- within Finance and Banking topic(s)

- with Finance and Tax Executives

- with readers working within the Banking & Credit, Technology and Law Firm industries

On 26 September 2025, the Swiss Parliament adopted the new Federal Act on the Transparency of Legal Entities and the Identification of Beneficial Owners(TJPG). Under the TJPG, in particular, Swiss legal entities and certain foreign legal entities (with registered Swiss branch, effective administration or owning real estate in Switzerland) are required to report information on their beneficial owners to a newly established, non-public federal register (Transparency Register).

The reform further introduces due diligence obligations with respect to certain legal advisory services deemed to pose an increased risk of money laundering by way of amendment of the Swiss Anti-Money Laundering Act (AMLA).

OVERVIEW AND PURPOSE OF THE LEGISLATIVE REFORM

Legal entities and trusts have been deemed as legal structures that can more likely be misused for money laundering, terrorist financing, or sanctions evasion. Further, advisory activities regarding the formation, structuring or sale of legal entities as well as real estate transactions are considered as being associated with an elevated money laundering risk and are often carried out by legal professionals and advisors who, unlike regulated financial institutions, have traditionally been exempt from explicit due diligence requirements under anti-money laundering (AML) legislation, at least to the scope of their core, profession-specific services.

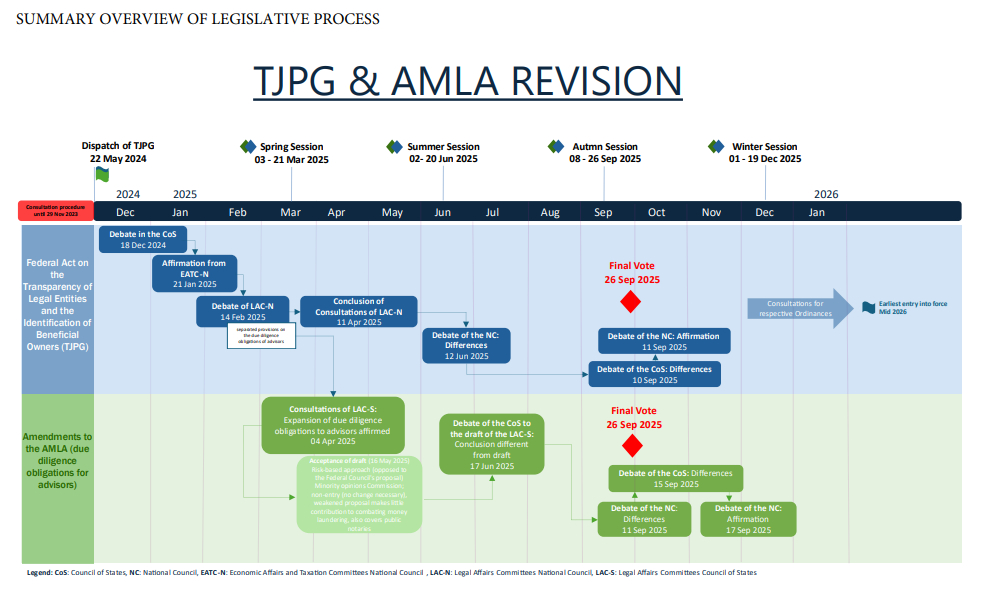

To address these risks and align Swiss AML regulation with international standards, particularly those issued by the Financial Action Task Force (FATF), the Federal Council, on 22 May 2024, adopted the dispatch on the further development of the AML framework. The legislative proposal introduced a new statute, the TJPG, as well as amendments to the AMLA, concerning, among other things, an extension of the scope of application of the AMLA to advisors, due diligence obligations and reporting duties. The reform aims to reinforce the integrity and competitiveness of Switzerland as a financial center and business location. The proposed measures are intended to improve transparency and regulatory consistency across both financial and non-financial sectors.

The reform sparked intense debate in Swiss Parliament and the wider public. A key point of contention were the rules governing advisors. Further, critics argued that the Transparency Register would create excessive bureaucracy while providing only limited benefits. Extending the reporting obligations to advisors constitutes a further departure from the original concept of confining the AMLA exclusively to financial intermediaries, noting that a deviation already exists as dealers (Händler) are required to comply with due diligence and associated requirements regarding cash transactions exceeding the statutory threshold. In response to the concerns expressed on the new due diligence rules for advisors, the TJPG and the proposed amendments to the AMLA have been separated and debated individually.

The reform not only introduces the new TJPG, but also revises the AMLA and several other statutes (such as the Swiss Code of Obligations and the Swiss Criminal Code (SCC) etc.).

TRANSPARENCY OF LEGAL ENTITIES AND THE IDENTIFICATION OF BENEFICIAL OWNERS (TJPG)

SCOPE OF APPLICATION AND KEY COMPONENTS

The TJPG applies to:

- Companies established under Swiss private law (i.e., stock corporations (Aktiengesellschaften), partnerships limited by shares (Kommanditaktiengesellschaften), limited liability companies (Gesellschaften mit beschränkter Haftung), cooperatives (Genossenschaften), investment companies with variable capital (Investmentgesellschaften mit variablem Kapital (SICAV)), investment companies with fixed capital (Investmentgesellschaften mit festem Kapital (SICAF)) and limited partnerships for collective investment (Kommanditgesellschaften für kollektive Kapitalanlagen));

- certain legal entities under foreign law (i.e., legal entities under foreign law that have a branch in Switzerland registered in the commercial register, whose actual administration is located in Switzerland or that own real estate in Switzerland or acquire real estate in Switzerland within the meaning of art. 4 of the Federal Act of 16 December 1983 on the Acquisition of Real Estate by Persons Abroad (BewG)); and

- trustees with domicile or registered office in Switzerland or who administer trusts in Switzerland (except trustees that are subject to the AMLA)

(Legal Entities) (art. 1 para. 1, art. 2 TJPG).

The new transparency rules of the TJPG include the following:

- duty to identify, verify and report the beneficial owners of Legal Entities;

- requirement to register beneficial owners in a newly introduced Transparency Register; and

- duty to identify the owners of structures governed by foreign law whose actual management is in Switzerland.

The TJPG, however, provides for certain exemptions. In particular, legal entities whose participation rights are (in whole or in part) listed on the stock exchange as well as subsidiaries that are held directly or indirectly for more than 75% by one or more such companies do not fall within the scope of application of the TJPG. The same applies to occupational pension institutions and other institutions with a pension purpose that are supervised in accordance with art. 61 and 64a of the Federal Act of 25 June 1982 on Occupational Retirement, Survivors' and Disability Pension Plans (art. 3 lit. a and b TJPG). In addition, simplified rules apply to legal entities that are partly owned by a listed company (see art. 7 para. 3, art. 9 para. 2, art. 13 para. 2 TJPG).

Swiss Parliament relaxed some of the provisions initially included in the draft TJPG by the Federal Council (Bundesrat) with the aim to keep the additional costs for the economy within reasonable limits. In particular, the Swiss Parliament excluded foundations and associations from the scope of application of the TJPG. Further, the proposal by the Federal Council to introduce a duty to identify, verify and report on fiduciary board members, managing directors, shareholders, and partners (Gesellschafter) was rejected by Swiss Parliament.

TRANSPARENCY REGISTER IN PARTICULAR

The Transparency Register is intended to enable in particular law enforcement authorities to ascertain, in a timely and reliable manner, the individuals who ultimately control a legal structure (cf. art. 1 para. 3 TJPG). This measure aims at preventing money laundering, and its predicate offenses, organized crime and financing terrorism.

A beneficial owner of a Legal Entity is defined as any natural person who ultimately controls the Legal Entity (a) by holding, directly or indirectly, alone or in concert with third parties, at least 25% of its capital or voting rights, or (b) by controlling it in any other way (for trusts see the separate definition in art. 15 TJPG). If no person meets these criteria, the highest-ranking member of the governing body is deemed the beneficial owner (art. 4 TJPG).

Legal entities are required to submit to the Transparency Register the name, date of birth, nationality, address, and municipality and country of residence of the beneficial owner, together with information on the nature and extent of the control exercised (art. 9 para. 1 TJPG). The Legal Entity must file the notification electronically with the Transparency Register within one month of its entry in the commercial register or, in the case of a Legal Entity under foreign law, within one month of becoming subject to the TJPG (art. 9 para. 4, art. 17 para. 1 TJPG). The Legal Entity must keep the information on the beneficial owners up to date at all times (art. 8 para. 1 TJPG). In case of a change to the information contained in the Transparency Register, the Legal Entity must notify the register within one month of the Legal Entity becoming aware of the change (art. 10 TJPG). Shareholders and beneficial owners are obliged to report the relevant information to the Legal Entity to enable it to fulfill its obligations (see art. 13 and 14 TJPG). Failure to comply with these obligations can be sanctioned with a fine of up to CHF 500'000 (art. 43 TJPG). The current art. 697j et seqq. of the Swiss Code of Obligations on the duty to report beneficial owners will be abolished.

Simplified registration via the commercial register authorities is available for entities that confirm that all their beneficial owners are registered as shareholders or corporate bodies in the commercial register (art. 11 TJPG). This option generally does not apply to larger companies or group structures, which are therefore obliged to submit two separate filings.

The entries in the Transparency Register are of a declaratory nature and have no constitutive effect (art. 23 para. 1 TJPG). However, if the diligent performance of the verification of the beneficial owners by a financial intermediary or advisor, in accordance with art. 4 or art. 8b and 8c AMLA, respectively, does not reveal any discrepancies, the financial intermediary or advisor, as applicable, may rely on the entries in the Transparency Register (art. 23 para. 2 TJPG).

To ensure the quality of the Transparency Register, an inspection body (Kontrollstelle) affiliated with the Federal Department of Finance ("FDF") will be tasked with carrying out inspections and imposing sanctions for violations of the identification and reporting requirements (see art. 35 et seqq. TJPG).

The Transparency Register will not be accessible to the public. Access is limited to the authorities specifically designated by law (e.g., the inspection body, federal and cantonal police, administrative, and criminal authorities and the Money Laundering Reporting Office), and only in connection with their official duties (art. 25 et seqq. TJPG). It will be maintained electronically by the Federal Office of Justice ("FOJ") (art. 20 TJPG) to leverage the existing infrastructure and expertise of the commercial register authorities. Furthermore, financial intermediaries in the meaning of art. 2 para. 2 and 3 AMLA and advisors in the meaning of art. 2 para 3bis and 3ter AMLA may access data of the Transparency Register (except for, e.g., certain deleted data) on-line to the extent required for the purpose of performing due diligence under the AMLA (art. 27 TJPG).

NEW RULES FOR ADVISORS

SCOPE OF APPLICATION

Advisors that going forward fall within the scope of the AMLA include natural persons and legal entities who professionally assist third parties with financial transactions, including fundraising, related to specific legal matters such as (art. 2 para. 3bis AMLA):

- Purchase and sale of real estate

- formation and establishment of Legal Entities that do not have the purpose of engaging, or of supporting an undertaking or group in engaging, in operational business activities (NonOperational Legal Entities), domiciled in Switzerland or abroad;

- management and administration of NonOperational Legal Entities;

- Contributions and distributions of NonOperational Legal Entities;

- purchase and sale of legal entities if the purchase or sale is conducted by a Non-Operational Legal Entity.

Additionally, natural or legal persons providing professional domiciliation services (addresses or premises) for legal entities for more than six months are also classified as advisors in the meaning of the revised AMLA (art. 2 para. 3ter AMLA).

KEY EXEMPTIONS

Lawyers and notaries who perform activities in connection with court, criminal, administrative, or arbitration proceedings are exempted from the scope of the revised AMLA in this context (art. 2 para. 4 lit. f AMLA). The same applies to natural and legal persons admitted or supervised by the Federal Audit Oversight Authority for providing statutory audit services (art. 2 para. 4bis AMLA).

Furthermore, the following activities are excluded from the scope of application of the AMLA due to their low risk of money laundering and terrorism financing (art. 2 para. 4ter AMLA):

- Transactions in connection with real estate and legal entities resulting from family, matrimonial, and matrimonial property law, inheritance law, or gift law, or in which interconnected persons in the sense of art. 2 para. 2 of the Financial Institutions Act are involved;transfer of agricultural businesses or land to persons who wish to farm them themselves;

- transfers of real estate and legal entities with a value of less than CHF 5 million, to the extent that the purchase price is paid and received exclusively through banks or other financial intermediaries subject to the AMLA;

- purchase of owner-occupied residential properties in Switzerland or purchase of residential properties that are used as replacement properties in Switzerland (Ersatzliegenschaft);

- transfer of real estate for the purpose of land consolidation and similar transactions;

- acting as corporate body for operational legal entities, charitable foundations and operational associations based in Switzerland;

- establishment of foundations upon death;

- pure notarization without ancillary consulting activities.

AML DUTIES

Advisors are required to identify clients and beneficial owners, determine and document the purpose and subject matter of transactions or services, and conduct enhanced scrutiny where justified by the heightened risk (art. 8b AMLA). The scope of these obligations is riskbased, with self-regulatory organizations tasked to define criteria for simplified or enhanced due diligence (art. 8c AMLA).

Additionally, advisors will have to implement adequate organizational measures, including staff trainings and internal controls, to mitigate risks of money laundering, terrorist financing, and breaches of coercive measures (art. 8d AMLA).

PROFESSIONAL SECRECY AND SUPERVISION

The amendments to the AMLA impose enhanced due diligence and organizational obligations on inter alia lawyers, including the identification of clients and beneficial owners and appropriate documentation measures. These obligations apply to both typical legal services, protected by professional secrecy under art. 321 SCC, and atypical activities such as financial intermediation, unless exempt from the scope of application of the AMLA. In principle, the new provisions do not mandate disclosure of information subject to attorney-client privilege to third parties. In particular, lawyers and notaries are only obliged to file a suspicious activity report to the Money Laundering Reporting Office if cumulatively (i) they are carrying out a financial transaction on behalf of or for the account of a client and (ii) the information at their disposal is not protected by professional secrecy under art. 321 SCC (art. 9 para. 2 AMLA).

Supervision of advisors for AML purposes is structured the same way as the AML supervision of financial intermediaries in the parabanking sector: They are required to affiliate with a recognized self-regulatory organization (art. 12 para. d AMLA). However, if a lawyer also serves as a financial intermediary, the type of service determines the applicable supervision.

NEXT STEPS AND ENTRY INTO FORCE

Following the adoption of the proposed legislation, the Federal Council will now initiate the public consultation on the corresponding ordinances, which will, in particular, further specify the types of controlling shareholders to which the new law applies.

The new rules are planned to enter into force mid-2026.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.