High Margin Growth Sector With Consolidation Opportunities

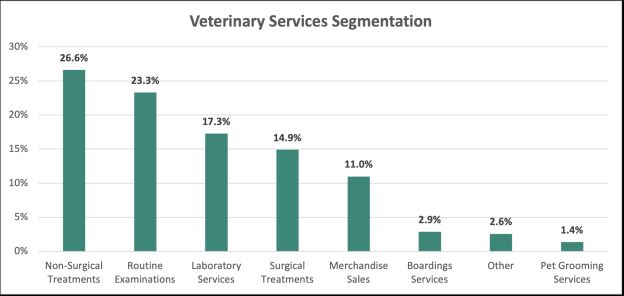

The veterinary services industry plays a crucial role in safeguarding the health and well-being of animals, encompassing a broad range of services such as medical care, surgical procedures, preventive healthcare, and diagnostics. In recent years, the industry has witnessed significant growth, driven by an increase in pet ownership, advancements in veterinary technology, and a rising awareness of the importance of animal healthcare.

The industry has evolved rapidly, mirroring the changes in societal attitudes towards pets and animals in general. With an increasing number of households owning pets and a growing emphasis on their well-being, the demand for veterinary services has increased. As a result, the industry has become more competitive, prompting various players to explore consolidation as a strategic move to achieve economies of scale, enhance service offerings, and increase operational efficiency.

Market Overview

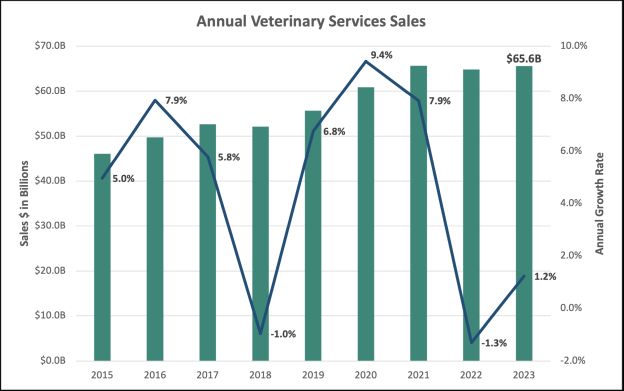

The veterinary services industry has experienced steady growth in recent years at a compound annual growth rate (CAGR) of 4.7%, with a U.S. market size reaching $66B and profit margins of 14.4%. The market is projected to expand at a CAGR of 1.2% over the next five years, reaching $70B by 2029.

Source: IBIS Veterinary Services in the U.S. 2023

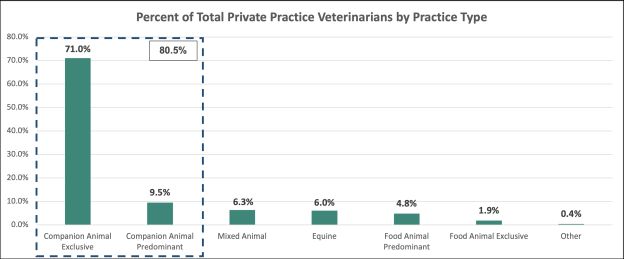

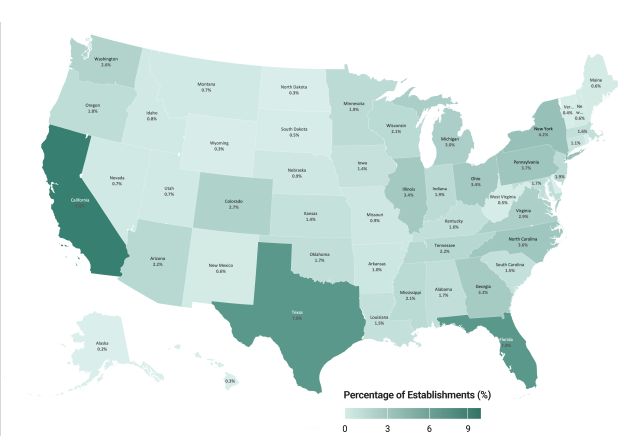

Veterinary services are focused primarily on companion animals (i.e., dogs, cats, etc.), with over 80% of private practice veterinarians devoted to this segment of the industry. In addition, a significant concentration of veterinary establishments is located in CA, TX, and FL.

Source: 2018 AVMA Report on The Market for Veterinary Services

Source: IBIS Veterinary Services in the U.S. 2023

Key Trends Driving Growth

There are several important trends setting the stage for increased growth within veterinary services.

- Growth of pet ownership and the rising trend of pet humanization, where pets are considered integral members of the family, has led to increased spending on veterinary services

- Technological advancements and innovations in veterinary diagnostics, telemedicine, and treatment modalities have enhanced the quality of pet care and attracted new entrants to the industry

- Shift toward preventive healthcare measures, where pet owners are creating opportunities for veterinary services that focus on wellness programs and early disease detection

Source: IBIS Veterinary Services in the U.S. 2023

Consolidation Opportunities and Advantages

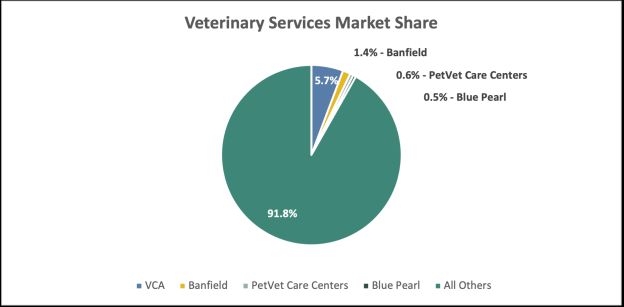

The veterinary services industry is highly fragmented, with 53,574 enterprises that have a total of 58,968 locations as of 2023. This high number of small and independent practices presents consolidation opportunities for larger entities looking to streamline operations and gain market share.

- Consolidation enables veterinary providers to achieve economies of scale, reducing costs related to the procurement of supplies, purchasing of high-technology medical equipment, marketing expenses, and administrative functions

- Mergers and acquisitions allow firms to enhance service offerings by diversifying their service portfolios, offering a more comprehensive range of veterinary care options under one umbrella

- Consolidation facilitates geographic expansion, allowing veterinary service providers to enter new markets and capitalize on a broader customer base

Source: IBIS Veterinary Services in the U.S. 2023

Challenges and Considerations

Companies in the industry looking to expand and consolidate will need to address several key strategic and operating challenges:

- Merging or acquiring veterinary practices may be subject to federal and state regulatory approvals, and will need to navigate and adhere to regulations and laws applicable to veterinary practices,

- Successful consolidation requires careful attention to cultural integration to maintain a cohesive and collaborative work environment,

- Retaining the trust and loyalty of existing clients during consolidation is crucial. Effective communication is key to managing client expectations and concerns.

Strategic Innovation Spotlight - Chewy

On December 14, 2023, Chewy announced the launch of its pet health practices under the brand name "Chewy Vet Care." The first practice will open in South Florida in early 2024 with additional locations launching throughout the year, and offer services including routine appointments, urgent care, and surgery. The new service offerings will be powered by Chewy's custom-built open platform that can apply seamlessly to Chewy Vet Care or third-party partner practices.

It is important to note that Chewy Vet Care is still in its early stages, and its overall impact on the veterinary services landscape remains to be determined. As more information becomes available, a clearer picture of their approach and potential influence will emerge.

Conclusion

Consolidation in the veterinary services industry presents a strategic opportunity for businesses to navigate the competitive landscape, achieve operational efficiencies, and deliver enhanced value to pet owners. As the industry continues to evolve, organizations must carefully assess consolidation opportunities, considering the unique dynamics of their target markets and the specific needs of their client base.

Ankura Performance Improvement Fundamentals

We have a proven record of executing strategic plans to achieve

sustainable performance improvement and targeted operating results

aimed at maximizing Earnings Before Interest, Taxes, Depreciation,

and Amortization (EBITDA), cash flow, and shareholder value.

We work side-by-side with management and other stakeholders to

guide companies through periods of uncertainty and subsequently

accelerate growth and value creation.

Ankura's Performance Improvement professionals leverage their

deep expertise across the firm to bring the appropriate specialized

resources to deliver solutions to complex problems to create

optimal outcomes.

Ankura Supports Private Equity Through Identifying and Executing Consolidation Opportunities:

- Due Diligence

- Mergers and Acquisitions

- Post Merger Integration

- Operational Improvement

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.