Our regular assessment of the current state of the profitability of British business and the economic factors influencing its prospects for the future, prepared by Roger Bootle, Economic Adviser to Deloitte.

- Profitability began to deteriorate last year, but the effects of the recession are now more clearly taking their toll. Although the near-term outlook for the economy has recently improved, I doubt that it will be growing at rates consistent with rising profits until 2011 or even 2012.

- The fall in profitability in the oil sector seen in Q1 should be short-lived, given the rise in oil prices over the past few months. But there are no such hopes for the non-oil sector. Admittedly, the fall in manufacturing profitability largely just reversed Q4's rise. But the sharp fall in services profitability from 15.8% to 13.8% took it to its lowest level since 1993. I expect both to fall further in the coming months.

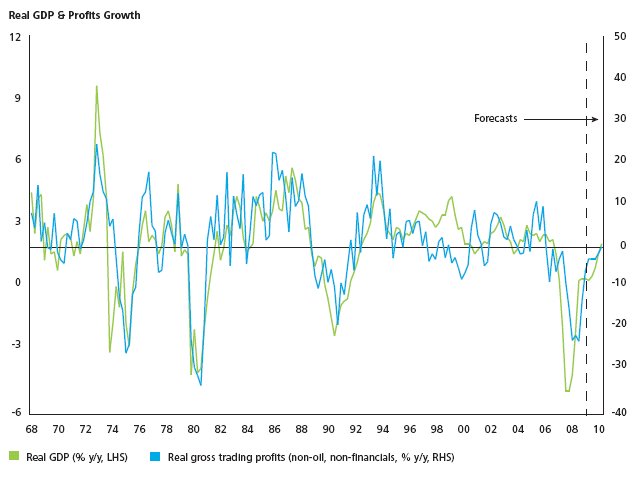

- Admittedly, profits growth tends to trough at about the same time as overall GDP growth. Given that the 2.4% drop in GDP in Q1 looks likely to have marked the sharpest rate of contraction during this recession, the biggest falls in profits may also have already been seen.

- What's more, the increased flexibility of the labour market has given firms greater scope than in previous recessions to cut labour costs by reducing hours worked and average earnings, rather than just by reducing headcounts. Indeed, so far profits have dropped by less than their previous relationship with GDP would suggest. Accordingly, my previous forecast for a 25% drop in profits this year now looks overly pessimistic. I think that a fall of around 15% now looks more likely.

- But this would still deal a severe blow to the corporate sector's finances. What's more, even if the economy is now growing again, it is not yet growing at the rates that in the past have been consistent with rises in profits. As the Chart shows, real GDP generally needs to grow by around 2% per annum in order to generate increases in profits. This reflects the fact that a large proportion of companies' costs (such as wages) tend to rise in real terms, even if revenues are rising more slowly or are falling.

- Of course, if the economic indicators continue to improve at their recent rates, it will not be long before they are consistent with GDP growth of 2% or so. However, I think it more likely that the recent recovery starts to peter out, as a number of factors – including weak bank lending, a deteriorating labour market and tighter fiscal policy – constrain economic growth.

- Indeed, although I now expect the economy to grow next year, it is set to be a pretty paltry expansion of around 0.5%. Even in 2011, I think the economy will grow by just 1.5%. If I am right, profits might not even start to rise until 2012.

- Further falls in total profits will continue to mask very different experiences amongst different sectors. One of the biggest drivers of individual sector performance is set to be the performance of the sterling exchange rate.

- The recent appreciation in the pound – of around 15% on a trade-weighted basis – has eroded some of the previous increase in the competitive position of the UK's net export sector. However, the pound remains some 20% down on its peak in 2007. I still expect exports to perform well in the medium-term, while UK manufacturing more generally should benefit from firms and households buying goods produced domestically, rather than abroad.

- What's more, the recent appreciation has had some positive impact by relieving some of the pressure on import-intensive sectors, such as clothing retailers. After all, weak consumer demand is set to make it very hard for retailers to pass on higher costs in the coming months.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.