- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Media & Information industries

- within International Law, Immigration and Intellectual Property topic(s)

- with Finance and Tax Executives

In this short article we will demonstrate to you what the best route to contact your business is in Cyprus. We take into consideration tax savings and of course the legal protection of the owner of the Company.

LEGAL PROTECTION:

Creating a limited by shares company protects the owner against the law and in most cases the local authorities (tax and other). Whilst this may not be important for all you, for some businesses, protection is significantly more important than tax savings. It all depends on the nature of your business, the type of services you offer, whether you have employees and of course the conditions of employment.

Outdoors dangerous repair work performed is surely more dangerous than an office work. Imagine that one of your employees falls over a roof or accidentally damages the property severely. This could generate a plethora of legal issues for the business which is no other than you, the owner of the business, or in accounting / tax terms the sole trader. It is the case that some services or product offerings are more dangerous than others and as such the business must protect itself against potential risks including legal negligence.

Such a protection can be obtained with the use of a limited company by shares; it is limited to its share capital and it is the actual company and not the owner legally responsible against the law.

The essence is simple; companies can close, can dispose of their assets and can be replaced by other companies so that business continues as normal offering a piece of mind to the owner. Physical persons on the other hand, sole traders as they are called in accounting terms, can't.

This is the reason so many business people set up companies despite the additional accounting, audit and tax fee involved. To be protected.

TAXES:

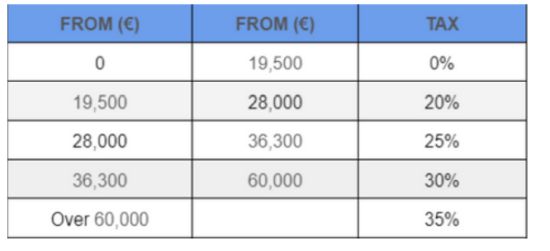

The Cyprus tax system is structured in such a manner that if you are trading as a person you are taxed as if you are an employee based on the below remuneration table with the exemption that your social securities and national healthcare system will be slightly different.

Like other jurisdictions, salaried income is taxed at the highest levels reaching more than 35% for taxable salaries exceeding Euro 60,000. In other words, if you earn more than Euro 60,000 it would be as if you give to the local Cyprus Tax Department 1/3 for tax payments!

Employment Tax Thresholds:

On the other hand, if you create a Cyprus Company it will only be taxed at 12.5% on its profits not turnover* and will enjoy tax free dividends if you are a Cyprus Tax Resident but non-domiciled or if you are not a Cyprus Tax resident at all.

This is why Cyprus companies are so popular; they are fully fledged European Union companies fully compliant with EU and OECD directives, taxed at only 12.5% locally in Cyprus with tax free dividends for overseas businessmen.

How are Cyprus companies taxed?

Cyprus companies like any other company are taxed on its profits and not on its turnover.

This implies that the following costs can be deducted from sales and can reduce the company taxation:

- travelling expenses

- entertainment expenses - up to a certain threshold

- legal expenses

- advisory expenses

- accounting, audit fees

- cost to purchase goods that are sold

- telephone, stationery

- rental expenses

- any other expense incurred wholly and exclusively for business use

COSTS

Costs: Lets compare the company vs the Sole Trader (trading as an individual)

Sole traders with income exceeding Euro 70,000 must prepare audited financial statements the same way companies do! In other words you can not get rid of the auditors fees if your turnover exceeds Euro 70,000.

Nor the accountants fees, in this respect, as you will need to have your accounting records, social securities, paye deductions and national healthcare deductions prepared and paid by a licensed accounting firm whether a sole trader or a company.

Your personal or corporate tax return must be backed up from accounting ledgers and or evidence so that in the event of inspection by the Cyprus income tax office the numbers can be supported.

In addition, the Cyprus tax returns for self-employed persons have become so complicated that they must be prepared and submitted by a professional.

COMPANY VS SOLE TRADER:

Conclusion

Since the VAT threshold for registration is mandatory and it is reached if the turnover of a business is only Euro15,300 within 12 consecutive months and the fact that more than Euro 70,000 turnover for sole traders books must be audited, coupled with the protection a Cyprus company offers to its employees, it is clear that most businesses choose to operate via a Company rather as individuals.

On the other hand, if expected turnovers are low <40,000 and the business services or operations do not carry any significant risk either to the actual person performing the work or to its clients, the most suitable solution would be to trade as a sole trader.

About Us

CYAUSE Audit Services has extensive experience in the insurance industry has helped tens of insurance brokers and agents register and get licensed by the local Cyprus regulator granting them passporting access to the rest of the European Union.

CYAUSE Audit Services is an Audit & Assurance firm with offices in Cyprus and the UAE. During 2015 we have been awarded by I.C.P.A.C and the A.C.C.A (local and international association of Chartered Certified Accountants) for the Quality of our Audit Services and our Office's Procedures.

Being a Truly International Audit & Assurance firm, we have associates from all over the world and we are constantly looking for new associates to expand our network further. At present, CYAUSE Audit Services operates internationally through its membership with BKR International amongst the largest American associations in the world, Accace Circle, a co-created business community of like-minded BPO providers and advisors who deliver outstanding services with elevated customer experience. Our network covers almost 40 jurisdictions with over 2,000 professionals, it supports more than 10,000 customers, mostly mid-size and international Fortune 500 companies from various sectors, and processes at least 170,000 payslips globally.

CYAUSE Audit Services Ltd is also a member of BKR International one of the biggest US Accounting Associations of the word and the 3E Accounting Network, an international accounting network which originates from Hong Kong and has more than 80 members from all over the world.

Learn More about Cyprus Corporate Environment

Information about CYAUSE Audit Services and the Cyprus Corporate & Tax System can be obtained from our Website or our YouTube channel which provides valuable information about the Corporate & Tax Environment of Cyprus.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]