EDITOR'S NOTE

Just when we thought we might be witnessing some sustained growth in the economy, the world comes crashing down around our ears again. Industrial output is negative, job creation is negative and our high street banks are in danger of being sued by the US Government.

So, where to now for pensions and related benefits?

I say, revisit the fundamentals. If we believe that history as it relates to economic cycles will broadly replicate itself, then we know that over the longer term equities will outperform the three other major asset classes: cash, bonds and property. Therefore no matter how tough the current economic climate, it should not alter long-term investment/retirement advice.

I have to say I get particularly concerned when I see headlines across the media to the effect that the value of pensions has been wiped out because stock markets have tumbled around the world. Yes, it is true to say at that point in time the value of assets held within pension funds may have diminished, but unless a crystallisation event is occurring at the same time it is broadly irrelevant and serves only to frighten the ill-informed.

The real concern should exist in relation to the effect the weak economy will have on employers, particularly those sponsoring defined benefit pension arrangements. In this instance, it will be for the trustees to determine the quality of the employer covenant which will be of a more pressing nature.

Continuing the theme of where the real problems are to be found, a recent survey conducted by Swiss Re has revealed that the average UK defined benefit pension fund is 10% underfunded for longevity risk. This shortfall has been worsened by the Government and professional bodies underestimating how long people will live, as a result of which most schemes now have larger than expected liabilities. Isn't it strange that we haven't seen this in the headlines, given that this is a deficit that won't bounce back as equities usually do?

Further, an interim report from the Association of Consulting Actuaries has revealed that more than 25% of employers are unaware of the starting date for autoenrolment, with 75% admitting they haven't budgeted for such changes.

So for the avoidance of doubt, between 2012 and 2016 every employer has a duty to designate a qualifying workplace pension scheme into which it will automatically enrol all of its qualifying workers and make contributions on their behalf.

No employer is exempt from this requirement and the choice it now faces is which pension scheme or schemes to use to comply with the new regulations. Even if the employer has an existing workplace pension scheme, it will require reviewing to ensure it complies with the new regulations.

Your company's auto-enrolment staging date may well be some way off but the time for planning is now. Failure to do so could leave your company exposed to financial and other risks.

I do hope you find some helpful and interesting reading in this issue of Employee benefits review .

NEW TO THE WORKPLACE THIS AUTUMN - AGENCY WORKERS REGULATIONS

By Ian Luck

Ian Luck discusses the arrival of the Agency Workers Regulations and the impact on both employers and agencies.

From October 2011 the Agency Workers Regulations 2010 (AWR) come into force. The AWR implement the Temporary and Agency Workers Directive approved by the European Parliament in 2008. Agency workers in the UK who have worked for a company for more than 12 weeks will have the same basic employment rights and working conditions as if they had been recruited directly by the company.

From the first day of an agency worker's employment, employers must ensure the agency worker has access to amenities like the canteen, childcare facilities, transport services and job vacancies, just as any permanent member of staff would have. Pregnant agency workers will also be allowed to take paid leave for ante-natal appointments during an assignment.

After 12 weeks in the same job, the new equal treatment entitlements relate to pay and other basic working conditions, such as annual leave, overtime, night work and rest periods. The definition of pay is wide and covers holiday pay, paid bank holidays, overtime rates, shift allowances, unsocial hour premiums and bonuses related to performance.

While some liability will lie with recruitment agencies, which will face increased payroll and administration costs, together with a potential rise in tribunal claims, ill-prepared employers could also face a rise in costs.

Employers who hire workers through agencies will have to provide the agency with up-to-date information on terms and conditions so they can ensure that an agency worker receives the equal treatment they will be entitled to. Agencies are responsible for monitoring and ensuring that both the agency worker and hirer are kept informed of any changes to the pay and basic working entitlements after the 12-week qualifying period.

The hirer would be liable if they do not provide the agency worker with 'day one' rights, but both the hirer and the agency could be held liable for pay and conditions breaches after 12 weeks.

Agency workers will also be included within the pension auto-enrolment regulations that are being introduced with effect from October 2012.

The AWR are backed by a range of antiavoidance measures to prevent employers from breaking the new rules. Recourse for agency workers through a compensation order via an employment tribunal can be had if a complaint is upheld. In cases where avoidance of the new AWR is found an additional £5,000 may be fined.

There have been many ideas as to how an employer could reduce the impact of the AWR, including limiting the use of agency workers for assignments to a period of fewer than 12 weeks. There are, however, the previously mentioned antiavoidance provisions that address situations where it is deemed that assignments are designed deliberately to deprive agency workers of their entitlements.

Negotiating exclusivity deals with agencies in exchange for them agreeing to absorb some of the additional costs is another way employers could reduce the impact of the AWR. With most employers using agency workers from time to time it would seem prudent that these negotiations start soon.

Guidance notes issued by the Government can be found on the department for business innovation and skill's website: www.bis.gov.uk

ARE YOU READY TO TAKE THE STAGE?

By Julia Ridger

With new employer duties coming into effect soon, is your company prepared for workplace pensions reform?

The Pensions Regulator's detailed guidance on workplace pensions reform has now been published. It provides clarification on how the working population is classified under the new legislation, the new employer duties and guidance on the steps an employer can take to prepare.

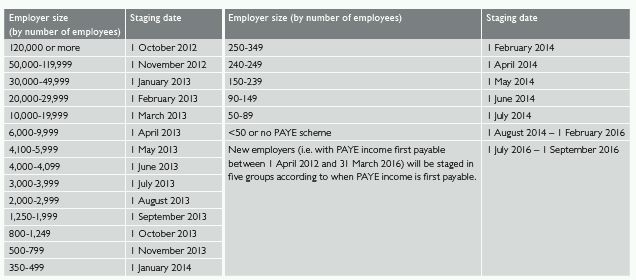

New employer duties and safeguards come into effect from 1 October 2012. Each employer will be allocated a date from when these new duties will apply, known as their 'staging date'.

The table below provides details of the relevant staging dates for different sized companies. The staging date is dependent on the number of people in the employer's largest pay as you earn (PAYE) scheme as at 1 April 2012. If you have more than one PAYE scheme then the staging date will be that of the largest employer. The number of employees in the PAYE scheme may well change between 1 April 2012 and the staging date, however the staging date will not be affected regardless of the change in size of the company.

The Pensions Regulator will contact each employer 12 months prior to the staging date to inform it of its duty to comply with the auto-enrolment laws.

Having looked at the table you may well see that your staging date is a long way off, say mid to late 2013, and think no action is required for some time. However, that is only around 24 months away and, considering you will hear from the Pensions Regulator 12 months before that, it will come round before you know it.

It's imperative now to at least consider the implications of workplace pensions reform, by taking a view of the likely make up of the workforce at your staging date and ascertaining the potential costs to the business if all eligible employees are automatically enrolled.

Careful consideration also needs to be made as to whether any existing pension arrangement meets the minimum requirements, in particular whether all eligible workers can enter the existing arrangement, and whether this has an impact on the structure and pricing of the current scheme. We believe the annual management charge for existing schemes held with insurers will be adversely affected if additional members enter the scheme as the average annual contribution is likely to be reduced.

Employers also need to start assessing how best to communicate the changes to employees. Recent market research from Legal & General identified that employees were heavily in favour of postal communication, and this will need to be well designed and written to ensure that the workforce take note of it.

These are just the first key steps employers need to think about to ensure that workplace pensions reform is successfully delivered on reaching their staging date.

In our next issue we will look in more detail at identifying the different categories of workers and the steps the employer must take for each. We also touch on whether the National Employment Savings Trust is the most appropriate arrangement for some employers to use or whether an employer-sponsored master trust or grouped personal pension plan would be the best approach.

PENSION SCHEME DEFICITS - A CORPORATE NEMESIS

By Julia Ridger and Peter Maher

Pension scheme deficits are often at the centre of restructuring negotiations. We discuss the issues.

Recent corporate activity such as that surrounding Uniq (formerly Unigate), Cattles Plc and Aquascutum, along with court judgments such as Bloom & Ors v The Pensions Regulator (2010), have shown that defined benefit pension schemes are often at the centre of restructuring discussions and that pension trustees and the Pensions Regulator are key players in this arena.

Contributory factors

Many companies remain responsible for substantial pension liabilities, even when the build up of new benefits under the scheme has long since ceased. There are numerous factors that have contributed to the prominence of pension scheme deficits. Increased regulation, together with the Pension Protection Fund (PPF) levy (based on the strength of the employer covenant), has escalated the cost of funding a defined benefit pension scheme. The volatility of equity markets continues to exacerbate funding deficits and the increase in liabilities under schemes from longer member life expectancy has also had a negative effect on the funding positions of such schemes.

Pension debt due by an employer on insolvency is calculated on an annuitised buy-out basis. This involves calculating the cost of buying out the pension scheme liabilities with an appropriate provider, either an insurance company or a noninsurance company. The latter are not subject to the same regulatory regime as the former and so are free to use different structures, although this carries its own risks. The cost of taking on pension scheme deficits is normally quite high as conservative assumptions are used in valuing liabilities. Alternative investment strategies and funding methods for the scheme are not considered.

Moral hazard/anti-avoidance Powers

Another matter which must be considered in all corporate restructurings is whether the Pensions Regulator could view it as an excuse to abandon the pension scheme liabilities and 'dump' the scheme into the PPF. If this is the case then, under its so-called 'anti-avoidance powers', the Regulator can impose a liability for pension scheme funding on companies and/or the directors of companies 'associated' or 'connected' with the sponsoring employer. A financial support direction and/or contribution notice is issued by the Regulator for settlement and can be imposed even if the associated company has never participated in the pension scheme.

Early compromise

Employers and trustees should always consult at an early stage when it becomes evident the employer's covenant is weakening. The Pensions Regulator should be included in the discussions from the outset as it may be possible to obtain a compromise over the pension deficit, thereby perhaps saving the employer from insolvency and enabling a rescue plan. There must, however, be buy-in from all parties. If, in the initial restructuring discussions, the employer is granted clearance from the Regulator, then although the clearance statement will not give the transaction approval, it will give assurance that the Regulator will not use its anti-avoidance powers in relation to it.

If it can be demonstrated that the outcome of a consensual restructuring will be better than formal insolvency, by allowing the company to survive and so preserving greater value, then the Regulator may agree to the transfer of the scheme to PPF control. This leaves the employer in a better position to meet its commitments to other creditors. Solutions of this kind may not work for every situation, but can have measurable benefits for protecting businesses and jobs if adopted successfully.

An additional factor which may increase the burden of pension schemes on employers is the ongoing running cost. This could easily be reduced by reviewing the adviser's/administrator's costs and by looking at methods of matching a proportion of the liabilities held within the scheme in the form of an annuity buy-in.

EQUALISATION OF NORMAL RETIREMENT DATES – A DONE DEAL?

By Michael Jones

Michael M Jones of Charles Russell LLP discusses the need for employers with defined benefit pension arrangements to double check their equalisation compliance position.

On 17 May 1990 the European Court issued the Barber decision. It held that equal pay as between males and females applied also to occupational pension schemes. Further European cases between 1993 and 1994 clarified matters.

Barber is still relevant today because employers with defined benefit pension schemes are finding to their cost that their previous attempt to equalise may not be valid.

The Barber decision impacted on pension schemes that had sex-based normal retirement dates (NRDs), such as 65 for males and 60 for females. As a result of the decision, from 17 May 1990 until the scheme actually equalised its NRD (the ' Barber window'), the disadvantaged sex (usually the male) was to have the benefit of the lower NRD (i.e. 60).

In practical terms this meant that scheme rules would need to allow males and females to retire without needing consent from age 60. It also meant that any actuarial reduction on early retirement had to be based on the lower NRD of 60 for benefits accrued during the Barber window.

Most pension schemes sought to close their own Barber window between 1993 and 1995. This was often done via an announcement with an amending deed being produced at a subsequent date.

The issue is still a live one today because for many pension schemes issuing announcements alone was not a valid way to amend the scheme. Such schemes required deeds, written resolutions or other formal procedures to validly amend their terms. Therefore, it was not until the formal amendment procedure was complied with, often years later, that the change took effect.

While many pension schemes sought to get around this time gap by making retrospective amendments, recent case law has clarified that benefits granted by European law cannot be amended retrospectively. This means that retrospective equalisation amendments are likely to only be valid from the date of agreement, not from any earlier date specified.

This can result in employers finding that they have a hidden material liability sitting in their pension scheme which hits their balance sheet. Recent cases have inspired some employers to open the bonnet of their pension scheme to look inside. Other employers are looking to de-risk their schemes and move the assets into buy-in contracts. This benefit review procedure can lead to the discovery of a problem with the equalisation process.

In most cases employers with active or historical defined benefit pension arrangements should check their equalisation compliance position. In many instances they will find their position is compliant. However, this is not necessarily the case, and the position may at least require further investigation. The problem will not go away and, in extreme cases, where the Barber window has never validly been closed, inattention will ultimately only increase the employer's liability. In this case, forewarned is forearmed.

ARE YOU PAYING TOO MUCH FOR YOUR ADMINISTRATION?

By Ken Burfitt

Ken Burfitt explains how closing a defined benefit pension scheme is not the end of the story; ongoing administration costs and services should be carefully monitored.

Many defined benefits arrangements have already closed to future accrual and many more are currently going through the same process. Once the consultations are complete, the member communications finished and the documentation executed you can relax; at last the scheme has been successfully closed – but should that really be the end of the process?

Talk from your consultant quickly turns to de-risking and the eventual winding up of the scheme. The asset mix also needs to be considered to better match its newly closed status. However, there is another step that many boards of trustees and their advisers (who are sometimes also their administrators) forget to take.

Did you ask your administrator to reduce their standard charges now that the scheme has closed?

Several of the normal administration processes become significantly simpler once a scheme has closed to future accrual and the members' preserved entitlements have been established. Now is the time to take steps to ensure that any historical benefit quirks are sorted out and, where possible, simplified. Once you have done that, it's time to consider how to save money by managing the scheme administration more effectively.

Mercers, one of the leading administrators in this market, recently commented: "As more and more occupational defined benefit schemes are closing to new members and future pension accrual, it naturally follows that the cost of delivering the administration services to the scheme reduces as the need for managing ongoing data interfaces and benefit statement information falls away. In our experience we would see the charges for this element of the population reduce by between 10% and 30%."

Smith & Williamson does not offer a defined benefit pension administration service to its clients. As a result, our employee benefits consultants can review third-party administrator services without any vested interest.

Our pension audit team regularly visit and review pension schemes and come across most administrators along the way, so we are well placed to get up-to-date feedback on what works and what doesn't in the administration world.

Our consultants can help you to realise significant savings by comparing current administration services against those that are actually required for the proper operation of a closed scheme. Such a review focuses minds on what is 'nice to have' and what is actually necessary in a newly closed scheme.

Once the required administration services have been agreed, we can help you by comparing your current services and costs against other leading providers. Often this results in a more streamlined service with an appropriate cost reduction from the holding administrator, but there will be times when a change of provider will be needed.

A number of specialist administration providers now offer a high-quality service aimed specifically at closed schemes. Our benchmarking facility can help match trustees with quality administrators who view your scheme as attractive new business. Their service will routinely include the management of the data handover and liaison with your former administrator to facilitate a smooth transfer.

RAISING AWARENESS - GROUP INCOME PROTECTION INSURANCE

By Matthew Haswell

Matt Haswell looks at the potential of group income protection schemes to protect the workforce and alleviate pressure on the welfare budget.

DEMOS recommendations

The independent think tank, DEMOS, cites public services and welfare as one of the themes upon which its work has focused in recent years. As a part of its Progressive Conservatism project, chaired by David Willetts MP, DEMOS has teamed up with UNUM, a leading provider of income protection insurance in the UK, to investigate incapacity welfare provision in the UK.

DEMOS embarked on this research specifically to address "...two interlinked deficiencies in public policy: the inadequacy of welfare coverage in protecting the squeezed middle when they are unable to work, and the huge cost to the taxpayer of disability benefits".

This rare venture between think tank and insurer has resulted in a report "of mutual benefit" which includes the following recommendations.

Reform statutory sick pay

It is recommended that compulsion should be introduced and all employers be required to insure their employees against sickness, ill health or injury so that the insurance company rather than the employers themselves, will be responsible for paying statutory sick pay (SSP).

Employer incentive

It is proposed that employers make payments to employees towards the cost of purchasing their own income protection insurance, for example a suggested incentive of £100 per policy.

Build the market

This can be assisted by Government subsidising income protection policies for public sector employees and sharing the cost of national insurance rebate available with employers who choose to subsidise coverage for their workforce.

Reform the £16,000 savings means test

The current means test forces those who become unemployed to spend any savings above £16,000 before receiving any state assistance. It suggested that this is counterproductive, causes anger and resentment and should be replaced by a system whereby savings are left untouched by the state for the first six months of absence from work/unemployment. The important role of income protection insurance is a constant theme of this report.

Income protection insurance

Income protection insurance is an insurance policy which will pay an individual a percentage of their salary in the event that they are unable to work due to accident, illness or injury after a defined period of absence (usually six months).

While it may seem to make sense to insure one's salary, research from the Association of British Insurers (ABI) shows that only 9.4% of UK workers have income protection insurance and fewer then one in ten private sector employees benefit from such cover.

This is in contrast to other insurances. As per ABI: 34% of households have life insurance, 23% of cat and dog owners insure their pets, 78% of households have home contents insurance and according to the Home Office 63% of homeowners have buildings insurance.

The gap between taking out income protection insurance and other insurances is due to several factors:

- lack of interest – an "it won't happen to me" mentality

- perceived high cost of purchasing such insurance

- a basic lack of awareness of the need for or the availability of the solution.

Group income protection schemes

According to Swiss Re, only approximately 1.8 million employees are covered by employer-sponsored group income protection schemes. This is not surprising as companies are only required to offer SSP for 28 weeks. Many employers that do have such group income protection schemes only open them up to senior staff, leaving much of the workforce without insurance.

The Government welfare budget has expanded greatly over the last decade, 45% in real terms according to Charles River Associates. As such the Government is keen to push responsibility for financial protection back to the individual or indeed the employer.

UNUM commenced a marketing campaign in June this year to raise awareness among employees with no income protection. This includes a media partnership with the Guardian, including guardian.co.uk, and activities in social media. Later this year it will also commence a TV advertising campaign which will obviously reach a large audience. UNUM's CEO, Jack McGarry, stated: "our goal is to get UK employees to understand why everybody needs a backup plan and to start conversations about it with their employers and colleagues."

To date this kind of marketing has not been seen in this area; it will be interesting to gauge its results and see how many employers face queries regarding income protection schemes from their staff. It would be sensible for employers to prepare for questions if they do not currently sponsor income protection schemes for their employees, and to be ready to promote their schemes if they do.

Group income protection schemes are available in various forms with many options available in terms of features and levels of insurance with corresponding premium costs.

TAX EFFECTIVE REMUNERATION – NOT WHAT IT USED TO BE

By Martyn Cross

Tailoring remuneration packages to suit the individual is becoming increasingly important in light of recent legislative changes.

With the higher rate of income tax at 50% and national insurance contributions for both employees and employers increasing by 1% in April 2011, reducing the tax burden on executive remuneration is becoming even more important. Yet recent legislative changes have made many of the ways remuneration was paid in the past far less tax effective, and even penal in certain executives' circumstances.

While there are still tax effective schemes available to companies to reward their employees, increasingly, tailoring the remuneration package to suit the personal situation of the individual is the best way to provide tax efficient remuneration to executives and key employees. Once established, it is important to ensure that the employee or executive appreciates its true value.

The practical effects of the tax raising measures effective since April 2011 are beginning to be felt and providing remuneration packages that reward, motivate and retain key employees and executives is becoming increasingly difficult. The loss of an individual's personal allowance can mean that any employees earning over £100,000 effectively suffer 62% deductions on their income until it exceeds £114,950. Those whose earnings exceed £150,000 lose 52% in deductions from each additional £1 earned.

Yet at the time they are most needed, tax and national insurance effective schemes, such as employee benefit trusts and employer-funded retirement benefit schemes, have lost many of their advantages. Even pensions, while still tax effective for some, for others, once the impact of the new annual allowance and life time allowance changes are assessed, can be very tax ineffective given an individual's pension entitlement.

In light of these issues the use of executive counselling services is becoming increasingly popular. These ensure that key employees and directors get the most from the benefits they are paid and help them to give their personal affairs the same attention as that given to company matters.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.