- with readers working within the Telecomms industries

- within Insolvency/Bankruptcy/Re-Structuring, Criminal Law, Litigation and Mediation & Arbitration topic(s)

The Australian economy is experiencing a complex period

characterized by high interest rates, elevated insolvency rates and

a strong stock market. Interest rates have surged to their highest

level in 12 years, driven by persistent inflation, while

insolvencies are at their peak in two decades.

To better understand these conflicting signals, the Turnaround

Management Association of Australia (TMA) and Alvarez & Marsal

(A&M) conducted a survey of stakeholders from various sectors,

including lenders, advisors and business leaders. This survey

sought to gather insights into the current market conditions and

the specific challenges faced by industries such as construction,

renewable energy, private healthcare, retail and mining.

A Murky Market Outlook

To provide context to the survey responses and A&M's experts views, here is a quick snapshot of the current macroeconomic backdrop:

Key Insights

- Input inflation, wage inflation and interest rates were

the clear leaders in the greatest challenges facing businesses over

the next 12 months, across all sectors. However, in a sign

of uncertainty, there was no consensus on the direction these will

take from here.

- 37% of the respondents expect a recession within 12

months, with another 16% predicting it within 24 months.

If a recession occurs, 77% anticipate growth in the market for

operational turnarounds, 85% expect an increase in financial

restructuring, and 87% foresee expansion in the insolvency

market.

- Participants ranked construction, engineering and

infrastructure as the industry most likely to be under extreme

stress in the next 12 months (24%), followed by travel,

hospitality and leisure (18%) and retail, consumer goods and

services (17%).

- Most participants believe that organisations should

focus on cash management (63%) and cost reduction (57%) to address

market challenges. Respondents also think businesses

should enact debt restructurings and change management, but they

see companies keeping these at a much lower priority at the

moment.

- Whilst turnaround directors aren't routinely seen

as being a solution for companies, 40% of survey

participants expect them to be used much more in the next 12

months.

- Around 30% of respondents indicated that safe harbour

is delivering better outcomes for stakeholders and they

expect to see more situations where this protection is used.

- Providers of finance to distressed situations are most

likely to be specialist credit funds and private credit

funds given their ability to use their experience and risk

tolerance to deliver value, whilst also generating appropriate

returns for that risk.

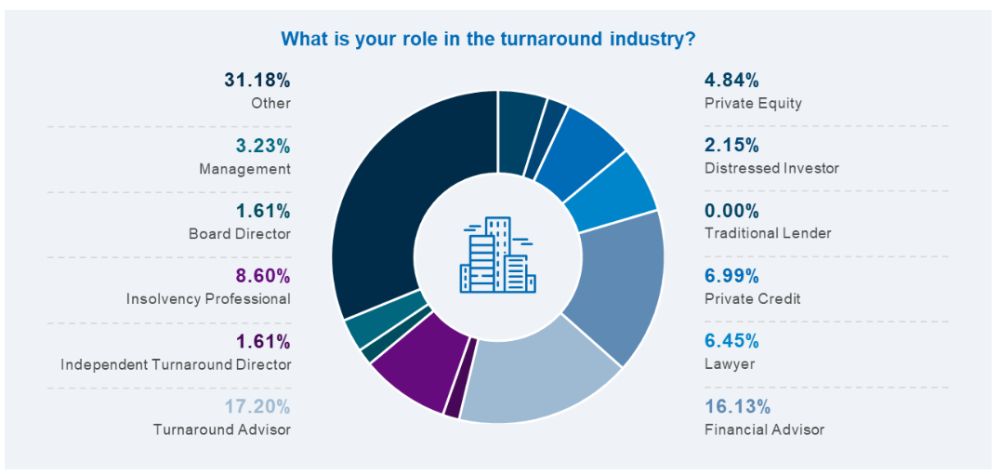

Annual Turnaround Survey

A&M, in conjunction with the Turnaround Management Association, surveyed professionals in the turnaround, restructuring and insolvency space in Australia to gather their views on the industry's outlook.

How A&M Can Help

Leading companies, investors and public organisations turn to Alvarez & Marsal (A&M) to drive significant results with practical approaches that work versus theoretical approaches that don't.

A&M partners with clients to address their operational, financial and regulatory challenges, transactional needs and to make an impact.

In an interconnected and unpredictable world where Australasian

companies face disruption, financial challenges, shifting

regulation, and evolving workforce and customer demands, A&M is

uniquely positioned to support its clients in navigating these

challenges. We act as an agent of change and as a trusted partner

to enable our clients to deliver during transitional and

transformational times.

Originally published 09 September 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.