What is in store for retail in the 2nd half of 2023? We are about to enter the relatively dull and uneventful days of summer for retailers. Other than the seasonal rush to garden centers, outdoor furniture, and BBQ retailers – and perhaps purveyors of warm weather sporting equipment - retail in general lazily meanders along until the back-toschool pick-up

Consumers are feeling the squeeze, hammered by rising costs to service credit card debt, escalating mortgage rates, inflation, and the upcoming end to the student debt payment moratorium. One must question whether shoppers will flock to stores in the 2nd half of 2023, even with back-to-school and the holidays looming.

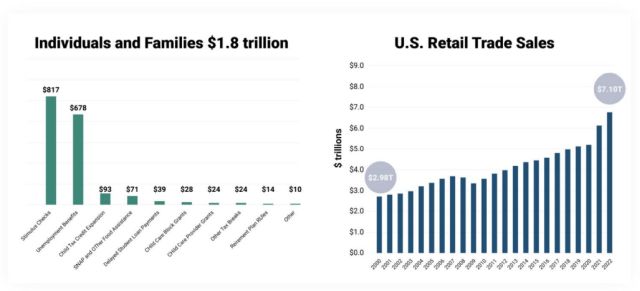

This is certainly in contrast to the consumer spending boom of the past few years. In the three-year period between 2020–2022, over $5 trillion of pandemic stimulus was injected into the U.S. economy1 , like the inflation adjusted cost of World War II (including the cost of the Manhattan Project). A large portion of this stimulus went directly to individuals and families ($1.8 trillion)2 , which helped contribute to an unprecedented level of consumer resilience during a period of great economic and health uncertainty, the COVID-19 pandemic.

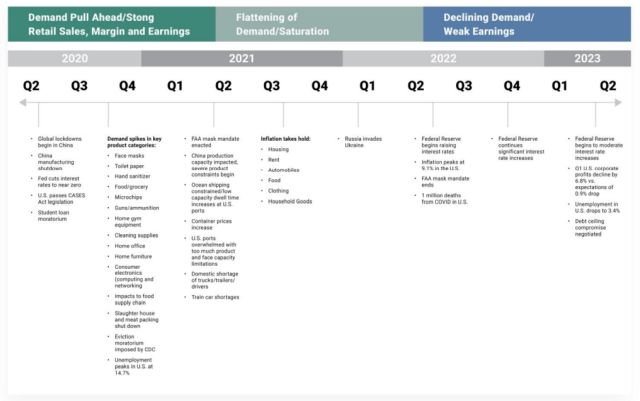

Multiple factors – some experienced in economic cycles before, some unique to a pandemic and post-pandemic world – contributed to the uptick in sales and pricing during this period. To understand and analyze this, and to give insight into what might be next, we aligned these factors into three groups: (1) Accelerated Demand, (2) Demographic and Shopping Shifts, and (3) Consumer Evolution.

Early in the pandemic, panic and comfort buying became prevalent consumer behaviors, driven by uncertainty and concerns surrounding the global economy.

Consumers rushed to secure essential items and sought comfort in purchasing products that provided familiarity and reassurance. Brand loyalty took a backseat during this period – toilet paper was toilet paper. If the store brand was in-stock, you grabbed it even if historically you purchased the brand name. And forget about getting your hands on hand sanitizer. A plethora of substitute products hit the market, with consumers buying in droves. Even the Food and Drug Administration (FDA) issuing recalls and warnings on multiple hand sanitizers did not stop the purchasing frenzy.

Household dynamics drastically shifted. Entire families working and/or studying from home demanded digital and personal electronic devices, and internet speed upgrades with increased monthly fees. Additionally, some households moved entirely, spurring "Pandemic City" terminology leading to growth in cities like San Antonio, Phoenix, Austin, Bend, Boise, Myrtle Beach, and Salt Lake City to name a few.

Low-interest rates facilitated by the Federal Reserve further encouraged spending and borrowing, stimulating sales. Supply chain disruptions, beginning with the 2019 China "trade war" and including an extended COVID shutdown in China, played a significant role in increasing product prices due to reduced availability and increased production costs. These factors collectively contributed to the growth in sales and pricing across various sectors.

In sum, many retailers generally prospered, especially if they could get inventory into their stores and distribution centers. Interestingly, total retail sales in the United States rose from $5.4 trillion in 2020 to $7.1 trillion in 20223 , an increase of $1.7 trillion, in line with the federal stimulus spending "lifeline" sent to households.

WHERE ARE WE TODAY?

Fast-forward to 2023. As demand and supply return to a sustainable state of equilibrium, the production chain reaching from the consumer back to global brands/vendors and component manufacturers is being impacted. This includes the web of services that surround consumer-focused production, from international and domestic multimodal freight providers to ports, pilots, drivers, installers, technicians, mechanics, and of course retail stores.

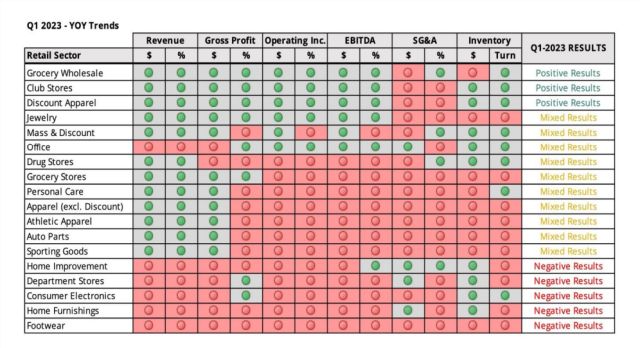

Recently reported quarterly earnings (and forward-looking guidance) are beginning to light up red, potentially confirming that the American consumer may be less resilient this go-around. Q1-2023 results show that twelve of the eighteen retail sectors we track are generating revenue growth versus last year. However, twelve of eighteen are also exhibiting a contraction in profit and operational measures.

These results underscore the growing vulnerability of the retailers in these sectors. In order to be set up for long-term success in retail, a blend of increasing sales, profit growth, and operational strength must be achieved.

Click here to continue reading . . .

Footnotes

1. Where $5 Trillion in Pandemic Stimulus Money Went. The New York Times, March 11, 2022.

2. What Were the 13 Most Expensive Wars in U.S. History? USA TODAY, June 13, 2019.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.