- within Tax topic(s)

- in South America

- with readers working within the Accounting & Consultancy and Banking & Credit industries

- with readers working within the Accounting & Consultancy industries

- within Employment and HR topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

A recent area of concern that our taxation team has been increasingly encountering is with whether distributions made by a family trust are within the family group and whether said distributions will attract the 47% family trust distribution tax. We expect that in the context of family trusts, the ATO will allocate further audit resources in determining whether the distributions are compliant which is made more abundantly clear with the ATO's key priority are from its Next 5,000 report suggesting that they will scrutinise succession planning arrangements more closely

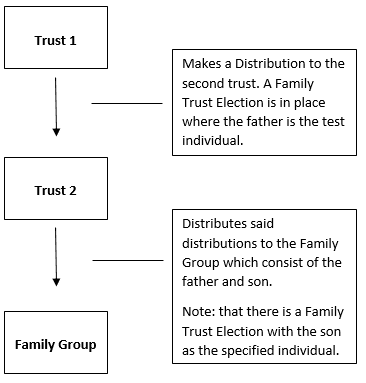

It is therefore important to determine whether your arrangements within your family trusts are compliant with schedule 2F of the Income Tax Assessment Act 1936 and whether you require an interposed entity election (IEE). In our experience, IEEs are common given that family trust structures may involve trusts being interposed between the family trust and ultimate distributions to family members. These interposed entities, subject to certain circumstances, can be included as part of the family group. The below structures are in our view, the most common structures which utilise interposed entities.

If the interposed entity is not part of the family group, this may mean the family trust distribution tax will be imposed on any present entitlements conferred on the entities or distributions made to them by the family trust. As a reminder, the family trust distribution tax is payable at the highest personal marginal tax rate, including the Medicare levy, for a total of 47%.

Hence, it is particularly important for tax professionals and members involved in a family trust arrangement to know when an interposed entity election (IEE) is required, the requirements for an IEE and the effect of said IEE.

When an IEE is not required

Some entities and individuals are automatically considered part of the family group by way of s 272 – 90. These include the following:

- The specified individual's family members;

- The trust in which the election is made;

- Interposed entities that have made an IEE to be included in the family group;

- Entities that have a fixed entitlement to all of the capital and income held by the individual or family members of the family trust;

- Estates of the individual or family members if all are deceased; and

- Certain charitable institutions covered by the DGR provisions or tax exempt bodies to which the distributions are allowed.

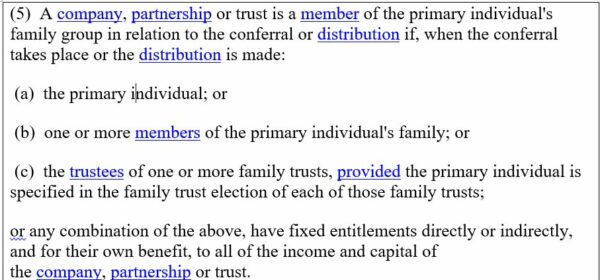

By way of reference to the diagram above, the Family trust distribution tax may only be avoided if the distribution is within the family group. Hence, for distributions from Trust 1 to Trust 2 to be essentially exempt from this provision, Trust 2 must have a fixed entitlement to all of the capital and income held by the specified individual or family members of the family trust under consideration. Relevantly, s 272 – 90(5) provides the following:

Note that the reference to fixed entitlements means that an IEE for a discretionary trust is always recommended. This is because a discretionary trust (if Trust 2 in the example is a discretionary trust) will never have a fixed entitlement to the distributions in Trust 1. The case is different for a unit/fixed trust.

It is also sufficient for another individual, provided it is the specified individual of the FTE or a member of that individual's family to also be entitled to part of Trust 1's distribution and not attract the Family trust distribution tax. For your reference, a person is a member of a primary individual's family if either:

- They are a spouse of either the primary individual or a member of the primary individual's family.

- A person who was the spouse of either the primary individual or of a member of the primary individual's family immediately before the death of the primary individual or member of the primary individual's family and who is now a spouse of a person who is not a member of the primary individual's family.

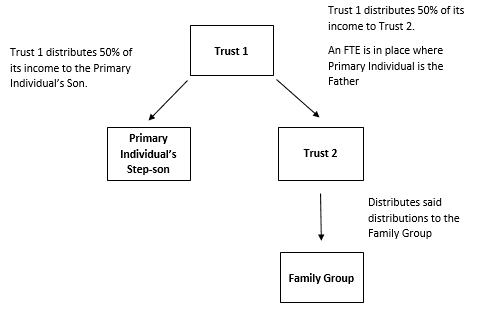

- A person who was a child of the spouse of either the primary individual or of a member of the primary individual's family before a breakdown in the marriage or relationship of the primary individual or of the member of the primary individual's family.

Interestingly, a spouse also includes a de facto spouse (including same sex relationships) and who are registered under a State law or Territory law for the purposes of section 2E of the Acts Interpretation Act 1901. Family also includes an adopted child, step-child or ex-nuptial child.

Based on this, the following structure and distribution to an interposed entity (Trust 2) would also be appropriate and not attract the family trust distribution tax.

How an Interposed Entity Election can be made

The rules governing how an IEE may be made are set out in s 272 – 85. In doing so, the first requirement generally states that the election must be in writing and a form approved by the Commissioner. A link to access said form, and the Commissioner's requirements, for your reference may be accessed here.

The largest hurdle to cross for a successful IEE is that the election must pass the family control test. A trust will pass the family control test if the following persons control the trust at the time of the election:

- The individual in the family trust election;

- Members of the individual's family, legal or financial advisers or some combination of those persons.

Control is a wide term and imports the following per s 269 – 95(1), a group controls a trust if the group:

- Has power, by means of the exercise of power of appointment or revocation or otherwise, to obtain beneficial enjoyment of the capital or income of the trust; or

- Is able to control the application of the capital or income of the trust; or

- Is capable, under a scheme, of gaining the beneficial enjoyment in paragraph (a) or the control in paragraph (b); or

- The trustee is accustomed, under an obligation or might reasonably be expected to act in accordance with the directions, instructions, or wishes of the group or

- The group is able to remove or appoint the trustee; or

- The group acquires more than 50% stake in the income or capital of the trust.

Specified Year of the Election

The effect of a successful IEE is that following the "specified" date of the election, the trust will be considered as part of the family group and any distributions of capital or income to the trust will not attract the 47% tax.

The interesting thing about this is that an IEE may be made for an earlier income year provided that the trust passes the family control test in relation to the FTE and the trust has made no distributions of income or capital to anyone outside of the family group. This essentially means that an IEE does not have to be made the same year as an FTE and can be a later income year.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.