The Federal Trade Commission (FTC) recently announced its annual adjustments to (1) the pre-merger notification thresholds under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (the HSR Act), (2) the HSR Act filing fee schedule, (3) the civil penalty amounts for HSR Act violations, and (4) the interlocking directorate thresholds under Section 8 of the Clayton Act.

Annual Adjustments to HSR Thresholds

The HSR Act requires parties to notify the FTC and the Antitrust Division of the U.S. Department of Justice (DOJ) of certain transactions and observe a waiting period prior to consummating the transaction if it meets the HSR Act's jurisdictional tests. The statute requires the FTC to annually adjust the jurisdictional and filing fee thresholds based on the change in gross national product (GNP). The FTC recently published the revised jurisdictional, filing fee, and related HSR-rule thresholds, which will become effective on March 6, 2024.

Revised Jurisdictional Thresholds

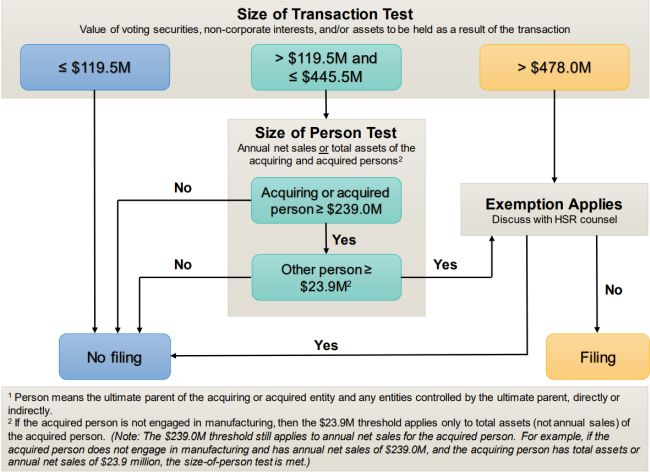

Certain transactions, including acquisitions of voting securities or assets, acquisitions of noncorporate interests that confer control of a noncorporate entity, and the formation of joint venture corporations or other entities, are subject to the reporting and waiting requirements of the HSR Act if the transaction meets the size-of-transaction test and, if applicable, the size-of-person test, unless an exemption applies:

- The size-of-transaction test is met if the value of voting securities, noncorporate interests, assets, or a combination thereof held as a result of the transaction is in excess of $119.5 million (increased from $111.4 million).

- The size-of-person test is met if the ultimate parent entity of one of the parties to the transaction has $23.9 million (increased from $22.3 million) or more in total assets or annual net sales, and the ultimate parent entity of the other party to the transaction has $239.0 million (increased from $222.7 million) or more in total assets or annual net sales.

- The size-of-person test does not apply if the transaction is valued in excess of $478.0 million (increased from $445.5 million).

Below is a summary of the changes to the jurisdictional thresholds and an HSR analysis decision tree with the new thresholds:

| Jurisdictional Tests and Thresholds | |||

| Original | Current | New | |

| Minimum size-of-transaction

threshold (size-of-person test must be met) |

> $50 million | > $111.4 million | > $119.5 million |

| Lower size-of-person threshold | ≥ $10 million | ≥ $22.3 million | ≥ $23.9 million |

| Higher size-of-person threshold | ≥ $100 million | ≥ $222.7 million | ≥ $239.0 million |

| Large size-of-transaction

threshold (size-of-person test is not applicable) |

> $200 million | ≥ $222.7 million | > $478.0 million |

Revised Notification Thresholds

Section 802.21 of the HSR rules exempts the acquisition of voting securities of a corporation for five years after the expiration or termination of the waiting period of a prior HSR filing if the acquiring person meets all of the following requirements:

- It completed the acquisition that was the subject of the filing within one year of the expiration or termination of the waiting period.

- It crossed the applicable notification threshold within one year of the expiration or termination of the waiting period.

- It will not meet or exceed the next notification threshold as a result of acquiring additional shares of voting securities.

Below are the original, current, and new notification thresholds, which become effective for transactions closing on or after March 6, 2024:

| Notification Thresholds | ||

|

Original (FY 2003 base year) |

Current |

New (effective on March 6, 2024) |

| > $50 million | > $111.4 million | > $119.5 million |

| ≥ $100 million | ≥ $222.7 million | ≥ $239.0 million |

| ≥ $500 million | ≥ $1.1137 billion | ≥ $1.195 billion |

| ≥ 25% if > $1 billion | ≥ 25% if > $2.2274 billion | ≥ 25% if > $2.39 billion |

| ≥ 50% if > $50 million | ≥ 50% if > $111.4 million | ≥ 50% if > $119.5 million |

Revised Filing Fee Schedule

On December 29, 2022, President Biden signed H.R. 2617, the Consolidated Appropriations Act, 2023, into law. The legislation included the Merger Filing Fee Modernization Act of 2022, which amended the amounts and tiers for HSR filing for the first time since 2001.

Beginning this year, the FTC is required to annually (1) adjust the filing fee tiers to reflect the percentage change in GNP for the prior fiscal year compared to the fiscal year that ended on September 30, 2022, and (2) increase the filing fee amounts annually by the Consumer Price Index (CPI) for the prior fiscal year compared to the fiscal year that ended on September 30, 2022, if the percentage increase is greater than 1%.

The current and new filing fee schedules are provided below:

| Filing Fee | Tiers (Size-of-Transaction) | ||

| Current | New | Current | New |

| $30,000 | $30,000 | Greater than $111.4 million but less than $161.5 million | Greater than $119.5 million but less than $173.3 million |

| $100,000 | $105,000 | $161.5 million or greater but less than $500 million | $173.3 million or greater but less than $536.5 million |

| $250,000 | $260,000 | $500 million or greater but less than $1 billion | $536.5 million or greater but less than $1.073 billion |

| $400,000 | $415,000 | $1 billion or greater but less than $2 billion | $1.073 billion or greater but less than $2.146 billion |

| $800,000 | $830,000 | $2 billion or greater but less than $5 billion | $2.146 billion or greater but less than $5.365 billion |

| $2,250,000 | $2,335,000 | $5 billion or greater | $5.365 billion or greater |

Civil Penalty

Effective January 10, 2024, the maximum civil penalty amount for violations of the HSR Act was increased from $50,120 to $51,744 per day based on changes in inflation as required by the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015 (the FCPIAA). The FCPIAA, as amended, directs agencies to implement annual inflation adjustments based on a prescribed formula. Although the daily fee may not appear astronomical, it is easy to see how the fee could quickly become quite significant if a violation remains unfixed for weeks or even months.

Agencies Actively Enforce Nonreportable Transactions

Parties should also keep in mind that just because a transaction is not reportable under the HSR Act does not mean that it is exempt from agency scrutiny of the potential anticompetitive effects of the transaction. The FTC, DOJ, and state attorneys general (as well as private parties) may challenge a transaction as anticompetitive even when no HSR filing is required for the transaction and even after a transaction is consummated. Therefore, all transactions should be reviewed for antitrust compliance prior to closing.

Revised Section 8 Thresholds and Renewed Enforcement

As required by statute, the FTC published its annual revisions to the interlocking directorate thresholds under Section 8 of the Clayton Act, effective as of January 22, 2024. Section 8 prohibits a "person" from serving as a director or officer of two competing corporations if each has capital, surplus, and undivided profits of more than $48,559,000 (increased from $45,257,000) unless one of the following de minimis exemptions is met:

- The competitive sales of either corporation are less than $ 4,855,900 (increased from $4,525,700).

- The competitive sales of either corporation are less than 2% of its total sales.

- The competitive sales of each corporation are less than 4% of its total sales.

The DOJ and FTC have reinvigorated enforcement of the prohibition on interlocking directorates under the Biden administration. The DOJ has announced that at least 15 directors have resigned from 11 boards as a result of its Section 8 enforcement initiative.

The FTC, on the other hand, concluded its first Section 8 enforcement action in roughly 40 years by approving a consent order concerning a proposed acquisition between Quantum Energy Partners and EQT Corporation that required Quantum to refrain from taking a seat on EQT's board and, absent prior approval from the FTC, from taking a seat on the board of any of the top seven natural gas producers within the Appalachian Basin. The consent order is particularly noteworthy because the FTC expressed its view that Section 8 applies to unincorporated entities despite the plain language of the statute only referencing corporations.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.