ECONOMIC REVIEW AND OUTLOOK

The year 2023 began with many, if not most, economists calling for recessions in the United States and abroad. High inflation, restrictive central banks, and slowdowns in manufacturing and housing all pointed to economic struggles ahead. However, the "most anticipated recession in history" did not occur, at least it hasn't yet.

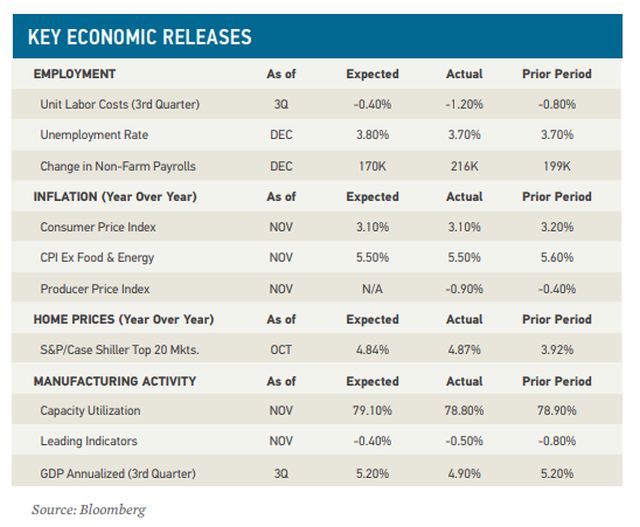

In the U.S., consumers and businesses were able to draw on excess savings, higher wages, and fiscal stimulus and, as the year went on, recession calls were pushed out. U.S. GDP growth remained unusually strong through 2023, even accelerating to a 4.9% annualized pace in the third quarter.

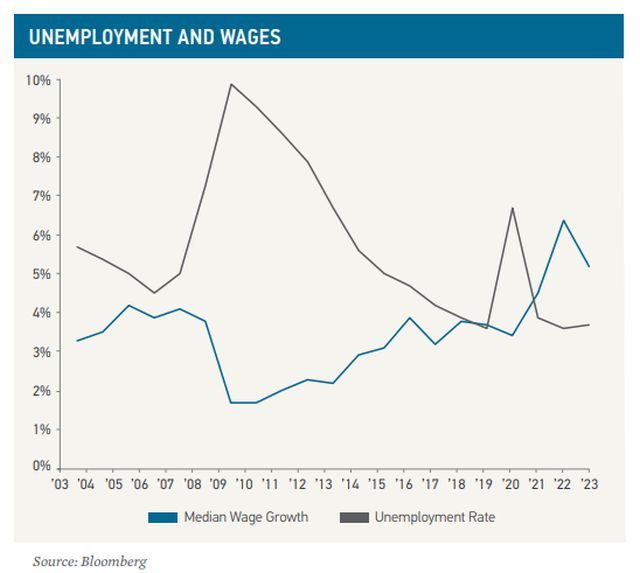

Power to the People A big driver of growth in the U.S. was the incredibly robust labor market. While the number of job openings declined through 2023, there remained more jobs to be filled than jobseekers to fill them. This gap provided workers the power to demand more pay and better working conditions, and they seized that power.

The Screen Actors Guild-American Federation of Television and Radio Artists and the Writers Guild of America, which represent actors and film and television writers, went on strike for months seeking improved working conditions and protections against the use of artificial intelligence (AI). Over 25 healthcare-related strikes took place in 2023, involving workers including nurses, pharmaceutical employees, and hospital staff. Most were requesting pay increases and additional staffing. Even just the threat of a strike helped Teamsters win a record contract covering 340,000 UPS employees nationwide.

The walkout by the United Auto Workers (UAW) was likely the most consequential. In mid-September, the UAW initiated a strike against three large American automakers: General Motors, Ford, and Stellantis. Thousands of workers halted production across factories that produce about half of the vehicles manufactured annually in the U.S., accounting for an estimated 1.5% of GDP. By late October, the UAW reached deals with all three automakers, which were described by The New York Times as the industry's "largest wage and benefit increases in decades."

As of November, average hourly earnings were up 4% year-overyear. While the pace of wage increases slowed and higher costs bit into consumers' budgets, price inflation fell faster such that real wage growth turned positive during the year. The unemployment rate was 3.7% at the end of 2023. Low unemployment and rising wages translated into sustained spending, particularly in restaurants, entertainment, travel, and other service-sector activities.

Manufacturing Down but Onshoring Expands Though services boomed in 2023, the manufacturing industry struggled. In November, the Institute for Supply Management's Purchasing Managers' Index (PMI) indicated the industry had contracted for the 13th straight month. The PMI is based on monthly surveys of more than 300 manufacturing firms and is considered a leading indicator for the economy.

Despite the contraction, a surge of manufacturing-related investment remained underway. Government stimulus, pandemic-related supply chain issues, and geopolitical tensions have increased incentives to onshore U.S. manufacturing in recent years. Tax breaks from the Inflation Reduction Act, along with programs in the Infrastructure Investment and Jobs Act and the CHIPS and Science Act, spurred sizable announcements for infrastructure improvements, new plants and factories, and expansions in electric vehicles and clean energy technologies.

Along with onshoring, "nearshoring" or "friendshoring" also gained traction. This was partially driven by the Russia-Ukraine war and high transport costs from Asia, but a strained relationship between the U.S. and China contributed as well. Mexico benefited from this trend and attracted significant foreign direct investment from large companies seeking new manufacturing capacity closer to the United States. For the first time since 2003, monthly imports into the U.S. from Mexico exceeded those from China on a trailing 12-month basis.

Still Growing, for Now Throughout 2023 there were worrisome signs in manufacturing, housing, sentiment, bank lending, and an inverted yield curve. High mortgage rates overwhelmed the impact of slightly lower home prices, and housing affordability fell to its lowest level in decades. Excess savings thinned and debt use—as well as delinquencies—increased.

Many economies abroad saw lackluster performance. Elevated inflation, tightening financial conditions, and weak demand stunted growth across the European Union (EU). The Chinese economy struggled to meet expectations for a strong post-pandemic recovery as housing market distress, ongoing deflationary pressures, and weak consumer confidence slowed its momentum. On the positive side, India's economy showed healthy growth in 2023. Employment surpassed pre-pandemic levels and the country's financial sector remained resilient through global financial stress early in the year.

While U.S. GDP appeared to be slowing, it was still positive. As the year ended, gasoline prices were down, mortgage rates had seemingly peaked, and the stock market rallied. The University of Michigan Consumer Sentiment Survey spiked in December, with consumers feeling better about both their present situation and their expectations for the future.

A strong labor market, lower inflation, and a stable credit environment underpin much of the positivity. These factors will bear watching as important indicators of which way the economy may be headed in the coming year

Policy Change Possible in Busiest Election Year With numerous countries scheduled to hold potentially consequential elections, 2024 is set to be a historic year. The U.S. presidential election could reshape the priorities for the world's largest economy, while the Taiwanese election may impact future relations between the U.S. and China. European Parliamentary elections could test the moxie of further EU integration. The world's most populous country, India, which relies on political stability as a key to economic growth, will vote for its prime minister. Elections in the United Kingdom, Mexico, South Korea, Iran, Russia, South Africa, and Venezuela will also be significant. Geopolitical volatility and policy shocks are risks to consider in 2024.

The bond market, after an unprecedented two consecutive years of losses, appeared poised for a historic third year of negative returns during most of 2023. Market participants braced for a recession while the Federal Reserve (the Fed) continued its fight against inflation. Nearly all sectors of the debt market were affected by additional unique challenges: municipal bonds faced declining tax receipts, the mortgage debt market experienced slowing repayments, and corporate debt's rising refinancing costs impacted their margins. Despite these hurdles, the Bloomberg Aggregate Index ended the year up 5.5% after a pivot in the Fed's interest rate policy drove a significant fourth-quarter rally across bond markets.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.