New Jersey Enacts Economic Opportunity Act of 2013

In an effort to enhance the competitiveness of its financing and incentives agenda, New Jersey Governor Chris Christie signed into law the New Jersey Economic Opportunity Act of 2013.1 The Act is administered by the New Jersey Economic Development Authority and consolidates five existing economic incentive programs into two programs: the Grow New Jersey Assistance Program (Grow NJ)2 and the Economic Redevelopment and Growth Grant Program (ERG).3

The bill also creates Garden State Growth Zones. Businesses or developers operating inside these zones may be eligible for additional benefits. The Act defines the Garden State Growth Zones as the four New Jersey cities with the lowest median family income based on the 2009 American Community Survey from the U.S. Census.4

Grow New Jersey Assistance (Grow NJ) Program

The Act greatly enhances Grow NJ, an incentive program designed to encourage economic growth and job creation as well as preserve currently existing jobs that are in danger of relocating to other states. To be eligible for the program, a business must demonstrate that New Jersey's financial support and subsequent retention of full-time jobs will yield a "net positive benefit" to the state.5

A business generally qualifies for the program if it will create at least 35, or retain a minimum of 50, eligible full-time positions in New Jersey within the eligibility period and meet certain capital investment thresholds.6 For technology start-up companies, these requirements are reduced to 10 new or 25 retained full-time jobs.7 For other targeted industries, the requirements are reduced to 25 new or 35 retained full-time jobs.8 These minimum employment numbers are reduced by 25 percent for projects in Garden State Growth Zones and in eight South Jersey counties.9 The eligibility period begins when the authority accepts certification of the business that it has met the program's capital investment and employment requirements and extends for a period of ten years.10

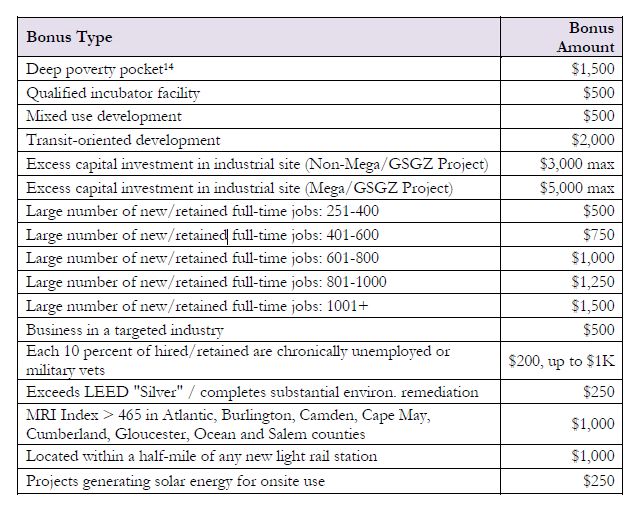

Base credits under Grow NJ range from $500 to $5,000 per job per year, depending on the project's location.11 The base credit can be supplemented annually based on other characteristics of the subject project,12 which can range from $250 to $5,000 per job per year and include, in part:13

The sum of the annual base and additional credit per job is subject to ceiling limitations that generally range from $2,000 to $15,000 per year.15 Credit limitations based on the entire 10-year grant term or total credits claimed annually may also apply.16 Qualified expansion projects that involve the creation of new, full-time jobs receive 100 percent of the tax credit amount while retained full-time jobs receive 50 percent of the tax credit amount.17

The Act also greatly expands Grow NJ's geographic boundaries. The definition of "qualified incentive area" has been expanded by the Act to include "mega projects," distressed or urban transit hub municipalities, areas within a Garden State Growth Zone, certain Priority Areas, and other identified locations.18 "Mega projects" include logistics, manufacturing, energy, defense or maritime businesses in a port district or businesses in aviation with either: (a) capital investment of at least $20 million and 250 jobs created or retained, or (b) 1,000 jobs created or retained. Businesses located in an urban transit hub that have capital investments of at least $50 million and 250 jobs created or retained are also considered eligible mega projects.19

In order to be eligible under the Act, the business (expressly including its landlord or seller20) must make, acquire or lease a minimum capital investment of $20 to $120 per square foot, depending on the type of construction.21 This requirement is reduced by onethird for projects either located in a Garden State Growth Zone or within Atlantic, Burlington, Camden, Cape May, Cumberland, Gloucester, Ocean or Salem County (all located in southern New Jersey).22

Qualifying capital investments include any and all redevelopment costs including but not limited to site acquisition; engineering, legal, accounting and other professional services; relocation and environmental remediation; and infrastructure improvements for theproject area such as on-site and off-site utilities, road, pier, wharf, bulkhead or sidewalk construction, or repair.23

Point-of-final-purchase retail facilities are not eligible for a grant under this Act.24 If a project consists of point-of-final-purchase retail facilities and non-retail facilities, only the portion of the project relating to non-retail facilities is eligible for the grant.25 Further, if a warehouse supplies only a single point-of-final-purchase retail facility, the warehouse is ineligible.26 However, up to 7.5 percent of retail facilities included in a mixed use project can be eligible for tax credits if the facility is located in a Garden State Growth Zone or Atlantic City Tourism District.27 In addition, a facility of 150,000 square feet or more, 50 percent of which is occupied by a full-service supermarket or grocery store, is eligible for tax credits if located within one of these designated areas.28

Eligible Grow NJ participants must submit an application for tax credits prior to July 1, 2019.29 A business must submit documentation certifying that it has met the capital investment and employment requirements within three years following the date of approval of its application.30 The business must enter into an incentive agreement prior to the issuance of tax credits.31 The incentive agreement includes a requirement that the applicant maintain the project at a location in New Jersey for at least 1.5 times the number of years of the period during which tax credits are received.32 If that requirement is not met, the Authority may recapture all or part of any tax credits awarded.33

Economic Redevelopment and Growth (ERG) Program

The ERG now represents New Jersey's sole redevelopment incentive program. Amendments made through the Act close project financing gaps and further provide incentives for redevelopment beyond the original ERG. Specifically, changes focus on rehabilitating public infrastructure, rebuilding certain areas affected by Hurricane Sandy and building markets that bring fresh produce to urban areas.

Under ERG, developers can obtain state and local incentive grants worth up to 20 percent of total project capital investment costs, or 30 percent if the project is located in a Garden State Growth Zone.34 In addition, the state and municipalities are authorized to increase the amount of the incentive by up to 10 percent if the project qualifies as a grocery store in a distressed municipality, qualified residential project for moderate income housing, disaster recovery project, or falls into one of several other qualified categories.35 The total amount of state grant is limited to the average of 75 percent of the projected annual incremental tax paid, which increases to 85 percent if the project is located in a Garden State Growth Zone.36 The projected annual incremental taxes used in this calculation include corporation business tax, income tax, sales and use tax and other enumerated taxes as applicable.37 Further, the maximum amount of any state and local incentive grant cannot exceed 30 percent of the total project costs, or 40 percent if located in a Garden State Growth Zone.38 The eligibility period during which reimbursements are paid to a development cannot exceed 20 years.39

Eligible project costs include land, buildings, improvements, real or personal property, or any interest therein such as land under water, riparian rights or air rights. Costs not directly related to construction can be included up to 20 percent of the total costs.40 Qualifying incentive areas have been expanded to include distressed municipalities, projects in Garden State Growth Zones and other defined localities.41

In the case of qualified residential projects, if the Authority determines that the estimated amount of incremental revenues pledged toward the state portion of an incentive grant is inadequate to fully fund the amount of the state portion of the incentive grant, then the Authority may instead award the developer tax credits equal to the full amount of the grant.42 The value of all credits approved by the Authority cannot exceed $600 million.43 Of this amount, $250 million will be earmarked for projects in Atlantic, Burlington, Camden, Cape May, Cumberland, Gloucester, Ocean or Salem County, of which $175 million would go exclusively to qualified projects in Camden and $75 million will be restricted to qualified residential projects in "distressed municipalities" or "deep poverty pockets."44 The remaining $350 million is targeted for qualified residential projects in other parts of the state.45 Minimum residential project costs must range between$5,000,000 and $17,500,000 for a project to be considered a "qualified residential project."46

Developers must apply for ERG local incentive grants prior to July 1, 2019, which application must state whether the developer is also applying for a state incentive grant program.47 The grant then has to be approved by the Local Finance Board.48 Grant approval is based on several factors, including the economic feasibility of the redevelopment project, the extent of the economic and related social distress in the area of project development, the likelihood that the project will generate new tax revenue for the state, general need for the grant and the degree to which the development project enhances and promotes job creation.49

Commentary

The New Jersey Economic Opportunity Act of 2013 represents a significant overhaul of New Jersey's state tax incentive scheme to increase the state's competitiveness in the business arena and help revitalize areas damaged by 2012's Hurricane Sandy. The Act is an effort to reduce high unemployment, and counter the attractiveness of strong incentive programs in neighboring states like New York and Pennsylvania.

Another important aspect of the Act is its inclusion of residential redevelopment within the scope of ERG benefits. Previously, such projects were effectively shut out of the incentive package, largely because they generated little tax revenue for the state. In light of the damage caused by Hurricane Sandy, the inclusion of residential development attempts to quickly address residential areas in need while spurring related job development in the construction sector. Further, the Act strives to make long-needed headway in some of the state's most impoverished cities and neglected suburban office parks, areas traditionally caught between project financing gaps. It is important for prospective applicants to act quickly to ensure receipt of these significant state tax incentives.

Footnote

1 Ch. 161 (A.B. 3680), Laws 2013 (as signed by Governor Chris Christie on Sep. 18, 2013).

2 N.J. REV. STAT. § 34:1B-242 et al.

3 N.J. REV. STAT. § 52:27D-489c et al. The Act will formally merge the following economic incentive programs out of existence: (i) the Business Retention and Relocation Assistance Grant Program; (ii) the Business Employment Incentive Program; and (iii) the Urban Transit Hub Tax Credit Program.

4N.J. REV. STAT. §§ 34:1B-243.2; 52:27D-489c.3.

5N..J. REV. STAT. § 34:1B-244.3.a.3.

6 Id. A full-time employee means a person who is employed by the business for a consideration for at least 35 hours a week, or who renders any standard of service generally accepted by custom or practice as full-time employment. A full-time employee does not include any person who works as an independent contractor or as a consultant. N.J. REV. STAT. § 34:1B-243.2.

7 N.J. REV. STAT. § 34:1B-244.3.c.1.

8 N.J. REV. STAT. § 34:1B-244.3.c.2.

9 N.J. REV. STAT. § 34:1B-244.3.c. Applicable counties include Atlantic, Burlington, Camden, Cape May, Cumberland, Gloucester, Ocean and Salem. Id.

10 N.J. REV. STAT. § 34:1B-243.2.

11 The base tax credit amount is: (a) $5,000 per year for a qualified facility located within an urban transit hub municipality, Garden State Growth Zone or is classified as a "mega project;" (b) $4,000 per year for a qualified business facility located within a distressed municipality; (c) $3,000 per year for projects in priority areas; (d) $2,000 per year for Disaster Recovery Projects; or (e) $500 per year for projects in other eligible areas. N.J. REV. STAT. § 34:1B-246.5.b.

12 N.J. REV. STAT. § 34:1B-246.5.c.

13 Id.

14 The term "deep poverty pocket" is defined as a population census tract having a poverty level of 20 percent or more, and which is located within an otherwise eligible incentive area and has been determined by the authority to be an area appropriate for development and in need of economic development incentive assistance. N.J. REV. STAT. § 34:1B-243.2.

15 N.J. REV. STAT. § 34:1B-246.5.d.

16 N.J. REV. STAT. § 34:1B-246.5.f. The maximum annual tax credit amount is: (a) $30 million per year for a project located within a Garden State Growth Zone or classified as a "mega project;" (b) $10 million per year for a project located in an urban transit hub municipality; (c) $8 million per year for a project located within a distressed municipality; (d) $4 million per year for a project located in a priority area; and (e) $2.5 million per year for a project located in other eligible areas.

17 N.J. REV. STAT. § 34:1B-246.5.e.

18 N.J. REV. STAT. § 34:1B-243.2. Priority Areas include: (a) Planning Area 1 (Metropolitan); (b) Planning Area 2 (Suburban); (c) a designated center under the State Development and Redevelopment Plan; (d) a designated growth center in an endorsed plan; (e) areas that intersect with portions of a deep poverty pocket, a port district, or a federally owned land approved for closure under a federal Base Realignment Closing Commission action; (f) proposed site of a disaster recovery project, a qualified incubator facility, a highlands development credit receiving area or redevelopment area, a tourism destination project, or transit oriented development; or (g) areas that contain a vacant commercial building having over 400,000 square feet of office, lab, or industrial space available for occupancy for a period of over one year, or a site that has been negatively impacted by the approval of a Hub-supported project. Qualifying areas do not include any property located within the preservation area of the Highlands region as defined in the Highlands Water Protection and Planning Act (Ch. 120, Laws 2004 (N.J. REV. STAT. § 13:20-1 et. al)). Id.

19 N.J. REV. STAT. § 34:1B-243.2.

20 N.J. REV. STAT. § 34:1B-244.3.a.1.

21 N.J. REV. STAT. § 34:1B-244.3.b.

22 Id.

23 N.J. REV. STAT. § 34:1B-243.2.

24 N.J. REV. STAT. § 34:1B-244.3.c.

25 Id.

26 N.J. REV. STAT. § 34:1B-244.e.

27 Id.

28 Id.

29 N.J. REV. STAT. § 34:1B-247.6.b.

30 Id.

31 N.J. REV. STAT. § 34:1B-245.4.

32 N.J. REV. STAT. § 34:1B-245.4.d.

33 Id.

34 N.J. REV. STAT. § 52:27D-489i.9.d.1. Local incentive grants may be equal to 100 percent of project costs if the developer is a municipal government or redevelopment agency. N.J. REV. STAT. § 52:27D-489k.11.b.1.

35 N.J. REV. STAT. § 52:27D-489i.9.d.2.

36 N.J. REV. STAT. § 52:27D-489f.6.b.1. This amount is compared against the "revenue increment base," which is the amount of all eligible taxes from sources within the redevelopment project area in the calendar year preceding the year in which the redevelopment incentive grant agreement is executed. N.J. REV. STAT. § 52:27D-489c.

37 N.J. REV. STAT. § 52:27D-489f.6.a.

38 N.J. REV. STAT. § 52:27D-489k.11.b.2.

39 N.J. REV. STAT. § 52:27D-489c.

40 Id.

41 Id. "Distressed municipalities" are defined as municipalities that are: (a) qualified to receive assistance under Ch. 14, Laws 1978 (N.J. REV. STAT. § 52:27D-178 et seq.), (b) under the supervision of the Local Finance Board pursuant to provisions of the Local Government Supervision Act, (c) identified by the Director of the Division of Local Government Services in the Department of Community Affairs to be facing serious fiscal distress, (d) an SDA municipality, or (e) a municipality in which a major rail station is located. Id.

42 N.J. REV. STAT. § 52:27D-489f.b.2. A developer may apply for a tax credit transfer certificate to be sold or assigned, in full or in part, to any other person that may have an eligible tax liability. N.J. REV. STAT. § 52:27D-489f.b.3.

43 N.J. REV. STAT. § 52:27D-489f.6.b.2.a.

44 Id. "Deep poverty pockets" are defined as a population census tract having a poverty level of 20 percent or more, located within the qualified incentive area and determined by the authority to be an area appropriate for development and in need of economic development incentive assistance. Id.

45 N.J. REV. STAT. § 52:27D-489f.6.b.2.b-d.

46 N.J. REV. STAT. § 52:27D-489c.3.

47 N.J. REV. STAT. § 52:27D-489d.4.b. Applications for qualified residential projects must be filed by July 1, 2015, and the developer must obtain a temporary certificate of occupancy for the project no later than July 28, 2015. N.J. REV. STAT. § 52:27D-489d.4.e.

48 N.J. REV. STAT. § 52:27D-489d.4.c.

49 N.J. REV. STAT. § 52:27D-489d.4.d.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.