WELCOME

Welcome to the 15th edition of the Deloitte Football Money League, in which we profile the highest earning clubs in the world's most popular sport. Published nine months after the end of the 2010/11 season, the Money League is the most contemporary and reliable analysis of clubs' relative financial performance.

Whilst there are a number of non-financial methods that can be used to determine a clubs' relative size – including measures of attendance, fanbase, broadcast audience, or on-pitch success – we focus on clubs' ability to generate revenue from day to day football operations. We therefore rank clubs based on the money coming in. We do not consider a club's budget for outgoings, what someone might pay to buy or invest in a club or owner wealth.

Strength in numbers

The top 20 clubs generated combined revenues of over €4.4 billion in 2010/11, which is the focus of this edition, a 3% increase on the previous year. This represents over a quarter of the total revenues of the European football market.

Continued growth in revenues of the top 20 emphasises the strength of football's top clubs in these tough economic times. Whilst clubs have undoubtedly had to adjust their approach in certain areas, the large and loyal supporter bases, ability to drive strong broadcast audiences and continuing attraction to corporate partners has made them relatively resistant to the economic downturn.

Whilst, in their home currency, seven of the top 20 clubs experienced a drop in revenue, this was mostly due to less successful on-pitch performance, particularly in European competition, and the resulting decreases in central distributions and matchday revenues rather than wider recessionary impacts. Nine of the 20 clubs enjoyed double digit percentage revenue growth in 2010/11.

The huge fan interest in both domestic and international markets underpin the brand strength of football's very top clubs and means there is limited movement in positions at the top of the Money League. For the fourth successive year, the clubs comprising the top six remain the same with no movement amongst these six for the last three years.

El clásico

Real Madrid top the Money League for the seventh successive year with an impressive €41m (9%) revenue growth to €480m in 2010/11. One more year in top position will match the dominance of Manchester United during the first eight years of the Money League. A phenomenal achievement.

FC Barcelona retain second place, maintaining a Spanish one-two for the third successive year, with a €53m (13%) growth driving revenues beyond €450m. Nonetheless they remain €29m behind their arch rivals.

The full impact of Barca's shirt sponsorship deal with the Qatar Foundation worth an average of €30m a season and US$5m (€3.5m) prize money gained from winning the FIFA Club World Cup will boost the club's revenue in 2011/12. This may allow it to narrow, or even bridge, the gap to Real. However, relative on-pitch performance particularly in the Champions League, may determine next year's top two Money League placings.

In any case, both clubs are closing in on revenues of €500m and are likely to pass this threshold within the next few years. Each club's annual revenues have grown by almost €200m compared with five years before, a remarkable achievement.

Euro boost

As a result of the club's run to the semi-final of the UEFA Champions League German club Schalke 04 is this year's biggest climber, jumping six places and breaking into the Money League top ten for the first time. Not since our very first edition covering the 1996/97 season has another German club, Borussia Dortmund, joined Bayern Munich in the top ten.

Schalke push Italian giants Juventus out of the top ten. Aside from Schalke, the other nine clubs in the top ten have maintained a position in the top half of the Money League for each of the last eight years.

The German club's strong Champions League performance means Tottenham just miss out on a top ten position despite achieving the second highest rate of revenue growth amongst Money League clubs – 36% (£44m) – following its first participation in the Champions League.

The emergence of Manchester City within European club football's elite, supported by heavy investment from the club's Abu Dhabi based owners, and participation in the Champions League in 2011/12 means that the club looks set to break into the top ten from next year, at the expense of Schalke who missed out on Champions League qualification in 2011/12.

Emerging forces

There are three new entrants in the top 20 with Borussia Dortmund, Valencia and Napoli replacing Atlético de Madrid, VfB Stuttgart and Aston Villa.

Dortmund's resurgent on-pitch form, which resulted in Die Borussen lifting the Bundesliga, provided a €33m (£30m) increase in revenue, allowing the club to return to the Money League after a one year absence. Indeed, French champions Lille is the only club of the 'big five' domestic league title winners in 2010/11 not to gain a place in the Money League.

Valencia return to the Money League after a three year absence as a result of participation in the Champions League. Italian club Napoli's third place finish in Serie A, its highest finishing position since the Diego Maradona inspired team won the Scudetto in 1989/90, means it gains a Money League placing for the first time.

Champions League participation in 2011/12 for both Dortmund and the Neapolitans will result in these two famous clubs achieving further revenue growth and as a result they should climb up next year's Money League.

Famous five

Once again, our top 20 comprises clubs from the 'big five' European leagues in England (six clubs), Italy (five), Germany (four), Spain (three) and France (two). The population and economic size of these five countries coupled with the popularity of football, match attendances and broadcast audiences, provides the platform for the biggest clubs in these markets to dominate the Money League.

Portuguese club Benfica is the highest placed club from a non 'big five' league and miss out on a top 20 place by c.€12m. A strong supporter base, excellent facilities at the Estadio da Luz and, participation in the Champions League allowed the club to generate just over €102m in revenues in 2010/11.

Competing in Europe

Participation in European competition remains important not only in gaining a top 20 position but also in terms of movement within the top 20. Six of the top 20 clubs did not participate in the Champions League – Liverpool, Manchester City, Juventus, Dortmund, Hamburger SV, and Napoli. Of these, only Hamburg didn't participate in either UEFA competition.

The revenues that European club competition participation delivers on a matchday and through central UEFA distributions are an important component of most Money League clubs' revenue profiles.

From 2012/13, four German clubs will qualify for the Champions League compared with three clubs from Italy, a reversal of the current situation. Five clubs from Italy, and four from Germany, appear in this year's Money League. This change in allocation could potentially shift the balance of clubs from the two countries within the top 20 in future editions.

Bridging the divisions

Real Madrid and Barcelona will head the list and contest the top two Money League positions for the foreseeable future. Manchester United's disappointing Champions League performance in 2011/12 means it is unlikely to close the €84m gap to the Spanish clubs. The gulf may widen to over €100m next year.

Spanish clubs are currently negotiating a collective model for the distribution of La Liga broadcast revenues, potentially from 2015/16. The revenue advantage that Real and Barca enjoy over their European peers indicates that a more even distribution of La Liga broadcast revenues would not necessarily challenge the two clubs' dominance at the top of the Money League.

We are starting to see widening gaps between clubs at the top of the Money League. In addition to the €84m gap between second placed Barcelona and third placed Manchester United, there is a €70m gap between fourth placed Bayern and fifth placed Arsenal. These are unlikely to be bridged in the short term unless a club fails to qualify for the Champions League.

The clubs placed from sixth to tenth have revenues between €200m and €250m with a €20m gap to 11th placed Tottenham, although it is possible to break into the top ten as Schalke has proved this year and Manchester City is likely to do in next year's edition.

Two of this year's new entries – Borussia Dortmund and Napoli – will enjoy revenue boosts from participation in the Champions League in 2011/12 whilst the other new entry, Valencia, has again participated in the competition. As a consequence it is possible that the 20 clubs comprising the Money League could remain the same in next year's edition, the first time this has happened since we started our Money League analysis in 1996/97. However Benfica may break the 'big five' country stranglehold on the Money League should it progress in the knock-out stages of the Champions League, although there remains at least a €10m gap to bridge.

Getting the house in order

Whilst the Money League covers clubs' revenue performance, there is an increasing focus within European football on achieving more sustainable levels of expenditure given UEFA's financial fair play breakeven requirement.

Some commentators may argue that regulating clubs' expenditure relative to revenue may further concentrate on-pitch success amongst those clubs earning the most. Nonetheless, we believe disciplined and responsible governance structures and financial management within European football, whilst providing the platform for investment in facilities and youth development, should only be encouraged.

Of course, generating the highest revenues does not guarantee on-pitch success. Only two of the highest revenue generating clubs in the 'big five' leagues won their respective domestic leagues in 2010/11 and only two of the five leagues saw the clubs with the highest overall wage costs lift the domestic crown.

This edition

In this year's edition we supplement our usual profiles of the top 20 clubs with a feature article on UEFA's Europa League and an insight into the clubs and leagues in emerging football markets in Brazil, Eastern Europe, China and the USA.

The Deloitte Football Money League was compiled by Dan Jones, Austin Houlihan, Richard Battle, Tim Bridge, Adam Bull, Chris Hanson, Richard Taylor and Alexander Thorpe. Our thanks go to all those who have assisted us, inside and outside the Deloitte international network. We hope you enjoy this edition.

Dan Jones, Partner

HOW WE DID IT

We have used the figure for total revenue extracted from the annual financial statements of the company or group in respect of each club, or other direct sources, for the 2010/11 season.

Revenue excludes player transfer fees, VAT and other sales related taxes. In a few cases we have made adjustments to total revenue figures to enable, in our view, a more meaningful comparison of the football business on a club by club basis. For instance, where information was available to us, significant non-football activities or capital transactions have been excluded from revenue.

Each club's financial information has been prepared on the basis of national accounting practice or International Financial Reporting Standards ("IFRS"). The financial results of some clubs have changed, or may in future change, due to the change in the basis of accounting practice. In some cases these changes may be significant.

Based on the information made available to us in respect of each club, to the extent possible, we have split revenue into three categories – being revenue derived from matchday, broadcast and commercial sources. Clubs are not wholly consistent with each other in the way they classify revenue. In some cases we have made reclassification adjustments to the disclosed figures to enable, in our view, a more meaningful comparison of the financial results.

Matchday revenue is largely derived from gate receipts (including season tickets and memberships). Broadcast revenue includes revenue from both domestic and international competitions. Commercial revenue includes sponsorship and merchandising revenues. For a more detailed analysis of the comparability of revenue generation between clubs, it would be necessary to obtain information not otherwise publicly available. Some differences between clubs, or over time, may arise due to different commercial arrangements and how the transactions are recorded in the financial statements, due to different financial reporting perimeters in respect of a club, and/or due to different ways in which accounting practice is applied such that the same type of transaction might be recorded in different ways.

The publication contains a variety of information derived from publicly available or other direct sources, other than financial statements.

We have not performed any verification work or audited any of the information contained in the financial statements or other sources in respect of each club for the purpose of this publication.

For the purpose of the international comparisons, all figures for the 2010/11 season have been translated at 30 June 2011 exchange rates (£1 = €1.1073). Comparative figures have been extracted from previous editions of the Deloitte Football Money League.

There are many ways of examining the relative wealth or value of football clubs and at Deloitte we have developed models of anticipated future cash flows to help potential investors or sellers do just that. However, for an exercise such as this, there is insufficient public information to do that. Here, in the Deloitte Football Money League, we use revenue as the most easily available and comparable measure of financial wealth.

UPS AND DOWNS

1. Real Madrid

![]()

A €40.9m (9%) increase in revenues to €479.5m (£433m) sees Real Madrid maintain its position at the top of the Money League for the seventh consecutive season. Following the appointment of José Mourinho as manager, the club emerged victorious in the Copa del Rey but again finished runners up in La Liga to their great rivals Barcelona who also knocked Real out of the Champions League at the semi-final stage.

Real has enjoyed phenomenal growth, with annual revenues increasing by almost €200m over the past five years and is closing in on revenues of €500m.

Broadcast revenue increased by €24.8m (16%) to €183.5m (£165.7m) in 2010/11. This increase was driven in large part by a return to form in the UEFA Champions League. Progress to the semi-final stage delivered €39.3m (£35.5m) in UEFA distributions compared with €27.2m in 2009/10. The majority of the club's broadcast revenue is still generated from its broadcast rights contract with Mediapro which runs until 2013/14.

Commercial revenue increased by €21.6m (14%) to a total of €172.4m (£155.7m) in 2010/11, with Real Madrid second only to Bayern Munich in terms of commercial revenue generation. Los Blancos' commercial success continues to be underpinned by strong revenue growth across areas including merchandising, sponsorship and non-matchday activities. The club's shirt front deal with Bwin runs until 2012/13, with Real also generating significant revenue through its continued kit sponsorship with Adidas. The club's commercial revenue looks set to remain strong with Real recently securing a five year partnership with Emirates Airlines from 2011/12.

The club's attendance levels decreased slightly in 2010/11 with an average league match home crowd of 66,261. The club also lost the benefit of the one-off revenue it had received from the hosting of the Champions League final in 2009/10. As a result, despite prolonged European and domestic cup campaigns contributing to an increase in gate receipts, overall matchday revenue in 2010/11 fell by €5.5m (4%) to €123.6m (£111.6m).

Strong revenue growth has kept Real Madrid at the top of this year's Money League. Although Barcelona has narrowed the gap, Real still had a €28.8m revenue advantage in 2010/11. The club hope the arrival of the "Special One" and continued investment in playing staff translates into on-pitch domestic and European success, in order to assist Real in maintaining its long-term supremacy at the top of the Money League.

2. FC Barcelona

![]()

FC Barcelona's recent on-pitch success continued in 2010/11, as the club won the Champions League and La Liga, allowing them to remain in second place in the Money League for a third successive year. This was the second time in three years Barca has won the Champions League and the third consecutive season as La Liga champions. The club also finished runner-up in the Copa del Rey.

A revenue increase across all three categories, totalling €52.6m (13%), has resulted in Barca extending their lead over third placed Manchester United from €48.3m to €83.7m (£75.6m). They also closed the gap on leaders Real Madrid from €40.5m in 2009/10 to €28.8m (£26m) in 2010/11.

Matchday revenue exceeded €100m for the first time, increasing from €97.8m to €110.7m (£100m) for the 2010/11 season. As well as playing more matches in 2010/11, up from 27 to 29, FC Barcelona's average home league attendance of 79,186 is the highest in the Money League.

Broadcast revenue also increased, from €178.1m to €183.7m (£165.9m), which maintains Barcelona's position as the number one Money League club from this source. The upturn can be attributed to an increase in UEFA distributions, with Barcelona receiving €51m as a result of winning Europe's top club competition in 2010/11. The club has recently extended its broadcast rights deal with Mediapro by a further year until the end of the 2014/15 season.

Commercial revenue increased significantly from €122.2m in 2009/10 to a club record €156.3m (£141.1m) in 2010/11, boosted by a €15m contribution from the new shirt sponsorship deal with the Qatar Foundation. The agreement was announced mid-season and will be worth an average of €30m per season until the end of the 2015/16 season. The club reports that the other key factors in this increase in commercial revenues were contractual bonuses from winning the Champions League, increased stadium tour visitors (1.5m), and the development of their new Seient Lliure ticket exchange service in Barcelona.

Barcelona will benefit from a full season of the Qatar Foundation agreement, as well as prize money from winning the FIFA Club World Cup, during 2011/12. If, in addition, Barcelona can continue their on-pitch success both in La Liga and the UEFA Champions League, this may allow them to further close the revenue gap on Real Madrid and to challenge them for the top position in the Money League.

3. Manchester United

![]()

Manchester United's continued success on the pitch contributed to a growth in revenues of £45m (16%) to £331.4m (€367m) in a domestic season which saw the club reach the final of the UEFA Champions League, become English champions for a record 19th time and reach the semi-finals of the FA Cup. The increased revenues helped the club retain third place in the Money League behind the Spanish duopoly of Real Madrid and Barcelona.

A £22m (27%) increase in commercial revenue to £103.4m (€114.5m) was the largest contributor to the club's revenue growth, driven by the four-year shirt sponsorship deal with Aon Corporation, reportedly worth £20m (€22.1m) per season, which began in June 2010. Other contributors to this growth in commercial revenue included contractual increases from the club's alliance with Nike, and new commercial partnerships such as those with Telekom Malaysia and Turkish Airlines.

The club is continuing to use its global brand to attract commercial partners, with new agreements such as the four-year training kit sponsorship with DHL, reportedly worth £40m (€44.3m), set to improve commercial revenues from 2011/12. The partnership with DHL is a first for the club, which will see the company sponsor United's training kit for all domestic matches.

The first year of the new collective Premier League broadcast rights deal saw Manchester United earn a record £60.4m (€66.9m) in broadcast payments. This was the principal driver behind the £14.6m (14%) growth in broadcast revenues to £119.4m (€132.2m). The Red Devils' run to the Champions League final generated €53.2m (£48m) in UEFA distributions compared to €46.4m in 2009/10, which also contributed to the growth in broadcast revenue.

An average home league attendance of 75,109, together with an extended run in both the FA Cup and Champions League, helped the club to generate £108.6m (€120.3m) in matchday revenue – an increase of £8.4m (8%) over the 2009/10 season, and the second highest of any Money League club behind Real Madrid. The number of home games rose from 28 to 29, meaning average revenue stood at £3.7m (€4.1m) per home match.

The club's consistent on-pitch success has helped establish it as a continued fixture in the top three of the Money League, yet in recent years a gap has grown between themselves and the Spanish giants Real Madrid and Barcelona, rising again to €83.7m in this year's edition. United's failure to qualify for the 2011/12 Champions League knockout phase will have a detrimental effect on revenues relative to the top two, which may result in this gap increasing to over €100m.

4. Bayern Munich

![]()

A comparatively disappointing season on the pitch for Bayern Munich was mirrored by a slight decrease in total revenues from €323m to €321.4m (£290.3m) in 2010/11. The club finished third in the Bundesliga and exited the Champions League at the first knockout round, as compared with a domestic double and Champions League final appearance in the previous season. This resulted in Bayern parting ways with manager Louis van Gaal, replacing him with Jupp Heynckes.

Despite a small drop in revenue, Bayern have maintained fourth position in the Money League, although the gap between the Bavarians and third placed Manchester United has increased from €26.8m to €45.6m (£41.2m).

Bayern's disappointing Champions League campaign contributed to an overall fall in broadcast revenue of €11.6m (14%) to €71.8m (£64.8m). The club's exit at the round of 16 resulted in UEFA distributions totalling €32.6m (£29.4m). This is a decrease of €12.8m on the €45.3m they received for the 2009/10 campaign in which the club reached the final, finishing runner-up to Internazionale.

Despite the Allianz Arena hosting fewer home games in the 2010/11 season, 23 compared with 25 in 2009/10, matchday revenue increased by €5.2m (8%) to €71.9m (£65m). This was due to a combination of higher ticket pricing, more friendly matches and more attractive home opposition in the domestic cup. The club continued to enjoy sell out home attendances of 69,000, for league matches.

Bayern continue to lead the Money League in terms of commercial revenue, with an increase of €4.8m (3%) to €177.7m (£160.5m) in 2010/11. While Real Madrid have narrowed the gap in terms of commercial revenue from €22.1m to €5.3m (£4.8m) in 2010/11, Bayern appear well placed to enjoy continued commercial revenue growth. The Bavarians recently extended its kit sponsorship agreement with Adidas, worth a reported €25m annually, for a further eight years until 2020.

The club has complemented this by signing an extension to its premium partner sponsorship with Audi. It has also recently been reported that the club is in talks to secure a partnership agreement with Russian energy company Gazprom, further indicating that commercial revenue looks set to remain strong in coming years.

This commercial strength is a key contributor in allowing the club to pay off the debt associated with the building of the stadium. Club president Uli Hoeness recently commented that Bayern hope to be free of stadium debt in six to seven years.

A return to domestic league and cup success, as well as prolonged European campaigns, appears crucial if Bayern are to build on their commercial revenue superiority and mount a challenge to the Money League's top three.

5. Arsenal

![]()

Arsenal narrowly remain in fifth place in this year's Money League after recording revenues of £226.8m (€251.1m) for 2010/11, which in sterling terms, is a £2.4m increase on the £224.4m earned in 2009/10.

Whilst football related revenues remained stable, Arsenal generated a further £30m (€33m) in property development revenue, despite a sharp though anticipated decrease, from the £157m reported in 2009/10. Our analysis focuses on football related revenue only. Although the Gunners reached the League Cup final, this was their sixth consecutive season without winning a major trophy or finishing in the top two of the Premier League.

Arsenal continue to benefit from excellent facilities and full capacity attendances at the Emirates Stadium, with a league match average of 60,025 in 2010/11. However, there were two fewer Champions League fixtures in 2010/11 and, as a result, a small reduction of £0.8m (1%) in matchday revenue from £93.9m to £93.1m (€103.2m). Nonetheless, this still represents the fourth highest amount from this source of all Money League clubs and Arsenal are the only club in the top 20 who accumulated more revenue from matchday than any other source.

Broadcast revenue only increased slightly from £86.5m to £87.4m (€96.7m) in 2010/11 due in part to Arsenal's UEFA distributions reducing from €33.8m to €30m (£27.1m), as a result of only reaching the last 16 of the Champions League, compared to the quarter-finals the previous season. However, this was wholly offset however by an increase in Premier League distributions and for English clubs, a more beneficial exchange rate from the UEFA distributions.

In contrast to their strength in matchday revenue, commercial revenue only accounted for 20% of Arsenal's total football related revenue. In absolute terms this is over £57m behind the leading English club, Manchester United. The club is bound to its long term (£90m) agreement with Emirates, which runs until 2020/21 for stadium naming rights and 2013/14 for shirt sponsor. Given the financial values of the shirt sponsor deals agreed by some of the other top clubs in the Money League, Arsenal will have a significant opportunity to boost commercial revenue when this deal expires.

The club is making headway with commercial revenue, growing from £44m in 2009/10 to £46.3m (€51.2m) in 2010/11. Looking ahead to the 2011/12 season, the club have agreed new partnership deals with Indesit, Betsson, Thomas Cook and Carlsberg, as well as a three-year renewal with Citroën, which should all contribute to an increase in commercial revenue in the next edition of Money League.

Arsenal remain committed to a long term vision of a self-sustainable football club built on solid foundations. If the Gunners are to retain their position in the top five of the Money League, they will need to close the gap in commercial revenues with Europe's other top clubs, whilst continuing to qualify for the Champions League.

6. Chelsea

![]()

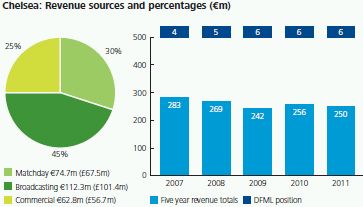

Chelsea remain in sixth position in the Money League with a £16.1m (8%) increase in revenues to £225.6m (€249.8m), closing the gap to fifth placed Arsenal from £14.9m to £1.2m (€1.3m).

A disappointing season on the pitch, compared with the previous year, saw the Blues finish runner-up in the Premier League to Manchester United, who also defeated them in the Champions League quarter finals. FC Porto's Europa League winning coach André Villas- Boas has replaced Carlo Ancelotti as team manager for the 2011/12 season.

Broadcast revenues accounted for almost all of Chelsea's increase, with matchday and commercial revenues similar to the previous year.

Broadcast revenue increased £15.4m (18%) to £101.4m (€112.3m), due to a more successful Champions League campaign delivering increased UEFA distributions and increased Premier League payments. Progression to the Champions League quarter-finals saw distributions increase from €32.6m to €44.5m (£40.2m). The new Premier League broadcast deals saw Chelsea's distribution grow by £4.9m (9%) to £57.7m (€63.9m), despite finishing runner-up in 2010/11 compared to Champions in the previous year.

Matchday revenue increased slightly by £0.3m to £67.5m (€74.7m), with capacity average league home match attendances of 41,435 in 2010/11. Prolonged European and domestic cup campaigns are needed to increase matchday revenue, due to the capacity constraints at Stamford Bridge. Chelsea's average matchday revenue of £2.5m (€2.8m) in 2010/11 is significantly below that of Manchester United, who generated £3.7m (€4.1m) per home match, and Arsenal at £3.3m (€3.7m). With the Blues continuing to be amongst the lower half of Money League clubs in terms of average attendance, the club is currently exploring options to either redevelop Stamford Bridge or move to a new stadium.

Chelsea showed a small increase in commercial revenue of £0.4m (1%) to £56.7m (€62.8m). The club's commercial revenue is underpinned by shirt sponsorship and kit supply deals with Samsung and Adidas respectively. Chelsea complemented their commercial partnership portfolio by signing a six-year deal from 2011/12 with Right to Play, the international humanitarian charity, which will see the charity's logo appear on the Blues' Champions League shirts.

Significantly outperforming Arsenal in the Champions League and Premier League is fundamental to challenging for a top five Money League placing in the short term, whilst a sustained longer term challenge is dependent on addressing its stadium issues in order to drive higher matchday and commercial revenues.

7. AC Milan

![]()

AC Milan is the leading Italian club in the Money League, sitting one place above city rivals Internazionale in seventh place, after achieving revenues of €235.1m (£212.3m) in 2010/11. Milan won the Serie A title in 2010/11 for the 18th time, the first since 2003/04, and reached the Round of 16 in the Champions League for the second successive season, losing to Tottenham.

Broadcast revenue totalled €107.7m (£97.3m) 46% of total revenue. This was underpinned by the central distribution from the new Serie A collective broadcast deals, whilst the club enjoyed a small increase of €1.7m in UEFA distributions to €25.8m (£23.3m). If Milan are to improve on their broadcast revenue in 2011/12, and hence their short term position in the Money League, they will need to go further than the last 16 of the Champions League, the stage at which they have been eliminated in both 2009/10 and 2010/11.

Matchday revenue increased to €35.6m (£32.1m) even though the club played the same number of home matches (25) as the previous season. The Scudetto winning season drove a 10,800 increase in average home league match attendance to 53,600. Nonetheless, apart from Inter, AC Milan has the lowest matchday revenue of any club in the Money League top ten. Compared with the clubs above it in the Money League, the Rossoneri have less than half the matchday revenue of Chelsea and Bayern, and between €67m and €88m less than that of the other four clubs.

Commercial revenue also improved significantly in 2010/11 to €91.8m (£82.9m). This was driven by the first season of a shirt sponsorship deal with Emirates, worth a reported €12m per season, as well as several new partnership deals including those with Audi, Dolce&Gabbana, MSC Crociere and Taci Oil.

AC Milan remain comfortably in the top ten of the Money League, something that is unlikely to change in 2011/12. However, if the Rossoneri are to maintain or improve upon this position in the longer-term, addressing stadium issues in order to provide the platform for matchday and commercial revenue growth is crucial.

8. Internazionale

![]()

Internazionale leapfrog Liverpool to claim eighth position in this year's Money League. Despite winning the FIFA Club World Cup, the Coppa Italia and reaching the quarter-finals of the UEFA Champions League, Internazionale's revenues declined by €13.4m (6%) to €211.4m (£190.9m). Given the club's on-pitch success in 2009/10 and the adoption of the collective selling of broadcast rights in Italy in 2010/11, generating revenues similar to the prior year was always going to be a challenge. Inter finished runner-up to their city rivals AC Milan in Serie A and are also one place (€24.5m) below them in the Money League.

Broadcast revenue fell €13.5m (10%) to €124.4m (£112.3m). Like their city rivals and Juventus, Inter suffered financially as a result of the introduction of collective selling arrangements for broadcast rights in Serie A. Broadcast revenue contributed the second highest relative proportion of total revenue (58%) of any Money League club behind AS Roma (64%). The Nerazzurri's run to the quarter-finals of the Champions League saw them receive €38m (£34.3m) in central distributions from UEFA, down from the €49.2m earned in 2009/10.

Despite average home league attendance levels of 52,788, matchday revenue decreased by €5.7m (15%) to €32.9m (£29.7m), equivalent to €1.3m (£1.2m) per home match. Matchday revenue accounted for 16% of Inter's total, far below the club's European rivals – a weakness shared by each of the Italian Money League clubs. Since Italy's 2016 UEFA Euro bid was unsuccessful, no imminent plans have been announced to redevelop the San Siro, which may limit the ability of the club to grow matchday and commercial revenues in the immediate future.

Commercial revenue increased by €5.8m (12%) to €54.1m (£48.9m), as the club announced they would adopt a new sponsorship strategy which will reportedly see the number of commercial partners reduced from 60 to 25. The club's long-term agreements with Nike (as kit supplier) and Pirelli (shirt sponsor) generated revenues of c.€12m (£11m) each.

With broadcast revenue representing 58% of Inter's 2010/11 revenue, the challenge for the Nerazzurri, along with the other Italian Money League clubs, is to increase revenue from other sources to avoid being left behind by the European competition. In addition, the reduction in Champions League places available to Italian clubs from 2012/13 means that success in Serie A is of utmost importance to remain in contention for the Money League top ten.

9. Liverpool

![]()

Liverpool continue to slip down the Money League, dropping one place to ninth position, after the club experienced its first season without Champions League football since 2003/04. They are the only top ten Money League club that did not compete in Europe's top club competition in 2010/11.

The club's overall revenues fell slightly in sterling terms, although reductions in both matchday and broadcast revenue were almost completely offset by a £15.3m (25%) increase in commercial revenue to £77.4m (€85.7m).

Driving the commercial revenue increase was the new four-year shirt sponsorship deal with Standard Chartered Bank, one of the largest in European football at a reported £20m (€22m) per season, and an estimated £12.5m annual increase on the previous shirt deal with Carlsberg. This allowed Liverpool to strengthen its position as the second highest earning English club, behind Manchester United, from this source.

Liverpool will further increase its commercial revenues from 2012/13, with a new six-year kit deal with Warrior Sports, worth a reported £25m per year, replacing its current deal with Adidas.

Matchday revenue decreased by £2m (5%) to £40.9m (€45.3m) in 2010/11, despite the fact Liverpool played the same number of games at Anfield (27) as in the previous two seasons. The principal factor in this was the replacement of three Champions League matches with the same number of Europa League fixtures, which attracted lower attendances at reduced ticket prices.

Broadcast revenue experienced a significant drop of £14.2m (18%) to £65.3m (€72.3m), mainly due to a substantial reduction in distributions from UEFA of €26.3m to €6.1m (£5.5m). A further fall is likely in 2011/12 as the club failed to qualify for a European competition for the first time in more than a decade. The reduction in UEFA distributions in 2010/11 was partly offset by an increase in Premier League distribution payments, which, following the improved central deals, which resulted in Liverpool's distribution increasing from £48m to £55.2m (€61.1m).

Liverpool's owners, New England Sports Ventures, have invested in the playing squad since they acquired the club in October 2010 and, in the short-term, will need this to translate to improved on-pitch performance and qualification for the Champions League if it is to halt its slide down the Money League. The club needs European football each year to maintain its status in the Money League top ten in future editions. In the medium to longer term, the Warrior Sports deal will underpin further commercial revenue growth, whilst formulating a viable plan to either redevelop Anfield or move to a new home is key in driving matchday revenue increases.

10. Schalke 04

![]()

Schalke is the biggest climber in this year's Money League, with total revenues increasing by €62.6m (45%) to €202.4m (£182.8m). This was due to a Champions League campaign that saw the club reach the semi-finals of the competition, beating holders Internazionale along the way. A disappointing 14th place finish in the Bundesliga was in some part offset by the Royal Blues' success in lifting the German Cup, which will provide UEFA Europa League football in 2011/12.

The club's most successful European performance in their history saw them receive €39.8m (£35.9m) in UEFA distributions, helping broadcast revenues more than double, from €35.4m to €74.3m (£67.1m). Failure to secure Champions League qualification for 2011/12 will mean that this spike in broadcast revenue, which contributed 37% of the club's total, will not be repeated and Schalke will drop back out of the top ten in next year's Money League.

The main proportion of Schalke's revenue came from commercial sources (45%), which increased by €11.9m (15%) to €90.9m (£82.1m). This level of commercial revenue, the fifth highest in the Money League, is underpinned by a long-term partnership with sports rights agency Infront Germany. This relationship with Schalke includes the marketing of the stadium for sports and entertainment events, as well as perimeter advertising sales, as part of a long term plan to maximise revenues from the use of the Veltins Arena. The multi-purpose venue has been used to host boxing, biathlon events, ice hockey and concerts.

Matchday revenue grew by €11.8m (46%) to €37.2m (£33.6m). The club once again sold out the 61,673 capacity Veltins Arena for most matches and the run in the Champions League provided an additional six home matches. Average revenue of €1.6m (£1.4m) per match, is still only around half the €3.1m (£2.8m) of Bundesliga rivals Bayern Munich.

Looking to the future, Schalke have recently extended their partnership with Gazprom for a further five years, reportedly worth c.€75m (£67.7m), through to the 2017/18 season. Coupled with the long-term kit sponsorship deal with Adidas, as well as commercial partners including Volkswagen and Ergo, this should see a sustained level of commercial revenue in future years.

The club's failure to qualify for the Champions League football in 2011/12 means that the club will not be able to maintain their lofty position in the Money League. However, Schalke have made a promising start to the 2011/12 Bundesliga season, and have progressed to the knock-out stage of the Europa League.

To read this report in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.