Issues affecting all schemes

Cyber security – Capita incident

The Pensions Regulator has published a statement on the recent cyber security incident experienced by Capita. The statement notes that it is now known that some data has been stolen during the incident and schemes that use Capita's services should check whether their data could be affected. The statement also covers:

- Communicating with members about the incident.

- Monitoring increased or unusual transfer requests.

- Data protection breach notification obligations.

- The importance of robust cyber security and business continuity plans.

The Information Commissioner's Office has also published a statement encouraging organisations that use Capita's services to determine if the personal data they hold has been affected and reminding them of their data breach reporting obligations.

For more information, please see our legal update.

Action

If they have not done so already, trustees of schemes that use Capita's services should contact Capita as a matter of urgency to establish whether their data is affected. If personal data under their control has been affected, trustees should establish and comply with their data breach notification obligations. More generally, all trustees, whether or not they use Capita's services, should ensure they are complying with the security requirements of UK data protection legislation and are taking all reasonable steps to prevent cyber attacks.

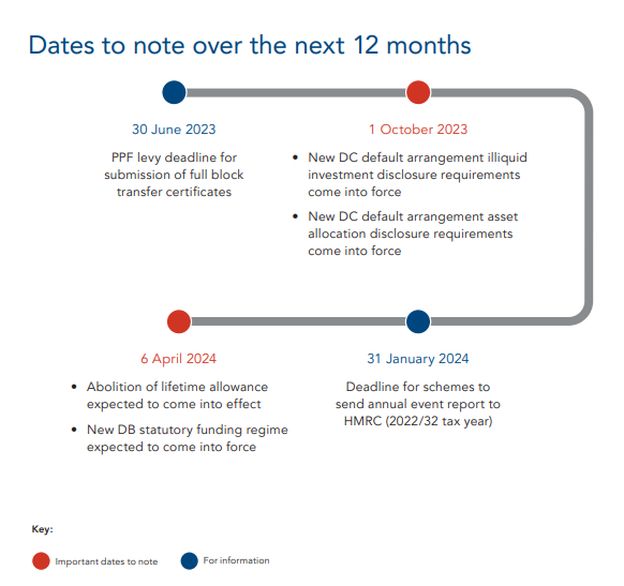

Pensions dashboards – Revised connection deadline

Draft regulations have been laid before Parliament for approval that replace the statutory staging timetable for connection to the dashboards ecosystem with a single connection deadline for all schemes of 31 October 2026. The government has separately announced that a revised staging timetable will be published in guidance. The regulations also change the date to be used for the purposes of determining whether a scheme is subject to the dashboards requirements from the scheme year end date falling between 1 April 2020 and 31 March 2021 to the scheme year end date falling between 1 April 2023 and 31 March 2024. For more information, please see our legal update.

Legislation has also received Royal Assent that prohibits trustees from being indemnified out of scheme assets in respect of civil penalties imposed under the pensions dashboards legislation.

In addition, the Pensions Dashboards Programme has published FAQs on data matching. The FAQs cover:

- The importance of developing an approach to matching.

- What happens if a member doesn't have a National Insurance (NI) number.

- Examples of match criteria that don't use an NI number.

- What a possible match is and why it is important.

- The approach in the recently published Pensions Administration Standards Association guidance to choosing possible match criteria.

- Examples of possible match criteria.

Action

Trustees and administrators should continue with their dashboards preparation while awaiting further announcements on the guidance setting out the revised staging timetable. They may find the FAQs helpful when considering data matching.

ESG – Pensions Regulator initiative

The Pensions Regulator has published a blog post on ESG which provides more detail on its regulatory initiative in relation to statements of investment principles (SIPs) and implementation statements. The initiative will have two phases:

- The Regulator will check that all trustees who are required to do so have published their SIPs and implementation statements on a publicly available website. Where schemes have not published their SIPs or implementation statements correctly, the Regulator will contact the trustees to ensure they do so.

- This autumn, the Regulator will carry out a review of a cross-section of SIPs and implementation statements. This will be a qualitative review and will only look at the climate, ESG and wider sustainability-related provisions included in those documents. The Regulator expects to focus on the extent to which the government's July 2022 guidance on preparing SIPs and implementation statements has been followed by trustees. The outcome of the review will be shared with the industry to highlight good practice.

Action

No action required.

Transfer delays – mitigation of loss

The Pensions Ombudsman has decided that where a transfer value had reduced following a delay in processing the transfer, but the price of the units in which the transfer payment was then invested had also fallen, the transferring scheme could not rely on the fall in the unit price to mitigate the loss caused by the reduction in the transfer value.

Action

No action required.

Issues affecting DB schemes

Automatic enrolment – alternative quality requirements

The government has published a call for evidence on the operation of the automatic enrolment alternative quality requirements for DB and hybrid schemes as part of its triennial statutory review of those requirements. The call for evidence closes on 19 June 2023.

Action

Trustees and employers of DB and hybrid schemes that are being used for automatic enrolment should keep the progress of the call for evidence under review.

Sponsoring employer distress – Pensions Regulator guidance

The Pensions Regulator has refreshed its 2020 guidance on protecting DB schemes from sponsoring employer distress. The guidance's content is largely unchanged and the key points continue to include the following:

- Trustees should adopt a fully documented integrated risk management (IRM) approach, with workable contingency plans and suitable triggers in place.

- Practising IRM will highlight problems early on, and the sooner trustees act, the greater the prospects of protecting the scheme's position. Trustees should regularly review their risk management and governance procedures to make sure they are fit for purpose.

- Engaging regularly with the employer and with other creditors (where applicable) will help trustees to identify and manage key risks early on.

- If trustees delay putting robust scheme protections in place, other stakeholders, such as lenders, will be in a better position to exert control over and extract value from a distressed employer, potentially to the detriment of the scheme.

- Trustees should remain alert to pensions scams or unusual transfer activity and prepare a communications strategy to support members when they are facing uncertainty.

- If an employer is facing the prospect of insolvency, trustees should refer to the Pension Protection Fund's contingency planning guidance for employer insolvency.

The Regulator has also published a blog post on the refreshed guidance. The post urges trustees to revisit the guidance and highlights the importance of trustees:

- Having appropriate covenant monitoring in place as part of their IRM framework.

- Engaging with the Regulator and other key stakeholders at an early stage if their sponsoring employer is demonstrating signs of stress or distress.

Action

No action required, but trustees may find the guidance helpful if they encounter circumstances of sponsoring employer distress. Generally, this refreshed guidance is a reminder of the need for trustees to have in place processes such as written information sharing protocols and covenant monitoring so there is regular engagement with the employer.

Click here to continue reading . . .

Originally Published May 2023.

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2023. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.