- within Consumer Protection, Litigation and Mediation & Arbitration topic(s)

Following the deliberation of the 2025 budget proposals by the States of Guernsey, several proposals relating to real estate were voted in, with a particular focus on alleviating the current housing crisis and subsequent stress on the rental market.

Below, we have compiled a summary of the passed proposals, and how these will impact you respectively as a landowner, tenant, landlord or prospective buyer/seller.

So, what's changed?

Document duty

The document duty thresholds have been increased by 25% to take account of inflation. This means that there will be a reduction in document duty on the average house purchase of more than £1,000.

This was brought into force immediately on the 8 November 2024 and will affect all current and future transactions.

Additionally, a new threshold of document duty has been introduced at 7% for transactions over £5,000,000.00.

Transitional relief

Transitional relief is available on document duty paid in connection with a qualifying registration which has been executed further to a qualifying agreement:

- Qualifying registration: Registration during/after the transitional period

- Transitional period: 8 November to 31 December 2024

- Qualifying agreement: Agreements entered into prior to 7 October 2024

This relief will consist of the States making a payment equal to any difference between the paid document duty on a chargeable transaction where:

- Conditions of sale were signed before 7 October 2024 and the document is to be registered between 8 November 2024 and 31 December 2024; or

- Conditions of sale were signed before 7 October 2024 and the document is to be registered after 31 December 2024 so long as the Greffier has received written notice of the completion date before 31 December 2024

(Please note this applies for both standard transactions and non-principal private residences transactions.)

Example

A buyer purchases a property for £500,000 as their principal residence. Conditions of sale were signed on the 5th October, with the transaction completing on 15 November. The document duty paid was £14,875. Here, the document duty should have been £13,750, which would enable the buyer to apply for relief amounting to £1,125 from the States of Guernsey.

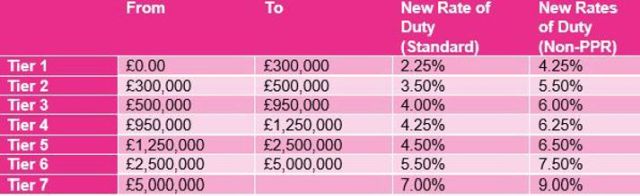

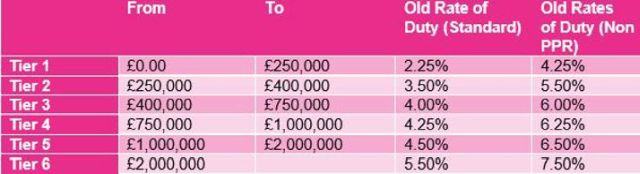

By way of illustration, the former and revised rates for these purchases are set out below, and our document duty calculator has been updated to assist you - click here.

Revised rates

Old rates

Scheme to encourage downsizing

First introduced in January 2023, this scheme will be continued for a further two years. This scheme involves reducing document duty to incentivise downsizing, and has now been aligned with the revised thresholds (please see above).

- 'Downsizing' transactions buyers can apply for relief where the document was registered between 7 October 2024 and 8 November 2024

- The maximum available relief has also increased from £10,875 to £13,750.

Tax on Real Property (TRP)

The TRP for all commercial buildings and land for 2025 will increase by 3.2% to maintain alignment to rates of inflation. Likewise, TRP for all domestic buildings and land will also increase by 3.2%.

Tax relief on mortgage interest

This relief applies to principal private residences and domestic let properties. The withdrawal for this relief was paused in 2023 and 2024, to provide continued support during a period of high inflation and rising interest rates.

The planned phase-out of this tax relief on this has been further paused, with a maximum of £3,500 per individual remaining deductible in 2025.

Introduction of 'rent-a-room relief'

Launching in 2025 to help alleviate the current housing crisis and incentivise the use of under-occupied properties, the 'rent-a-room relief' will be implemented.

Under this, there will be an annual tax free allowance for personal taxpayers who let a room in their property, regardless of whether they own that property or not. This exemption is set at a maximum of £10,000 per room for up to a maximum of two rooms, with eligibility restricted to those properties where one or two rooms only are let.

Accordingly, if a property is jointly owned or rented, the exemption would be halved for each individual.

This relief is subject to satisfaction of the following conditions:

- The tenant must be over 18 and not a family member;

- The room must be in the taxpayer's principal private residence;

- The room must be furnished and cannot be a self-contained unit in that property;

- The room cannot form part of a guest house or bed and breakfast business;

- Eligibility is restricted to properties where only one or two rooms are let; and

- The maximum gross rental income per room cannot exceed £10,000 per annum. This would be taxable.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.