Recovering from a relatively slow start to the year, due in no small part to the global pandemic, the U.S. Foreign Corrupt Practices Act ("FCPA") Units of the U.S. Department of Justice ("DOJ") and Securities and Exchange Commission ("SEC") closed the year with a bang. With 32 combined FCPA enforcement actions, 51 total cases including ancillary enforcement, and a record-setting $2.78 billion in corporate fines and penalties (plus billions more collected by foreign regulators), 2020 marks another robust year in the annals of FCPA enforcement.

This client update provides an overview of the FCPA and other domestic and international anti-corruption enforcement, litigation, and policy developments from 2020, as well as the trends we see from this activity. We at Gibson Dunn are privileged to help our clients navigate these challenges daily and are honored again to have been ranked Number 1 in the Global Investigations Review "GIR 30" ranking of the world's top investigations practices, the fourth time we have been so honored in the last five years. For more analysis on the year in anti-corruption enforcement, compliance, and corporate governance developments, please view or join us for our complimentary webcast presentations:

- 11th Annual Webcast: FCPA Trends in the Emerging Markets of Asia, Russia, Latin America, India and Africa on January 12 (view materials; recording available soon);

- FCPA 2020 Year-End Update on January 26 (to register, Click Here); and

- 17th Annual Webcast: Challenges in Compliance and Corporate Governance (date to be announced).

FCPA OVERVIEW

The FCPA's anti-bribery provisions make it illegal to corruptly offer or provide money or anything else of value to officials of foreign governments, foreign political parties, or public international organizations with the intent to obtain or retain business. These provisions apply to "issuers," "domestic concerns," and those acting on behalf of issuers and domestic concerns, as well as to "any person" who acts while in the territory of the United States. The term "issuer" covers any business entity that is registered under 15 U.S.C. § 78l or that is required to file reports under 15 U.S.C. § 78o(d). In this context, foreign issuers whose American Depository Receipts ("ADRs") or American Depository Shares ("ADSs") are listed on a U.S. exchange are "issuers" for purposes of the FCPA. The term "domestic concern" is even broader and includes any U.S. citizen, national, or resident, as well as any business entity that is organized under the laws of a U.S. state or that has its principal place of business in the United States.

In addition to the anti-bribery provisions, the FCPA also has "accounting provisions" that apply to issuers and those acting on their behalf. First, there is the books-and-records provision, which requires issuers to make and keep accurate books, records, and accounts that, in reasonable detail, accurately and fairly reflect the issuer's transactions and disposition of assets. Second, the FCPA's internal controls provision requires that issuers devise and maintain reasonable internal accounting controls aimed at preventing and detecting FCPA violations. Prosecutors and regulators frequently invoke these latter two sections when they cannot establish the elements for an anti-bribery prosecution or as a mechanism for compromise in settlement negotiations. Because there is no requirement that a false record or deficient control be linked to an improper payment, even a payment that does not constitute a violation of the anti-bribery provisions can lead to prosecution under the accounting provisions if inaccurately recorded or attributable to an internal controls deficiency.

Foreign corruption also may implicate other U.S. criminal laws. Increasingly, prosecutors from the FCPA Unit of DOJ have been charging non-FCPA crimes such as money laundering, mail and wire fraud, Travel Act violations, tax violations, and even false statements, in addition to or instead of FCPA charges. Perhaps most prevalent among these "FCPA-related" charges is money laundering-a generic shorthand term for several statutory provisions that together criminalize the concealment or transfer of proceeds from certain "specified unlawful activities," including corruption under the FCPA or laws of foreign nations, through the U.S. banking system. DOJ now frequently deploys the money laundering statutes to charge "foreign officials"-most often, employees of state-owned enterprises, but occasionally political or ministry figures-who are not themselves subject to the FCPA. It is thus increasingly commonplace for DOJ to charge the alleged provider of a corrupt payment under the FCPA and the alleged recipient with money laundering violations. DOJ has even used these foreign officials to cooperate in ongoing investigations.

FCPA AND FCPA-RELATED ENFORCEMENT STATISTICS

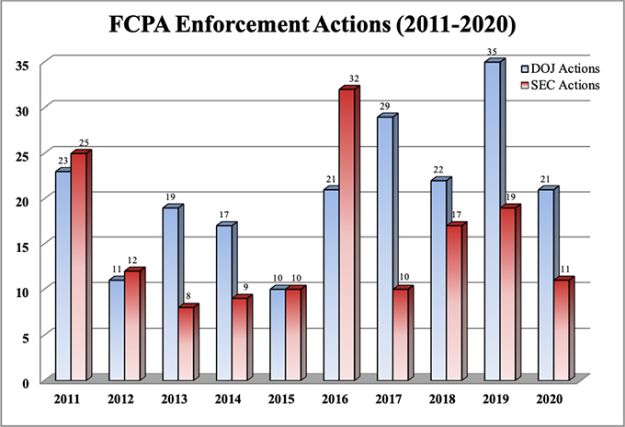

The below table and graph detail the number of FCPA enforcement actions initiated by DOJ and the SEC, the statute's dual enforcers, during each of the past 10 years.

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | ||||||||||

| DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC |

| 23 | 25 | 11 | 12 | 19 | 8 | 17 | 9 | 10 | 10 | 21 | 32 | 29 | 10 | 22 | 17 | 35 | 19 | 21 | 11 |

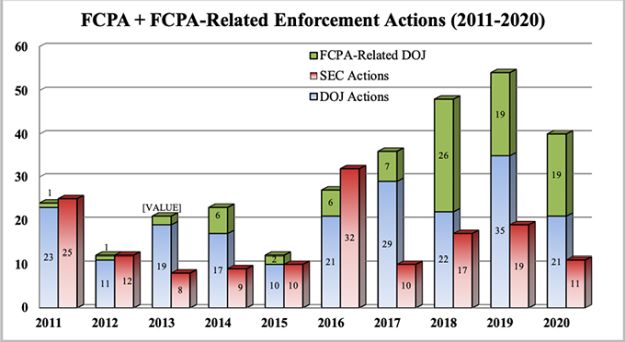

The regularity of non-FCPA charges brought by DOJ FCPA Unit prosecutors was noted by the OECD Working Group on Bribery, which published a thorough Phase 4 report on the United States in November 2020. It praised the United States for "further increas[ing] its strong enforcement of the [FCPA] [and] maintaining its prominent role in the fight against transnational corruption," noting in particular that "U.S. enforcement authorities have made broad use of other statutes and offences to prosecute payments to foreign government officials and intermediaries either in addition to or instead of FCPA charges." With 19 such actions in 2020 (vs. 21 FCPA cases), thus continues what has matured into a multi-year trend of substantial extra-FCPA enforcement by DOJ.

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | ||||||||||

| DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC | DOJ | SEC |

| 24 | 25 | 12 | 12 | 21 | 8 | 23 | 9 | 12 | 10 | 27 | 32 | 36 | 10 | 48 | 17 | 54 | 19 | 40 | 11 |

2020 FCPA + FCPA-RELATED ENFORCEMENT TRENDS

In each of our year-end FCPA updates, we seek not merely to report on each of the year's FCPA enforcement actions, but more so to distill the thematic trends that we see stemming from these individual events. For 2020, we have identified five key enforcement trends that we believe stand out from the rest:

- Yet another high-water mark for corporate FCPA financial penalties;

- The CFTC dives into FCPA waters;

- The cautionary tale of Beam Suntory;

- No FCPA-related monitorships in 2020; and

- Spotlight on Latin America.

Yet Another High-Water Mark for Corporate FCPA Financial Penalties

For all of the fears expressed by some with respect to our 45th President-Donald J. Trump has been recorded as openly hostile to the FCPA-one that did not come to pass was diminishment of enforcement of the FCPA. Put simply, the modern era of FCPA enforcement largely has been indifferent to shifting political winds.

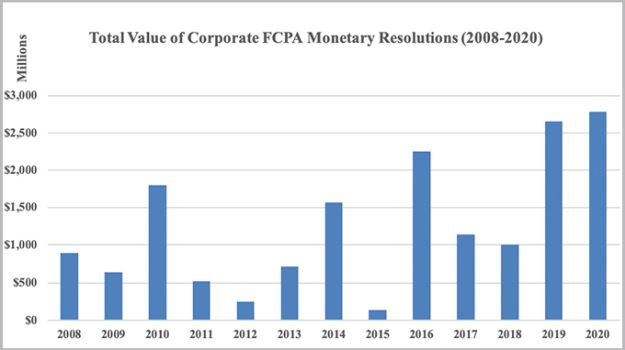

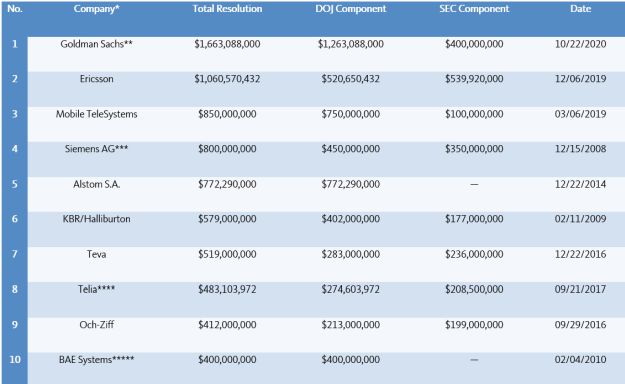

As just one measure of this phenomenon, one year ago we reported in these pages that corporate fines in FCPA cases had topped $2.5 billion for the first time in the history of the statute. In large part, this was because the record for highest single corporate FCPA resolution was set twice over in 2019-first, with the $850 million resolution with Mobile TeleSystems PJSC in March 2019, only to be outdone months later with the $1 billion resolution with Telefonaktiebolaget LM Ericsson in December 2019 (both covered in our 2019 Year-End FCPA Update). In 2020, the aggregate and individual records fell yet again.

Our readership is familiar with the long-running corruption investigation related to Malaysian sovereign wealth fund 1Malaysia Development Berhad ("1MDB"). From a massive civil forfeiture action seeking to recover allegedly misappropriated funds, to criminal FCPA actions against Malaysian businessperson Low Taek Jho ("Jho Low") and former bankers Tim Leissner and Roger Ng Chong Hwa, even to charges under the Foreign Agents Registration Act ("FARA") against individuals allegedly trying to lobby the Trump Administration on Jho Low's behalf, the 1MDB scandal has resulted in significant enforcement activity and scrutiny over the last several years. Collectively, the former bankers and Jho Low allegedly participated in the diversion of more than $2.7 billion from 1MDB, between 2009 and 2014 and in connection with three separate bond offerings, for the illicit purposes of making payments to officials of state-owned investment funds of Malaysia and the UAE and embezzlement for their own personal benefit. Now added to the 1MDB enforcement list is the largest monetary corporate FCPA resolution ever. On October 22, 2020, global financial institution The Goldman Sachs Group Inc. reached a multi-billion dollar coordinated resolution in connection with the same core allegations with the SEC, DOJ, other U.S. authorities, as well as authorities in Singapore, the United Kingdom, and Hong Kong.

On the U.S. enforcement front, Goldman Sachs resolved the criminal case by entering into a three-year deferred prosecution agreement with DOJ alleging conspiracy to violate the FCPA's anti-bribery provisions, while its Malaysian subsidiary pleaded guilty to one count of conspiracy to violate the anti-bribery provisions. The criminal penalty was calculated at $2.315 billion, but after a variety of offsets for payments to other regulators-domestic and foreign-Goldman Sachs agreed to pay $1.263 billion to DOJ. To resolve the civil case with the SEC, the bank consented to the entry of a cease-and-desist order charging anti-bribery, books-and-records, and internal controls violations, and agreed to pay a $400 million civil penalty, bringing the total FCPA financial resolution to $1,663,088,000. The SEC also ordered disgorgement of $606 million, but fully credited the amount against payments Goldman Sachs made under an earlier settlement in Malaysia pursuant to which the bank agreed to a $2.5 billion payment, as well as a guarantee of the return of $1.4 billion of 1MDB assets seized by authorities around the world.

Goldman Sachs also reached parallel resolutions with the Federal Reserve ($154 million), New York State Department of Financial Services ($150 million), UK Financial Conduct Authority ($63 million) and Prudential Regulation Authority ($63 million), Singaporean authorities ($122 million), and Hong Kong Securities and Futures Commission ($350 million). All told, total payments under the various resolutions exceed $5 billion.

In addition to Goldman Sachs and the Airbus and Novartis FCPA resolutions covered in our 2020 Mid-Year FCPA Update, two other 2020 corporate FCPA enforcement actions that topped the $100 million mark in combined penalties and disgorgement include:

- Herbalife Nutrition Ltd. - On August 28, 2020, DOJ and the SEC announced a combined $123 million FCPA resolution with U.S.-based global nutrition company Herbalife. According to the charging documents, over several years employees of Herbalife subsidiaries in China allegedly provided improper benefits, including cash, gifts, travel, and hospitality, to influence government officials in a variety of regulatory matters. To resolve the SEC investigation, Herbalife consented to the entry of an administrative cease-and-desist order charging FCPA accounting violations and agreed to pay more than $67 million in disgorgement and prejudgment interest. Herbalife also entered into a deferred prosecution agreement with DOJ and agreed to pay $55 million in criminal penalties to resolve a charge of conspiracy to violate the books-and-records provision of the FCPA. Herbalife received full credit for its cooperation and remediation, including steps to enhance its anti-corruption compliance program and accounting controls and take disciplinary actions against employees involved in the conduct. Herbalife will self-report on the status of its compliance program for a three-year period. Gibson Dunn represented Herbalife in connection with the joint resolutions.

- J&F Investimentos S.A. - On October 14, 2020, the SEC and DOJ announced a combined $155 million FCPA resolution with private Brazilian-based holding company J&F Investimentos S.A. and its affiliated global meat and protein producer and ADS-issuer JBS, S.A. J&F pleaded guilty to a single charge of conspiracy to violate the FCPA's anti-bribery provisions based on allegations that over many years, millions in payments were made to high-level Brazilian officials, including high-ranking executives at state-owned banks and a state-controlled pension fund, to obtain hundreds of millions of dollars of financing and approval for a corporate merger. The SEC brought FCPA accounting charges against JBS and two of its executives: brothers Joesley and Wesley Batista. To resolve the criminal case, J&F agreed to a total fine of $256,497,026, but will pay only $128,248,513 (50%) of that to DOJ, with an offsetting credit applied against agreements in Brazil pursuant to which J&F agreed to pay approximately $3.2 billion. To resolve the SEC's civil allegations, JBS agreed to pay $26.8 million in disgorgement and the Batistas agreed to pay civil penalties of $550,000 each. J&F and JBS will report on compliance and remedial measures for a three-year term.

Together with the other enforcement activity from 2020, corporate fines in FCPA cases reached a new height of $2.78 billion. A chart tracking the total value of corporate FCPA monetary resolutions by year, since the advent of blockbuster fines brought in with the 2008 Siemens resolution, follows:

Our Corporate FCPA Top 10 list currently reads as follows:

* Our figures do not include the 2018 FCPA case against Petróleo Brasileiro S.A. -

* Our figures do not include the 2018 FCPA case against Petróleo Brasileiro S.A. - Petrobras ("Petrobras"), even though some sources have reported the resolution as high as $1.78 billion, because the first-of-its kind resolution negotiated by Gibson Dunn offset the vast majority of payments against a shareholders' class action lawsuit and foreign regulatory proceeding, leaving only $170.6 million fairly attributable to the DOJ / SEC FCPA resolution.

** Goldman Sachs's U.S. FCPA resolutions were coordinated with numerous authorities in the United States, United Kingdom, Singapore, Hong Kong, and Malaysia, with total payments under the various resolutions exceeding $5 billion.

*** Siemens's U.S. FCPA resolutions were coordinated with a ?395 million ($569 million) anti-corruption settlement with the Munich Public Prosecutor.

**** Telia's U.S. FCPA resolutions were coordinated with resolutions in the Netherlands and Sweden for a combined total of $965.6 million.

***** BAE pleaded guilty to non-FCPA conspiracy charges of making false statements and filing false export licenses, but the alleged false statements concerned the existence of the company's FCPA compliance program, and the publicly reported conduct concerned alleged corrupt payments to foreign officials.

The CFTC Dives into FCPA Waters

Our readers well know that as the prominence of international anti-corruption enforcement has grown, so too has the number of enforcers from around the world taking an active participation interest. Meetings with regulators are now coordinated across global time zones rather than a question of meeting at the Bond Building or at the SEC. But even as the waters of international anti-corruption enforcement were already crowded, a new entrant just caught its first big wave: the U.S. Commodity Futures Trading Commission ("CFTC").

As covered in our 2019 Year-End FCPA Update, on March 6, 2019 the CFTC published an advisory on self-reporting and cooperation for "violations involving foreign corrupt practices," and the same day the Enforcement Division Director delivered remarks announcing the CFTC's intent to bring enforcement actions stemming from foreign bribery. Almost overnight, multiple companies then announced investigations by the CFTC with a potential foreign bribery nexus. And it did not take long for the first to reach a resolution.

On December 3, 2020, DOJ and the CFTC announced their first coordinated foreign corruption resolution, with Vitol Inc., the U.S. affiliate of one of the world's largest energy trading firms. DOJ charged an alleged conspiracy to violate the FCPA's anti-bribery provisions through payments to government officials in Brazil, Ecuador, and Mexico over a period of several years. To resolve the criminal case, Vitol entered into a deferred prosecution agreement and agreed to a $135 million fine, but will pay only $90 million of that to DOJ, with an offsetting credit applied to $45 million paid as part of a leniency agreement with Brazil's Federal Public Ministry ("MPF").

But perhaps most notable about the resolution is that, in a first-of-its-kind action, Vitol also consented to a cease-and-desist order by the CFTC for "manipulative and deceptive conduct" under the Commodity Exchange Act ("CEA"). According to the CFTC, Vitol paid the alleged bribes to state oil companies in Brazil, Ecuador, and Mexico in order to obtain preferential treatment, access to trades with the oil companies, and confidential information, including (in Brazil) specific prices at which Vitol understood it would win a particular bid or tender. The CFTC order, which also alleges that Vitol attempted to manipulate two oil benchmarks through separate trading activity, requires Vitol to pay more than $95 million in civil monetary penalties and disgorgement. However, so as not to impose duplicative penalties, the CFTC order provides a $67 million offsetting credit for the FCPA criminal fine, leaving Vitol to pay approximately $28.8 million.

Two former oil traders also were charged with FCPA and FCPA-related charges for their roles in the alleged criminal conspiracy. Javier Aguilar-a Mexican citizen, U.S. resident, and former Vitol oil trader-was charged in an indictment unsealed on September 22 with FCPA and money laundering conspiracy counts. Aguilar allegedly paid $870,000 to officials of Ecuador's state-owned oil company, Petroecuador, in exchange for a contract to purchase $300 million in fuel oil. Aguilar pleaded not guilty in October 2020 and awaits trial in the Eastern District of New York. And on November 30, DOJ unsealed the February 2019 guilty plea of Rodrigo Garcia Berkowitz, a former oil trader of Petróleo Brasileiro S.A. ("Petrobras"), to money laundering conspiracy. Garcia Berkowitz allegedly accepted money from commodity trading companies, including Vitol, in exchange for directing Petrobras business to the companies, and also helped the companies determine the highest price they could charge to Petrobras and still win the bids. Berkowitz awaits sentencing.

The Cautionary Tale of Beam Suntory

In our 2018 Mid-Year FCPA Update, we reported on what appeared to be a rather modest FCPA resolution between the SEC and Chicago-based spirits producer Beam Suntory, Inc. The allegations were that senior executives at Beam's Indian subsidiary directed efforts by third parties to make improper payments to increase sales, process license and label registrations, obtain better positioning on store shelves, and facilitate distribution. The SEC cited Beam's voluntary disclosure-reportedly spawned by a series of proactive investigations initiated in the wake of competitor Diageo plc's 2011 FCPA enforcement action in India-and reached what seemed like a favorable result for Beam, including a relatively modest combined penalty and disgorgement figure of just over $8 million. But there was mention of an ongoing DOJ investigation, with which Beam continued to cooperate. That investigation came to a less favorable end in 2020.

On October 27, 2020, DOJ announced its own, separate resolution with Beam arising from what appears to be substantially the same course of conduct in India with the lead corrupt payment allegation being a 1 million rupee (~ $18,000) payment to a senior government official in exchange for a license. The result was a deferred prosecution agreement on FCPA anti-bribery, internal controls, and books-and-records charges with a criminal fine of $19,572,885, none of which was credited against the prior SEC resolution.

Unlike the SEC, DOJ did not give Beam voluntary disclosure credit because it contended that the disclosure occurred only after a former employee sent a whistleblower complaint that copied U.S. and Indian authorities. DOJ further did not provide Beam with full cooperation credit, citing "positions taken by the Company that were not consistent with full cooperation, as well as significant delays caused by the Company in reaching a timely resolution and its refusal to accept responsibility for several years." Finally, in support of a criminal internal controls charge (knowing and willful failure to implement and maintain internal controls), DOJ cited at length what it perceived to be an inadequate investigative response by certain in-house counsel to numerous red flags from audit reports and outside counsel opinions regarding the risks that third parties were paying bribes on Beam's behalf. In one cited email, an in-house counsel allegedly wrote: "Beam Legal believes it is critical to approach a compliance review with the understanding that a U.S. regulatory regime should not be imposed on our Indian business and that acknowledges India customs and ways of doing business." DOJ's citation to and reliance on internal audit reports as evidence of internal controls breakdowns is troubling. Internal audit is, by definition, one of the lines of defense in a corporate control environment. Using it as a sword against a corporation is unfortunate and will lead to process changes within a corporation.

Had DOJ credited Beam's voluntary disclosure and cooperation under the FCPA Corporate Enforcement Policy, and credited the penalty previously imposed by the SEC under the "Anti-Piling On" Policy, Beam's criminal fine could have been less than $9 million rather than the more than $19.5 million fine imposed.

If one thing is clear it is that the public record does not disclose the full background and there surely is another side to the story. Nonetheless, Beam stands as a cautionary tale worthy of further study on subjects ranging from investigative response to red flags, to the challenges of educating business personnel on the need to conduct business in a compliant manner even in challenging markets, to the risks of unilaterally settling with one regulator while another investigation continues.

No FCPA Compliance Monitorships in 2020

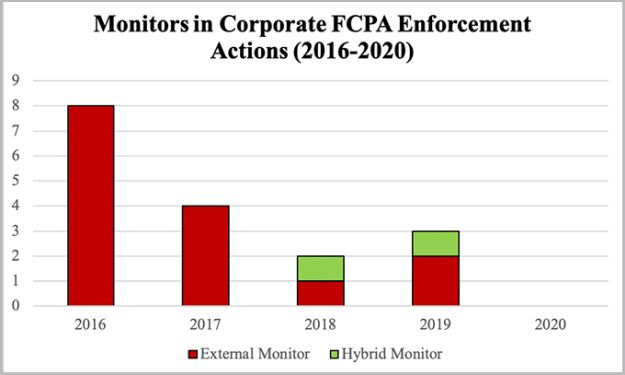

Post-resolution oversight mechanisms long have been a mainstay of corporate FCPA enforcement. Early in the modern era of FCPA enforcement, it was commonplace for DOJ and/or the SEC to impose external compliance monitors in corporate FCPA resolutions. In more recent years, we observed a trend of the government employing a more diverse mix of post-resolution mechanisms, including requiring corporate self-assessments, which a company conducts itself and submits the findings of to the government (as covered in our 2009 and 2012 Year-End FCPA Updates), to using a "hybrid" approach whereby a company retains a monitor for part of the post-resolution period followed by a self-assessment period (as discussed in our 2014 Year-End FCPA Update).

Even as the frequency and mix of the different types of obligations have changed over time, it is rare to see a year go by without a single corporate monitor being imposed. In 2020, however, despite an overall record year in corporate FCPA fines and several large individual corporate resolutions, not a single FCPA-related monitorships was imposed. What may be the driving force for this shift is adherence to DOJ's 2018 guidance concerning compliance monitors, covered in our 2018 Year-End FCPA Update. The "Benczkowski Memorandum" signaled that "the imposition of a monitor will not be necessary in many corporate criminal resolutions." Among the considerations that should be taken into account in deciding whether to require a monitor are the company's remediation efforts as well as the potential cost of a monitor and its impact on the company's operations.

As can be seen from the following chart, which tallies the frequency of external monitors in corporate FCPA enforcement actions over the last five years, monitors are becoming relatively rarer oversight mechanisms in these cases.

Spotlight on Latin America

A headline from nearly 15 years ago, in our 2007 Year-End FCPA Update, read "China, China, China" to highlight the dramatic uptick in FCPA enforcement actions spawning from one of the world's leading and most challenging economies. Then, five years ago, in our 2016 Year-End FCPA Update, we commented that it was "Still China, China, China . . . But Don't Forget About Latin America," to highlight that while China still remained the most prevalent situs of FCPA enforcement activity, Latin America was emerging as the new risk capital of anti-corruption compliance. That trend has continued, with more than 60% of the 51 FCPA and FCPA-related enforcement actions brought or announced in 2020 involving allegations of misconduct in Central or South America. Highlights not covered elsewhere include:

- Sargeant Marine, Inc. ("SMI"), a Florida-based asphalt company, on September 21, 2020 pleaded guilty to FCPA conspiracy related to its alleged conduct in several South American countries, including most prominently Brazil. DOJ alleged that SMI offered and paid bribes to officials in Brazil, Venezuela, and Ecuador in order to secure business contracts to provide asphalt to state-owned oil companies Petrobras, Petróleos de Venezuela, S.A. ("PDVSA"), and EP Petroecuador. The criminal penalty, reflecting a 25% discount off the bottom of the Sentencing Guidelines range for SMI's cooperation and remediation, was $90 million, but DOJ reduced the penalty to $16.6 million by applying its "Inability to Pay" Policy. Relatedly, seven individuals have been charged in connection with the investigation of corrupt practices in the Latin American asphalt procurement market, including SMI part-owner and senior executive Daniel Sargeant; SMI traders Jose Tomas Meneses andRoberto Finocchi, SMI consultants Luiz Eduardo Andrade and David Diaz, and former PDVSA officials Hector Nuñez Troyano andDaniel Comoretto.

- On December 16, DOJ announced a superseding indictment bringing money laundering and money laundering conspiracy charges against two new defendants allegedly involved in corruption relating to Venezuela's state-run currency exchanges: former National Treasurer of Venezuela Claudia Patricia Diaz Guillen and her husband, Adrian Jose Velasquez Figueroa. As covered in our 2018 Year-End FCPA Update, Diaz Guillen's predecessor, former National Treasurer of Venezuela Alejandro Andrade Cedeno, pleaded guilty to money laundering after allegedly accepting bribes from Globovision news network mogul Raul Gorrin Belisario, who was indicted in August 2018, in exchange for conducting foreign exchange transactions on Gorrin's behalf at artificially high government rates. According to the superseding indictment, when Diaz Guillen succeeded Andrade Cedeno as National Treasurer, she also succeeded him as Gorrin Belisario's access point to Venezuela's government currency exchanges, and she and her husband began accepting bribes from Gorrin to continue the scheme.

- On November 24, Venezuelan businessperson Natalino D'Amato became the latest defendant to face charges stemming from DOJ's investigation of Venezuelan "pay for play" corruption. From 2015 to 2017, D'Amato allegedly bribed officials of multiple PDVSA subsidiaries to secure inflated supply contracts for D'Amato's businesses. The PDVSA subsidiaries allegedly transferred over $160 million into Florida-based accounts controlled by D'Amato, and D'Amato allegedly paid out over $4 million of those funds in bribes to PDVSA officials. D'Amato now faces 11 counts of money laundering, money laundering conspiracy, and engaging in transactions involving criminally derived property.

- On August 6, DOJ unsealed an indictment against Jose Luis De Jongh Atencio, a new defendant in a separate branch of the Venezuela "pay for play" scheme detailed in our 2020 Mid-Year FCPA Update. Juan Manuel Gonzalez Testino and Tulio Anibal Farias-Perez pleaded guilty in May 2019 and February 2020, respectively, to FCPA charges for bribing officials of PDVSA subsidiary Citgo Petroleum Corporation in exchange for Citgo supply contracts. De Jongh, a former Citgo procurement officer and manager, allegedly was a recipient of those bribes. According to the indictment, De Jongh accepted Super Bowl, World Series, and concert tickets, in addition to approximately $2.5 million in payments used to purchase property in Texas. De Jongh was charged with money laundering and conspiracy to commit money laundering.

- Alexion Pharmaceuticals, Inc., a Boston-headquartered pharmaceutical company, settled an SEC-only cease-and-desist proceeding on July 2, 2020 arising from alleged violations of the FCPA's accounting provisions primarily associated with the alleged bribery of Turkish and Russian officials to influence regulatory treatment and prescriptions for the company's primary drug. The SEC also alleged that employees of Alexion's subsidiaries in Brazil and Colombia created or directed third parties to create inaccurate records concerning payments that were used to cover employee personal expenses, though no bribery was alleged in these areas. Without admitting or denying the SEC's findings, Alexion agreed to $17.98 million in disgorgement and prejudgment interest, as well as a $3.5 million penalty. Alexion earlier reported that DOJ had closed its five-year inquiry into the same conduct without any enforcement action.

- World Acceptance Corporation ("WAC"), a South Carolina-based consumer loan company, on August 6, 2020 agreed to resolve FCPA charges with the SEC arising from alleged misconduct in Mexico between 2010 and 2017. According to the settled cease-and-desist order, employees of WAC's former Mexican subsidiary paid more than $4 million to Mexican government officials and union officials to secure the ability to make loans to government employees and then ensure those loans were repaid. To resolve these charges, and without admitting or denying the findings, WAC consented to the entry of an administrative order finding violations of the FCPA's anti-bribery, books-and-records, and internal controls provisions and paid $19.7 million in disgorgement and prejudgment interest, as well as a $2 million civil penalty. Although the SEC order does not mention a voluntary self-disclosure, DOJ did recognize WAC's voluntary disclosure, cooperation, and remediation in issuing a public declination pursuant to the FCPA Corporate Enforcement Policy.

Rounding Out the 2020 FCPA and FCPA-Related Enforcement Docket

Additional 2020 FCPA and FCPA-related enforcement actions not covered elsewhere in this update or our 2020 Mid-Year FCPA Update include:

Deck Won Kang

On December 17, 2020, New Jersey resident and contractor to Korea's Defense Acquisition Program Administration ("DAPA") Deck Won Kang pleaded guilty to one count of violating the FCPA's anti-bribery provisions. According to the charging document, DAPA solicited bids in connection with contracts to upgrade the Korean Navy's fleet, and Kang paid $100,000 to a DAPA procurement official to obtain non-public information to help Kang's companies secure and retain the contracts. Kang also has been sued in New Jersey state court by DAPA. The civil proceedings are ongoing, and Kang is scheduled to be sentenced on the FCPA charge in April 2021 in the District of New Jersey.

Jeremy Schulman

In a matter that appears to have arisen out of an FCPA investigation, DOJ's FCPA Unit announced on December 3, 2020 the indictment of Maryland attorney Jeremy Schulman on charges stemming from an alleged six-year conspiracy to misappropriate Somali sovereign assets held in accounts with U.S. financial institutions that had been frozen since the beginning of Somalia's 1991 civil war. According to the charging documents, Schulman and his co-conspirators allegedly forged paperwork purporting to show that Schulman acted on the authority of the Central Bank of Somalia in repatriating these assets, which materials Schulman then presented to banks with requests to recover the frozen funds. Schulman and his co-conspirators learned the locations of the frozen assets from a former Governor of Somalia's Central Bank, who was appointed as an advisor to the Transitional Government of Somalia's President after the alleged conspiracy began; however, neither Schulman nor the former Governor were authorized to recover the funds. Schulman allegedly obtained control of approximately $12.5 million of the frozen Somali funds using his forged documents; his law firm retained approximately $3.3 million and the rest was remitted to the Somali government. Schulman now faces 11 counts of bank, mail, and wire fraud and money laundering, as well as associated conspiracy counts.

Foreign Adoption Corruption

We reported in our 2019 Year-End FCPA Update on FCPA charges against Ohio-based adoption agent Robin Longoria, alleging that she and other U.S. adoption agents bribed Ugandan probation officers to recommend that certain children be placed into orphanages, then bribed Ugandan judges and court personnel to grant guardianship of these children to the adoption agency's clients. On August 17, 2020, DOJ announced the indictment of three alleged co-conspirators, U.S. citizens Debra Parris and Margaret Cole, and Ugandan citizen Dorah Mirembe. The charges, which include FCPA bribery, visa fraud, mail fraud, money laundering, and false statements, relate to alleged corrupt payments to process international adoptions without following the correct procedures in Uganda (Parris and Mirembe) and Poland (Parris and Cole). Although Mirembe is a Ugandan citizen, for purposes of applying the FCPA she is alleged to be an "agent" of a "domestic concern"-the Ohio-based adoption agency to which she provided services. Parris and Cole have pleaded not guilty, while Mirembe has yet to be arraigned. Longoria is scheduled to be sentenced in January 2021.

Although this could be dismissed as a confined fact pattern, this is not the first time the FCPA Unit has brought charges related to corruption in international adoptions. In February 2014, DOJ announced charges against four former employees of an adoption agency (Alisa Bivens, James Harding, Mary Mooney, and Haile Ayalneh Mekonnen) for, among other things, allegedly conspiring to pay bribes to Ethiopian officials to facilitate adoptions. In August 2017, Mooney, Harding, and Bivens were sentenced-Mooney to 18 months, 3 years of supervised release, and $223,946 in restitution; Harding to 12 months, 3 years supervised release, and $301,224 in restitution; and Bivens to one year probation and $31,800 in restitution. Although they were not charged with FCPA violations (possibly because the foreign "officials" at issue included a teacher at a government school and a head of a regional ministry for women's and children's affairs), the DOJ FCPA Unit was involved in the prosecution.

Click here to continue reading .The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.