On 1 January 2023, the long-awaited reform of Swiss corporate law enters into force. Key changes relate to increased flexibility in various areas (e.g., share capital in foreign currencies, possibility of virtual shareholders' meetings) and strengthened minority shareholder rights.

This briefing focuses on the practical impacts of the reform for privately held Swiss stock corporations and the potential need for adjustments to their corporate documents and shareholders' agreements. With respect to listed companies, please refer to our earlier briefing.

SHARE CAPITAL

The share capital of Swiss stock corporations no longer has to be denominated in CHF, but can in the future alternatively be in EUR, USD, GBP or JPY – provided the respective currency is the functional currency of the business and the reporting currency used in the financial statements (art. 621 Swiss Code of Obligations CO"). While it is already possible today to prepare financial statements in a currency other than CHF, the amount of distributable equity still needs to be determined in CHF as well. Aligning the share capital with the reporting currency avoids FX discrepancies in the future. The share capital currency can be changed as of the beginning of a financial year by amending the company's articles of association.

From a tax perspective, under current law the so-called capital contribution reserves (which can be repaid without Swiss withholding tax) generally have to be declared in CHF even if the financial statements are prepared in another currency; this can lead to difficulties in determining the repayable amount. Under the revised law, if the share capital is denominated in a foreign currency, the capital contribution reserves will also be determined in such currency, thereby avoiding such FX discrepancies. According to the current intention of the Swiss Federal Tax Administration, existing capital contribution reserves will be converted at the same FX rate used for the conversion of the share capital – which is generally beneficial for companies. An official circular from the Swiss Federal Tax Administration is expected to be published in late 2022.

Going forward, the minimum nominal value of a share is no longer CHF 0.01, but can be any lower fraction as long as it is greater than zero.

INCORPORATION AND CAPITAL INCREASES

Up until now, companies could create authorised capital, empowering the board of directors to issue shares out of such authorised capital during a maximum period of two years. The authorised capital is set to be replaced by the concept of a capital band" (art. 653s et seq. CO): The shareholders' meeting can, by amending the articles, authorise the board to increase and/or reduce the share capital within a predefined bandwidth of up to 50% of the share capital up- and downwards during a maximum period of five years. Apart from the useful time extension, the capital band essentially follows the rules of authorised capital. Note that it is still possible to create contingent capital for the issuance of shares upon exercise of stock options and convertible bonds. From a tax perspective, the capital band has the benefit that the 1% Swiss stamp duty payable on capital contributions is only due on the net increased amount at the expiry of the capital band.

Where share capital is increased by setting off claims of the subscriber towards the company, under the new law, the publicly available articles must disclose the name of the subscriber and the amount of its claim being set off (art. 634a CO).

Under current case law, the issue price for shares in a capital increase can be set quite freely provided the subscription rights are not curtailed; if on the other hand subscription rights are suppressed, the issue price needs to reflect the company's fair value. New art. 652b CO states that in capital increases no shareholder may be advantaged or disadvantaged without objective reasons by: (i) a limitation or cancellation of the subscription right or (ii) the determination of the issue price. There is a fair probability that the courts will interpret this new provision in the sense that the issue price must reflect the fair value of the company, regardless of whether the subscription rights are curtailed or not, unless a lower issue price can be justified with objective reasons.

Within current law, if a company is incorporated or increases its capital and it is intended that it will acquire assets from a shareholder or a close person, the intended acquisition, including the purchase price, must be disclosed in the articles and an auditor must confirm that the price is justifiable. These rules regarding intended acquisition in kind (beabsichtigte Sachübernahme) are now abolished, making incorporations and capital increases faster and more cost-efficient.

LEGAL RESERVES / ACCOUNTING RULES

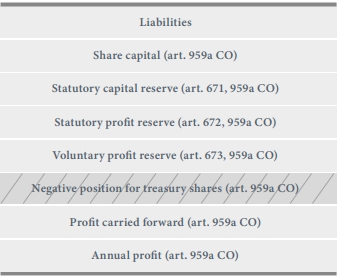

The classification of the equity positions on the balance sheet is now harmonised with the accounting provisions of the CO that entered into force ten years ago. The liability side of the balance sheet thus has to be structured as follows (art. 671 et seq. and 959a CO):

In case of dividend distribution, the mandatory profit allocation to legal reserves (up to 50% of the share capital or 20% in case of holding companies) from retained earnings is simplified by abolishing the so-called ,second allocation' (art. 672 CO).

The motions to, and minutes of, the annual shareholders' meeting should reflect the new denomination of the equity positions where not yet implemented. A repayment of capital contribution reserves should no longer be labelled as dividend" in the minutes, but as repayment".

INTERIM DIVIDENDS

Under current law, legal doctrine already considers it permissible for a company to disburse interim dividends, i.e., dividends out of earnings for the current financial year, based on an interim balance sheet. However, audit firms were reluctant to provide the required certificate for such interim dividends.

New art. 675a CO positively confirms that such interim dividends are permitted

AUDIT

Under the new law, the auditor can, during its period of office, no longer be freely replaced, but only for important reasons (art. 730a CO).

If a company's net assets no longer cover half: (i) of its nominal share capital and (ii) of the blocked part of the statutory capital reserve and statutory profit reserve (a socalled capital loss"), the company must have its financial statements reviewed (limited audit) by an external auditor even if they otherwise qualified for an audit opting out (art. 725a CO). Companies encountering a capital loss may consider restructuring their balance sheet to avoid a future audit requirement.

SHAREHOLDERS' RESOLUTIONS

While shareholders' meetings have always had to be held as physical meetings (absent Covid-relief), the reform introduces flexibility by offering a number of additional ways to hold such shareholders' meetings (art. 701 et seq. CO):

- Normal physical meeting (unchanged).

- Physical meeting concurrently at several locations with electronic transmission between such locations.

- Physical meeting with remote participants exercising their (voting) rights electronically.

- Entirely virtual meeting, if the articles so allow and subject to the board designating an independent person to whom proxy can be given. The articles may waive the requirement for an independent proxy.

- Circular (i.e., written) resolution in wet ink or electronic form (email etc.), unless a shareholder requests oral discussion.

Note that physical shareholders' meetings outside Switzerland are in the future only possible if the articles explicitly provide for this possibility and if an independent proxy is appointed (unless all shareholders waive the right to such independent proxy) (art. 701b CO).

To benefit from the flexibility of virtual meetings and to retain the freedom to hold physical meetings abroad, companies therefore need to adapt their articles.

The articles can provide that a shareholder may only be represented by another shareholder in shareholders' meetings. Under the new law, if the articles contain such a restriction, the board must designate an independent person or an officer of the company to whom proxy with instructions can be given (art. 689d CO).

BOARD RESOLUTIONS

The reform eliminates uncertainties around if/how electronic board resolutions are permitted, by clearly listing the options to hold board meetings and pass resolutions (art. 713 CO):

- Normal physical meeting (unchanged).

- Physical meeting with remote members exercising their (voting) rights electronically.

- Entirely virtual meeting. Unfortunately, the wording of the new law could be interpreted so that such virtual meetings require a respective basis in the articles. While legal scholars advocate that such a provision is not necessary, we recommend to nevertheless include it in the articles until the question has been clarified by court decision;

- Circular (i.e., written) resolution in wet ink or electronic form (email etc.), unless a board member requests oral discussion.

The new law further codifies existing legal doctrine regarding conflicts of interests (art. 717a CO): If a director or officer faces a conflict of interest, he/she must promptly and comprehensively inform the board thereof, whereupon the board takes the appropriate measures to safeguard the company's interests (abstention from voting/acting; abstention from participating in the discussion etc.).

MINORITY SHAREHOLDER PROTECTION

As mentioned, a key aim of the reform was to strengthen the protection of minority shareholders. The new law provides in particular for the following amplified minority rights (art. 697 et seq. CO):

- Right of each shareholder to receive information in shareholders' meetings (unchanged).

- Right of shareholders representing 10% of the capital or votes to receive requested information in writing from the board (new).

- Right of shareholders representing 5% of the capital or votes to inspect books and records (previously only with permission of the shareholders' meeting or the board). The above information / inspection rights only extend to the information necessary for the exercise of shareholders' rights and are subject to trade secrets and legitimate interests of the Company not to disclose certain information.

- Right of shareholders representing 10% of the capital or votes to request an investigation of specific matters by an independent expert (previously shareholders representing 10% or CHF 2 million of the capital).

- Right of shareholders representing 10% of the capital or votes to request the calling of a shareholders' meeting (previously shareholders representing 10% of the capital).

- Right of shareholders representing 5% of the capital or votes to request inclusion of agenda items and motions regarding a scheduled shareholders' meeting (previously shareholders representing 10% or CHF 1 million of the capital).

The list of shareholder resolutions requiring a supermajority is expanded: From 1.1.2023, the following decisions require, by mandatory law, an affirmative vote of 2/3 of the represented voting rights and more than half of the represented share capital (art. 704 CO):

- any change of the company's purpose;

- the merging of shares, unless the consent of all affected shareholders is required (new);

- any capital increase from the Company's own equity, capital increase with contribution in kind, capital increase by way of set-off (new) or the granting of special privileges;

- any restriction or cancellation of subscription rights;

- the creation of contingent share capital or a capital band (partially new);

- the conversion of participation certificates into shares (new);

- any restriction on the transferability of registered shares;

- the introduction of shares with preferential voting rights;

- a change of the currency of the share capital (new);

- the introduction of a casting vote of the chairperson of the shareholders' meeting (new);

- amendment of the articles to allow physical shareholders' meeting outside Switzerland (new);

- the taking private of a listed company (new);

- any relocation of the seat of the company;

- the introduction of an arbitration clause in the articles (new);

- the waiver to appoint an independent proxy for an entirely virtual shareholders' meeting (new).

- the (voluntary) dissolution of the company

In practice, shareholders' agreements sometimes define veto rights of certain shareholders (also with stakes lower than 1/3 of the votes) by referring to art. 704 CO or copying the list of supermajority matters into the shareholders' agreement. We recommend reviewing existing shareholders' agreements to establish whether their wording still reflects the parties' understanding under the revised law or if a clarifying amendment is required (i.e., whether contractual veto rights should apply for the newly introduced supermajority matters or not).

FINANCIAL DISTRESS

As under current law, if the board has developed concern that the liabilities of the company are no longer covered by its assets (over-indebtedness), it must prepare audited interim financial statements. If such financial statements indeed show an over-indebtedness, the company must file for bankruptcy, unless creditors subordinate their claims in an amount sufficient to cover the over-indebtedness (art. 725b CO).

While so far interest payments on subordinated claims could still be made, going forward the subordination of a claim must necessarily include interest thereon (art. 725b CO). Accordingly, for companies that are over-indebted and have subordinated loans in place that do not encompass interest, the subordination clauses should be amended to include interest.

Under current case law, in case of over-indebtedness the board can delay a bankruptcy filing during a grace period of a maximum 4-6 weeks if it promptly implements restructuring measures and there is a realistic prospect of financial recovery. The revision codifies the concept of a grace period, stating that the board may delay a bankruptcy filing if there is realistic prospect that the overindebtedness is cured within 90 days from the date the interim financial statements are available (art. 725b CO). While the duration of the grace period has been extended, the new law rather narrows room for manoeuvre, as the over-indebtedness must actually be cured within the grace period (i.e., a delay is not permitted if the effect of the implemented measures unfolds later than 90 days).

Codifying existing case law, the reform further introduces a new article 725 CO according to which the board must supervise the liquidity of the company and, if there is a threat of illiquidity, take appropriate measures. In this context, a provision was introduced that the board files for composition proceedings if required". Legal doctrine is rightfully of the view that this provision does not introduce an additional obligation of the board to file for composition proceedings in case of impending liquidity problems. As the exact interpretation of this provision by the courts is not yet certain, however, we recommend that in potential distress situations the board seeks legal advice at an early stage.

On a positive note, new art. 634a CO clarifies that a debtequity swap is permitted even in situations where the company is over-indebted – which was disputed by some scholars under the existing law. This will likely lead to a more widespread use of this expedient restructuring instrument.

ARBITRATION CLAUSE

The reform clarifies that the company's articles may contain an arbitration clause which is binding on the company, directors and officers as well as shareholders regarding corporate disputes (art. 697n CO). In cases where a shareholders' agreement provides for an arbitration clause, it may be beneficial to introduce such clause in the articles as well to align dispute resolution mechanisms. The pros and cons of an arbitration clause should, however, be thoroughly assessed and weighted.

TRANSPARENCY RULES

Finally, the following new transparency rules take effect under the revised law:

- Companies subject to ordinary audit and active in the exploitation of certain commodities must prepare a report regarding payments to governmental bodies (art. 964d et seq CO; from FY 2022)

- Larger companies with minimum 500 FTE and either a balance sheet exceeding CHF 20 million or revenues exceeding CHF 40 million must prepare an ESG report and have it approved by the board and shareholders' meeting (art. 964a et seq CO; from FY 2023);

- Companies: (i) importing or processing commodities from conflict regions or (ii) offering products or services which are under suspicion to have been produced or carried out involving child labour, must implement a management system regarding their supply chain, assess risks and have compliance with their duties of care reviewed by an external expert (art. 964j et seq. CO; from FY 2023).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.