- within Government, Public Sector and Employment and HR topic(s)

- in Africa

Welcome to Walkers' 2020 Fundamentals White Paper Series, in which we discuss certain trends identifiable among the hedge funds and private equity funds that we helped our clients launch over the last twelve months.

In last year's White Paper, published in November 2019, managers and their funds appeared to be positioning themselves for market turbulence in the face of global uncertainties and a volatile economic and financial environment. One year on, with the benefit of hindsight, this was something of an understatement. 2020 has tested all aspects of managers' businesses, from the boardroom to the back office, and in many parts of the world out of the office altogether. All of this, of course, is not to overlook the broader global context of the pandemic and the significant health, economic and political challenges that 2020 has brought and continues to present.

Hedge Fund Trends – Part 1

As in prior years, our purpose in this White Paper is to analyse trends we see in the terms of newly-launched funds, and consider them in the broader context. While few could have predicted the cause or scale of 2020's volatility, a period of greater uncertainty had been widely forecast for several years. This had started to show in fund terms: longer and harder lock-ups, greater use of liquidity management tools like gates and side pockets, as well as a shift in the relative popularity of the key strategies.

A RESURGENCE OF MULTI-STRATEGY FUNDS

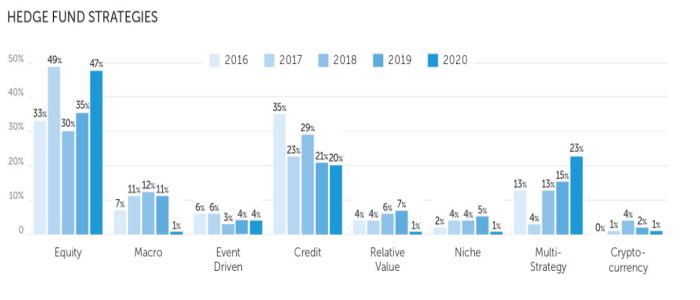

Looking first at questions of strategy, equity funds retain both their absolute and relative dominance over other strategies in terms of number of funds launched this year. This is consistent with recent reports from Preqin, which suggest equity funds as a group out- performed all other strategies, benefitting from the equity market rally earlier in the year. Multi-strategy funds were also significantly more popular than in prior years, possibly reflecting a trend towards larger institutionally-managed diverse vehicles (with attendant risk management and, ideally, smoother returns). Preqin also noted that multi-strategy managers have seen smaller outflows than other strategies so far in 20201.

FOCUS ON FEES

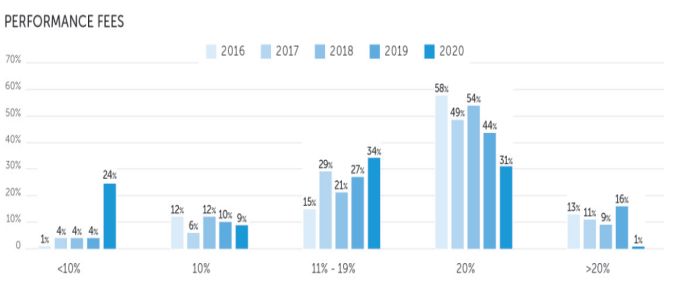

In prior years we have reported the slow but steady decline of the 2% headline management fee, and this year was no different: the median management fee was 1.25%, and less than 10% of funds had a management fee of 2% or more. Funds are often launching with tiered fee structures too (our 1.25% median is based on the highest fee classes in each fund under review), so many investors will be paying less.

For several years we have observed the trend of fewer funds launching with a 20% headline performance fee rate, and the rise of funds subject to an 11-19% rate. 2020 was the first year that funds in the 11-19% category outnumbered the 20% funds. This is consistent with data reported by other industry observers: HFR's most recent quarterly survey suggested average incentive fees of 17.55%.2

REDEMPTION TERMS

Half of funds launched this year used some form of lock-up, more than in any previous year of our survey. Of these funds, nearly 60% have a lock-up period of 18 months or longer, which represents a slight increase over prior years, but too early to call a trend. As in prior years, lock-ups tend to be implemented as 'hard' lock-ups (a complete restriction on redemption) rather than soft (redemptions during the lock-up period are possible, subject to an early redemption fee).

The use of gates is significantly higher this year than in prior years, continuing an upward trend we have observed since 2018. This year, over 40% of funds employed some form of gate, and of those funds approximately two-thirds imposed the gate at the level of the investors individually, rather than the fund as a whole.

Footnotes

1 2020 Preqin Global Hedge Fund Report

1 HFR Market Microstructure Report, Q2 2020 (September 2020)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.