Prior to the introduction of section 9 of the Conduct Standard for Banks in July 2021, absent a clause to the contrary in the agreement between the bank and its client, the relationship is terminable on reasonable notice, provided that the termination is not contrary to public policy or does not offend a constitutional value

2. Case Law:

- Bredenkamp v Standard Bank 2010 (4) 468 (SCA)

- Hlongwane v Absa Bank Limited (case I 75782/13 (GP) (10 November 2016))

- Minister of Finance v Oakbay Investments (Pty) Limited and others 2018 (3) SA 515 (GP)

- Annex Distribution (Pty) Limited v Bank of Baroda 2018 (1) SA 562 (GP)

- AB and Another v Pridwin Preparatory School and Others 2020 (5)

- Beadica 231 CC and Others v Trustees for the time being of the Oregon Trust and Others 2020 (5) SA 247 (CC)

Bredenkamp v Standard Bank 2010

- In 2008 the US Department of Treasury listed Bredenkamp as a ''specially designated national'' (SDN) because of his association with President Mugabe, and because Bredenkamp was said to have provided financial and logistical support to ''Mugabe's regime''.

- 3 initial reasons were advanced by the Bank for the closure:

- inclusion as a SDN

- allegations might impair the Bank's reputation

- certain business risks could arise should the Bank continue offering banking services to Breedenkamp

- The SCA held that it would not be fair to impose an obligation on the Bank to retain a client because other banks may refuse to bank that client.

- The Bredenkamp judgment confirmed that banks may unilaterally terminate contracts on reasonable notice.

Hlongwane v Absa Bank Limited (2016)

- Mr Hlongwane brought an application in terms of PAIA for all records relating to ABSA's decision to close his accounts.

- The Court dismissed Mr Hlongwane's application and held that the Bank's bona fides in closing Mr Hlongwane's accounts could not be questioned.

- The Court recognised that the Bank had no obligation to retain a client whose monitoring in terms of money laundering measures would be more onerous when compared with the benefit the Bank would receive from banking Mr Hlongwane.

Minister of Finance v Oakbay Investments (Pty) Limited

- Full bench of the Gauteng High Court confirmed that the bank may terminate the relationship, in its discretion, on reasonable notice to the customer, provided that the reasons for terminating the account do not violate public policy or constitutional values.

- The Gauteng High Court in this case also quoted with approval the Bredenkamp judgment.

Annex Distribution (Pty) Limited v Bank of Baroda 2018

- A bank has a right to terminate a contract with its client either on the notice period provided in the contract or in the absence of an express notice provision, on reasonable notice.

- A bank has no obligation to give reasons for terminating this relationship (this was decided before the conduct standards took effect). The Bank's motives for terminating are generally irrelevant (there may be an exception where there is found to be an abuse of rights)

- There are no self-standing rights to reasonableness, fairness or goodwill in the law of contract.

- A bank is entitled to terminate the relationship with a client on a basis of reputational and business risks and Courts should be reluctant to second guess a bank's assessment of this risk.

- Irrespective of whether negative publicity about the client is true, a bank is fully entitled to terminate the relationship with a client that has a bad reputation.

- The fact that the client may have difficulty finding another bank does not impose any obligation on the bank to retain the client.

Customers should be provided sufficient time in order to arrange their affairs before an account is closed. In this case, the Bank provided almost 3 months' notice which the Court found to be more than reasonable.

AB and Another v Pridwin Preparatory School and Others 2020

- The central issue in the Pridwin case was whether an independent school is entitled to terminate a contract on reasonable notice without a hearing and without providing reasons for its decision.

- The Constitutional Court unanimously held that independent schools are obliged not to impair a child's right to basic education and consequently found that an independent school cannot terminate a schooling contract without following fair process, which entailed giving the children an opportunity to make representations before the decision to terminate the contract was made.

- Based on the Bredenkamp, it was for some time believed that a bank is not required to afford a customer a hearing prior to the termination of accounts.

Does it follow that a bank is obliged to give the client an opportunity to make representations before the decision to terminate is made?

Beadica 231 CC and Others v Trustees for the time being of the Oregon Trust and Others

- The Constitutional Court's judgment in Beadica provided clarity on the contested question of fairness in contract law.

- The majority judgment held that the SCA finding in Bredenkamp that a court may not refuse to enforce contractual terms on the basis that the enforcement would, in its subjective view, be unfair, unreasonable or unduly harsh, remains good law.

- In order to avoid a contract or the exercise of the counter party's rights under the contract, it is necessary to satisfy the court that the contractual term or the exercise of the right under the contract is contrary to public policy.

- Since Beadica, a court need no longer be as reticent as it was in the past, to refuse to enforce contractual terms on the basis that they are contrary to public policy.

Ayo v FirstRand 2021

- During the course of last year an urgent application was instituted by Ayo Technologies wherein it sought to interdict FNB from closing its accounts.

- Ayo also sought to obtain declaratory relief to the effect that the bank's termination clause is unconstitutional.

- The Ayo application was struck from the roll for lack of urgency.

- The applicant has not taken steps to progress the hearing of the second part of the application or the application.

- Ayo together with Dr Surve and various other Sekujalo Group Companies have since laid a complaint with the Competition Commission, applied for interim relief before the Competition Tribunal and is also proceeding with an application before the Equality Court where it contends that the banks are discriminating against them because they are black.

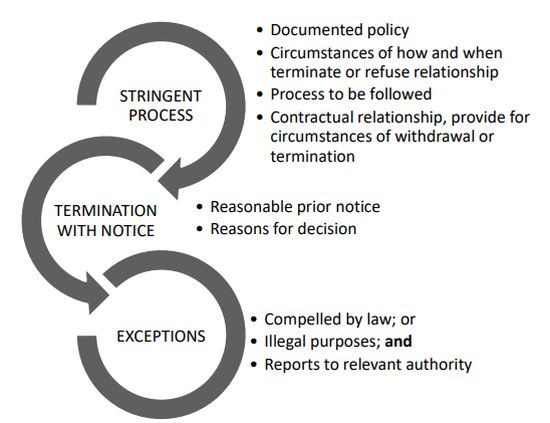

REFUSAL, WITHDRAWAL OR CLOSURE OF FINANCIAL PRODUCTS OR SERVICES BY BANK

Contractual Amendments Required?

- 9(5) requires contractual agreements with customers to make provision for the circumstances in which the contractual agreement may be terminated or withdrawn.

- Standard retail terms and conditions would include events of default, breach of regulation (FICA, Sanctions, Environmental Laws) but not necessarily reputational risk to the bank.

- If that circumstance is not included in the contractual agreement will the bank be precluded from terminating?

BASA Code of Conduct

"We reserve the right, however, to protect our interests in our discretion, which might include closing your account without giving you notice: if we are compelled to do so by law (or by international best practice); if you have not used your account for a significant period of time or if we have reasons to believe that your account is being used for any illegal purposes."

But what if the Bank is not compelled and the purposes are not illegal but are embarrassing or reputationally difficult for the bank?

notice of termination and the giving of reasons

Subject to exceptions:

- reasonable prior notice of the withdrawal, termination or closure must be provided to the financial customer – this has always been the case

- refusal to provide financial products or services to a customer requires reasons

Prior to the introduction of the Conduct Standard, there was debate in our law as to whether there was an obligation to provide reasons for the refusal to offer a financial product or service or for terminating the relationship with a customer.

Another question that a court may in due course have to grapple with is whether the reasons for closing must be a good reason and what gets taken into account in deciding whether the reasons are good or not. Can reputational risk be a good reason?

exceptions

No notice or reasons if:

- is compelled to do so by law;

- it has reasonable suspicion that the financial product or financial service is being used for any illegal purpose; and

- has made the necessary reports to the appropriate authority'.

If pursuant to a reasonable suspicion, the Bank makes a report in terms of FICA to the Financial Intelligence Centre or, the Financial Intelligence Centre secures an order from a court requiring the Bank to close the account, or the Bank is otherwise compelled by law to terminate its relationship with a customer, the Bank may terminate the relationship with the customer without providing reasons for doing so.

procedural things to think about

- Off-boarding in instances where account closure is not possible, i.e. other financial products with a longer term or a lock in

- procedure to ensure the customer, or any related party, is not in a position to open new accounts with the Bank in the future.

- customer should not be contacted by agents of the Bank offering new products to such a former client.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.