GOODS AND SERVICES TAX ("GST")

a. The Petitioner is engaged in providing development services for Metro Rail Project. In pursuance of the services rendered, the Petitioner raised invoices and deposited the applicable GST. After the payment of tax, the Petitioner was informed that in terms of Notification No.12/2017 - Central Tax (Rate) dated June 28, 2017, services provided by the Petitioner were not chargeable under GST. Consequently, the Petitioner filed an application for refund of tax mistakenly paid by it. However, the refund application was rejected on the ground that it was filed after the expiry of two years from the relevant date. Aggrieved, the Petitioner preferred the instant Writ Petition ("WP") on the ground that the amount paid under a mistake would amount to wrong collection of law, which is violative of Article 265 of the Constitution of India.

The High Court while allowing the WP, held that Article 265 of the Constitution of India prohibits any levy or collection of tax except by authority of law. The amount deposited by the Petitioner on an erroneous belief, that payment for services rendered by it were chargeable to tax, cannot be retained by the Respondent. The limitation period for applying for a refund as prescribed under Section 54 of the CGST Act would not apply where GST is not chargeable, and it is established that the amount has been deposited under a mistake of law. Accordingly, the refund rejection order was set aside, and the Respondents were directed to process the Petitioner's claim of refund.

Takeaway: Period of limitation not applicable on refund application made under mistake of law

[Delhi Metro Rail Corporation Ltd Vs. Additional Commissioner, Central Goods and Services Tax Appeals, WP (C.) No. 6793 of 2023, Order dated September 18, 2023 (High Court, Delhi)]

b. The Petitioner, an Export Oriented Unit ("EOU") registered with the Software Technology Parks of India ("STPI") is a subsidiary of a company registered in the USA and is primarily engaged in exporting information technology software services ("ITSS") to entities located overseas. The Petitioner entered into an Intercompany Service Agreement ("the Agreement") dated June 10, 2016, with its holding company in USA for export of ITSS.

The Petitioner applied for refund of Integrated Goods and Services Tax ("IGST") on export of services, for which it was issued a show cause notice ("SCN") wherein the refund was proposed to be rejected on the ground that the supplier and recipient were merely establishments of a single person under Section 2(6)(v) of the Integrated Goods and Services Tax Act, 2017 ("IGST Act") and therefore, the services provided by the Petitioner to its holding company did not constitute as export of services.

IMPORTANT CASE LAWS

The Petitioner in its reply, placed reliance upon Circular No. 161/17/2021-GST dated September 20, 2021 ("the Circular dated September 20, 2021") and submitted that it was an independent company incorporated in India and supplies to its holding companies were required to be considered as export of services. However, the Petitioner's refund application was rejected vide the impugned order and the Petitioner was held to be an intermediary. Aggrieved, the Petitioner filed the instant WP. The High Court while allowing the WP, placed reliance on the Supreme Court's decision in the matter of Bacha F. Guzdar1, wherein it was held that the identity of an incorporated company is separate from that of its shareholders. The services rendered by a subsidiary of a foreign company to its holding are not covered under Section 2(6)(v) of the IGST Act and the same is clarified in the Circular dated September 20, 2021. The Court held that the impugned order completely ignored the Circular and was passed mechanically without application of mind and in disregard of the provisions of law. The Petitioner was not intermediary as it was providing services on principal-to-principal basis on its own account and not facilitated by the provision of services from any third-party service provider. Accordingly, the Department was directed to process the Petitioner's claim for refund along with interest.

Takeaway - Services supplied by company incorporated in India to its holding company abroad are export of services.

[Xilinx India Technology Services Pvt. Ltd. Vs. The Special Commissioner Zone VIII, W.P.(C) 11413/2023, Order dated September 1, 2023 (High Court, New Delhi)]

c. The Petitioner was issued a SCN proposing cancellation of registration due to discrepancies noticed during physical verification. Subsequently, the Petitioner's GST registration was cancelled. The Petitioner filed for revocation of cancellation of registration and informed the Department regarding shifting of its principal place of business. It further informed that it could not file the requisite forms for shifting its address because at the material time, its registration was cancelled, and no such application could be filed. The application was rejected on the ground of limitation as the explanation for delay of even one day was not accepted by the officer. The Petitioner's appeal before the Appellate Authority was also rejected due to multiple reasons like non-reflection of HSN code, new place of business on the CBIC portal and certain discrepancy in the tax returns and tax liability. Aggrieved, the Petitioner filed the instant WP.

The High Court while allowing the WP, held that cancellation order was not maintainable as the reason for cancellation was not informed to the Petitioner, consequently the subsequent orders were also not maintainable. The Petitioner's application for revocation was within the limitation period as it was filed on the 30th day following the date of its cancellation. Further, the Petitioner's disability to file the requisite forms for change of place of business, due to cancellation of registration could not be considered as a ground for not restoring its GST registration. Furthermore, discrepancies in the tax returns and tax liability too cannot be a ground for cancellation of the Petitioner's GST registration. Furthermore, the Appellate Authority proceeded on the basis that the Petitioner had not declared the classification of the goods dealt with by it without granting an opportunity to correctly disclose the goods when its registration was active. Accordingly, directions were given for restoration of the Petitioner's registration.

Takeaway - Inability to file forms for change of place of business due to cancellation of registration cannot be a ground not to restore the registration.

[Shiv Ganga Udyog Vs. Commissioner of CGST, W.P. (C) 11450/2023, Order dated August 29, 2023 (High Court, New Delhi)]

CUSTOMS CASE LAW

CUSTOMS

a. The Appellant is engaged in manufacturing heavy machinery and has filed Bills of Entry ("BoE") for import and procurement of imported capital. The subject capital goods were imported vide BOE in the Special Economic Zone ("SEZ") unit from Switzerland. The clearance of such capital goods under Export Promotion Capital Goods scheme ("EPCG") was allowed under provisional assessment as per provisions of SEZ Act/Rules. The Department disallowed the clearance of goods by the Appellant since it had not, by then, exited from SEZ and so, was not eligible to clear capital goods under the EPCG scheme as per the SEZ Rules, 2006; and thus, liable to re-workout the value as per the provisions of SEZ Act, 2005. The Commissioner Appeals confirmed the order of the Adjudicating Authority. Aggrieved by the order of the Commissioner (Appeals), the Appellant filed the instant appeal.

The CESTAT while dismissing the appeal, observed that there is no absolute bar on clearance of capital goods from SEZ to DTA under EPCG, but following the condition that a SEZ Unit can opt for EPCG scheme only at the time of exit as per SEZ Rules. Therefore, the Appellant is not eligible for EPCG Scheme benefits under the SEZ Rules, without having exited from the SEZ. Accordingly, the Appellant was required to pay applicable Customs duty on the assessable value of the capital goods cleared.

Takeaway: The benefits of the EPCG scheme provided in the SEZ Rules shall only be applied where an assessee exits from the SEZ.

[ISGEC Heavy Engineering Ltd. Vs. C.C.-Ahmedabad, C.A. No.: 12023 OF 2018, Order dated September 11, 2023 (CESTAT Ahmedabad)]

INDIA REGULATORY & TRADE HIGHLIGHTS

FOREIGN TRADE POLICY NOTIFICATIONS

- De-listing of 29 chambers/ agencies from issuing Certificate of

Origin (Non-Preferential) on account of their failure to comply to

repeated directions of DGFT to on-board on the e-CoO platform of

DGFT for electronic issuance of Certificate of Origin

(Non-Preferential), with immediate effect.

[Public Notice No. 31/2023 dated September 20, 2023].

- Regularization of imports made under Advance Authorization

Scheme between period October 13, 2017 till January 9, 2019, which

could not meet pre-import conditions.

[Trade Notice No. 27/2023 dated September 25, 2023].

- The benefits under Remission of Duties or Taxes on Export

Product ('RoDTEP') scheme extended for exports made from

October 1, 2023 till June 30, 2024.

[Notification No. 33/2023 dated September 26, 2023].

THE DIRECTORATE GENERAL OF TRADE REMEDIES, MINISTRY OF COMMERCE & INDUSTRY

a. Initiation of Anti-Dumping Duty Investigation on import of:

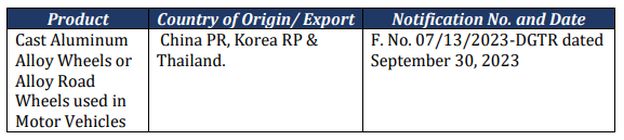

b. Initiation of Sunset Review Investigation of Anti-Dumping Duty imposed on import of:

c. Final Finding of Anti-Dumping Duty Investigation on import of:

INDIAN CUSTOMS HIGHLIGHT

a. Exemption extended for goods imported under Project Imports

The Central Board of Indirect Taxes & Customs ("CBIC") has extended the customs duty exemption under Notification 50/2017-Customs dated June 30, 2017 for the goods to be imported under the following projects till September 30, 2025:

- Goods required for coal mining, power generation and power transmission projects.

- Goods required for setting up mega power projects.

- Goods required for LNG regasification plant and aerial passenger ropeway projects.

- All goods including machinery, instruments, apparatus and appliances, control gear and transmission equipment, auxiliary equipment required for setting up any project.

- Goods required for setting up nuclear power projects.

- Goods required for water supply projects.

[Notification No. 54/2023-Cus dated September 14, 2023]

INDIA CUSTOMS HIGHLIGHTS

b. Implementation of Ex-Bond Shipping Bill in Indian Customs EDI System ("ICES")

The CBIC has implemented an Ex-Bond Shipping Bill in ICES for capturing export of goods from a bonded warehouse. This shipping bill can only be used for export of warehoused goods and is not meant for the export of goods resulting from manufacturing or other operations in a bonded warehouse. Further, if the goods imported in a warehouse for manufacturing are exported as such, then the Ex-Bond Shipping Bill can be filed. It has also been stated that no incentive such as Drawback, RODTEP/ROSCTL benefit advance authorisation/EPCG etc. shall be available for such cargo and the shipping bill would be a free shipping bill.

[Circular No. 22/2023-Cus dated September 19, 2023]

c. Implementation of restriction on export of certain goods on payment of IGST

The CBIC has developed a backend functionality to implement Section 16(4) of the IGST Act providing restriction on the export of certain goods or services on payment of IGST and claim of refund of the tax paid. Since IGST refund is paid at shipping bill level, the checks have been enabled at shipping bill level.

In cases where a shipping bill contains single or multiple invoices for which IGST has been paid, even if one invoice contains an item which is restricted for export on payment ofIGST underSection 16(4) of the IGST Act, the shipping bill containing such items will not be allowed to be filed.

[Circular No. 24/2023-Cus dated September 30, 2023]

INDIA GST HIGHLIGHTS

1. NOTIFICATIONS

a. CBIC Amendment Notifications

Pursuant to the recommendations by Goods and Services Tax Council, the Central Government has notified the amendments to the Central Goods and Services Tax Act, 2017 ("the CGST Act"), the Central Goods and Services Tax Rules, 2017 ("the CGST Rules") and Integrated Goods and Services Tax Act, 2017 ("the IGST Act"), respectively, which are to be effective from October 1, 2023, details of which are enumerated below:

I. Amendments made in the CGST Act/ Rules:

- Supply of online money gaming, supply of online gaming, supply of actionable claims in casinos shall be considered as supply under Section 15 (5) of the CGST Act.

[Notification No. 49/2023 Central Tax, dated September 29, 2023]

- Registered persons supplying specified actionable claim by way of way of betting, casinos, gambling, horse racing, lottery or online money gaming are excluded to opt for composition scheme under Section 10 of the CGST Act.

[Notification No. 50/2023 Central Tax, dated September 29, 2023]

- Person supplying online money gaming from a place outside India to a person in India referred to in Section 14A of the IGST Act, is not required to file application for registration in Form GST REG-01 under Rule 8 (1) of CGST Rules but in Form GST REG-10 under Rule 14 of the CGST Rules.

- The Notification proposing to introduce Rule 31B and Rule 31C regarding valuation of supply of actionable claim in case of online gaming and casinos, respectively, has been made effective.

- Proviso to Rule 46 (f) of the CGST Rules shall be inserted to include that tax invoice issued by the registered person supplying supply of online money gaming shall contain the name of the state of the recipient and the same shall be deemed to be the address on record of the recipient.

- Rule 64 the CGST Rules amended to include that registered person supplying money gaming from a place outside India to a person in India is required to report its details of supplies in Form GSTR-5A on or before twentieth day of month succeeding the calendar month or part thereof.

- Second Proviso to Rule 87 (3) of the CGST Rules amended to include that a person supplying online money gaming from a place outside India to a person in India as referred to in section 14A of the IGST Act can also make payment of tax through international money transfer via society for Worldwide Interbank financial telecommunication payment network".

[Notification No. 51/2023 Central Tax, dated September 29, 2023]

II. Amendments made in the IGST Act:

- Definition of Online Information and Data Access or Retrieval ("OIDAR") services under Section 2(17) has been amended by substituting sub- clause (vii) of Section 2(17) from 'online gaming' to 'online gaming excluding online money gaming as defined in CGST Act'. Thereby, excluding the scope of online money gaming from the scope of OIDAR services.

- Proviso to Section 5(1) of the IGST Act which defines the integrated tax on imports of good collected in accordance with the Customs Act, has been amended by virtue of which the Government may notify goods on import of which integrated tax under Section 5(1) of the IGST Act will be collected instead of that under the Customs Act.

- Section 10 of the IGST has been amended to provide for place of supply in case of supply of goods to unregistered person. In case the goods are supplied to an unregistered person, the place of supply shall be the location as recorded in the invoice issued for the supply. However, place of supply where the address of the recipient is not recorded in the invoice, shall be location of the supplier.

- A new section 14A has been inserted to provide for special provisions for online money gaming supplied by a person located outside the taxable territory to a person located in India, who will be liable to pay integrated tax on such supply.

[Notification No. 2/2023- Integrated Tax, dated September 29, 2023]

- IGST will be leviable on import of supply of online money gaming under section 5(1) of IGST Act.

[Notification No. 3/2023- Integrated Tax, dated September 29, 2023]

III. Amendments made in the Rate of Tax:

GST will be levied @ 28% on supply of Actionable claim involved in or by way of betting, casinos, gambling, horse racing, lottery or online money gaming vide entry 227A in Schedule IV of the GST Rate Schedule.

[Notification No. 14/2023-Integrated Tax (Rate) and Notification No. 11/2023-Central Tax (Rate) & Union Territory Tax (Rate), all dated September 29, 2023]

GSTN PORTAL UPDATES

a. Geocoding Functionality for the Additional Place of Business

- Functionality for geocoding for additional place of business address now live for normal, composition, SEZ units, SEZ developers, ISD, and casual taxpayers who are active, cancelled, and suspended in all States and Union territories.

- Geocoding functionality can be accessed under the Services/Registration tab in the FO portal.

- The system will display a system-generated geocoded address. You can accept or modify it accordingly. In case system-generated address is not available, you can input the geocoded address directly.

- The geocoded address details can be found under the "Geocoded Places of Business" tab. They can be viewed under My Profile >> Geocoded Places of Business.

- Submission of geocoding details is a one-time activity, and once submitted, revision in the address will not be allowed. The address appearing on the registration certificate can be changed only through the core amendment process.

[GST Portal Update dated September 19, 2023]

Footnote

1. Bacha F. Guzdar v. Commissioner of Income-Tax, AIR1955 SC 74

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.