Structural and technological shake-ups in any industry don't simply alter future value opportunities. Transitions of this magnitude offer huge value creation potential in the immediate evolving state, not only for firms seeking to exit profitably but also those that can successfully transition from one structure or technology to another.

The seismic transformation currently sweeping through the automotive industry is a shift away from the internal combustion engine (ICE) to battery electric vehicles (BEV). This change is leading to a wholesale shift to alternative vehicle propulsion, unravelling an ICE supply chain constructed over the previous 100 years. Indeed, numerous major car markets have set the 2030s as the decade new ICE vehicles can no longer be sold.

The 2023 AlixPartners Automotive Outlook details how this strategic restructuring has already catalysed an inevitable uptick in auto part M&A activity, as consolidators emerge, and private equity interest grows.

In the near term, M&A activity in the automotive supply chain has the potential to create a deal backlog, with regulators scrutinising competition and companies needing to establish legal separations and transition service agreements in relation to businesses that will be divested.

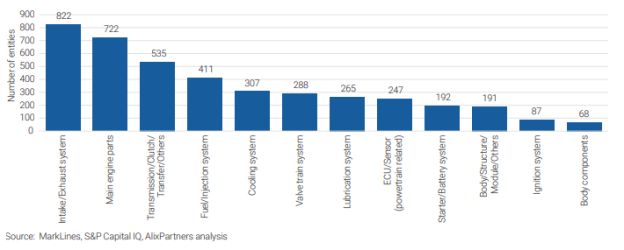

AlixPartners has carried out a detailed review on over 800 global suppliers and mapped 2,693 entities that supply ICE components to the Original Equipment Manufacturers (OEMs) within them. Some of these entities are easily defined business units, while others range from dedicated ICE-component factories to ICE-focused internal operational structures or product groupings.

Many of the world's largest suppliers have already indicated whether they wish to be an ICE-consolidator, transform existing ICE-related units to new BEV supply, or exit the ICE supply business altogether. Some, like Continental, have completed their exit already

There is now a relatively clear BEV transition roadmap and the time to move is right for those suppliers or funds yet to finalise their strategies. Terminal values are clearer to calculate, and those that want to exit risk being left holding assets with limited residual value.

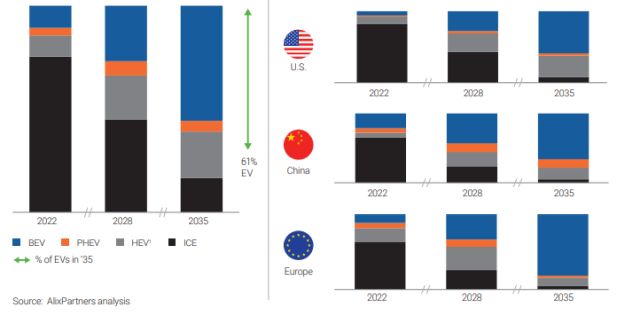

FIGURE 1: FORECAST GEOGRAPHICAL TRANSITION FROM ICE TO BEV

Global

ICE MELTING; A TRANSFORMING MARKET

New ICE component sales to OEMs across transmission, engine systems, drivetrains, and fuel systems are expected to decline steadily from this point forward.

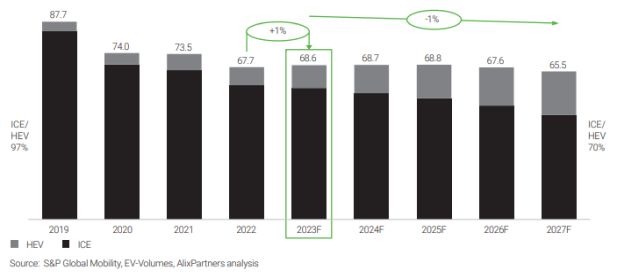

This transition becomes clear when reviewing annual sales volumes. Despite the post-pandemic and semi-conductor overall market recovery, ICE sales are only predicted to grow 1% in 2023, before shrinking consistently year on year afterwards. AlixPartners predicts that ICE will only constitute 70% of the market by as early as 2027 (see Figure 2).

FIGURE 2: GLOBAL ICE AND HYBRID LIGHT-VEHICLE SALES (UNITS, MILLIONS)

CONSOLIDATION

Against this backdrop, the case for consolidation among ICE suppliers continues to grow. Those preparing to be the "last person standing" seek those that want cash now to reinvest in transforming their business to BEV through the disposal of ICE entities that are no longer core.

And this uptick for ICE-related supplier M&A has already begun. Automotive supplier-related M&A activity reached its highest level for five years in 2022, driven by a 67% increase in ICE-related deals. This was in a year in which the automotive industry performed better than other industrial areas: in terms of value, automotive was up around 4.5% versus the industrial sector fall of 16% from 2021 to 2022. These deals also took place amid a drop-off in listings and special purpose acquisition company (SPAC) creations from 2021 highs.

It is also clear that private equity is now in the driving seat for automotive dealmaking, accounting for 71% of ICE transactions based on 2022 deal value.

Sales of ICE business units have been supported, as these assets trade at a discounted market valuation; a diversified automotive component supplier is likely to be valued at 10x earnings (EBITDA) multiples, while an ICE business trades at approximately 6x earnings.

However, deciding which sub-sector to consolidate is a highly complex task, requiring a deep understanding of the existing global supplier map for each component. The AlixPartners market review categorises each supplier entity into a category, sub-category, and primary component to identify which entities exist, their competitors, and overall market concentration levels.

FIGURE 3: NUMBER OF UNIQUE SUPPLIER ENTITIES PER AUTOMOTIVE SUBSYSTEM

Click here to continue reading . . .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.