INTRODUCTION

When we published the first issue of our Competition Bulletin (Bulletin Concurrence) last year, our goal was to offer a reliable quarterly overview of the latest news and developments in French competition law.

Today, we are pleased to share with you the English version of our fifth Competition Bulletin, which covers the period from July to September 2022.

We hope that this quarterly panorama of French competition law provides information that you will find interesting and useful.

McDermott Will & Emery's Paris Competition Team.

1. LITIGATION

CUMULATIVE ADMINISTRATIVE SANCTIONS AGAINST THE SAME PARTY FOR SIMULTANEOUS BREACHES ARE CONSTITUTIONALLY PERMISSIBLE

In a judgment dated June 23, 2022, the Paris Administrative Court fully upheld the cumulative fine of EUR 6,340,000 imposed on Eurelec Trading (Eurelec) for 21 breaches of the rules of transparency in commercial relations between suppliers and distributors.

In this case, the Regional Directorate for Enterprises, Competition, Consumption, Labour and Employment of Île-de-France (DIRECCTE, a branch of the French Ministry of Economy) found that Eurelec, a joint purchasing group for the large-scale distribution of products in the French and European markets, had failed to conclude agreements with its suppliers by March 1, of the year of their application, as required by Article L 441-3 of the French Commercial Code (formerly codified at Article L 441-7).

In its defence, Eurelec raised a priority preliminary challenge to the constitutionality of Article L. 470-2, IV of the French Commercial Code in its version applicable to the dispute complied with the Constitution. This article provides that "where, in the same or separate proceedings, several administrative sanctions have been imposed on the same author for simultaneous breaches, these penalties shall be applied cumulatively."

Specifically, Eurelec argued that the cumulation of administrative penalties under the provisions of Article L. 470-2, IV violates the constitutional principles of proportionality of penalties (no ceiling on the cumulation of administrative penalties imposed for simultaneous infringements was laid down), legality of criminal offences and penalties (the concept of "simultaneous failure" was not sufficiently defined), and ne bis in idem (no one may be punished twice based the same set of facts).

In a decision dated March 25, 2022, the Constitutional Council held that (i) there is no constitutional requirement that administrative sanctions imposed for separate breaches be subject to a rule of non-cumulation, and (ii) the provisions of Article L. 470-2 of the Commercial Code comply with the principle of proportionality.

On this basis, the Paris Administrative Court rejected the various arguments asserted by Eurelec.

"Those provisions thus pursue an objective of defending economic public policy and allow, by their deterrent effect, a balanced functioning of the market as a whole. In those circumstances, and since it is common ground in the present case that the products covered by the disputed agreements, all concluded with French suppliers, are intended for the French market, the DIRECCTE of Île-de-France was right to invoke against the applicant company the provisions of Article L. 441-3 of the French Commercial Code."

DELISTING DOES NOT NECESSARILY CONSTITUTE AN ABUSE OF A DOMINANT POSITION

In a judgment delivered on September 6, 2022, the Paris Commercial Court determined that Google France, Google LLC and Google Ireland Limited ("Google")'s delisting of the website, articles and videos of newspaper France Soir was unlikely to be sanctioned as an abuse of dominance because the actions were justified by France Soir's serious and repeated violations of Google's rules.

On July 15, 2021, France Soir Groupe and its subsidiary company Shopper Union sued Google for (i) de-referencing of newspaper France Soir's website and articles from Google's services "Google News" and "Discover", (ii) closing France Soir's YouTube channel, and (iii) removing access to Google's advertising service "AdSense." The applicants claimed that the rules laid down by these services particularly those relating to medical content and content transparency – constituted an abuse of dominance by Google under Article L. 420-2 of the French Commercial Code and Article 102 of the Treaty on the Functioning of the European Union.

According to the Paris Commercial Court, if Google held a dominant position in the markets for online news searching, online advertising, and possibly online video hosting, a company in such a position can safeguard its own commercial interests as long its practices are based on objective justifications and carried out to a reasonable extent.

2. MERGERS

TF1 / M6: ONLINE ADVERTISING IS NOT SUBSTITUTABLE FOR TELEVISION ADVERTISING

On September 16, 2022, and following sessions on September 5 & 6, 2022 before the French Competition Authority's ("FCA") board, the Bouygues group (TF1) announced that it was withdrawing its proposed acquisition of the Métropole Télévision (M6) group, putting an end to proceedings that had been ongoing before the FCA for over a year.

As a reminder, on February 17, 2022, Bouygues notified the FCA of its proposed acquisition of the M6 group, and the FCA subsequently opened an in-depth examination of the transaction (known as phase 2). The FCA determined that the transaction would have merged seven free-to-air DTT channels under the Bouyges group: TF1, M6, TMC, W9, Gulli, LCI and TF1 Séries Films.

According to the FCA, the transaction would have therefore raised competitive concerns in the television advertising market, as the new entity would have held a combined market share of more than 70%, as well as a significant portion of the market for the distribution of free-to-air television services.

In their defence, the parties argued that the relevant advertising market should include digital platforms (in particular video-on-demand services), as online advertising exerts a significant competitive constraint on television advertising and should be considered a substitute. By integrating online advertising into the broader definition of the television advertising market, the new entity would thus have held a combined market share of less than 25%.

However, in view of the results of the investigation, the FCA noted that (i) television remains a very powerful medium for the French population as a whole (especially people aged between 25 and 49), and (ii) the development of video-on-demand services will not challenge this power in the foreseeable future as they are intended to remain paid models that are based, above all, on individualized consumption that is not conducive to mass advertising to all users simultaneously. In other words, according to the FCA, digital platforms do not have the screen power of television channels, except when they broadcast unifying events, but this remains the exception.

Therefore, the FCA concluded that online advertising is not a substitute for television advertising.

"The fact that platforms use advertising to finance their business does not mean that the affected market is the same. The uses remain different; they are complementary and non-substitutable."

(President of the FCA, Benoît CSuré, before the Senate on September 27, 2022)

As a result, the FCA concluded that the transaction could have created major competitive risks in the market for television advertising and the distribution of television services. Moreover, according to the FCA, the commitments proposed by the Bouygues group would not have made it possible to remedy these competitive risks.

Of note, because Bouygues abandoned the proposed acquisition of M6, the FCA did not issue a decision but instead published a press release in which it explained its views on market delimitation and set out the competition concerns identified during the procedure.

ALTICE / SFR: UNPRECEDENTED DECISION ON THE LIQUIDATION OF PERIODIC PENALTY PAYMENTS

In a decision dated September 29, 2022, for the very first time the FCA liquidated periodic penalty payments imposed on a company that had not properly executed injunctions within the time limits set by Article L. 430-8, IV of the French Commercial Code.

This unprecedented decision follows an earlier decision from October 20, 2014, in which the FCA authorised the Altice group's (formerly Numéricable) acquisition of sole control of SFR, subject to structural and behavioral commitments.

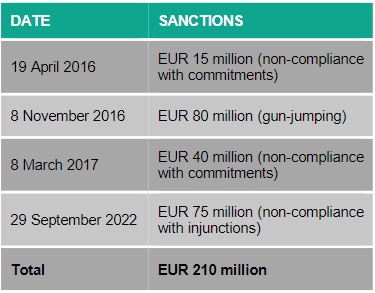

Subsequently, on April 19, 2016, the FCA fined the Altice group EUR 15 million for failing to satisfy some of its commitments related to the sale of Outremer Télécom's mobile telephone activities, which Altice group agreed to as part of the 2014 decision.

Then, on March 8, 2017, the FCA again fined the Altice group EUR 40 million for failing to meet its commitments relating to the "Faber" contract for the continued deployment of fiber optic cable, which were also agreed to in the 2014 decision. The FCA also issued several injunctions, some of which were subject to penalty payments.

In its September 2022 decision, the FCA found that the Altice group had not complied with the 2017 decision's penalty injunctions within the prescribed time limits, in violation of the Altice group's clear obligations under the order. As a consequence, the FCA imposed a financial penalty of EUR 75 million.

This decision echoes the decision of November 7, 2019, in which the FCA imposed another financial penalty of EUR 20 million as well as structural injunctions against the Fnac / Darty group. However, significantly, given Fnac / Darty group's compliance within the established time limits, the FCA did not initiate a sanction procedure of the kind it pursued against the Altice group.

TABLE No.1

3. INVESTIGATIONS

DAWN RAIDS IN THE LEATHER GOODS RETAIL SECTOR

On September 29, 2022, the FCA's investigation services carried out, upon authorisation by a liberty and detention judge (juge des libertés et de la détention – JLD), unannounced raids on companies suspected of implementing anticompetitive practices in the leather goods retail sector.

To our knowledge, this is the third set of dawn raids conducted in the past year by the FCA's investigative services.

TABLE No.2

4. MISCELLANEOUS

THE FCA PUBLISHES ITS 2021 REPORT

On July 6, 2022, the new Chairman of the FCA, Benoît CSuré, presented the annual activity report for 2021, titled "Source of Oxygen for the Economy," to the press.

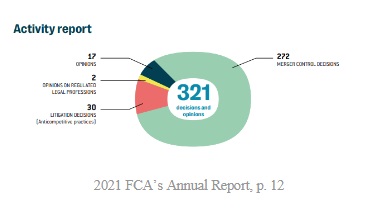

In terms of anticompetitive practices, the FCA issued 14 penalty decisions in 2021 for a total fine of EUR 873.7 million. The main sanctions concerned Google's abuse of a dominant positions in the press and related rights remuneration (EUR 500 million), and the online advertising (EUR 220 million) sector, and a cartel in the eyewear sector (EUR 125.8 million).

Within merger control, the FCA's activity was particularly intense with 272 decisions issued, including 10 clearance decisions with commitments and 1 prohibition decision – only the second ever issued by the FCA since 2009, when it became competent to examine mergers.

The FCA also publicly revealed its roadmap for 2022- 2023 and indicated that it wants to focus on the following objectives:

- Take action to ensure the competitive functioning of digital markets, e.g., the sector inquiry conducted on the cloud computing sector;

- Fight anticompetitive practices affecting public resources;

- Promote a competition culture;

- Ensure the efficiency and responsiveness of the FCA in a dynamic environment;

- Ensure the consistency of the FCA's actions with other public policy objectives, such as the European Regulation on the Transmission of Data (GDPR) or the new Digital Markets Act.

THE DGCCRF PUBLISHES ITS ANNUAL ACTIVITY REPORT FOR 2021

On July 11, 2022, Olivia Grégoire, the Minister Delegate for Small and Medium Enterprises, Trade, Crafts and Tourism, and Virginie Beaumeunier, the Director-General of the General Directorate for Competition Policy, Consumer Affairs and Fraud Control ("DGCCRF", a branch of the French Ministry of Economy), presented the DGCCRF's annual activity report.

During 2021, the DGCCRF remained committed to its mission to defend economic actors by ensuring the loyalty in inter-company relations and fighting against late payments. It has also mobilized to ensure that the balance of commercial relations between suppliers and distributors is respected with regard to the provisions of the "Egalim 1" and "Egalim 2" laws, having announced 18 administrative sanctions against food distribution brands for non-compliance with provisions relating to the supervision of promotions. In addition, the DGCCRF paid particular attention to the proper functioning of digital trade by carrying out 16,000 website checks.

According to its activity report, in 2021, the DGCCRF also carried out 133,277 inspections, imposed 1,328 administrative fines for a total of EUR 38.5 million, and sent 49 reports of anticompetitive practices to the DGCCRF, 20 of which found that the relevant practices were indeed anticompetitive.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.