INVESTMENT REVIEW - SLOWING GROWTH WEIGHS ON MARKETS

April brought further gains in global stock markets, despite evidence of slowing growth in the UK, China and Europe, prompting bond yields to resume their downward trajectory.

UK

The Chancellor George Osborne was handed some positive news for a change as first quarter GDP came in at 0.3%, beating expectation but failing to excite equity markets. The figures mean that GDP is back to the level it was at the start of 2007, but remains around 2.5% below its prior peak level. More encouraging was the 0.6% rise in services output, which accounts for around 70% of UK GDP. The continued decline in real wages has weighed heavily on consumption and remains a key piece in the UK's 'productivity puzzle' - the fact that output has fallen, even though employment growth has remained relatively robust. Firms have continued to hire at low wages, taking on more (but not necessarily more productive) workers than they would ordinarily need. Combine this with the 15% decline in business investment from the pre-recession high and disappointing export performance, and we can begin to see where the UK's lack of growth originates.

The key question for markets now is whether the growth figures are sufficiently weak to bounce the MPC into action with further quantitative easing. While there is certainly scope for more monetary stimulus, we don't expect the Bank of England to restart its asset purchase programme until the new governor Mark Carney takes over on 1 July. What Mr Carney has in store remains to be seen, but Mr Osborne has paved the way for his arrival by publishing a new and more flexible mandate for the Bank's Monetary Policy Committee. Further monetary stimulus in some form is likely. However, investors expecting a massive programme similar to that promised in Japan are likely to be disappointed. The prospect of slower growth meanwhile pushed up bond prices and sent bond yields back to their levels of last summer. UK equity markets eked out a small positive total return. The outperformance of defensive sectors in the first three months of the year suggests that while appetite for risk may have begun to pick up, investors are only dipping their toes in the shallower end of the risk pool.

US

Economic growth in the United States remains positive but the rate of growth remains stubbornly below its long term average – not such a bad result perhaps, given the effective tax increases involved in the eventual budget agreed by Congress at the start of the year, but nowhere near enough to bring down unemployment to levels that might enable the Federal Reserve to rein back on its asset purchase programme. US equities produced a modest 1.8% return in April and made a number of new all-time highs, bringing the gain to 14% so far this year. With more than half the companies in the S&P 500 now having reported their first quarter figures, earnings have beaten expectations by an average of nearly 5%. Revenues however have fallen short of expectations. The question for investors is whether this is a new cyclical peak or a base for further gains. Seasonal factors may lead to a softer patch through the summer. With the Fed's liquidity and loose monetary policy likely to continue this year, combined with the superior growth outlook for the US economy relative to Europe, the US market could be a first port of call for equity investors looking to switch into more cyclical sectors of the market. With the market currently trading on a P/E ratio of around 13.5x, valuations are not obviously expensive compared to the levels reached during the last two market peaks (25.6x in 2000 and 15.2x in 2007), but a correction is quite likely in the short term.

Europe

After the drama of the Cyprus bailout in March, the eurozone experienced a quieter month in April, with sovereign debt yields in some of the more vulnerable geographically "peripheral" members (Spain, Greece, Portugal, Italy and Ireland) falling to levels not seen for at least two years and their stock markets also posting striking gains of between 6% and 12% in the course of the month. The worrying aspect of this otherwise positive sounding development is the continued evidence that no end is in sight for the economic contraction which appears now to be spreading to the more prosperous northern part of Europe. The German economy has slowed to a virtual halt while a sharp housing market decline is sending the Netherlands into recession. Meanwhile fears are growing for the French economy. Capital controls remain in Cyprus, while the public finances in Spain continue to deteriorate and unemployment rises to new record levels. Against this miserable economic background, investors risk being accused of complacency for the general consensus belief that the European Central Bank has eliminated the risk of the single currency collapsing and that some resumption of growth will occur before the end of the year. Given the decline in P/E ratios that occurred during the Greek crisis last year, however, there is clearly potential for markets to rise sharply when and if – a big if – there is a return to growth.

Asia

China's economy lost further momentum in the first quarter with GDP rising 7.7% from a year earlier, below expectations and further denting investor sentiment towards the region. Industrial production and exports, historically the main drivers behind China's economic growth story, have both eased, the latter reflecting weaker demand from areas of the West where growth remains non-existent. However the key for China going forward will be the quality of growth, not just its quantity. We are beginning to see signs of the economy shifting its focus on consumption, a top priority for the new leadership. At over 55%, consumer spending was a bigger contributor to growth in the first quarter than investment (30%), which is a significant change when you consider that just four years ago investment accounted for almost 90% of growth. Unfortunately for the equity market, investor sentiment remains relatively risk averse. The A-share market has fallen around 8% since the start of February. Valuations remain attractive, earnings growth estimates have been improving, and if investors can begin to look beyond this transitional period and readjust expectations, the Chinese market remains an interesting investment prospect.

Japanese equity markets are showing little sign of losing momentum as investors keep faith that the radical approach from policymakers will finally reverse the economy's fortunes. The new Bank of Japan Governor Haruhiko Kuroda, signalled his intentions by announcing the central bank will double its bond purchases to ¥7 trillion ($75 bn) a month as it bids to end deflation and reach its 2% inflation target within two years. The Nikkei index has risen to its highest level since mid 2008 while the yen has continued to fall in value against the dollar, helping to boost the earnings outlook for Japan's large exporters. Consumer spending rose sharply, according to the latest monthly figures, suggesting that Japanese consumers are heeding their government's attempts to start drawing down their savings. The banking sector, which has risen around 40% year to date, should continue to benefit from the government's inflationary policies. Looking ahead the government faces an uphill battle to tackle the country's huge structural problems. Japan's poor demographics and debt-to-GDP ratio of over 200% mean that failure to meet the new growth and inflation targets would be disastrous. The new policy is unlikely to fail for lack of commitment therefore and for now the momentum behind Japanese equities could well drive the stock market a good way higher, although progress will be needed for reality to catch up with expectations.

MARKET HIGHLIGHTS

A warning signal from PMI readings

The regular monthly surveys of purchasing managers' intentions (PMIs) have long been used by investors as a useful forward indicator of likely trends in the economy. Historically the readings on these surveys have also proved to be correlated to the performance of the stock market. In the past few months however, the equity market, represented in the graph by the FTSE All Share, has started to run ahead of the readings of the UK PMI. The trend has been replicated in other countries and regions as well. Although the long term case for owning equities in a period of financial repression remains valid, this is one of a number of potential warning signs that in the short term, momentum may be driving equities higher than the fundamentals can justify.

The global impact of Japan's new policies

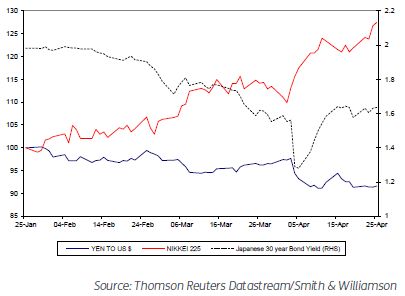

The four months since the start of the year have seen some significant movements in the value of Japanese financial instruments, responding to the new policy initiatives from the Government and Bank of Japan (see the Q & A article in this newsletter). The yen has fallen in value by more than 20% since 1 January 2013 while the main stock market index, the Nikkei 225, has risen from under 9,000 to more than 14,000 since November 2012. It has risen 25% in sterling terms so far this year. Smaller company shares have risen even faster than the main index. The only real surprise is that long term government bond yields have fallen rather than risen. If Japan's experiment succeeds, it is likely to produce some big shifts in the behaviour of Japan's savers and companies, affecting the rest of the world's financial markets too.

Gold falters after 12 strong years

The gold price suffered its most difficult month for some time in April, as short sellers attacked the market for gold- backed exchange-traded funds, resulting in a sudden $200/ oz fall in the price of bullion. Holdings of gold ETFs, often described as 'holders of paper gold', have fallen by more than 10% since the start of the year. Demand for physical gold remains as strong as ever, however, suggesting that the 7.8% decline in the price in April is more the result of 'loose holders', including speculators, being driven out of their positions than of any fundamental weakening of the arguments for holding gold as an insurance policy against future inflation and currency debasement. The gold price suffered more extreme price declines in December 2011 and October 2008.

To read this article in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.