On June 29, 2023, the Court of Justice of the European Union ("Court") issued its decision in Case C-232/22, Cabot Plastics, addressing the concept of fixed establishment in EU VAT law.

A fixed establishment, as defined under EU VAT law, refers to the presence of a business in a jurisdiction that possesses a significant level of human capital and resources. This concept holds great significance in EU VAT law as it determines the location where services are considered to be supplied, and establishes the obligations of taxpayers in relation to VAT.

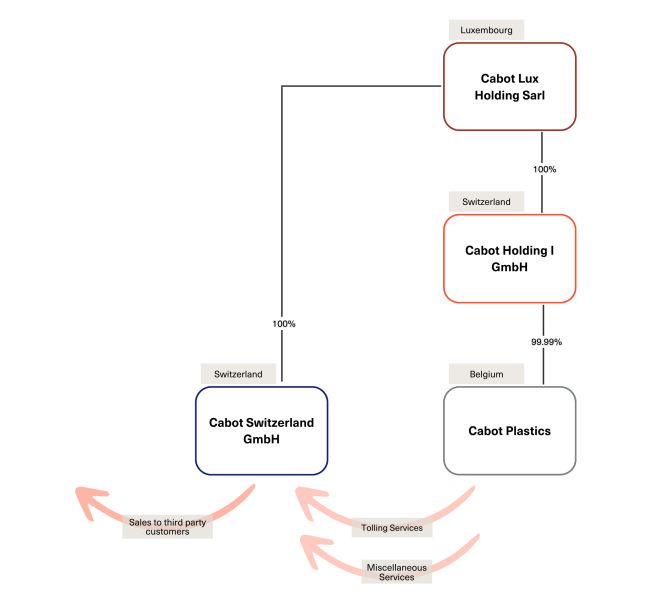

The case revolved around a segment of the Cabot Group, a major corporate group operating in the raw resource processing industry. The group entities in question, Cabot Switzerland and Cabot Plastics, were respectively based in Switzerland and Belgium and were legally independent from each other.

Cabot Plastics entered into a tolling manufacturing agreement with Cabot Switzerland. In a tolling agreement, the service provider offers manufacturing services to its counterparty, who supplies the raw materials for production. The primary source of Cabot Plastics' turnover was derived from the agreement it had with Cabot Switzerland. Furthermore, Cabot Plastics provided additional services to Cabot Switzerland, which included:

- Stock management of raw materials;

- Yearly inventory of the raw materials;

- Quality control;

- Stock management of finished products; and

- Preparation of orders before sending.

The diagram below illustrates the structure and the arrangement:

The Belgian tax authorities asserted that Cabot Plastics supplied its products not to Cabot Switzerland's place of establishment in Switzerland but to its fixed establishment in Belgium, making Belgian VAT applicable. The authorities based their argument on several points:

- The tolling agreement's exclusivity allowed Cabot Switzerland extensive use of Cabot Plastic's resources and staff as if they were its own;

- The structure in Belgium enabled Cabot Switzerland to receive and use the products; and

- The contract's longevity since 2012 indicated a significant element of permanence.

The Court was asked to determine whether a fixed establishment existed in Belgium. In line with prior rulings of the Court, for a company to be recognized as having a fixed establishment in another EU member state, that company must possess a permanent and suitable structure in that state in terms of human and technical resources, allowing it to receive and utilize the services for its business purposes. The Court, in this case, emphasized the importance of economic realities over the legal relationship between the parties, giving little weight to their belonging to the same corporate group. Thus, the fact that the parties belonged to the same corporate group played little role in the Court's deliberations.

The Court acknowledged that the exclusive tolling contract with Cabot Switzerland did not confer a fixed establishment in Belgium, as Cabot Switzerland lacked the right of legal possession over the resources used to supply its products. The Court also noted the difficulty in distinguishing between the resources used by Cabot Plastic to make supplies and those used by Cabot Switzerland to receive the said supplies in Belgium, making it impossible to attribute resources to Cabot Switzerland's alleged fixed establishment in Belgium.

Thus, without being able to delineate which resources were used for what, it was not possible to determine precisely what resources should be attributed to the alleged receiving fixed establishment of Cabot Switzerland in Belgium.

Additionally, the Court disregarded the immateriality of numerous auxiliary services provided to Cabot Switzerland, differentiating them from supplies under the tolling contract. Citing previous case-law, the Court clarified that preparatory or auxiliary activities for the recipient's business do not create a fixed establishment, similar to how auxiliary services do not constitute permanent establishments under international tax law. Ultimately, the Court ruled that there was no fixed establishment in Belgium, and the services were deemed to be received in Switzerland.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.