U.S Venture Capital firms and foreign investors prefer to have their portfolio companies in a state in the United States called Delaware. This is the case even when they decide to invest out of North America and in emerging economies in like Africa. For African founders who already have a company in their home country, this often means that they have to do what is called a 'Flip'.

What is a Delaware Flip?

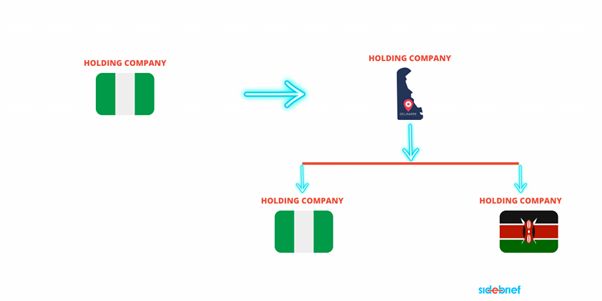

A "flip" involves formation of a Delaware corporation taxed under subchapter C of the Internal Revenue Code i.e. a Delaware C corp, and rendering the African entity as a subsidiary of Delaware C corp, with the goal of attracting U.S. investors.

It involves incorporating a Delaware company and issuing shares in that entity to investors and founders, reflecting their respective shareholding in the local entity at the time of incorporation. Thus, if Founder A and B own 70% and 30% respectively in 'A&B Limited', a Nigerian company, their shares will be transferred to a newly incorporated Delaware entity called 'A&B Incorporated' while they will now hold then hold stock in the same proportion in the newly incorporated company. In essence Founder A and Founder B will now own 70% and 30% stock in A&B Inc while A$B Limited will be owned 100% by A&B Inc.

After this flip. The founders are able to raise money using A&B Inc. while they trade in their home country, using A&B Limited.

Why do companies Flip to Delaware?

Why do startups incorporate in Delaware?

Annual compliance requirement for Delaware Company

Conclusion

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.