEOs in almost any other industry – believe that new regulation, increasing competition, technological developments around service provision, and changes in distribution will have more of a disruptive impact over the next five years

SUMMARY OF INDUSTRY-WIDE SURVEY

CEOs are displaying a sense of optimism about their respective companies' growth potential despite having real concerns about an increasingly disrupted business environment. In PwC's 18th Annual Global CEO Survey, we look at how business leaders are finding new ways to compete in an era of unprecedented technological change. We surveyed 1,322 CEOs in 77 countries and a range of industries in the last quarter of 2014, and conducted face-to-face interviews with 33 CEOs.

Rapid, technology-led change presents many risks – but also many opportunities. It's reshaping the relationship between customers and companies and breaking down the walls between industry sectors. It's making forward-thinking CEOs question the very businesses they're in as they reassess how their organisations' differentiating capabilities can better solve customer problems.

In 'A marketplace without boundaries? Responding to disruption', we explore three implications of this changing competitive landscape. CEOs need to understand how to create new value in new ways through digital transformation, develop diverse and dynamic partnerships, and find different ways of thinking and working. And to succeed, business leaders will have to show vision, flexible thinking and carefully listen to and learn from stakeholders to make clear, informed decisions.

This report is a summary of the key findings in the insurance industry, based on interviews with 80 insurance CEOs in 37 countries. We also were fortunate to have an in-depth interview with John Neal, QBE Group CEO.

PREFACE

"The transformation of the insurance marketplace is accelerating, creating opportunities for some and threats for others," says David Law, PwC's Global Insurance Leader.

"People are living longer and have more wealth to protect. But the latest CEO survey raises questions about whether established insurers have the technology, customer insight and trust to capitalise on these favorable trends."

"The threats to insurers include mounting commoditisation, the squeeze on margins and increase in self-insurance. This reflects both intensifying price competition and difficulties in conveying the true value of the coverage they sell. Regulation is adding further cost and complexity. Looking ahead, insurance CEOs – more than CEOs in almost any other industry – believe that new regulation, increasing competition and changes in distribution will have more of a disruptive impact over the next five years."

"Slow adaptation is not a viable option in the face of relentless disruption and change. Insurers need to be more radical in challenging and changing business models and move quicker in developing the necessary competitive capabilities if they want to sustain growth and keep pace with market expectations."

INSURANCE AT THE CROSSROADS

The insurance marketplace is transforming. It's creating openings for some; 59% of insurance CEOs believe there are more growth opportunities than three years ago. However, it's creating disruptive challenges for others; 61% of industry leaders see more threats than they did in 2012.

The positive prospects include a growing global middle class that has more wealth to protect. The question is how much of this wealth they and other consumers will choose to insure and how much competition insurers will face from other sectors.

To win this business, insurers first and foremost need trust. Customers naturally want to be sure that the company that insures them will put their interests first by providing appropriate coverage and promptly settling legitimate claims. Yet, the proportion of insurance CEOs who see lack of trust as a threat to their growth prospects continues to rise – 64% today, compared to 59% last year. However, behind the headline figure is considerable national and regional variation. In markets where trust is strong, insurers are reaping the benefits. The industry's response to the 2011 Japanese earthquake and tsunami, when large numbers of staff were deployed in the affected areas to support claims identification and payment, has helped create a very positive image among consumers. Eighty percent of earthquake claims were settled within ten weeks1 and Japanese revenue growth has outstripped other major insurance markets in subsequent years.2

To make the most of market potential, insurers also need to be able to keep pace with changing customer expectations. Within non-life, price drives most purchase decisions, as many customers have difficulty understanding or underestimate the value of the coverage they're buying. They also want coverage that is quick and easy to access. However, slow and unwieldy legacy processes and systems often hamper insurers' ability to provide convenience at competitive prices. Seventy per cent of insurance CEOs see the speed of technological change and the shift in consumer spending and behaviour as threats to growth, more than in almost any other industry in the survey.

As people live longer, there should be significant growth potential for life and pensions companies. However, many life insurers are caught in a vicious circle in which excessive complexity reduces transparency and makes it harder to convert leads into sales. This complexity also increases the need for advisors, which creates higher distribution costs and a squeeze on margins. In many cases, life insurance agents concentrate on relatively well-off and middle-aged customers as they offer the easiest win rates. They are far less likely to target others, including younger and less wealthy people. This failure to reach out to a broader addressable market is compounded by the fact that many younger people don't believe life and pensions' products are relevant to them, and are difficult to engage through traditional channels.

Regulation and other disruptors

As Figure 1 above highlights, industry leaders see no let-up in disruption. Regulation is the biggest concern, and more insurance CEOs see the potential for regulation to be a challenge than those in any other industry. With Solvency II now less than a year from going live and other regional and local changes coming up over the horizon, the challenge is how to maintain attention to other strategic challenges and minimise upheaval by building the new requirements into a reliable and cost-efficient business as usual.

Despite the challenges that accompany new compliance demands, there are opportunities to turn them into a competitive advantage. It would make sense to build regulatory demands into wider investment and business development programmes. Regulatory impetus could provide the catalyst for improved information systems, more efficient use of capital and much-needed changes in reserving and financial reporting. Many companies are taking this further by using regulatory change as an opportunity to improve operational flexibility, promote greater collaboration within the organisation, and even reassess their business models. Evolving regulatory demands can help to clarify where change is most needed and how quickly.

Further challenges centre on the increasing fragmentation of the insurance market, with millennials at one end and a longer living population at the other. Each segment has different expectations. Indeed, individual tailoring increasingly will be the norm. This is going to require a major increase in how well insurers really understand customers and how flexibly they can respond to their needs and expectations.

One of the most striking findings is that insurers see changes in customer behaviour and distribution channels as more disruptive than other financial services sectors. Does this suggest that they have been slower to respond?

Further disruption is likely to come from the new entrants targeting the sector. We've already seen the game changing impact of price comparison sites. Think what a big mobile or internet provider could do if it applied its customer insight to insurance.

Heightened risk

With disruption comes heightened risk. More than 70% of FS CEOs believe that cyber threats and lack of data security could jeopardise their growth prospects over the coming year. The survey also highlighted concerns over geopolitical uncertainty and social instability.

THE SEARCH FOR INNOVATION AND GROWTH

The search for new collaborative opportunities and openings in markets beyond insurance is ushering in an era of 'competitive diversity', in which organisations freely compete across sector and market boundaries and across physical and virtual spaces.

Opportunity 1: Realising the digital potential

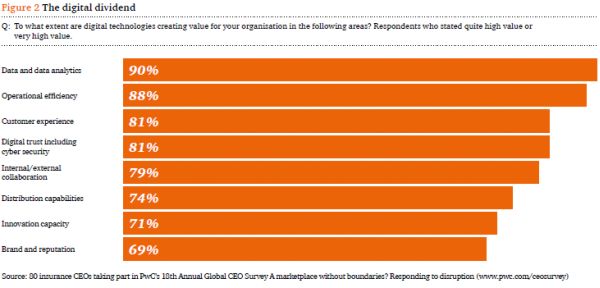

Insurance CEOs recognise how digital technology can help them sharpen data analytics, strengthen operational efficiency and enhance customer experience (see Figure 2).

But, are they really making the most of digital's potential? Most insurers are still primarily focusing on e-commerce – doing what they already do just via a different channel. The frontrunners are using digital to engage more closely with customers, fine-tune underwriting and develop customised risk and financial solutions. They're also pushing back frontiers in areas like real-time risk monitoring and more proactive risk prevention.

A separate PwC survey of over 9,000 consumers worldwide3 found that greater accessibility and tailoring the buying experience to their needs are the two most important steps insurers can take to appeal to customers. Digital would allow life and pensions companies to rely less on agents to cultivate relationships. By enabling businesses to reach out to younger and other largely untapped sections of the population in new and engaging ways, digital would also greatly expand the addressable market. In turn, more efficient distribution and no commission costs would open up more cost-effective options for less wealthy customers.

The potential for non-life insurers includes more effective risk prevention and remediation. Two-thirds of consumers would be willing to have a sensor attached to covered property if doing so would lower their premiums. Insurers also could use a deeper knowledge of customer needs to provide a broader range of non-insurance products, services and solutions. Half of the consumers in our consumer survey would be prepared to provide their insurer with additional personal and lifestyle information to enable them to seek the best deal for relevant products services (e.g. energy, holidays or car hire) on their behalf.

How can insurers make the most of their digital investments? As the CEO survey confirms, a clearly defined strategy is critical (see Figure 3). The CEO as champion is also crucial. It's vital that business leaders embrace digital literacy as technology shapes their strategic options. Our research into what develops the highest 'digital IQ' underlines the importance of leadership from the front rather than simply delegating responsibility for digital innovation and management to technology teams.4 Few of today's insurance leaders have technology backgrounds, though this could change as the axis of the industry shifts.

Opportunity 2: Seeking out complementary capabilities

Nearly half of insurance CEOs plan to enter into a new joint venture or strategic alliance over the next 12 months. Two-thirds see these tie-ups as an opportunity to gain access to new customers, much more than in other financial services sectors.

Business networks, customers and suppliers are seen as the most important focus for strategic collaborations. Examples could include affinity groups or manufacturers. A further possibility is that one of the telecoms or internet giants will want a tie-up with an insurer to help it move into the market.

More than 30% of insurance CEOs see alliances as an opportunity to strengthen innovation and gain access to new and emerging technologies. Yet only 10% are looking to partner with start-ups, even though such alliances could provide valuable access to the new ideas and technologies they need.

The challenge is how to align objectives and get people from different industries to 'talk the same language'. Key questions include who owns the customer relationship and how to ensure the priorities for and timing of investment and return are compatible.

Opportunity 3: Pushing into new sectors

Over half of insurance CEOs say it is likely that insurers will increasingly compete in sectors other than their own over the next three years. However, compared to other sectors, the range and extent of their inroads into other sectors is limited. For example, around a quarter of the banks taking part in the survey are making moves into technology, compared to only 3% of insurers.

There are real opportunities for insurers to use their customer data and relationships to develop new revenue streams, much as the new entrants coming into insurance have done. As sensor technology extends into household systems (e.g. boilers or security), there will be opportunities to buy/partner with maintenance and repair businesses as part of a concierge model for example.

Re-imagining your workforce

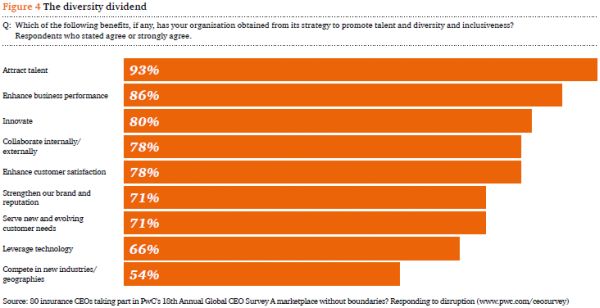

A rapidly changing market requires a more diverse workforce with new talents. Eighty per cent of insurance CEOs now look for a much broader range of skills. Diversity is now recognised as a key way to enhance business performance, innovation and customer satisfaction (see Figure 4).

Seeking to broaden the diversity of talent not only could widen the talent pool, but also help to bring in new ideas and experiences. Nearly three-quarter of insurance CEOs have a strategy to broaden talent diversity and inclusiveness – more than any other sector. But these plans may need to go further. Nearly 40% have no plans to seek out talent in different geographies, industries and/or demographic segments.

To read this Report in full, please click here.

Footnotes

1. IMF Country Report No. 12/228, August 2012

2. Swiss Re Sigma, World Insurance in 2013

3. PwC surveyed a representative sample of 9,281 consumers from 16 countries for 'Insurance 2020: The digital prize' ( http://www.pwccn.com/webmedia/doc/635405982747262648_insurance2020_jul2014.pdf)

4. 319 financial services organisations were interviewed for PwC's Sixth Annual Digital IQ Survey 'The five behaviours that accelerate value from digital investments'. The cross sector report is available from http://www.pwc.com/us/en/advisory/digital-iq-survey

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.