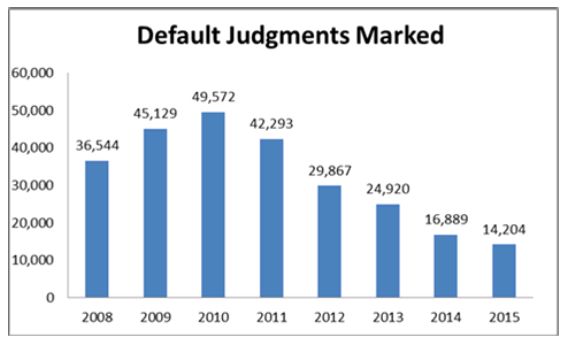

As mentioned in a previous Debt Recovery article collection litigation has reflected economic cycles with the consequent time-lag that one might expect. This trend was seen in the sizeable rise of debt recovery proceedings from 2009 to 2011, in particular, and the subsequent fall-off in numbers from 2012 onward. Statistics presented in the Courts Service 2015 Annual Report (the "Report") confirm that this trend continued into 2015, with figures for judgments marked in both the High Court and Circuit Court down 41% on their 2014 equivalents. Overall the number of judgments marked in court offices fell from 16,889 in 2014 to 14,204 in 2015. Interestingly though, there was a 14% increase in judgments marked in the District Court (to 8,836 in 2015 from 7,771 in 2014).

This may reflect the fact that businesses and lenders had gradually begun to extend credit in 2014 and into 2015, at modest levels, as the upward jurisdictional limit of the District Court now stands at €15,000. Obviously, increased economic activity and credit growth brings with it increased risk! Although the number of debt recovery claims issued out of the District Court in 2015 was slightly less than in 2014, more creditors chose to follow through undefended proceedings to having judgment marked.

This is also indicative of a period of economic recovery during which creditors may have formed a belief that debtors have additional means to make payments against judgment debt. The Report details statistics on specific enforcement activities, for example judgments actually published and judgment mortgage certificates lodged, which show slight increases on the equivalent figures for 2014.

Other trends

In terms of court orders actually made, one area that has continued to experience a notable increase has been that of repossession cases where creditor applicants have sought possession of lands/premises including family homes, particularly in the Circuit Court. The Circuit Court granted 1,284 possession orders in 2015, an increase of 21% on 2014. It is worth remembering though that the 2014 itself represented an increase of almost 200% on 2013 and previous years.

The arrangements available under the Personal Insolvency Act 2012 were designed to provide debt resolutions for people who were financially insolvent. The Report notes that there were 1,735 applications in 2015 in respect of these arrangements, an 84% increase on 2014. Interestingly, the majority of these, some 1,059, were for personal insolvency arrangements, confirming that mortgage debt remains the main category of personal debt that people are still seeking to resolve.

Comment

In terms of both default judgment applications and court listings, debt recovery proceedings in Ireland have been dominated by financial institutions following the worldwide financial crash in 2008 and the demise of our so-called Celtic Tiger economy. A return to more normal economic activity should see business creditors replace financial institutions as more active plaintiffs in debt recovery litigation. This trend, when combined with the sale of loan books by many financial institutions is likely to mean that the identities of creditors in debt recovery litigation will change significantly in this legal year and in the years ahead. Though the recovery litigation numbers are not likely to approach those of 2009 and 2010 anytime soon, we expect the courts to stay busy as economic growth hopefully continues.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]