- within Finance and Banking topic(s)

- within Insolvency/Bankruptcy/Re-Structuring, Law Department Performance and Criminal Law topic(s)

ALVAREZ & MARSAL: TOP TEN UAE BANKS EXHIBITED IMPROVED ASSET QUALITY, HIGHER PROFITS IN Q2 2024

- Aggregate net income increased by 2.9 percent quarter-on-quarter (QoQ) to AED 21.5 bn in Q2'24

- At peak interest rates, deposits mobilization eased while credit outlay sustained its momentum

- Interest rate cycle reversion is expected to begin from Q3'24.

Dubai – August 20, 2024 – Leading global professional services firm Alvarez & Marsal (A&M) has released its latest United Arab Emirates (UAE) Banking Pulse for the second quarter of 2024. The report notes that the UAE's top banks' capital position remains robust, supported by high profits, and their asset quality further improved in the quarter ending June 2024.

Profitability increased to AED 21.5 billion for Q2'24on the back of higher net interest income (NII) and lower impairment charges (-35.4 percent QoQ). Although interest rates remained stable, NII grew by 2 percent QoQ due to a higher loan-to-deposit ratio (LDR). Non-interest income was slightly lower (-2.9 percent QoQ) to bring the growth in total operating income to a nominal +0.4% (QoQ) in an expansion of return on equity (RoE) by 48bps QoQ. However, return on assets (RoA) remained stable at 2.2 percent in the same period.

Loans and advances (L&A) grew moderately (+3.2 percent QoQ), as retail lending witnessed a surge of 8 percent QoQ. However, deposits mobilization slowed down (+0.4 percent QoQ) mainly due to decline in time deposits by 2.5 percent. Consequently, LDR increased by 2 percent QoQ.

The prevailing trends identified for Q2 2024 are as follows:

- Credit demand outpaced deposits mobilization in Q2'24. Aggregate L&A grew by 3.2 percent QoQ for the top 10 UAE banks outpacing deposits growth of 0.4 percent QoQ. Consequently, LDR increased by 2 percent QoQ to 75.8 percent.

- Total operating income moderated due to lower non-core income offsetting NII growth. Operating income increased marginally by 0.4 percent QoQ as non-interest income declined by 2.9 percent QoQ. The aggregate non-interest income / total operating income ratio stood at 32.5 percent in Q2'24.

- NIM remained mostly flat in Q2'24 as the benchmark interest rates were stable.Aggregate NIMs contracted slightly by 1bp QoQ to 2.65 percent during Q2'24. Yield on credit increased by 8bps QoQ to reach 12.3 percent, whereas cost of funds increased by 13bps QoQ to 4.6 percent in Q2'24. Faster growth in L&A as compared to deposits led the increase in LDR.Eight out of ten banks reported NIM contraction.

- Six out of the top ten banks reported a deterioration in the cost efficiencies. Cost to income ratio (C/I) deteriorated by 19bps QoQ to 28.1 percent in Q2'24: still below ~30 percent level.Cost efficiencies deteriorated as aggregate total operating income (+0.4 percent QoQ) increased slower than the total operating expense (1 percent QoQ) in Q2'24.

- Cost of risk (CoR) continued to improve for the UAE banks reaching a multi-year low. CoR improved by 16bps QoQ to settle at 0.3 percent for Q2'24. Total impairments declined by 35.4 percent QoQ in Q2'24 to AED 1.3 bn. Six out of the top ten banks reported an improvement in CoR.

- Profitability increased on the back of higher NII and lower impairment charges. UAE banks remain well capitalized with aggregate capital adequacy ratio (CAR) levels at 17.6 percentage (+0.34 percentage points QoQ).

OVERVIEW

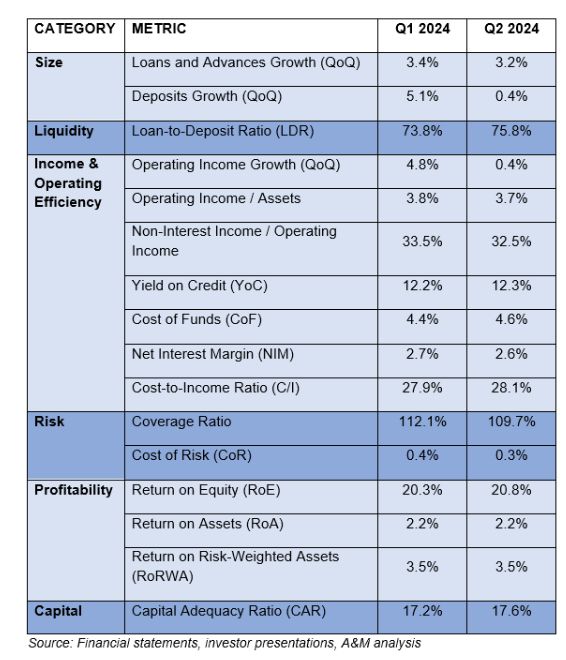

The table below sets out the key metrics:

Mr. Asad Ahmed, A&M Managing Director and Head of Middle East Financial Services commented: "The UAE banks' performance continues to remain strong on the back of lending growth and improvement in asset quality. The sector is well capitalized with aggregate CAR levels at 17.6 percent and reported continued growth in Q2'24.

"The Central Bank of the UAE (CBUAE) maintained its benchmark interest rate at 5.4 percent at the end of Q2'24 with no movement as the rate is anchored to the US Fed rate. Recent Fed comments indicate that the first rate cut is imminent – market expectations are that this may occur in September.Banks are expected to take some precautionary provisioning as asset quality remains sensitive at the peak of the interest rate cycle. Banks are also expected to emphasize the growth of non-interest income as net interest margins come under some pressure with the rate cuts. We see, for example, a number of banks refocussing on their Transaction Banking offering.Further, we expect the UAE banks to show increased benefits from their investments in digital initiatives leading to improved cost efficiency."

ENDS

Notes to editors:

Methodology:

A&M's UAE Banking Pulse examines data from the 10 largest listed banks in the UAE, comparing the Q2'24 results against Q1'24 results. Using independently sourced published market data and 16 different metrics, the report assesses banks' key performance areas, including size, liquidity, income, operating efficiency, risk, profitability, and capital.

The report also offers an overview of the key developments affecting the banking sector in the UAE and further analysis with a segment view of loans & assets, deposit mix and a stage–wise breakdown of the lending book.

The country's 10 largest listed banks analyzed in A&M's UAE Banking Pulse are First Abu Dhabi Bank (FAB), Emirates NBD (ENBD), Abu Dhabi Commercial Bank (ADCB), Dubai Islamic Bank (DIB), Mashreq Bank (Mashreq), Abu Dhabi Islamic Bank (ADIB), Commercial Bank of Dubai (CBD), National Bank of Fujairah (NBF), National Bank of Ras Al-Khaimah (RAK) and Sharjah Islamic Bank (SIB).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.