Newgate Compliance Managing Director, Matthew Hazell, outlines the steps investment firms need to take in order to prepare for the new UK prudential regime. This article forms part of our IFPR readiness series.

The Financial Conduct Authority (FCA) is introducing a new streamlined UK Investment Firm Prudential Regime (IFPR) for investment firms authorised under the Markets in Financial Instruments Directive (MiFID) which will come into force on 1 January 2022.

IMPACT OF THE IFPR

The new regime will have a significant impact on the prudential requirements that apply to many investment firms, including collective portfolio management investment firms, and will particularly impact firms that are part of a UK company group structure.

HOW TO PREPARE

Firms should assess their classification under the new regime and, where applicable, comply with new requirements including:

- increased minimum capital requirement;

- consolidated reporting required for firms part of UK group companies;

- new public disclosure requirements and quarterly returns due on the FCA's RegData system;

- enhanced governance and remuneration requirements;

- implementation of a new Internal Capital Adequacy and Risk Assessment (ICARA) process to replace ICAAP; and

- implementation of new policies e.g. remuneration, disclosure and prudential policies.

DETERMINE YOUR FIRM'S CLASSIFICATION

The first step is to determine which prudential category your firm falls into. Firms will no longer be classified as Exempt CAD, BIPRU or IFPRU firms under the new regime. There are two types of investment firms under IFPR:

- 'Small and non-inter connected' (SNI); or

- firms that are not SNIs (Non-SNI).

SNI firms are those whose activities fall below the following thresholds in the table below. Firms operating above these thresholds or who deal on their own account and/or hold client money and/or safeguarding client assets will be deemed to be Non-SNIs

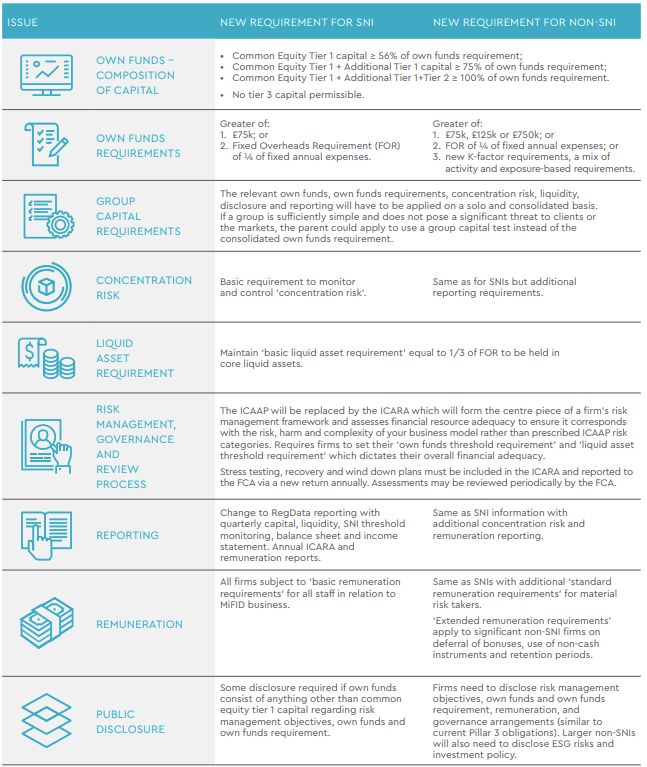

UNDERSTAND THE IMPACT TO YOUR FIRM

The new requirements will apply differently to SNIs and Non-SNIs. A summary of requirements is set out below:

NEXT STEPS

Firms should start familiarising themselves with the proposed IFPR changes and starting planning on how to meet the new requirements.

HOW CAN NEWGATE HELP?

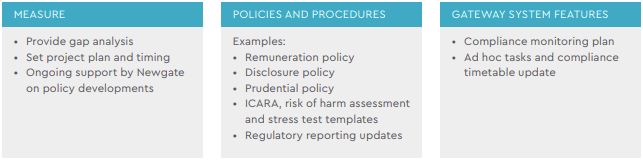

Newgate have developed a readiness assessment to undertake a gap analysis of a firm's systems and controls against the requirements identifying any remediation actions to be undertaken.

We have developed an enhanced compliance framework on our proprietary compliance system "GATEway" that encompasses updated polices, assessment documents and the compliance monitoring plan to ensure these changes are considered and complied with on an ongoing basis.

Newgate's IFPR readiness package includes:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.