Seyfarth Synopsis. Democrats in the U.S. House and Senate have reintroduced a bill to increase the federal minimum wage to $15 for virtually all non-exempt workers. While the "Fight For Fifteen" has made several trips to Congress before, the circumstances are much different this time around. While the proposed law likely won't pass quickly, its enormous potential impacts command attention from the business community.

On January 26, 2021, Democrats in Congress reintroduced the Raise the Wage Act, H.R. 601 (the "Act"), a bill to amend the Fair Labor Standards Act to gradually increase federal minimum wage to $15, in addition to peeling back relaxed wage requirements for tipped and youth workers. Developments on the Hill late last week make it increasingly likely that the Act could be seriously considered this year. In this post, we review the Act's key features, its potential impacts, and its path forward.

Overview of the Raise the Wage Act

The Act's core features are as follows: (i) the minimum wage would increase to $15 by 2025, beginning with an increase to $9.50 in 2021 and annual increases thereafter; (ii) the minimum wage would be indexed to median wage growth after 2025; and (iii) the FLSA's relaxed wage thresholds for tipped employees, youth workers, and certain other workers would be gradually eliminated.

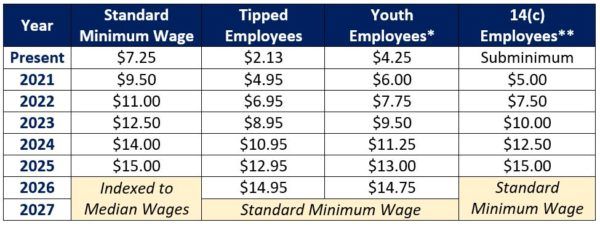

The following table provides an overview of the scheduled minimum wage increases under the Raise the Wage Act, beginning with current minimum wage thresholds and continuing through 2027:

*The FLSA allows employers to pay employees under 20 years old a sub-minimum wage during the first 90 calendar days of their employment.

**Section 14(c) of the FLSA authorizes employers, after receiving a certificate from the U.S. DOL's Wage and Hour Division, to pay subminimum wages to workers with disabilities that impair their earning or productive capacity for the work being performed.

The Act's Potential Impacts

While a graduated increase to a $15 minimum wage is a familiar proposal, it would nevertheless present a drastic change for employers in numerous states, as well as for employers throughout the restaurant industry.

The Fight for $15 has visited most parts of the country and prevailed in many. In 2016, California and New York passed laws to gradually pull the minimum wage within their borders up to $15. Massachusetts followed suit in 2018. Other states, like Illinois, Florida, and New Jersey, have since done so as well, and so too have many cities, such as San Francisco, Seattle, and Los Angeles. A $15 wage floor is already in place in Washington, D.C.

But the proposed increase to $15, familiar as it may be, will still have massive implications in many parts of the country. Though many states have pushed their wage floors above the current federal threshold of $7.25, more than 20 states-primarily those with lower costs of living, such as Georgia, Louisiana, and Texas-have not. Employers in these jurisdictions are, as a result, currently bound by a minimum wage threshold that the Raise the Wage Act would more than double over the next four years.

Additionally, the Act could have a seismic impact on the restaurant industry. Currently, the FLSA allows employers to pay tipped employees a direct wage of $2.13 per hour, with the remaining portion of minimum wage-i.e., $5.12 per hour-can be paid via tips. Tipped employees are still guaranteed at least $7.25 per hour, the only difference is that it may be paid in the form of tips.

The Act would eliminate this so-called "tip credit." Restaurants would be required to directly pay tipped employees the full minimum wage, irrespective of tips they receive. Restaurants accustomed to paying tipped workers a direct wage of $2.13 would have to find a way to pay them more than double that amount in 2021, and more than seven times that amount by 2026. In a restaurant industry that has spent most of the last year on life support, this change has been met with heavy resistance.

The Path Forward for Raise the Wage-Reconciliation or Bust

While the Raise the Wage Act is not particularly complex, its path to enactment is fairly muddled. As such, a brief trip through the very recent history of the minimum wage policy debate is helpful.

As noted above, dozens of states, cities, and counties have raised their minimum wage thresholds over the past few years. Heated debate over the minimum wage, and the cascading consequences of the same, has moved from city council halls, to the floors of state legislatures, to the forefront of the national discourse.

Even casual followers of the news likely heard about the controversy surrounding President Biden's proposal to include a massive minimum wage hike in a legislative package aimed at addressing the pandemic. Last Friday, however, Biden for the first time conceded that he does not foresee a path forward for raising the wage floor via an immediate COVID-19 package.

This statement came after Senator Joni Ernst (R-IA) introduced, and the Senate passed-with a surprising vote from the foremost proponent of a wage hike, Senator Bernie Sanders (I-VT)-a nonbinding amendment authorizing the Senate Budget Committee chairman to remove any $15-minimum-wage provision from the reconciliation bill.

Democrats' willingness to budge on the wage hike in the COVID-19 stimulus appears to stem from confidence in their ability to enact a minimum wage increase through future legislation. President Biden, as part of his comment last week, said he would seek to raise the minimum wage in future legislation. And as part of his vote on the Ernst amendment, Senator Sanders referred specifically to the Raise the Wage Act. In short, the Democratic coalition seems to be coalescing around this piece of legislation.

So, what is the likelihood the Raise the Wage Act will pass? Well, Democrats are going to run into the same problem: the political dynamics in the Senate will preclude passage through normal legislative mechanisms. As a result, Democrats would still have to press such a hike without any Republican support, through either reconciliation,1 or by doing away with the filibuster, which is not likely.

Using reconciliation comes with its own problems, not the least of which would be convincing moderate Democrats like Senator Kyrsten Sinema (AZ) to back this progressive policy. But the February 5th senatorial victories, as well as the last Congress' failure to pass a FY 2021 reconciliation bill, gives Democrats two bites at the reconciliation apple this year. That, combined with the fact that the Democratic machine appears to be coalescing behind this measure, raises the likelihood that this stand-alone measure passes later this summer. Notably, however, the general consensus is that an increase in minimum wage is not quite as a high of a Biden priority as other initiatives, such as comprehensive immigration reform and infrastructure.

How Else Could the Administration Accomplish its Policy Goals?

As our colleagues have previously noted, the Biden Administration can and will press the policy rationale behind a minimum wage hike through federal employment agencies. To some extent, we've already seen the opening machinations of that agenda: President Biden immediately fired and replaced the top attorneys at the NLRB, presumably so his hand-picked replacements can move cases with the right factual predicate in front of decision-makers. By bringing the right cases in front of the board, the Biden Administration will be able to accomplish many of the policy goals underlying the exceedingly union-friendly PRO Act, which will almost assuredly not pass in its current form.

Similarly, should the Raise the Wage Act not come to fruition, employers should expect Marty Walsh, Biden's pick to take the helm at the U.S. DOL, to move quickly through rulemaking and beefed up enforcement of wage requirements. For example, the DOL could presumably alter the tipped employee rule through rulemaking. Given the structural barriers facing the Act, employers should be prepared for enhanced movement from the DOL's Wage & Hour Division on this front.

Conclusion

As noted, the Raise the Wage Act contains a number of provisions that could prove particularly challenging for employers in certain areas of the country, as well as certain industries. The Biden Administration's placement of raising the minimum wage close to the top of its labor and employment policy agenda, combined with the Act's extra shot at reconciliation and the will of the Democratic Party to get this done, all form a legislative recipe that just might just result in the President's signature.

That said, now is not the time to be reactionary. At the end of the day, the Act currently lives in Washington D.C., a place where earth-shaking legislation has not emerged quickly or smoothly in decades. The Act will face structural, procedural, and political barriers, all of which make a quick passage of the legislation in its current form very unlikely.

In short, the message to employers is simple: watch closely and stay tuned.

Footnote

1. Simply stated, reconciliation permits, once every year, the passage of one bill with only a simple majority in the Senate, as opposed to the normal 60 votes required due to the filibuster rule. What can (and can't) move through reconciliation is further restrained by the so-called Byrd Rule, which provides that bills are only eligible if they affect federal revenue or spending.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.