Background

The new Irish Transfer Pricing (TP) rules introduced by Finance Act (FA) 2019 apply to Accounting Periods starting on or after 1 January 2020. The accounts for the first period covered by the rules are being prepared and audited right now. Are you aware of the new requirements?

Revenue published TP guidance in February 2021 (Part 35A-01-01 of the Tax and Duty Manual) which provides additional details for taxpayers on how the rules will apply. One of the main aspects of the updated guidance is in respect of TP documentation and the requirements to be satisfied in order to comply with the new rules.

Revenue have also revised the tax return from FY2020 onwards to include TP related questions. For example, it is now necessary to tick a box on the tax return confirming whether a local file or master file has been prepared. It can be expected that companies with a documentation requirement but unable to tick these boxes may find themselves the subject of future Revenue inquiries.

There is also a new penalty regime introduced by FA 2019 relating to failures to meet your obligations; this is covered in more detail below.

Key Elements in Revenue TP guidance

The key elements for Irish TP documentation requirements can be summarised as follows:

- Transfer pricing documentation is fundamental to validating and explaining the pricing of intra-group transactions. Under the old rules, taxpayers only needed to show that the company's trading income was computed in accordance with transfer pricing legislation. This has now been enhanced.

- The new rules require larger taxpayers to prepare a master file and/or a local file in accordance with the OECD Guidelines. This TP documentation must be in place no later than the date on which the return for the chargeable period is due to be filed. The documentation must be provided to Revenue within 30 days of a written request.

- Small & Medium Enterprises [SMEs] are currently excluded from these requirements but they will be brought within the scope in the future by Ministerial Order. From that point, a small enterprise will not need any TP documentation and medium enterprises will only need simplified documentation in respect of relevant transactions.

Thresholds for Local and Master Files

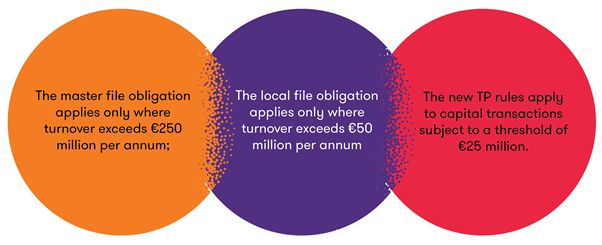

The new rules have de minimis thresholds to ensure that the TP documentation requirements are proportionate. The thresholds are based on the annual consolidated global turnover of the group (not just Irish entities)

Master File requirement

Where an Irish taxpayer forms part of a multinational group of enterprises ('MNE group') and the total consolidated global revenue of the MNE group is at, or above, the €250 million threshold, they need to prepare and have available a master file, no later than the filing date of the relevant tax return.

The master file provides a high-level outline of the business operations and policies at group level. It must include:

- An overview of the group's global operations,

- The MNE's organisational structure;

- A description of the MNE's business;

- Details of the MNE's intangibles;

- The MNE's intercompany financial activities; and

- The MNE's financial and tax positions.

Local File requirement

Where an Irish taxpayer forms part of a multinational group of enterprises ('MNE group') and the total consolidated global revenue of the MNE group is at, or above, the €50 million threshold, they need to prepare and have available a local file, again no later than the filing date of the relevant tax return.

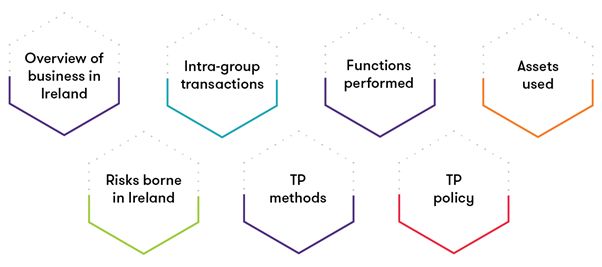

In contrast to the master file, the local file provides detailed entity-level information. This file is specific to the Irish operations, identifying related party transactions with associated persons in different countries, the amounts involved in those transactions, and the company's analysis of the transfer pricing determinations they have made with regard to those transactions. It must include:

The local file must also show how the transfer pricing policy was actually applied including a reconciliation with the financial results in the accounts. The level of detail required on an annual basis to demonstrate compliance with transfer pricing documentation obligations will depend on the facts and circumstances of the arrangement.

Frequency of review of transfer pricing documentation

Revenue guidance provides that TP documentation must be up to date and contemporaneous and must be reviewed regularly to determine whether the pricing remains arm's length and that the transfer pricing documentation adequately demonstrates this.

Information showing how the transfer pricing policy was actually applied in each period should be updated annually, including a reconciliation to the accounts.

To the extent that other facts and circumstances haven't changed significantly, the content of the TP documentation can be carried forward from one year to the next and updated at less regular intervals.

Penalties

As outlined above, TP documentation should be prepared no later than the filing date of the relevant tax return. It must be made available to Revenue within 30 days of a written request. Where a taxpayer fails to comply with the written request within 30 days, a fixed penalty of €4,000 will apply.

Where the taxpayer is required to prepare a local file, the fixed penalty is increased from €4,000 to €25,000 plus €100 for each day on which the failure continues.

This increased fixed penalty applies where that relevant person has failed to provide any required transfer pricing documentation; it is not limited to a failure to provide the local file.

Country File

A local file is normally prepared for each Irish group company. However, as an alternative, companies may choose to prepare a consolidated 'Country File' for all Irish entities of an MNE group.

The Country File will contain essentially the same content as a local file. However, it must also include entity level qualitative and financial information. Where financial information is consolidated in the country file, companies will not be treated as having complied with their TP documentation obligations.

Expanded Scope of Irish TP legislation

The new rules broaden the scope of Irish TP legislation to include non-trading transactions, capital transactions (exceeding market value of €25 million) and previously grandfathered transactions.

Financial transactions are also covered by the new rules. Taxpayers will be required to test the arm's length nature of the quantum of debt (i.e. debt capacity and serviceability), as well as interest rate analysis, in the local file for debts which are in place from 1 January 2020.

The arm's length nature of historic transactions now within scope of the Irish TP legislation should be tested based on when the arrangement was entered into. Helpfully, the updated TP guidance notes that if it is not possible to trace historic information following reasonable efforts then taxpayers can rely on the earliest information that is available.

As mentioned above, where a capital transaction whose market value exceeds €25 million, the new TP rules will replace market value rules.

As a result of Finance Act 2019 changes, Irish transfer pricing documentation requirements have been significantly enhanced, with penalties for non-compliance. It is important that companies are aware of the new obligations.

What can we do to help you?

Our transfer pricing team has extensive experience in assisting, leading and coordinating domestic and international TP projects across all industries. Our team comprises professionals from countries where similar OECD TP documentation regimes have been in place for some time. We know how to manage the issues involved in ensuring documentation meets the new Irish requirements.

We can also use the wider Grant Thornton Transfer Pricing Network to provide you with the best possible global solutions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.