Ontario Dispute Adjudication for Construction Contracts ("ODACC") recently issued its fourth annual report on construction adjudication in Ontario. Below, we consider its key takeaways.

Background

ODACC, created on October 1, 2019 as part of the adjudication and prompt payment regime of the Construction Act, R.S.O. 1990 c. 30 (the "Act") and O. Reg. 306/18, is the entity responsible for administering construction-related adjudications and for training and certifying adjudicators who render decisions in these construction-related adjudications.

As many readers will already appreciate, adjudication is intended to be a timely and cost-effective dispute resolution procedure for construction-related disputes, which allows parties to refer its dispute to adjudication for determination by an ODACC-certified adjudicator. The determination (rendered within 30 days, unless otherwise extended) is interim binding on the parties, unless a final decision is made in a subsequent court proceeding or through arbitration. The parties, in conjunction with the adjudicator, can tailor the adjudication procedure in many respects to better fit the nature of the dispute.

2023 marked ODACC's fourth year of operation, and as noted below, there appears to be an increasing uptick in the number of adjudications for construction matters.

The Report

ODACC's fourth annual report includes statistics for the 2023 fiscal year, which ran from August 1, 2022 to July 31, 2023.

In the 2023 fiscal year, 269 adjudications were commenced, 161 determinations were delivered (including in respect of 21 adjudications which were commenced during the 2022 fiscal year), and 80 adjudications were terminated. The reasons for termination included: settlement of the dispute, resolution of the dispute through other means, or the lack of jurisdiction to adjudicate the matter.

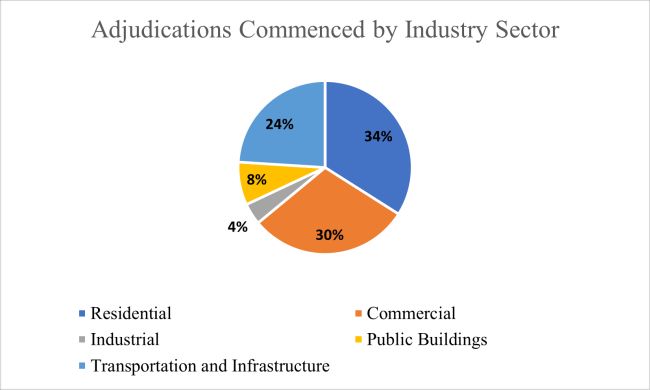

Interestingly, adjudication was used across a variety of sectors within the construction industry, including residential (34%), commercial (30%), industrial (4%), public buildings (8%) and the transportation and infrastructure sectors (24%).

Based on the total notices of adjudication that were delivered, there was significant growth in the use of adjudication across the entire industry (with especially large increases in the commercial, public buildings, and transportation and infrastructure sectors):

| Industry Sector | Number of Notices of Adjudication Given during the 2023 Fiscal Year | Number of Notices of Adjudication Given during the 2022 Fiscal Year | Percentage

Increase from 2022 to 2023 |

| Residential | 91 | 52 | 75% |

| Commercial | 81 | 23 | 252% |

| Industrial | 11 | 6 | 83% |

| Public Buildings | 22 | 10 | 120% |

| Transportation and Infrastructure | 64 | 30 | 113% |

| All Sectors | 269 | 121 | 122% |

The number of determinations has also increased in 2023, from 67 in 2022, to 161 in 2023 – an overall 140% increase. In particular, there were 100%+ increases across all sectors except for the residential sector, with a roughly three-fold increase in the commercial and public buildings sectors leading the way:

| Industry Sector | Number of Determinations Made during the 2023 Fiscal Year | Number of Determinations Made during the 2022 Fiscal Year | Percentage

Increase from 2022 to 2023 |

| Residential | 54 | 35 | 54% |

| Commercial | 46 | 12 | 283% |

| Industrial | 7 | 2 | 250% |

| Public Buildings | 14 | 3 | 366% |

| Transportation and Infrastructure | 40 | 15 | 166% |

| All Sectors | 161 | 67 | 140% |

Perhaps the most interesting question to readers, however, is how many adjudications have actually resulted in a determination being rendered. On that point, ODACC has noted across all sectors, approximately 60% of the notices of adjudication delivered during the 2023 fiscal year resulted in a determination. This ratio is relatively consistent across all sectors, ranging between 57% to 64%:

| Industry Sector | Number of Notices of Adjudication Given during the 2023 Fiscal Year | Number of Determinations Made during the 2023 Fiscal Year | Percentage of Notices that result in a Determination |

| Residential | 91 | 54 | 59% |

| Commercial | 81 | 46 | 57% |

| Industrial | 11 | 7 | 64% |

| Public Buildings | 22 | 14 | 64% |

| Transportation and Infrastructure | 64 | 40 | 63% |

| All Sectors | 269 | 161 | 60% |

With respect to the subject matter of adjudications, the largest categories were related to either the valuation of services or materials under the contract (42% of the total adjudications completed), or payment under a contract (39%). Matters related to the payment of a holdback under s. 26.1 or s. 26.2 of the Act, and the non-payment of holdback under s. 27.1 of the Act, experienced a modest uptake in 2023 as compared to 2022, where neither of these matters were addressed in a determination:

| Matter Listed Under Paragraphs 1 to 7 of Subsection 13.5(1) of the Construction Act | Number of Adjudications Completed during the 2023 Fiscal Year | Number of Adjudications Completed during the 2022 Fiscal Year |

| The valuation of services or materials provided under the contract | 68 | 31 |

| Payment under the contract, including in respect of a change order, whether approved or not, or a proposed change order | 63 | 29 |

| Disputes that are the subject of a notice of non-payment under Part I.1 | 20 | 3 |

| Amounts retained under section 12 (set-off by trustee) or under subsection 17 (3) (lien set-off) | 0 | 0 |

| Payment of a holdback under section 26.1 or 26.2 | 3 | 0 |

| Non-payment of holdback under section 27.1 | 4 | 0 |

| Any other matter that the parties to the Adjudication agree to, or that may be prescribed | 3 | 4 |

| Total | 161 | 67 |

In the 2023 fiscal year, the total amount claimed in adjudications was approximately $69 million, with an average amount of $256,000 per determination across all sectors. Given that only 60% of the notices of adjudication resulted in determinations, the total amount required to be paid under determinations was approximately $24 million. In assessing the average amount to be paid under determinations by each sector, the industrial sector had an average of $432,000, then the residential sector at $213,000, and followed by the commercial sector at $106,000.

| Industry Sector | Total Amount Claimed | Total Amount Required to be Paid Pursuant to Determinations |

| Residential | $20,002,076.26 | $11,543,723.49 |

| Commercial | $25,257,534.98 | $4,918,062.46 |

| Industrial | $6,598,733.27 | $3,027,245.75 |

| Public Buildings | $4,662,173.75 | $811,732.84 |

| Transportation and Infrastructure | $12,349,857.78 | $4,081,225.36 |

| All Sectors | $68,870,376.04 | $24,381,989.90 |

Takeaways

Overall, ODACC's fourth annual report reflects an encouraging uptake in adjudication as a method of dispute resolution available to the construction industry. Across the various construction industry sectors identified in the Report, there was steady growth in the use of adjudication, with significant gains in certain of those sectors. In that regard, the report presents a welcome indication that adjudication in Ontario is continuing to see growth in much the same manner as was the case in the United Kingdom – that is, slowly at first, with growing adoption as industry participants come to recognize its value. We wait with interest to see if next year's report confirms this trend.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.