- within Insolvency/Bankruptcy/Re-Structuring, Transport and Immigration topic(s)

n December 2024 the Parliamentary Joint Committee on Corporations and Financial Services (the Committee) published a Report following an inquiry into how well the existing financial services regulatory framework is protecting against financial abuse. The Report highlighted a range of regulatory gaps and considered how financial institutions could better mitigate the risk of financial abuse.

Privacy

Inquiry submissions revealed that existing privacy laws prevent financial institutions from appropriately identifying, responding to and reporting financial abuse. Institutions are currently required to obtain explicit consent from customers before recording any sensitive information in their accounts. This prevents financial institutions from proactively documenting or flagging actual or suspected financial abuse thereby creating a barrier to the provision of appropriate support. It was therefore recommended that privacy legislation be revised to better allow financial institutions to respond to financial abuse cases.

Sector-Specific Reform

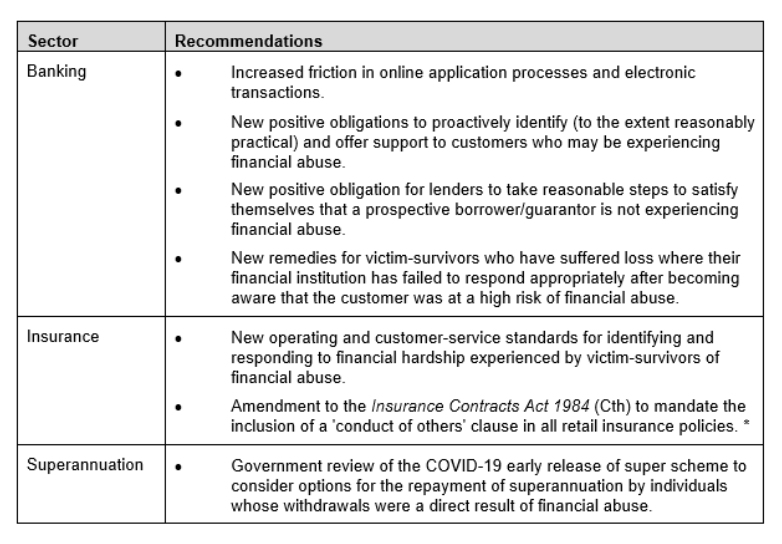

While it was recognised that financial institutions were making progress in the implementation of measures to identify and respond to financial abuse, the Committee highlighted the need for reform across all three sectors. The table below outlines some of the key recommendations for each sector.

Key Takeaways

The Committee's Report has shed greater light on the urgent need to improve the existing regulatory framework to allow financial institutions to explicitly address the widespread risk of financial abuse arising in relation to financial services. To prepare for potential reform, financial institutions should consider the Committee's recommendations and seek to proactively improve internal mechanisms designed to identify and respond to financial abuse.

* For information on 'conduct of others' clauses see our previous alert on general insurance policies.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.