- within Tax topic(s)

- in United States

- within Criminal Law topic(s)

A. INTRODUCTION AND TAX ESSENTIALS IN CYPRUS

Since its accession to the European Union in 2004, Cyprus has established itself as a premier destination for investment, continuously enhancing its position as a competitive global hub for finance, tourism, retirement, and relocation. With a strategic location, a highly skilled workforce, modern infrastructure, reliable communication networks, and a stable legal system based on English Common Law, Cyprus offers an exceptional environment for both business and personal growth. This is further complemented by a favourable cost of living, a warm climate, and the renowned hospitality of its people.

The Government of Cyprus has long implemented policies designed to attract foreign investment and individuals to the island. Among the most significant of these policies are the "non domicile" status and the 'First Employment exemptions', which position Cyprus as one of the leading jurisdictions for High-Net-Worth Individuals seeking an ideal place to reside.

Furthermore, the recently announced and ongoing tax reform is planned to further modernize the Cypriot tax system, enhance competitiveness, and ensure a fairer distribution of the tax burden. The Cypriot government has introduced a series of measures that affect both businesses and individuals, including new provisions for the taxation of income, dividends, and corporate profits.

Herein, we present a summary of the principal tax considerations that an individual intending to relocate or retire in Cyprus will encounter.

This outline focuses on the tax considerations applicable to individuals and does not address those relevant to legal entities. For information pertaining to legal persons, please refer to our other relevant publications on corporate taxation.

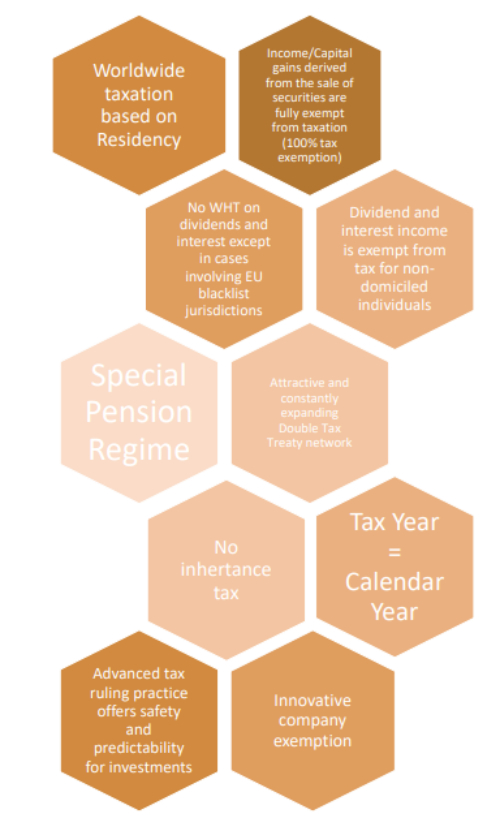

B. OVERVIEW OF THE TAX SYSTEM: MAIN HIGHLIGHTS

NON-DOMICILE RULES FOR INDIVIDUALS

Individuals who are tax residents in Cyprus but do not have a Cyprus domicile, are exempt from Special Defence Contribution (SDC) tax on:

- Dividends (17%);

- Passive Interest (17%/3%); and

- Rental Income (3%).

Domicile Status

A Cyprus tax resident who has remained in Cyprus for at least 17 out of the last 20 years, will be considered domiciled for SDC purposes, and so be subject to the applicable SDC tax rates, irrespective of their original domicile of origin.

Duration of Tax Benefits

The SDC exemptions available to individuals who are residents but non-domiciled in Cyprus, are granted for a maximum period of 17 consecutive years (Please refer to Section E below).

'FIRST EMPLOYMENT' INCOME TAX EXEMPTIONS

o 50% exemption on gross remuneration: Under the island's expanding investment strategy, a revised tax deduction scheme is available to 'high-earning' individuals relocating to Cyprus, in an effort to attract highcalibre professionals to the local work force.

Following the amendment to the Income Tax Law, approved on 30 June 2023, individuals with employment income in Cyprus exceeding €55,000 annually (in the first 12 month period) are eligible for a 50% deduction from income for the first 17 years of employment.

To qualify, the individual must not have been a Cyprus resident for at least 15 consecutive years prior to beginning their first employment in Cyprus.

Additionally, individuals who started employment in Cyprus between 2012 and 2021 may still be eligible for this deduction, subject to certain 'grandfathering' provisions.

o 20% or €8.550 exemption of the remuneration earned, whichever is lower:

Prior to the 26th of July 2022, individuals moving to Cyprus for both residence and employment were eligible for an annual allowance, for up to five years following the start of their employment, equal to the lesser of €8,550 or 20% of their salary.

This scheme was enhanced in 2022 as part of the new Cyprus investment strategy.

As of 26 July 2022, employees who for three consecutive years immediately prior to the commencement of their 'First Employment' in the Republic, were employed outside the Republic by an employer who is not a resident of the Republic, can now claim a 20%/€8,550 deduction for up to seven years, starting from the year after their employment begins. We note that such individuals will need to be able to demonstrate that they had remained in salaried employment positions for three consecutive tax years immediately prior to taking up employment in Cyprus.

OTHER KEY TAX EXEMPTIONS

- 100% exemption on profits from the sale of shares;

- 100% exemption on retirement lump sums received;

- capital sums from approved life assurance policies and provident or pension funds;

- 100% exemption on income derived from employment services provided overseas to:

- a non-resident employer or

- a permanent establishment of a resident employer

for a duration exceeding 90 days but less than 183 days within the tax year;

- 100% exemption on foreign exchange (FX) gains, with the exception of FX gains arising from trading in foreign currencies and derivatives;

- 100% exemption on salaries of officers and crew of ships owned by a Cyprus shipping company sailing under the Cyprus flag and operating in international waters; and

- 100% exemption on income from a qualifying scholarship, exhibition, bursary, or similar educational grant.

CAPITAL GAINS TAX (CGT)

Cyprus does not impose capital gains tax, except for a 20% CGT on capital nature gains (based on 'Badges of Trade') derived from the sale of real estate situated in Cyprus, or from the sale of shares in companies that directly or indirectly own real estate in Cyprus. In such cases, the taxable gain is determined by the portion of the gain related to the real estate. (See Section H Below).

RENTAL INCOME

Rental income derived from Cyprus sources or abroad, by a Cyprus tax resident individual, are subject to personal income tax at their marginal rates, whilst a flat 20% deduction is permitted. Additionally, capital allowances are available at the rate of 3% p.a., on the cost of acquiring the property, whilst interest expenses on loans specifically financing the purchase of the property may be deducted. Rental income is also subject to SDC, as explained in Section E below herein.

PENSION RECEIVED FROM ABROAD

Foreign pension income is subject to a specific tax regime, where the initial €3,420 per year is exempt from taxation. Any amount exceeding this threshold is taxed at a reduced rate of 5%, provided it qualifies for this special taxation scheme. Alternatively, individuals have the option to elect to be taxed according to the standard income tax rates on their foreign pension income. Practically, taxpayers work out which regime is most suited to them on an annual basis, and elect accordingly. Kinanis LLC remains available to assist with this process upon request.

SUCCESION TAXES

Cyprus does not impose any inheritance or other similar taxes.

TAX PAID ABROAD

Tax relief or credits for taxes paid in other countries may be granted through the provisions of a double tax agreement or, alternatively, through unilateral relief.

C. HOW TAX RESIDENCY IS DETERMINED FOR INDIVIDUALS

The Cyprus tax system may impose taxes only on tax residents of Cyprus or individuals who derive income from sources within Cyprus.

I. Tax Residents in Cyprus:

Tax resident of Cyprus, in the case of a physical person, means:

a. 183 Days Rule: Any individual who resides in Cyprus for one or more periods which exceed in total 183 days in the tax year (same as calendar year), or

b. 60 Days Rule: Any individual who stays in Cyprus for at least 60 days in the year of assessment, provided that:

1) The individual is not tax resident in another country; and

2) The individual does not spend more than 183 days in any other single jurisdiction; and

3) The individual maintains a permanent residence in Cyprus which can be owned or rented; and

4) The individual conducts any business or is employed in Cyprus or is a director in a Cyprus company as at the 31st of December in the year of assessment.

Further Clarifications and Special Circumstances on Cyprus Tax Residency:

Moving from UK: When an individual seeks tax residency in the Republic based on the 60-day rule for a specific tax year, and for part of that year he/she is also considered a tax resident of the United Kingdom (UK), the condition that the individual is not a tax resident in another country is not considered breached. The UK tax year runs from 6 April to 5 April of the following year. As a result, it is possible for the individual to be a tax resident of the UK during either the UK tax year that ends (or begins), which may overlap with the Republic's tax year being assessed.

Furthermore, upon prior approval from the Tax Commissioner, this treatment can also apply to individuals who are tax residents of another country for part of the year, where the tax year of that country does not align with the Republic's tax year.

Fiscal Year Definition: The "fiscal year concerned" refers to the fiscal year of the Contracting State where employment services were performed. Taxation may apply to remuneration in a different year from when services were rendered, depending on the relevant 12-month period, even if it spans two fiscal years (OECD Model Tax Convention on Income and on Capital - Commentary on Article 15, Paragraph 4.1).

Scope of Taxation: All Cyprus tax residents, as identified above, either Cypriots or foreign nationals, are taxed in Cyprus on their worldwide income accrued or derived from all sources, both in Cyprus and abroad. A person who is a tax resident of Cyprus but the place of domicile remains outside Cyprus can enjoy significant tax benefits as analysed in Section F below.

To view the full article clickhere

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.