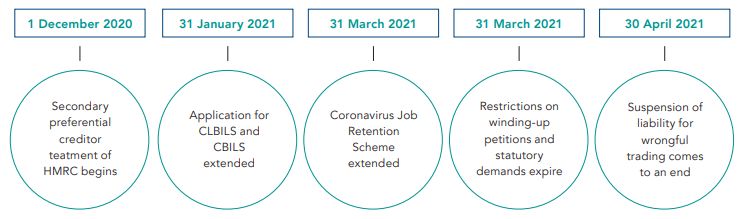

Timeline for Government's extended measures

- Secondary preferential creditor status of HMRC: HMRC becomes a secondary preferential creditor for PAYE, VAT, Construction Industry Scheme deductions, Employee National Insurance Contributions and student loan repayments in insolvencies commencing on or after 1 December 2020.

- Restrictions on winding-up petitions and statutory demands: the current restrictions on the presentation of winding-up petitions and the service of statutory demands where Covid-19 is the reason for the worsened position have been extended and will now expire on 31 March 2021.

- CBILS and CLBILS new applications: Coronavirus Business Interruption Loan Scheme and Coronavirus Large Business Interruption Loan Scheme have been extended further until 31 January 2021. These schemes were put in place to support businesses in the short to medium term where they suffer lost revenue and/or cashflow disruption due to Covid-19. The loans are administered by the British Business Bank, with funding being provided by a range of lenders which will have security in the form of a Government guarantee.

- CJRS: the Coronavirus Job Retention Scheme, which was due to come to an end on 31 October 2020, has been extended until 31 March 2021. The Job Support Scheme which the Government had intended to replace the CJRS has been postponed. Under the extended scheme, employers can claim 80% of employees' salaries. There is no requirement to have used the CJRS scheme before to be eligible under the extended scheme, and there is no limit on the number of employees who can be furloughed.

- Suspension of liability for wrongful trading: the Corporate Insolvency and Governance Act 2020 (Coronavirus) (Suspension of Liability for Wrongful Trading and Extension of Relevant Period) Regulations 2020 ("Regulations") have, once again, temporarily suspended directors' liability under the wrongful trading provisions of the Insolvency Act 1986. The Regulations have exactly the same impact as the suspension of liability for wrongful trading that was brought into force by the Corporate Insolvency and Governance Act 2020 (the "Act"), which came to an end on 30 September 2020. We discussed this measure in our previous blog post, link here. Unlike the other temporary measures under the Act, which were extended to 31 December 2020, the original suspension of liability for wrongful trading introduced by the Act was not extended. The new suspension introduced by the Regulations is only effective from 26 November 2020 until 30 April 2021. Interestingly, the Regulations do not have retrospective effect and it would appear that decisions and actions taken by directors during the period between 30 September 2020 and 26 November 2020 would be subject to the ordinary wrongful trading provisions under insolvency laws.

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe - Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.