Summary

The Federal Inland Revenue Service (FIRS) has issued a Public Notice ("the Notice") communicating that the Honourable Minister of Finance, Budget and National Planning ("Minister of Finance") has approved certain increments in Withholding Tax (WHT) rates on dividends, interest and royalties paid by residents of Nigeria and beneficially owned by residents of countries with Double Taxation Agreements (DTAs) with Nigeria effective 1 July 2022.

Details

Since 1999, Nigeria has been unilaterally implementing a uniform WHT rate of 7.5% on dividends, interest and royalties paid by residents of Nigeria and beneficially owned by residents of Nigeria's tax treaty partners. The 7.5% rate is lower than the average 10% rate applicable under the Nigerian tax laws and was implemented based on the budget pronouncement made by the then Military Head of State.

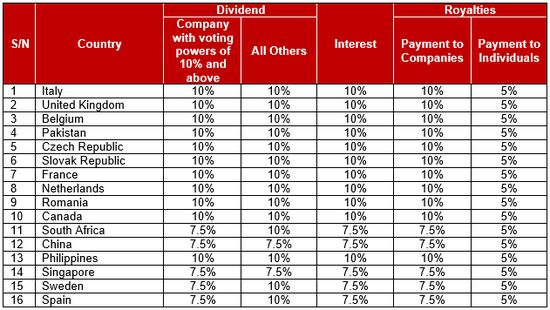

The Notice therefore states that the Minister of Finance has approved the discontinuation of the unilateral application of a uniform WHT rate of 7.5% on such dividends, interest and royalties and that the rates specified in the tax laws will now apply, except where it exceeds the maximum rate specified in the tax treaty; in which case, the maximum rate in the tax treaty will apply. Accordingly, the Notice provides that the following WHT rates will apply to Nigeria's tax treaty partners with effect from 1 July 2022:

In addition to the foregoing, the Notice states that in granting tax treaty benefits to residents of the countries with which Nigeria has DTAs, such residents and all agents of deduction of WHT, including government departments, agencies and parastatals, statutory bodies, companies, institutions and other establishments approved for the operation of PAYE system are required to comply with its contents as well as the contents of FIRS updated Circular No 2022/15 on the Claim of Tax Treaties Benefits in Nigeria, which stipulates the procedure for granting such benefits (Click here to access the FIRS Circular). It further clarifies that any previous ruling, direction or approval issued by the FIRS on applicable WHT rates with respect to any tax treaty is hereby withdrawn with effect from 1 July 2022.

Implications

The issuance of this Public Notice implies that, in many instances, there may be no difference in applicable WHT rates for treaty and non-treaty countries save for certain specific treaties concluded with South Africa, China, Singapore, Sweden and Spain which contain a lower WHT rate. As such, companies wishing to take benefits of any treaty will need to be properly informed about the rates applicable to their specific treaty or if the rates in the tax laws will apply. They may also wish to evaluate their business models and operations to determine if they are still eligible to claim the benefits of any treaty.

Based on the foregoing, there may be concerns as to the powers of the Minister of Finance or the FIRS to alter the 7.5% DTA rates which were applied by virtue of the budget pronouncement by the Military Head of State in 1999. In this regard, the rates have been applied over the years and even if they were not documented in a Federal Government gazette or backed by legislation have been taken to be the position of the law and applied by the FIRS itself, companies, individuals and treaty partners ever since. In effecting a change in these rates, it will be far tidier to do so by legislation (Finance Act, 2022) as this will carry the full force of law and be less open to challenge or controversy. Additionally, it will create certainty in the law rather than this approach of issuing a circular.

As the Federal Government continues to make efforts to improve its tax revenue, it is important that taxpayers are constantly aware of any changes introduced in the laws and administrative practices of the FIRS and other tax authorities in order to ensure compliance with the provisions of the law.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.