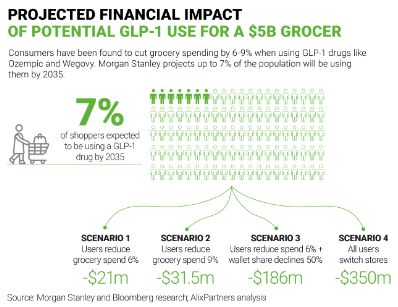

Failure to adequately respond to the burgeoning use of GLP-1 drugs like Ozempic and Wegovy could cost a $5 billion grocer as much as $350 million in revenue in a single year.

Morgan Stanley projects that up to 7% of the U.S. population will be taking these medications by 2035, and Bloomberg reports that consumers cut grocery spending by 6-9% while on the drugs. Such shoppers also completely revamp their purchasing, meaning that grocers who are unable to react swiftly to rapid changes in consumer behavior might not only see GLP-1 users' baskets shrink, but disappear entirely.

Even the mildest of the scenarios outlined in Figure 1 would impede progress toward the company's biggest goals. To achieve a modest growth rate of 2%, a grocer in Scenario 1 would need to find an extra 60 basis points of growth to counteract the effects of GLP-1. If that same grocer started losing share of wallet (Scenario 3), the growth rate needed in the remaining business would need to triple to a whopping 6.1% to stay on track.

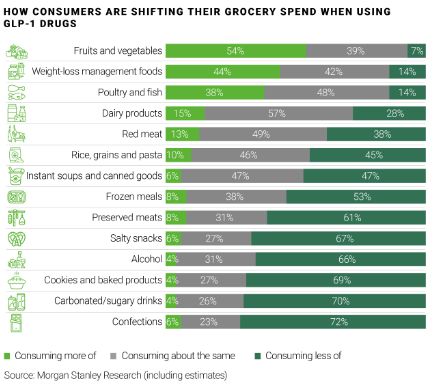

Numerator data shows that people taking GLP-1 drugs tend to spend less in categories they see as unhealthy and more in ones they see as healthy. For grocers who are prepared to capture this shifting spend, the movement could actually be a positive, if shoppers transition their dollars from lower-profit center-store categories to higher-profit perimeter ones.

Grocers might believe they have ample time to prepare for the GLP-1 trend given that, due to the high price of the drugs, the medications have mainly been used by affluent consumers on the coasts. But adoption is expected to accelerate as innovation and regulatory activity in the space drive down prices.

To effectively respond to this trend when it hits their markets, grocers must be able to quickly identify changing customer behavior and adjust assortment, merchandising and marketing in response. For grocers with those capabilities, staying in sync with the GLP-1 trend will be a breeze. For those without, now is the time to invest in two foundational areas: personalization and category management.

Personalization

A robust personalization program needs to strike a balance between two competing objectives and be flexible enough to adapt when behavior changes. We call this the "Explore Vs. Exploit" framework.

On the "Exploit" pole, we find all of the standard marketing tactics: personalized discounts, upsells and loyalty reward programs. These tactics, largely informed by past purchases, are popular for a reason: they work! This type of marketing falls short, however, when consumer preferences change rapidly.

The other pole, "Explore," has tactics that allow grocers to lead their customers on a journey, introducing novelty or anticipating lifestyle changes like those triggered by starting a course of GLP-1. In this mode, grocers feature products that may be unfamiliar yet resonate with a customer whose habits are changing. Of course, this strategy hinges on knowing what each shopper typically buys and noticing when those patterns shift. The system must be smart enough to recognize deviations from the norm.

For example, if a customer who had soda in the basket in 80% of weeks hasn't purchased any during the last three trips but has been buying bagged salad, which wasn't in previous baskets, those are signals that something happened. A grocer's system should be able to identify that customer as a possible GLP-1 user, and marketing offers should be tailored accordingly. Grocers have to know to stop sending coupons for ice cream to shoppers who are now actively avoiding it.

Category management

It's never the wrong time to focus on the fundamentals, but it's especially important when major change is on the horizon. Grocers need to honestly assess their current practices and make improvements as needed. Category managers should be able to readily identify both the major trends impacting their category and the current trajectories of key brands and items. They need to be empowered—and willing and able—to quickly reallocate space based on sales trends.

For example, shoppers using GLP-1 drugs would be likely to spend less on red meat and more on poultry or fish, so space may need to be adjusted to avoid out-of-stocks in the categories seeing growth and avoid excess shrink in the categories seeing declines.

Keeping an open mind about traffic drivers will also be important. Given that GLP-1 drugs decrease impulsivity, convenience and impulse categories could see declines. When those sales start to slide, it is time to find new traffic drivers, with placement to match. Relationships with vendors should be strong enough that collaboration on strategic adjustments can happen quickly if purchase patterns shift.

Protecting share

If grocers aren't ready when the GLP-1 trend hits their market and their customers go elsewhere for an experience that better suits their new lifestyle, not all will return, and not all will bring back their full baskets even if they do.

Grocers on the fence about investing in personalization and category management should remember that strong capabilities in these areas will be hugely beneficial whether GLP-1 ultimately has the projected impact or not. Not having the responsiveness those capabilities provide will be crippling sooner or later—but with GLP-1 use on the rise, "sooner" is more likely.

Want more? Check out these other recent insights from the grocery experts at AlixPartners:

- How grocers could prepare to compete with a combined Kroger-Albertsons

- The $100 billion opportunity for U.S. grocers

- Prioritize selling conversations with your suppliers

- Three ways grocery retailers can promote more profitably in fresh

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.