Schuldschein loans are no longer the sole preserve of German Mittelstand borrowers, and have started to play an increasingly prominent role in cross-border finance. This article examines some of the key features of Schuldschein loans which we believe is an attractive financing alternative for Danish borrowers.

Introduction

The Schuldschein loan market has grown substantially and become more international in recent years. The private nature of the market makes its size difficult to estimate, though a January 2019 report by Scope Ratings placed the size of issuance in 2018 at €24.5bn, down 10% year-on-year from 2017, but over three times higher than in 2013.

That expansion has in part been driven by the extension of Schuldschein loans to "cross-over" borrowers with sub-investment grade characteristics, and borrowers outside of the core German, Austrian, and French Schuldschein markets. This has in turn resulted in Schuldschein loans becoming an attractive alternative to syndicated loans for international borrowers. Recent Danish transactions include Danish Crown, Danish Agro and notably the Danish agricultural company Dansk Landbrugs Grovvareselskab (DLG) with a EUR 250 million financing arranged by Danske Bank, NordLB, Nykredit and UniCredit with maturities of 3, 5 and 7 years. Danish banks, including Nordea, Handelsbanken and SEB are increasingly making the Schuldschein market available to their corporate banking clients. In addition, the Schuldschein market is opening up to Nordic borrowers, including Swedish food producer Orkla and automotive Saab.

This article summarises what Schuldschein loans are and why borrowers and lenders participate in the Schuldschein loan market.

What are Schuldschein Loans?

There is no strict legal definition of a Schuldschein loan. The term "Schuldscheindarlehen" literally means "a loan evidenced by a certificate of indebtedness". However this is not a strict legal requirement for a Schuldschein loan and most Schuldschein loans today are issued on an uncertificated basis.

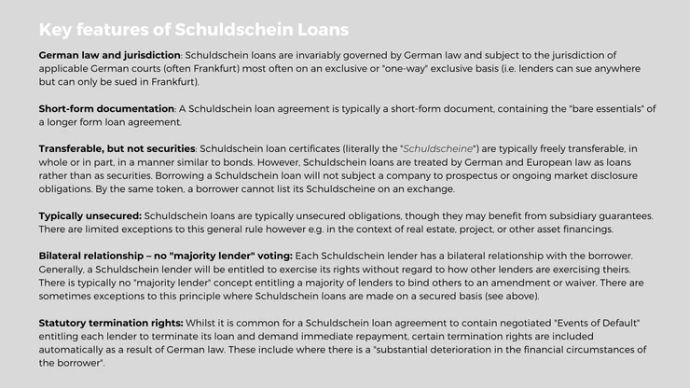

There are however market conventions that define what is typical for a Schuldschein loan. The box at the end of this briefing highlights six key attributes.

Who borrows Schuldschein loans, and why?

The "classic" Schuldschein borrower is a German Mittelstand company, with "investment grade" characteristics but which is too small, or which otherwise does not want to seek a rating. Austrian and French companies with similar credit strength have traditionally been the next largest cohorts.

More recently, the Schuldschein market has broadened to include:

-

Borrowers who are "cross-over" (i.e. sub-investment grade) credit risks; and

-

Borrowers in jurisdictions outside the traditional/core Schuldschein markets.Schuldschein loans have been borrowed by companies in the UK, SouthAfrica, Brazil, the Middle East and increasingly the Nordics.

The attractions of Schuldschein loans for borrowers include:

-

Market access: Schuldschein loans provide access to a wider/different pool ofcreditors to traditional syndicated loan or bond markets.

-

Lower transaction costs: Schuldschein documentation is short, simple, andpresents minimal disclosure obligations, meaning that transaction costs aretypically lower than for syndicated loans or bond documentation.

-

Maturity profiles: By market convention, it is common to borrow Schuldscheinloans on the same terms but with different maturity dates, corresponding tohigher/lower interest rates. This can give borrowers the ability to create a moretailored maturity profile than with traditional syndicated loans or (at least certaintypes of) bonds.

-

Covenants: Often, Schuldschein loans will provide greater covenant flexibilityand/or headroom than syndicated loans. For example, financial covenants maybe left out or given additional headroom to avoid "hair trigger" defaults; andbaskets may be defined as a percentage of assets rather than in absoluteterms to permit the business to grow. This reflects the absence of any abilityfor the "majority lenders" to make amendments to these provisions, or to waiveevents of default on behalf of the Schuldschein lenders as a whole.

Who lends Schuldschein loans, and why?

Traditionally, Schuldschein loans were originated by a small number of large European banks, and then distributed primarily to German savings banks (Sparkasse). In recent years, the universe of buyers has widened to include, among others, pension funds, insurers, and other types of banks (notably banks headquartered in Asian jurisdictions). For cross-border Schuldschein loans, there are broadly two main categories of Schuldschein lender. The first are institutions seeking to build a diversified portfolio of loans with a modest amount of capital and at limited cost. Schuldschein loans are attractive to such institutions owing to their short-form and ostensibly simple documentation (which can take less time to review than lengthy syndicated or bond documents); no or low minimum participation size (participations as small as €500k are relatively common); and free transferability (as with most Danish banks who do not syndicate loans nor trade debt in the secondary loan market, Schuldschein lenders typically "buy to own" but the in-principle ability to trade remains important).

In addition, such institutions take comfort from the absence of any "majority lender" concept in Schuldschein loans that would allow institutions with larger exposures to make amendments with which they may not be comfortable. The second category of Schuldschein lender are institutions who have other exposures to a borrower. Whereas some German borrowers rely primarily on the Schuldschein market for debt capital, this is rarely true of international borrowers, who will typically have other creditor relationships e.g. under syndicated loans or notes. Institutions with existing exposures to a borrower may see participating in a Schuldschein loan as an attractive means of increasing their exposure. Again, free transferability, and the inability for other lenders to give amendments or waivers on their behalf, are usually key attractions - these features may allow them to apply a more favourable capital or accounting treatment, and be integral to their ability to make the loan. Moreover, Schuldschein loans often pay a slightly higher yield than syndicated loans, particularly where a lender accepts a slightly longer term.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.