Executive Summary

Our Legislative & Public Policy Team reviews the latest federal fiscal relief for state, local, and tribal governments and how they can be used to help recover from the massive effects of the coronavirus pandemic.

- The American Rescue Plan Act provides $350 billion in emergency aid

- Guidance provides clarity on eligible uses for the funds

- State and local governments will prioritize and distribute the funds

This week, the U.S. Department of the Treasury announced the launch of the Coronavirus State and Local Fiscal Recovery Funds, established by the American Rescue Plan Act (ARPA) of 2021, to provide $350 billion in emergency funding for state, local, territorial, and tribal governments. Treasury also released operational guidance (via an Interim Final Rule) on how these funds can be used to respond to acute pandemic response needs, fill revenue shortfalls among these governments, and support the communities and populations hardest hit by the COVID-19 crisis. The receiving jurisdictions have considerable flexibility to use these funds to address the diverse needs of their communities, and interested stakeholders should engage with their relevant jurisdiction.

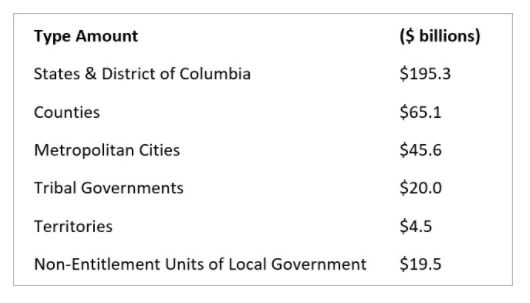

Congress has allocated this funding to tens of thousands of jurisdictions, including:

States, territories, metropolitan cities, counties, and tribal governments can expect to receive these funds directly in the coming weeks, and local governments classified as non-entitlement units will receive funding through their state governments. Eligible jurisdictions will receive funding beginning this month in either a single tranche or two, depending on unemployment rates and type of jurisdiction.

Broadly, eligible uses include:

- Supporting public health expenditures by funding COVID-19 mitigation efforts, medical expenses, behavioral health care, and certain public health and safety staff.

- Addressing negative economic impacts caused by the public health emergency, including economic harms to workers, households, small businesses, impacted industries, and the public sector.

- Replacing lost public sector revenue, using this funding to provide government services to the extent of the reduction in revenue experienced due to the pandemic.

- Providing premium pay for essential workers, offering additional support to those who have borne and will bear the greatest health risks because of their service in critical infrastructure sectors.

- Investing in water, sewer, and broadband infrastructure, making necessary investments to improve access to clean drinking water, support vital wastewater and stormwater infrastructure, and expand access to broadband internet.

It is worth noting that the funds may not be used to directly or indirectly offset a reduction in net tax revenue due to a change in law from March 3, 2021 through the last day of the fiscal year in which the funds provided have been spent or to make a deposit to a pension fund.

Furthermore, the ARPA established the Coronavirus Capital Projects Fund (CCPF), which provides $10 billion for payments to states, territories, and tribal governments to carry out critical capital projects that directly enable work, education, and health monitoring, including remote options. This funding is separate from the $350 billion allocated to target capital projects that include investments in depreciable assets and the ancillary costs needed to put the capital assets in use.

Similar to the implementation of the CARES Act's Coronavirus Relief Fund last spring, jurisdictions will be charged with prioritizing and distributing the funds. Due to the broad scope of eligible recipients, we anticipate there will be a lot of questions and various implementation challenges ahead. As a result, additional federal operational guidance is likely.

Eligible governments can request their allocation through the Treasury Submission Portal, and interested stakeholders should immediately engage with the relevant local jurisdictions as priorities and spending plans are developed.

Alston & Bird's multidisciplinary COVID-19 Response & Relief Team advises clients on the business and legal implications of the coronavirus, including the rollout of vaccines. You can view all our work on the coronavirus across industries and subscribe to our future webinars and advisories.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.