On 11 December 2014, authorities in Mexico made a call for bids and announced the terms and conditions for the bidding of 14 blocks in shallow waters as part of Round 1. Additionally, drafts of the contracts and the calls for bids were published in the webpage www.ronda1.gob.mx.

The map below shows the location of the 14 blocks:

On the following page is a high-level summary of some of the most significant matters of the published call for bids and the draft contracts. This new information requires a comprehensive analysis and should be carefully reviewed based on the facts and circumstances applicable to each interested company.

Bidding terms

- Interested parties and bidders should not contact any official from the National Hydrocarbon Commission ("CNH" by its acronym in Spanish) or government official that is in any manner related to the Round 1 bid, as bidding terms and contracts should not be subject to any negotiation. However, any interested party should be able to make comments and questions related to the bidding terms and contracts through the CNH's webpage.

- The entire process will take place in Spanish and there will be no official translations into English or other foreign languages.

- Bidding and contract terms, excluding prequalification requirements, are subject to change at any point in time before their final publication on 15 June 2015.

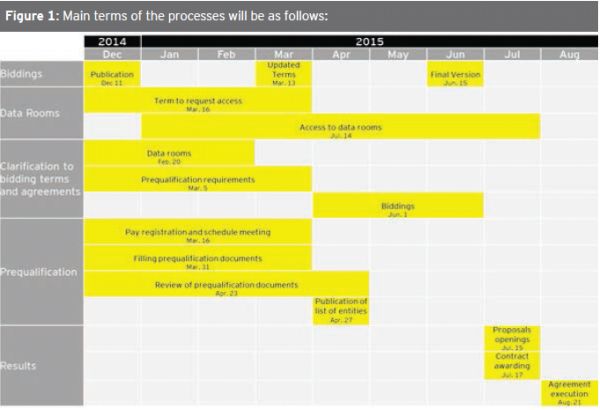

- The bidding process will occur in the following stages: i) publication of bidding terms, ii) access to data rooms, iii) registration, iv) clarifications to the bidding terms, iv) prequalification, v) filing of proposals, vi) awarding of contracts and vii) execution of contracts. Bidders must pay a registry fee of MXP $280,000 to participate in the bidding process.

- The chart below (see Figure 1) shows the main terms of the process.

- Access to data rooms will be granted to companies engaged in exploration and production of hydrocarbon activities or companies that may participate as financing partners. Such companies may not be incorporated in Mexico. To have access to the data rooms, companies will have to pay MXP $5,300,000.

- Only companies that have paid for

access to the data room, as well as their affiliates and partners,

will be able to participate in the bidding process. To prequalify

for the bidding process, companies must demonstrate the

following:>/p>

- Legal origin of funds confirmed by the Ministry of Finance's Unit of Financial Intelligence

- Experience as an operator in exploration and production activities from 2010 to 2014 through (i) participation in at least three projects or (ii) investments in exploration and production of hydrocarbon activities of at least US $1 billion

- Experience in offshore projects

- Personnel with sufficient technical capabilities with a minimum of 10 years of experience

- Experience in environmental, health and safety in the industry during the last five years

- Economic capacity, meaning the operator needs to own assets of at least US $10 billion and have an investment credit rating , or shareholder's equity of at least US $1 billion or US $600 million if going in a consortium, and the remaining US $400 million are supported by its partners

- For consortiums, the operator should have at least one-third of the economic participation and should own the largest investment in the consortium.

- Two large oil companies as defined in the bidding terms cannot participate in the same joint venture or consortium.

- The criteria for determining the winner will be a weighted average of the government profit oil share (90%) and the increased investment factor commitment (10%).

- Minimum work commitments and wells to be drilled are also included, but vary depending on the block. Minimum government profit oil shares are still pending.

PSCs model contracts

- Production sharing contracts (PSC) will apply for Round 1 of bidding on the first 14 blocks in shallow waters. Drafts of two different contracts were published; one for individual investors and the second for consortiums. The term of the contracts is 25 years with the possibility of two five- year extensions. The exploration period is anticipated as three years with two one-year extension periods contemplated. A cost recovery limit of 60% is included in the contracts.

- The term to conclude the minimum work commitment during the exploration period is included in the PSCs. The draft PSCs also include provisions for guarantees for work commitment and execution of the activities as obligations of the contractors.

- In case of a discovery of a productive oilfield, the contractor must establish a trust, under the control of the CNH and the contractor, to fund abandonment provisions.

- The PSCs contain local content requirements for each phase of the project as well as penalties for not complying with those requirements. The local content will be of 13% during exploration period. During development period local content will be of 25% during first year with annual increases of 1% till 35%.

- If participants desire to transfer their rights under the contract, CNH must approve it. Also, CNH must approve any changes in control and participants must report any change in the ownership of the contracting entities to CNH. Additionally, the PSCs include limitations related to the ownership of assets used to carry out exploration and production activities, including assets leased from related parties.

- The PSCs define the methodology to determine the contractual value of hydrocarbons and include clarifications to the measurement point of the hydrocarbons. Contractors may suggest measurement methodology according to international standards and measurement point will be within the contractual area. True up provisions are included to adjust the contractual value to real trading values.

- The mechanism of adjustment (R factor) is determined according to the operating profit margin of the contractor and the PSCs include a formula for determining the adjustment. Additionally, the Fund or the Ministry of Finance can adjust the government take when there are variations in hydrocarbon prices or if larger than anticipated deposits are found.

- Payments under the contracts to the contractor and government will be made monthly on the 17th.

- Contractors are required to keep a registry of the costs, expenses and investments according to the chart of accounts issued by Mexico's Oil and Gas Sovereign Fund. These Registries should be kept in Spanish and in US dollars or MXN pesos. However, it is still uncertain whether the functional currency of the contracts will be MXN pesos or not.

- Additional exclusions were included for cost recovery purposes, in addition to the ones included in the Hydrocarbons Revenue Law.

- The PSCs require the contractor's financial statements to be audited by external auditors on an annual basis and the audit's cost will be eligible for cost recovery.

- The PSCs include tax stabilization clause, but that provision may not guarantee full protection to the contractors. Although royalties' formulas are included in the contract, it is uncertain if that protects any changes to the Revenue of Hydrocarbons Law.

- A specific procurement procedure is established in the PSCs, as well as certain clauses that must be included in contracts executed with subcontractors and other suppliers of goods and services. If the good and services exceed USD $20,000,000, the selection of the supplier should be carried out through an international public bid.

- The contractor must comply with safety and environmental requirements and is responsible for any environmental contingencies caused by its activities. The contractor will not be responsible for environmental issues existing in the blocks prior to the execution of the agreements. The contractor must have valid insurance to cover all the operation and environmental risks at all times.

- Specific rules for flaring, burning and self-use of hydrocarbons without compensation to the government are included in the PSCs and will be subject to further regulation. The PSCs also include rules regarding sharing the production of hydrocarbons obtained in the development phase.

- The procedures for the administrative termination of the contracts are consistent with the Hydrocarbons Law.

- In case of a dispute, controversies will be solved in the Mexican Courts and arbitration is also available under United Nation rules.

- Inspection fees will have to be paid to CNH and the newly created Security and Environmental Agency; however, amounts are still uncertain.

The publication of the call for bids and the drafts of the PSCs indicate the beginning of Round 1 in Mexico; however, there is still additional information to be issued by the government authorities, such as guidelines for cost recovery.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.