- within International Law topic(s)

- within International Law and Transport topic(s)

Today's Deep Dive is 1,245 words and an 8-minute read.

On October 11, the US imposed additional sanctions on Iran and its networks exporting oil via its "ghost fleet." The US took the action under E.O. 13902 and E.O. 13846, seeking to disrupt the flow of revenue Tehran uses to fund its nuclear program and missile development, support terrorist proxies and partners and perpetuate conflict throughout the Middle East. While some commentators are tying the measure to a US attempt to shape the Israeli response to the Iranian missile attack on October 1, the enforcement action is actually part of a much larger program to limit Iranian capabilities to project power in the region and with Russia in its war against Ukraine. US actions can be expected to accelerate beyond the current crisis and expand in the form of secondary sanctions against non-Iranian owned ships, shipping services companies and financial services companies, as well as individuals who own and/or are associated with them.

Challenges Iran Poses to US and Western Interests

The Iranian missile attack against Israel on October 1 is the most recent incident of Iranian efforts to project power across the Middle East as part of its strategic plan to attack US allies and drive the US out of the region. Iran has successfully developed allies among armed actors who reject the current status quo, including Hizballah (based in Lebanon and Syria), the Houthis (based in Yemen), the Islamic Resistance in Iraq, a coalition of pro-Iranian armed groups, and Palestinian Islamic Jihad and Hamas (West Bank and Gaza). The Middle East is currently enflamed in a zone of conflict arcing from Iraq in the Arab heartland, west to Mediterranean states of Syria and south through Lebanon, Israel and Palestinian territories, through the Red Sea, to Yemen. Iran periodically escalates tensions by attacking shipping in the waters of the Gulf, reminding governments and oil markets of the vulnerabilities of this strategic waterway for global energy security.

While these regional alliances are mature, developed over years of cooperation, Iran's blossoming relationship with Russia has emerged as a potent, new security threat for the US and western allies. Iran has shipped to Russia munitions, artillery shells, UAVs (drones) and close-range ballistic missiles for use against Ukraine, shoring up Moscow's military supply lines. In exchange, Tehran has requested Russian technology, including Russian Su-35 fighter jets, Mi-28 attack helicopters and, reportedly, the highly advanced S-400 missile defense system. On the margins of the BRICS forum in next week in Moscow, Iran and Russia are expected to sign a new Comprehensive Partnership Agreement, opening new chapter in Russia-Iran relations by deepening their strategic and economic ties as both nations face increasing isolation from the West.

Trends in Enforcement Actions

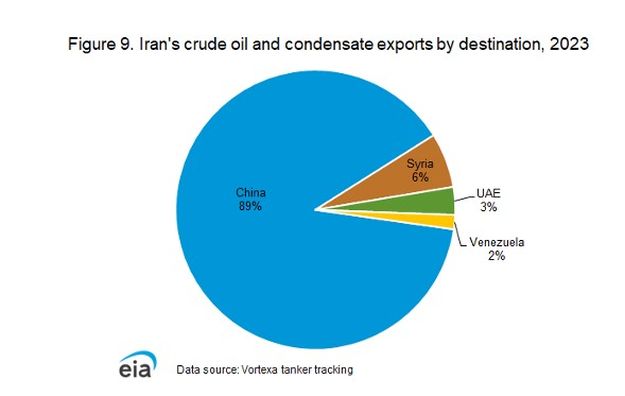

The regulatory environment vis-à-vis Iran has changed dramatically, with the multilateral Joint Comprehensive Plan of Action (JCPOA, aka Iranian nuclear deal) in 2015, the US withdrawal in 2018 and the Iranian compliance walk-back, and the lapse of the UN ban on the export of Iranian missiles and drones in 2023. The regulatory regimes of the US and European allies are no longer as neatly aligned on Iran as they once were, but there are still a lot of commonalities. For example, the US, UK and EU have imposed their own missile sanctions in coordination. But on petroleum exports, Iran has successfully leveraged policy discord between the US, Europe and Asia to find new markets, with crude oil and petroleum products revenues growing substantially since 2021 as a result of evading unilateral US sanctions. According to the US Energy Information Agency (IEA) October 2024, using data from two different third-party sources, Iranian crude oil and condensate exports grew from 825/848 thousand barrels per day (t/bpd) in 2021, to 1,120/989 t/bpd in 2022 to 1,590/1,360 t/bpd in 2023. IEB estimated revenue grew from $37 billion in 2021 to $53 billion in 2023. IEB concluded that in 2023, based on a third-party data source, China was the primary consumer of Iranian crude oil and condensate exports.

US Energy Information Agency: Country Analysis Brief: Iran

One key emerging trend is that US sanctions on Iran and Russia have become very similar, and in some cases, are being merged. The recent enforcement focus on Russia, designating shipping companies and vessels, so called ghost fleets, is now a key feature for Iranian sanctions. Secondary sanctions are part and parcel of the US enforcement actions against both countries. US and EU sanctions on Iranian export of drones or unmanned aerial vehicles (UAVs) and missiles are being linked in the same documents to export both to the Middle East and Russia.

While the US oil sanctions on Iran are unilateral, sanctions on Iran for UAV and missile proliferation are increasingly matched by European partners. Since July 2023, the EU has been progressively expanding the scope of their export restrictions and sanctions on Iran. On 14 May 2024, Brussels broadened the scope of the EU framework for restrictive measures in view of Iran's military support of Russia's war on Ukraine, so as to cover both drones and missiles, as well as the Iranian drone and missile program's support for armed groups and entities in the Middle-East and the Red Sea region.

Given current trends, it is likely that the US will expand Iranian oil-related secondary sanctions to include non-Iranian shipping services companies, similar to what it has done against the Russian ghost fleet, including logistics services, repair and docking services. Companies in the Arab Gulf and Asia are particularly at risk, given export logistics and the prime destination of buyers.

The US will likely push the EU to focus on financial networks that enable the transfer of military technology from Iran to its Middle East proxies but Russia as well, including financial networks linked to oil exports. While there remains diplomatic discord over how the JCPOA fell apart, conditions on the ground have changed since 2018 and Washington will likely press Brussels to move on to focus on current threats, not lost opportunities.

Risks to Energy Markets from Sanctions and Middle East Escalation

While the Biden administration would certainly wish to avoid an energy shock, driving up oil prices just weeks ahead of US elections, and the timing of the October 11 sanctions was designed to demonstrate US support for Israel, there can be no doubt that the US ultimately seeks to curtail Iranian oil exports over time, despite potential risks to the global energy market. Washington believes there is sufficient surplus capacity among OPEC+ producers to compensate, as needed. Additionally, OPEC+ is currently exceeding current quotas, as certain member states are cheating to meet their budgetary shortfalls, which has kept prices under OPEC's target range. After Tehran, Beijing faces the highest risks of Iranian petroleum products being removed from the market through a shock. A more gradual reduction will enable Beijing to switch suppliers to secure needs, albeit at a higher price point.

However, should Israeli retaliation to the Iranian October 1 missile attacks target Iranian oil infrastructure and trigger an escalatory Iranian counter response, targeting Gulf Arab energy suppliers, the resulting energy shock could be significant and protracted. To deter Iran, the US Department of Defense announced on October 13 that it is sending the Terminal High Altitude Area Defense system (THAAD) to boost Israel's missile defense capabilities, along with US troops to operate the advanced anti-missile system. Having US troops on the ground in Israel raises the stakes for Iran, risking a direct confrontation with the US. While the escalation risks are understood by the parties, this does not eliminate the risks of brinkmanship.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.