On December 11, 2023, the U.S. Treasury Department ("Treasury") and the U.S. Internal Revenue Service ("IRS") released Notice 2023-80 (the "Notice"), announcing their intention to issue proposed regulations that will address the interaction of certain provisions under the Organisation for Economic Co-operation and Development's ("OECD's") Global Anti-Base Erosion Rules (Pillar Two) ("Pillar Two Rules")[1] with the United States' foreign tax credit ("FTC") and dual consolidated loss ("DCL") rules. Significantly, the Notice also indefinitely extended the previous two-year suspension under Notice 2023-55 of the most burdensome parts of the controversial 2022 final FTC regulations. We discuss in further detail below the key provisions of the Notice.

FTCs and Pillar Two Taxes

Relevant Pillar Two Taxes

As discussed in a prior alert, the Pillar Two Rules provide countries with an implementation roadmap for a coordinated tax system that imposes a minimum level of taxation on multinational enterprise groups with an annual revenue of EUR 750 million or more ("MNE Groups"). The Pillar Two Rules achieve their aim by imposing a "top-up tax" on one or more members of an MNE Group to the extent the MNE Group has an effective tax rate ("ETR") on its book income, determined under the Pillar Two Rules, that is below 15% in any jurisdiction.

A top-up tax may be imposed and collected under a Qualified Domestic Minimum Top-up Tax ("QDMTT"), the Income Inclusion Rule ("IIR") or the Undertaxed Profits Rule ("UTPR"). As the Notice acknowledges, certain jurisdictions have already enacted, and others have proposed, legislation to implement the Pillar Two Rules for the IIR and the QDMTT, effective for fiscal years beginning on or after December 31, 2023, and for the UTPR, effective for fiscal years beginning on or after December 31, 2024.[2]

The Notice primarily provides guidance on the treatment of the IIR and the QDMTT under the FTC rules, while Treasury and the IRS continue to analyze issues related to the UTPR. The Notice states that Treasury and the IRS intend to issue future guidance regarding issues related to the UTPR.

Creditability of Taxes Imposed under an IIR or QDMTT

The Notice differentiates taxes imposed under an IIR, which will not be creditable in many circumstances, from taxes imposed under a QDMTT, which often will be creditable.

To address the IIR, the Notice provides special rules for so-called "final top-up taxes." A top-up tax is a final top-up tax if, in computing the top-up tax, the foreign tax law takes into account:

- the amount of tax imposed on the direct or indirect owners of the entity subject to the top-up tax by other countries (including the United States) with respect to the income subject to the top-up tax; or

- in the case of an entity subject to the top-up tax on income attributable to its branch in the foreign country imposing the top-up tax, the amount of tax imposed on the entity by its country of residence with respect to such income.

In computing an IIR under the Pillar Two Rules, the taxes imposed under a CFC regime (e.g., GILTI or subpart F) on a direct or indirect owner of an MNE Group member are considered in determining such MNE Group member's ETR if the direct or indirect owner is also a member of the MNE Group. As a result, the GILTI or subpart F taxes of an MNE Group member owed with respect to a lower-tier MNE Group member will reduce (or eliminate) the likelihood that an IIR top-up tax will be imposed with respect to such lower-tier MNE Group member. On the other hand, under the Pillar Two Rules, the tax owed under a QDMTT is determined without taking into account any taxes that may be imposed on a direct or indirect owner of an MNE Group member under a CFC regime.

Accordingly, a top-up tax imposed under the IIR is expected to be a final top-up tax, while a top-up tax imposed under the QDMTT is not. Different FTC rules will apply to each of these top-up taxes.

Treatment of IIR

Although the Notice implies an IIR top-up tax may be considered a foreign income tax, a person may not take an FTC for such a tax if, in computing the IIR under the foreign tax law, any amount of U.S. tax liability of such person is taken into account. This rule applies without regard to whether the person actually has any amount of U.S. tax liability that is taken into account in such computation.

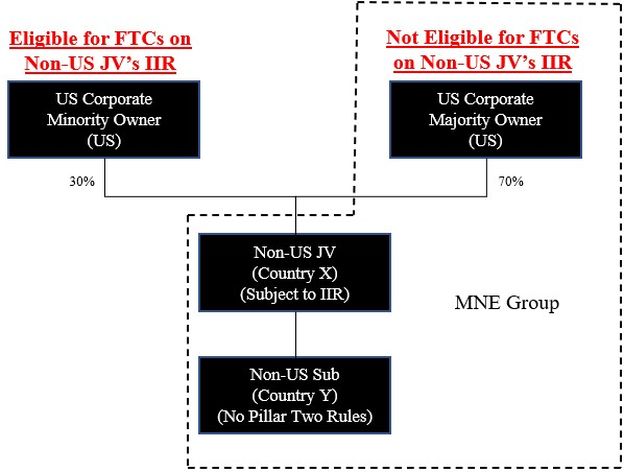

As a result, if a U.S. person is a member of the same MNE Group as the entities on, and with respect to which, the IIR is imposed, such U.S. person should not be eligible to take an FTC for the IIR top-up tax because, for example, any U.S. federal income taxes imposed on such U.S. person under the GILTI or subpart F rules would have been taken into account in computing the IIR. On the other hand, a minority owner of an entity on which an IIR top-up tax is imposed may be eligible to take an FTC for its proportionate share of such IIR top-up tax because the minority owner should not be a member of the same MNE Group as such entity and its taxes (including GILTI and subpart F taxes) should not be included in the computation of the IIR. Consider the diagram below.

Regardless of whether an IIR top-up tax is creditable, if it is a foreign income tax, the Notice clarifies that a U.S. taxpayer that elects to claim FTCs will be required to include any such IIR in its section 78[3] gross-up amount and would not be eligible to take a deduction with respect to such tax under section 275(a)(4). Accordingly, if the U.S. Corporate Majority Owner in the above diagram elects to credit foreign income taxes, under section 78, it would be required to include in its gross income as a deemed dividend its proportionate share of the Non-U.S. JV's IIR despite the fact that it is not allowed to take an FTC for such amount. In effect, such a rule disallows the deduction for the IIR top-up taxes otherwise taken at the level of the Non-U.S. JV in computing its tested and subpart F income.

Finally, the Notice provides that an IIR top-up tax will be excluded from the amount of foreign income taxes taken into account under the subpart F and GILTI high-tax exceptions and must be added back to the net subpart F and tentative tested income items tested for such high-tax exceptions.[4]

The policy rationale for the Notice not crediting most IIR top-up taxes is unclear. However, the Notice's treatment of IIR top-up taxes appears to address a "circularity" issue. The circularity results from U.S. taxes on GILTI or subpart F reducing an IIR top-up tax that would otherwise be imposed. As a result, the IIR top-up tax should not then be taken into account to reduce the same GILTI or subpart F taxes. However, because the Notice does not provide an explanation of the rationale for the rule, it is difficult to say with certainty that Treasury and the IRS intended only to address circularity. It is also difficult to say what authority Treasury and the IRS are relying on to promulgate such a rule. We expect that the preamble to the proposed regulations will provide additional color on the rationale and support for this rule.

Treatment of QDMTTs

Unlike the IIR, because the taxes of an entity's owner outside of the entity's jurisdiction are not considered in computing a QDMTT under the Pillar Two Rules, the Notice indicates that QDMTTs are generally creditable provided they are foreign income taxes. Furthermore, a QDMTT that is a foreign income tax may be taken into account under the subpart F and GILTI high-tax exceptions.[5]

Because a QDMTT may be computed by reference to the income of two or more persons in a single jurisdiction, Treasury and the IRS intend for the proposed regulations to provide a methodology to determine the legal liability for such taxes. In particular, the proposed regulations are expected to allocate legal liability for a QDMTT based on a "QDMTT Allocation Key" that takes into account, for each relevant entity, the product of (i) the excess (if any) of the QDMTT rate over such entity's separate ETR (before the QDMTT), and (ii) such entity's separate income taken into account in the QDMTT computation. The QDMTT Allocation Key will control for FTC purposes regardless of how foreign tax law allocates QDMTT liability or which person is legally obligated, or does in fact, remit the QDMTT.

The fact that QDMTTs will generally be creditable in the United States should create a favorable result under the OECD's February 2023 administrative guidance for allocating CFC taxes under a "Blended CFC Tax Regime" like the GILTI regime.[6] In particular, under such allocation rules, if a QDMTT were not creditable in the United States, the QDMTT would be ignored for purposes of allocating U.S. federal income taxes on GILTI among MNE group members, resulting in GILTI taxes being allocated for IIR testing purposes to entities that already had an ETR equal to or in excess of 15% and causing double taxation. On the other hand, if a QDMTT is creditable, it is respected for purposes of such allocation, increasing the amount of U.S. federal income taxes on GILTI allocated for IIR testing purposes to MNE group members that would otherwise have ETRs below the 15% threshold. As a result, generally allowing FTCs for QDMTTs is expected to decrease the incidence of IIR top-up tax with respect to a U.S. MNE group's entities in lower-tax jurisdictions.

IIR, UTPR and QDMTT Will Be Separate Levies

The Notice announces that the proposed regulations will provide that each of an IIR, UTPR and QDMTT imposed by a foreign country is a separate levy within the meaning of section 1.901-2(d) of the Treasury regulations from any other levy imposed by that country. Accordingly, the IIR, UTPR and QDMTT will be tested separately from other taxes imposed by a particular country to determine whether it is a creditable foreign income tax, regardless of whether the country imposes the IIR, UTPR or QDMTT by adjusting the base of any other levy (such as through an addition to income or denial of deductions).

With this rule, an IIR, UTPR or QDMTT in a particular jurisdiction may qualify as a creditable foreign income tax even if other taxes (including the generally applicable net income tax) in such jurisdiction do not.

Impact of IIR and QDMTT on the Non-Duplication Requirement for In-Lieu Of Taxes

Treasury and the IRS intend to amend the non-duplication requirement in section 1.903-1(c)(1)(ii) of the Treasury regulations to ensure that the enactment of an IIR and/or QDMTT in another jurisdiction does not cause an in-lieu of tax in such jurisdiction to fail the requirements of section 903. The Notice clarifies that, in order to qualify as an in-lieu of tax, a foreign tax need only be in substitution for a generally imposed net income tax and not in substitution for all net income taxes imposed by that country. Accordingly, an IIR or QDMTT may be imposed on a taxpayer that is otherwise subject to an in-lieu of tax without causing that in-lieu of tax to no longer be creditable.

Applicability Periods

According to the Notice, the proposed regulations incorporating the above FTC rules will be applicable for taxable years ending after December 11, 2023. In the meantime, provided the guidance is applied consistently across all relevant taxable years, taxpayers are permitted to rely on the foregoing FTC rules for taxable years ending after December 11, 2023, and until the date when the forthcoming proposed regulations are published in the Federal Register. Moreover, for taxable years starting on or after December 28, 2021, and ending on or before December 11, 2023, taxpayers may rely on the guidance pertaining to the non-duplication requirement for in-lieu of taxes.

DCLs and the Pillar Two Rules

Treasury and the IRS are examining the extent to which the DCL rules should interact with the Pillar Two Rules, including the extent to which jurisdictional aggregation of income and losses required under the Pillar Two Rules should result in a foreign use of a DCL and the extent to which Pillar Two Rules may cause an entity to be subject to the DCL rules in the first place. In the meantime, Treasury and the IRS intend to issue proposed regulations that will establish that the implementation of the Pillar Two Rules will not result in a "foreign use" of a DCL arising in a taxable year ending on or before December 31, 2023 or certain fiscal years beginning before January 1, 2024 and ending after December 31, 2023. However, this proposed rule would not apply to any DCL that was incurred or increased intentionally to reduce a Pillar Two top-up tax or to qualify for the rule proposed in the Notice.

Taxpayers may rely on the DCL guidance in the Notice until proposed regulations are published in the Federal Register.

Extension and Modification of FTC Relief in Notice 2023-55

In Notice 2023-55, Treasury and the IRS provided temporary relief from the application of the 2022 final FTC regulations, which had significantly narrowed the definition of a creditable foreign income tax under sections 901 and 903. Notice 2023-55 generally enabled taxpayers to elect to determine the creditability of foreign income taxes and in-lieu of taxes under the FTC rules that pre-dated the 2022 final FTC regulations. This relief was, however, limited to foreign taxes paid in any taxable year beginning on or after December 28, 2021, and ending on or before December 31, 2023.

The Notice extends the relief period under Notice 2023-55 to cover taxable years starting on or after December 28, 2021, and ending before the issuance of a notice or other guidance that either withdraws or alters the interim relief (or any subsequent date mentioned in such notice or guidance). The Notice also clarifies that, in the case of a partnership, the interim relief provided in Notice 2023-55 generally must be elected at the partnership level, and a partner will be required to consistently apply the FTC relief if its partnership so elects (or does not elect) unless the partner has no control over the partnership's determination to elect (or not elect) the relief.

While the indefinite extension of Notice 2023-55's relief from the application of the 2022 final FTC regulations will generally be welcomed by taxpayers, it remains unclear whether Treasury and the IRS are fundamentally reassessing the policies in the 2022 final FTC regulations. Furthermore, the applicability period provided in the Notice leaves something to be desired as the ability to withdraw the relief at any time before the end of a taxable year only provides certainty to taxpayers after a particular taxable year has ended. This makes it difficult for taxpayers to prospectively analyze their FTC profiles.

Footnotes

1. OECD, Tax Challenges Arising from the Digitilisation of the Economy – Global Anti-Base Erosion Model Rules (Pillar Two) (Dec. 14, 2021), available at https://www.oecd-ilibrary.org/taxation/tax-challenges-arising-from-digitalisation-of-the-economy-global-anti-base-erosion-model-rules-pillar-two_782bac33-en.

2. Under the European Union Directive requiring the adoption of the Pillar Two rules, European Union Member States will, in limited circumstances, apply the UTPR for years beginning on or after December 31, 2023. See Council Directive 2022/2523, art. 50, 2022 OJ (L 328) 1, 55.

3. All section references herein are to the Internal Revenue Code of 1986, as amended, or the Treasury regulations promulgated thereunder.

4. Interestingly, the Notice does not indicate whether an IIR will be disregarded for purposes of other U.S. federal income tax provisions that take into account an entity's local ETR, including, for example, the foreign base company sales income rules applicable to branches of CFCs under section 954(d)(2) and section 1.954-3(b) of the Treasury regulations.

5. U.S. MNEs will no doubt consider the creditability of a QDMTT versus the non-creditability of an IIR in modeling out their group-wide FTC consequences, and we expect such differences may impact where U.S. MNEs decide to form non-U.S. subsidiaries.

6. OECD, Tax Challenges Arising from the Digitalisation of the Economy – Administrative Guidance on the Global Anti-Base Erosion Model Rules (Pillar Two) (Feb. 2, 2023), § 2.10.3, available at https://www.oecd.org/tax/beps/agreed-administrative-guidance-for-the-pillar-two-globe-rules.pdf .

Originally published December 15, 2023.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.