- within Accounting and Audit, Real Estate and Construction, Food, Drugs, Healthcare and Life Sciences topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in Australia

- with readers working within the Accounting & Consultancy, Automotive and Banking & Credit industries

On 26 June 2023, the International Sustainability Standards Board ('ISSB') released its inaugural global sustainability reporting standards, IFRS S1 and IFRS S21 ('Standards'). Australian companies must proactively prepare for these forthcoming changes, with mandatory climate-related financial disclosure anticipated to impact our shores as early as Q2 2024 as the Standards are adapted for the Australian context. The ISSB Standards release represents one of the most significant shifts in financial reporting in recent years, marking the next step towards equal prominence for sustainability and financial reporting.

The ISSB Standards are vital to investors by providing reliable sustainability information to support investment decisions. Over the next six months, Boards, CEOs, CFOs and sustainability executives should start planning and allocating sufficient funds and resources in preparation for the Australian implementation of the Standards and the mandatory requirements which in Australia will extend to climate-related financial disclosures. To ensure companies are prepared well before the requirements come into effect, our Australian ESG specialists outline the steps companies should consider implementing during the second half of 2023.

A crucial element within the Standards is the connection to financial statements. They are designed to work with accounting standards, incorporating sustainability strategy into business strategy.

FTI CONSULTING'S KEY TAKEAWAYS

The perception held by some of ESG as a mere appeasement for socially conscious investors is about to shift with the upcoming introduction of the ISSB Standards, specifically IFRS S1 (covering general sustainability-related financial disclosures) and IFRS S2 (focused on climate-related financial disclosures), starting in January 2024 when the Standards will take effect globally. They will not be immediately mandatory across markets, with each jurisdiction needing to define the extent to which they will be implemented, however, with the global community seeking a consistent sustainability disclosure baseline, the ISSB Standards are likely to be widely adopted across the globe.

Covering governance, strategy, risk management, metrics and targets, the Standards establish a consistent global framework, requiring companies to report on all relevant sustainability topics, not just climate-related ones.

Be aware, this is more than just a reporting requirement; it is also a rewiring of how company value is determined, articulated and how performance is measured.

Companies will need to assess information to disclose that can reasonably influence decisions by key stakeholders such as investors, lenders and creditors. Once adopted internationally and in Australia as a consistent set of standards, businesses will need to align financial reporting with sustainability reporting. As a result, there may be a requirement for additional disclosures in an entity's financial statements. This means companies must be ready to share a much more comprehensive range of information than before with investors, lenders and other financial stakeholders.

WHAT DOES THIS MEAN FOR AUSTRALIA?

The development of mandatory climate-related financial disclosures is part of the Australian Government's commitment to ensure greater transparency and accountability regarding climate-related plans, to ultimately deliver on the country's net zero commitments. As such, the Treasury is leading the policy design of the new mandatory requirements, with the Australian Accounting Standards Board (AASB) responsible for the draft, consultation and issuance of the standards.

The Treasury has signalled that mandatory climate-related financial disclosures for Australian large-listed and unlisted companies and financial institutions will follow the ISSB Standards.2 The Treasury's proposed framework would therefore cast a wide net on thousands of companies.

The AASB is consulting on proposals for the disclosure design and is expected to issue Australian climate-related disclosure standards in Q2 2024.3 These are to follow the ISSB IFRS S2, with some aspects of IFRS S1, for example, materiality definition, implemented to give effect to IFRS S2.

Beyond climate disclosures, AASB is developing sustainability disclosure standards for the Australian market, likely to be closely aligned with the ISSB Standards.4 There is currently no indication these standards will become mandatory in Australia in the near future.

With the phased rollout of the Treasury's climate-related disclosure standards over the next year, companies have reasonable time to prepare and adjust, as mandatory reporting may commence as soon as FY2024-25. Non-compliance will result in civil penalties5.

The Standards, as implemented for Australia, will help ensure investors have the data they need to make more informed investment decisions related to climate risk and opportunities.

With such a wide adoption expected internationally, the ISSB Standards will be important for Australian companies as global investors start to expect consistency and comparability in any disclosures they review.

HOW AND WHEN COULD THEY AFFECT YOU?

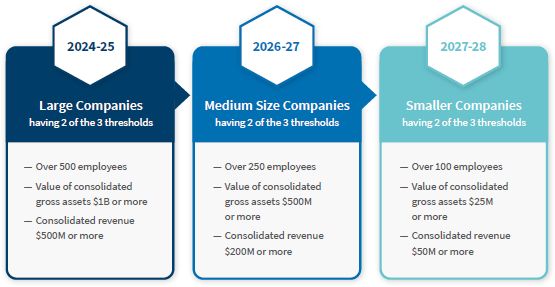

- The Treasury's mandatory climate-related financial disclosure rules would apply to the largest Australian companies for the reporting period commencing 1 July 2024 and then expand to smaller companies over the following three years.

WHERE WILL INFORMATION BE DISCLOSED?

- The Australian climate-related financial disclosures would be published in an entity's annual report, specifically integrating information in management commentary.

- Companies would be expected to outline their climate-related governance structure, risk assessment, scenario modelling and strategy development for addressing climate-related risks and opportunities as well as disclose relevant metrics and targets.

Australia's Mandatory Climate-Related Financial Disclosures6

QUESTIONS TO GET YOU READY

What should be addressed right now:

- When and how will the Standards affect

you?

As a starting point, understand when and how the changes will impact your company. Also, compare your current internal and external reporting and practices with the new Standards. - Is training required to bring your Executives and Board

up to speed?

Ensure senior management and your Board are well-informed of the latest Standards and what this means for the business, to the same level as financial reporting standards is currently understood. - Is your materiality up to date? Have you identified the

correct climate-related risks and opportunities?

Review the company's existing material climate-related risks and opportunities, ensuring these are in line with the Standards' requirements. Focus on matters that affect the company's prospects and consider what will impact investor sentiment. - Are there effective processes in place to gather

information and for integrated reporting?

An issue for many companies is likely to be collecting data. Systems and processes must be created and implemented to ensure effective data monitoring and reporting. Make sure you have a dedicated and experienced team for oversight and collection. - Are you preparing for scenario analysis?

Climate-related scenario analysis will be used to assess the company's climate resilience. Start preparing to conduct a climate-related scenario analysis to ensure the business has adequate time to obtain, develop and analyse information. - How are you planning to capture and disclose GHG

emissions?

Commence laying the essential groundwork towards capturing not only Scope 1 and 2, but also subsequent Scope 3 emissions reporting requirements. - How does your corporate strategy align with your

sustainability agenda?

Understand how your corporate strategy impacts and drives sustainability values. The aim is to provide a clear view of how sustainability factors may affect the company financially. This is vital as it could affect the company's cash flow, ability to raise capital, or cost of capital over the short, medium or long term.

HOW CAN YOU PREPARE IN H2 2023

For Boards – strengthen governance

To prepare for the Standards, boards of directors have a critical role in enhancing the company's governance. Boards are responsible for ensuring the integrity of corporate reports and the underlying reporting process. This will provide the basis for improving the quality of integrated corporate reports and better-preparing organisations for external assurance. The duty of the Board will also be to oversee the correlation between sustainability performance metrics and remuneration policies.

For CFOs – strengthen integration, systems and processes

CFOs will need a clear grasp of the differences between historical financial information and sustainability metrics and targets. Integrating financial and sustainability disclosures simultaneously will be required. Sustainability and finance teams will have to speak the same language, and a culture of collaboration be nurtured between the two departments. Alongside this, CFOs will need to enhance communication with their investor base, including ESG rating agencies.

For Sustainability Leaders – strengthen metrics and targets and provide clear and consistent communication

Develop a robust transition plan towards achieving net zero by 2050, including specific targets and actions. Communicate within the business and connect key business functions. Once your sustainability-related strategy is in the Annual Report, don't stop there. Ensure proactive communication with all your stakeholders on your strategy and steps towards achieving targets.

CONCLUSION

Now is the time to get your company ready for the incoming Standards. Additional standards are also anticipated in the future, providing guidance on other topics such as biodiversity and deforestation. Effective leadership with strong and timely oversight is crucial for promoting robust and reliable sustainability reporting and future-proofing your reporting program. For a more detailed overview of the IFRS S1 and S2 Standards and requirements, see our recent thought leadership piece, 'New ISSB Standards and What They Mean for Australian Companies?'. For more information on FTI Consulting's ESG and sustainability client services, visit fticonsulting.com/Australia-esg.

Footnotes

1. "Ten things to know about the first ISSB Standards", IFRS (27 June 2023), https://www.ifrs.org/news-and-events/news/2023/06/ten-things-to-know-about-the-first-issb-standards/.

2. "Consultation Paper 'Climate-related financial disclosure'", Australian Government Treasury (June 2023), https://treasury.gov.au/sites/default/files/2023-06/c2023-402245.pdf.

3. "Climate-related Financial Disclosure", AASB (17 March 2023), https://aasb.gov.au/media/5jmkf3er/ps_climate_03-23.pdf.

4. Geoff Hoffman et al, "Who would need to report on climate-related financial risks – and when?", Clayton Utz (7 July 2023), https://www.claytonutz.com/knowledge/2023/july/mandatory-climate-reporting-second-consultation-period-underway-to-shape-the-final-regime.

5. "Consultation Paper 'Climate-related financial disclosure'", Australian Government Treasury (June 2023), https://treasury.gov.au/sites/default/files/2023-06/c2023-402245.pdf.

6. Ibid.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.